US Legal Forms - one of many largest libraries of authorized varieties in the United States - provides a variety of authorized papers templates it is possible to acquire or produce. Utilizing the website, you can get thousands of varieties for enterprise and individual uses, categorized by groups, claims, or search phrases.You will discover the most up-to-date types of varieties much like the Massachusetts Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act in seconds.

If you already have a subscription, log in and acquire Massachusetts Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act in the US Legal Forms library. The Acquire option will appear on each type you look at. You gain access to all previously downloaded varieties inside the My Forms tab of your account.

If you would like use US Legal Forms for the first time, here are basic instructions to help you started:

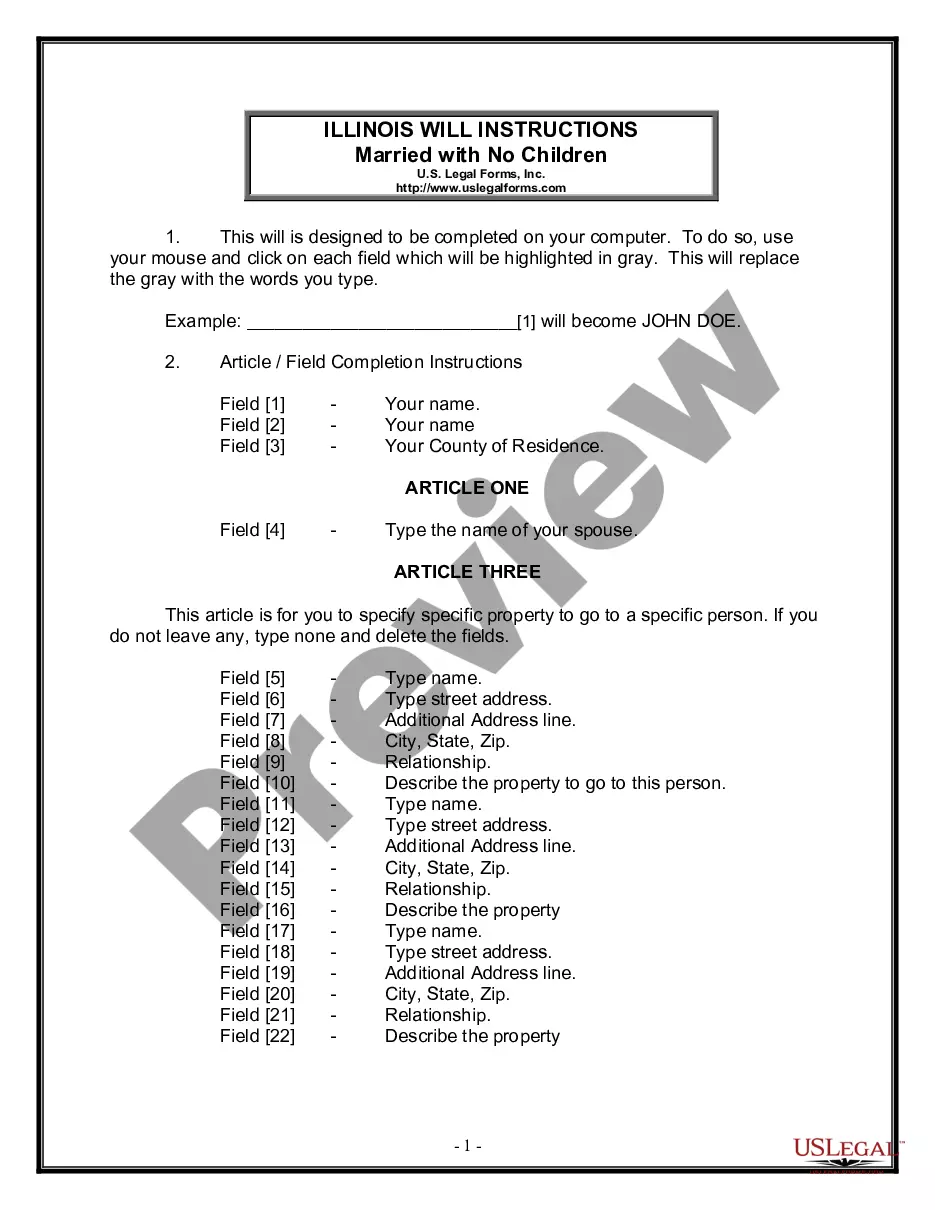

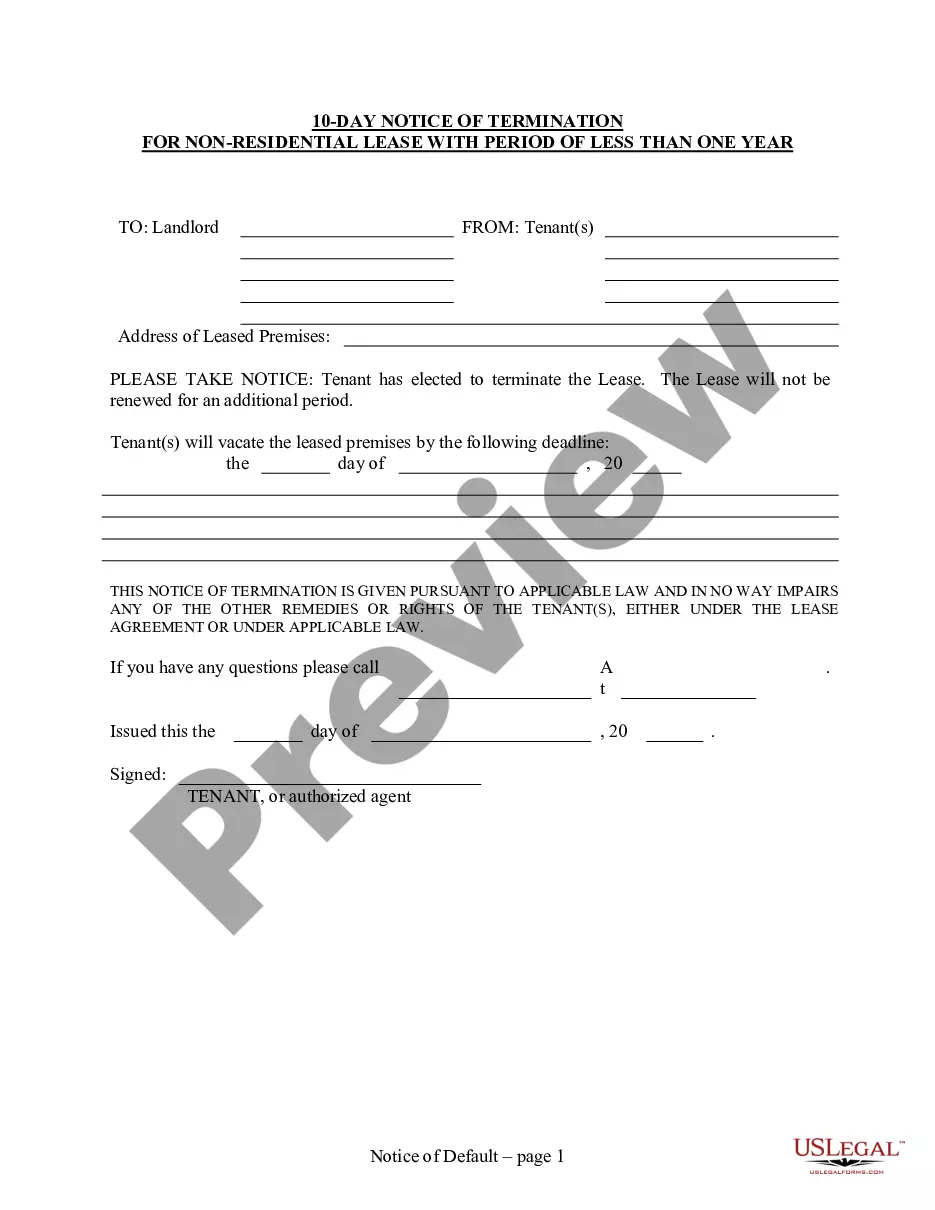

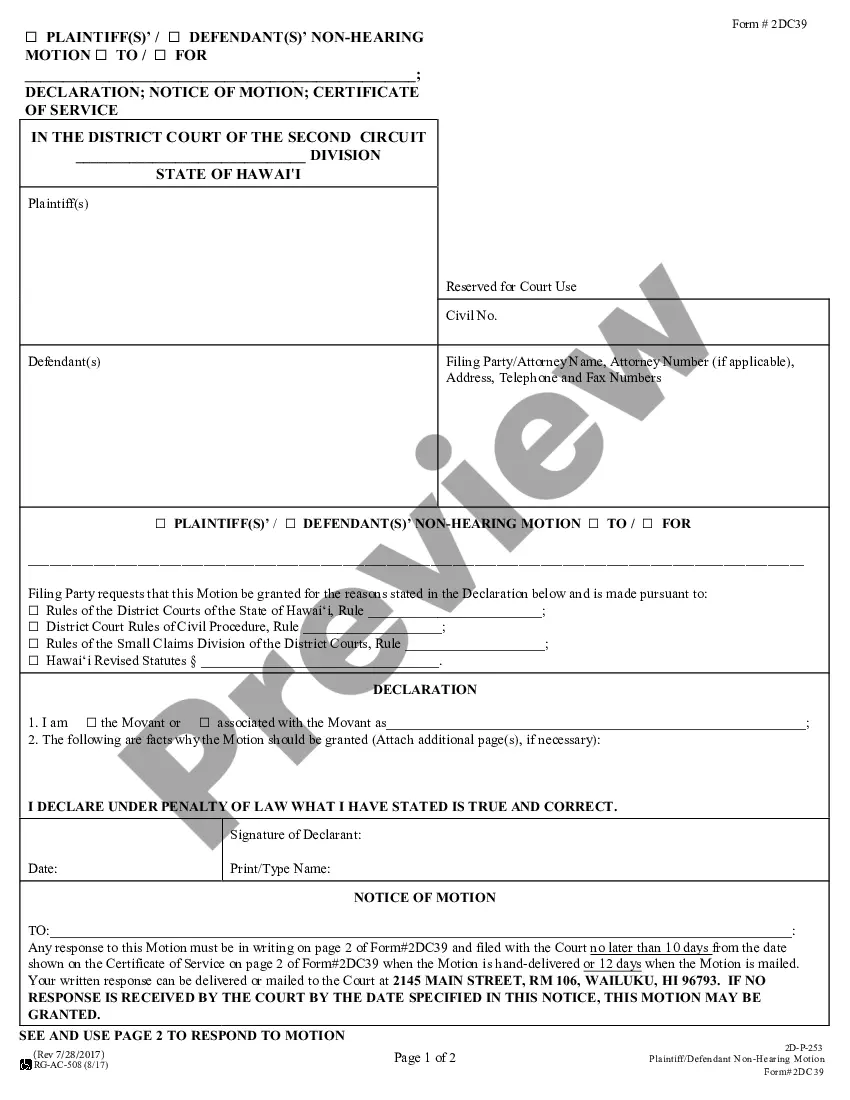

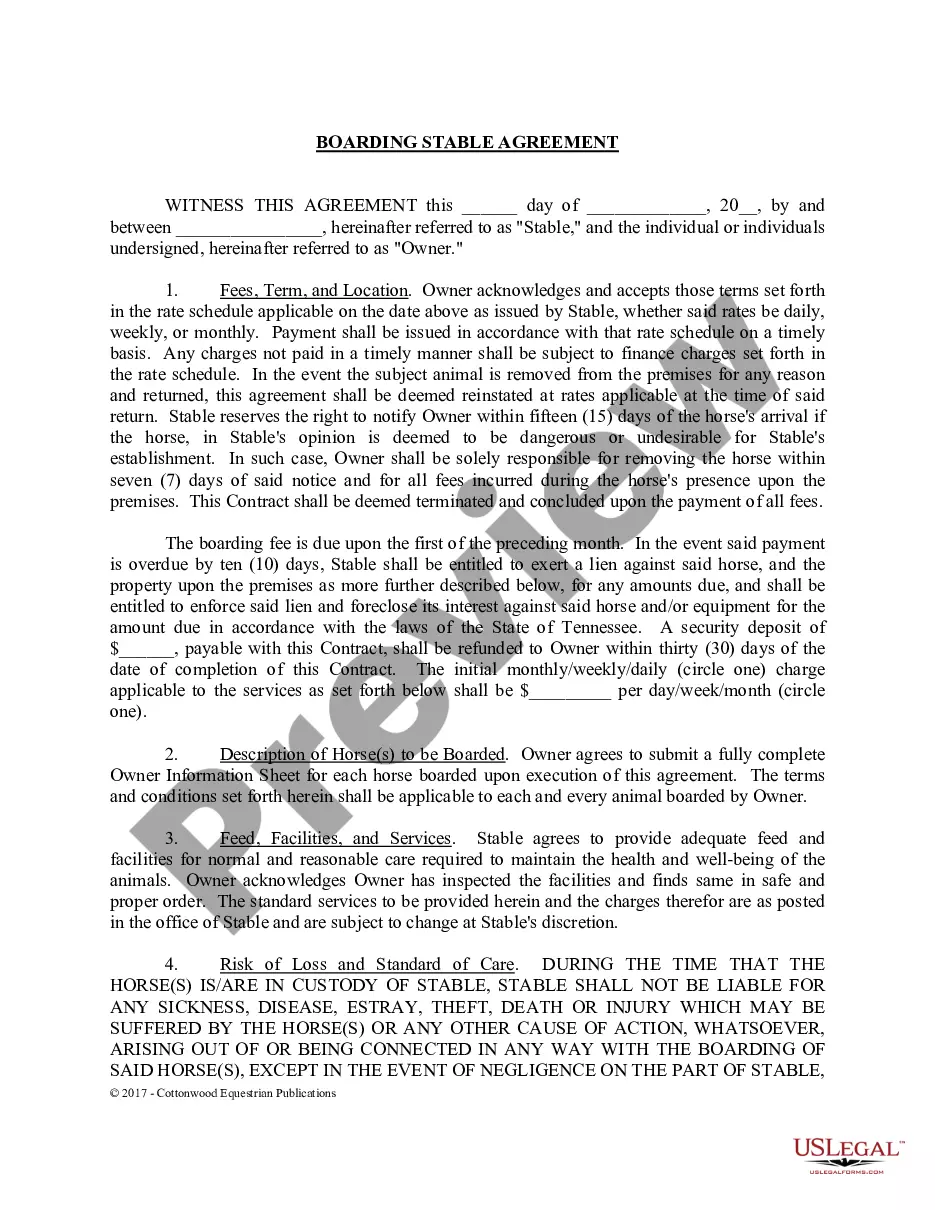

- Ensure you have picked the right type for the town/area. Select the Review option to analyze the form`s content material. Browse the type description to ensure that you have chosen the correct type.

- When the type doesn`t match your demands, use the Search field towards the top of the monitor to obtain the one that does.

- If you are content with the shape, affirm your option by simply clicking the Buy now option. Then, choose the prices plan you want and supply your qualifications to sign up on an account.

- Method the purchase. Make use of your Visa or Mastercard or PayPal account to finish the purchase.

- Choose the structure and acquire the shape on your own product.

- Make adjustments. Fill out, revise and produce and indicator the downloaded Massachusetts Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act.

Each and every template you included with your bank account lacks an expiry time and is also the one you have for a long time. So, if you would like acquire or produce one more version, just go to the My Forms portion and click on in the type you need.

Get access to the Massachusetts Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act with US Legal Forms, the most extensive library of authorized papers templates. Use thousands of professional and status-certain templates that meet up with your organization or individual needs and demands.