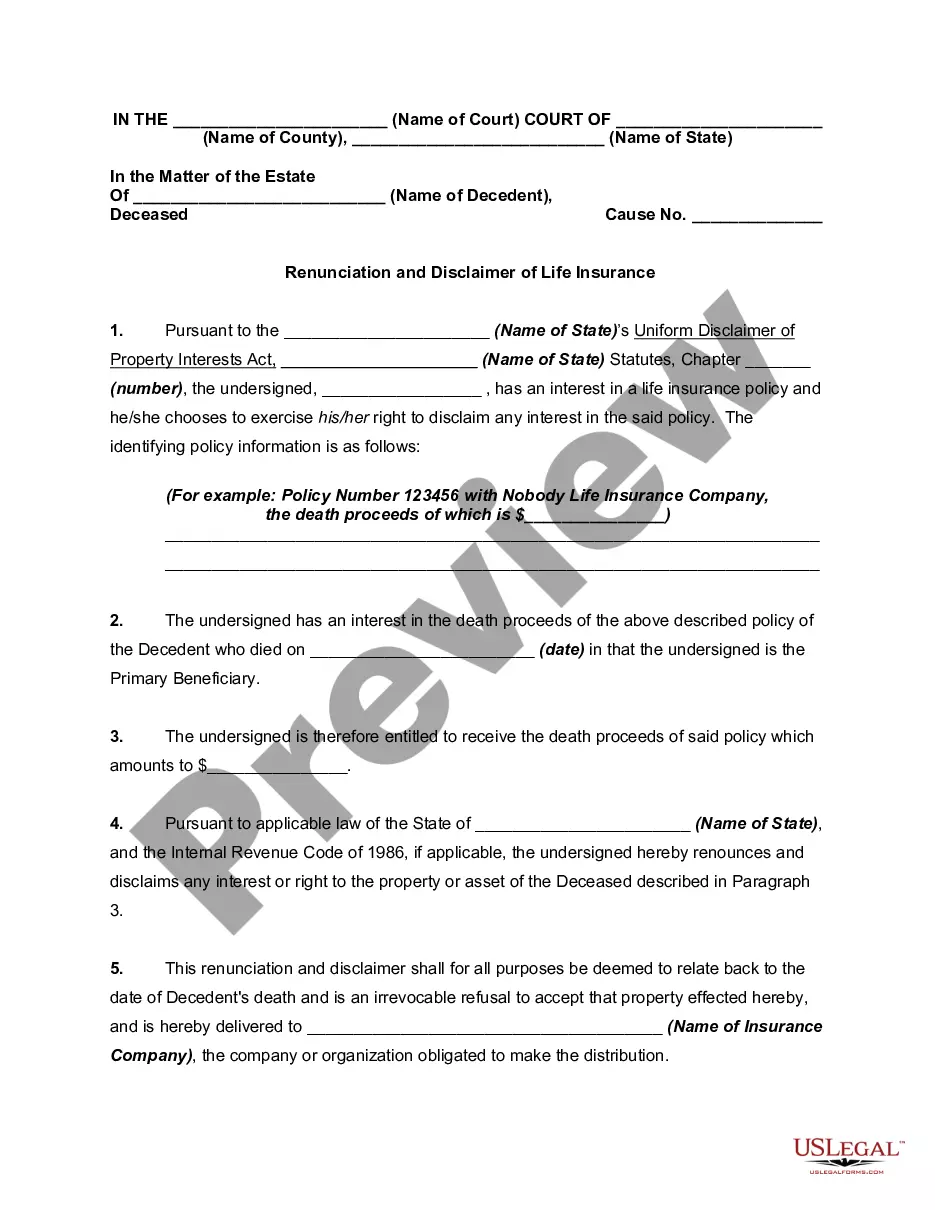

If you wish to comprehensive, download, or print out legal file web templates, use US Legal Forms, the greatest selection of legal kinds, which can be found on the web. Take advantage of the site`s easy and handy look for to get the files you want. Numerous web templates for organization and personal functions are sorted by classes and says, or search phrases. Use US Legal Forms to get the Massachusetts Renunciation and Disclaimer of Interest in Life Insurance Proceeds within a handful of click throughs.

In case you are presently a US Legal Forms client, log in for your bank account and click the Download option to obtain the Massachusetts Renunciation and Disclaimer of Interest in Life Insurance Proceeds. You can also entry kinds you formerly acquired inside the My Forms tab of your own bank account.

If you work with US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have selected the shape for the right city/region.

- Step 2. Take advantage of the Preview choice to check out the form`s articles. Never forget to learn the description.

- Step 3. In case you are unsatisfied using the kind, utilize the Lookup industry at the top of the display screen to discover other variations of your legal kind template.

- Step 4. Once you have discovered the shape you want, select the Purchase now option. Pick the costs strategy you prefer and include your references to sign up on an bank account.

- Step 5. Approach the financial transaction. You may use your charge card or PayPal bank account to complete the financial transaction.

- Step 6. Pick the formatting of your legal kind and download it on your device.

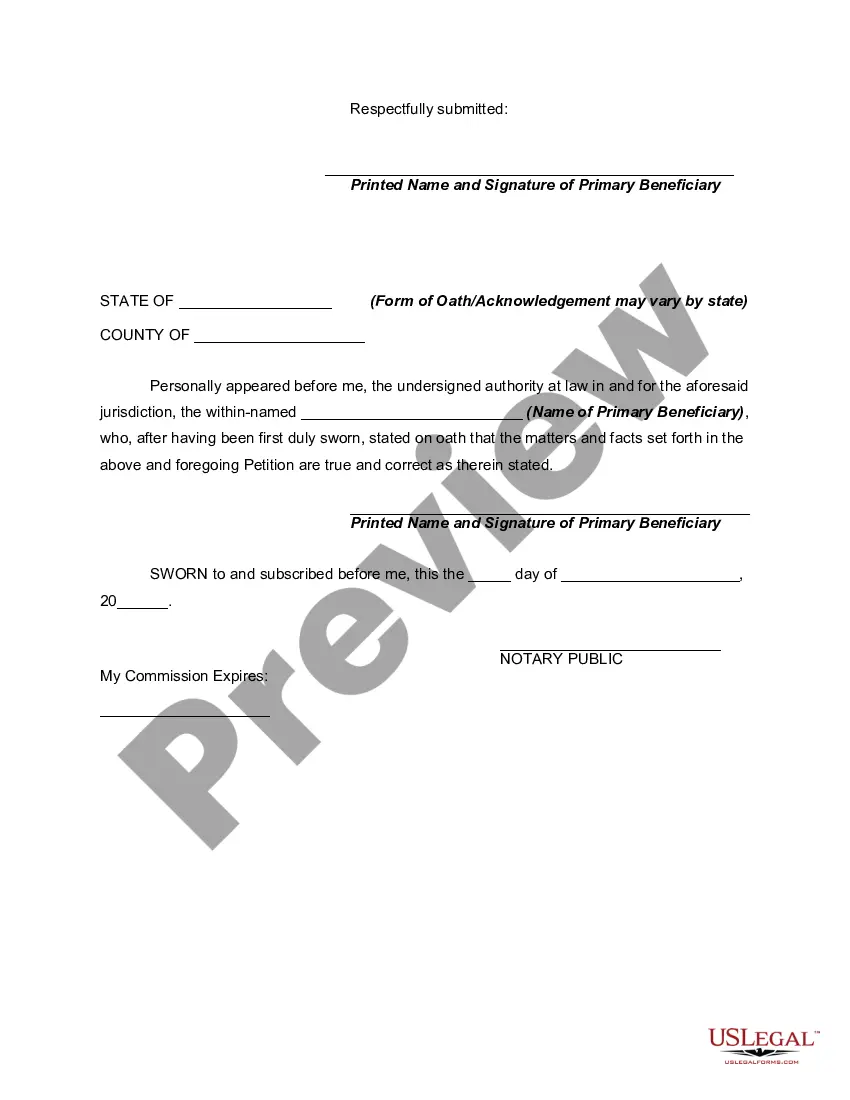

- Step 7. Comprehensive, modify and print out or indication the Massachusetts Renunciation and Disclaimer of Interest in Life Insurance Proceeds.

Every legal file template you purchase is your own property for a long time. You possess acces to each and every kind you acquired within your acccount. Select the My Forms area and choose a kind to print out or download once again.

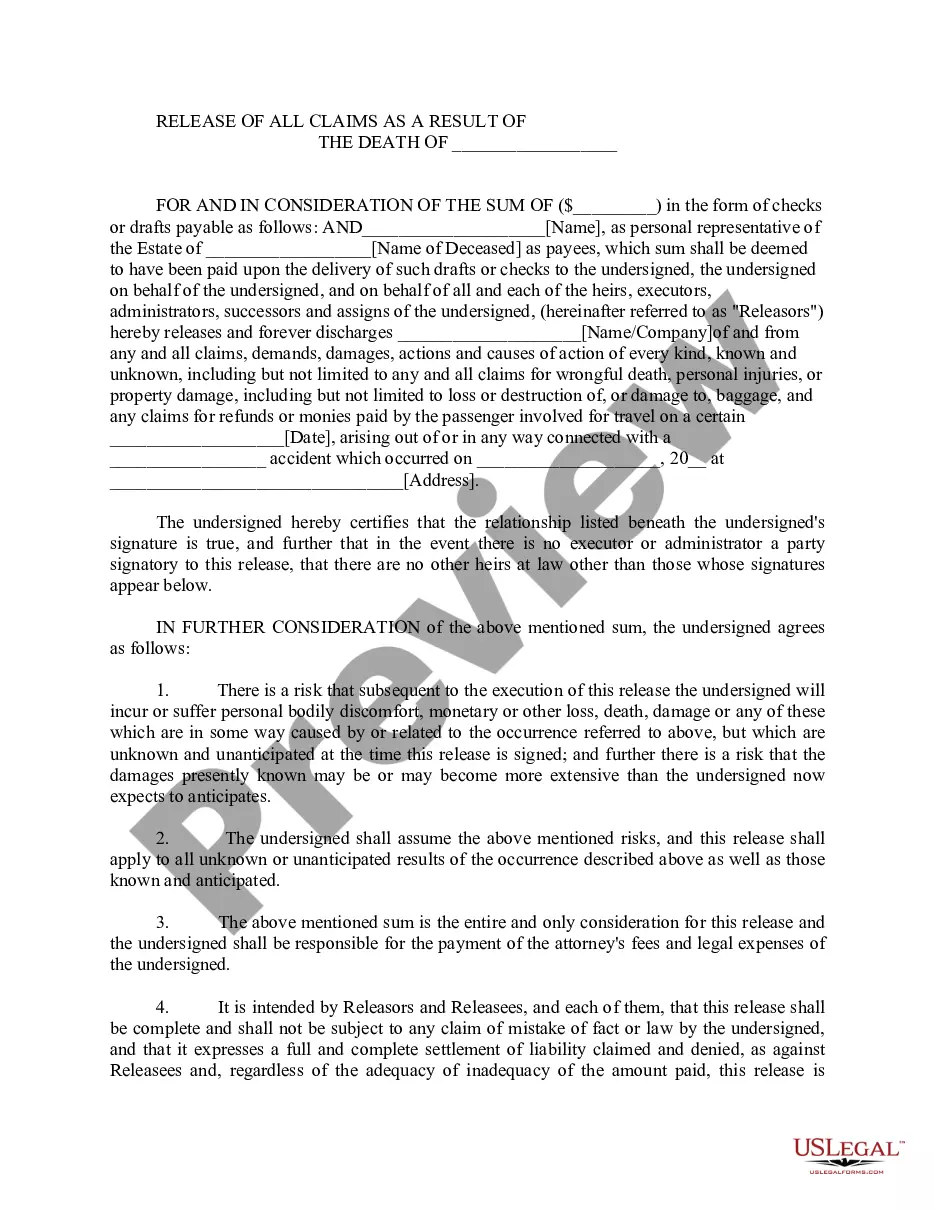

Contend and download, and print out the Massachusetts Renunciation and Disclaimer of Interest in Life Insurance Proceeds with US Legal Forms. There are thousands of specialist and express-particular kinds you can utilize for your personal organization or personal demands.