A limited liability company (LLC) is a separate legal entity that can conduct business just like a corporation with many of the advantages of a partnership. It is taxed as a partnership. Its owners are called members and receive income from the LLC just as a partner would. Management of an LLC is vested in its members. An operating agreement is executed by the members and operates much the same way a partnership agreement operates. Profits and losses are shared according to the terms of the operating agreement.

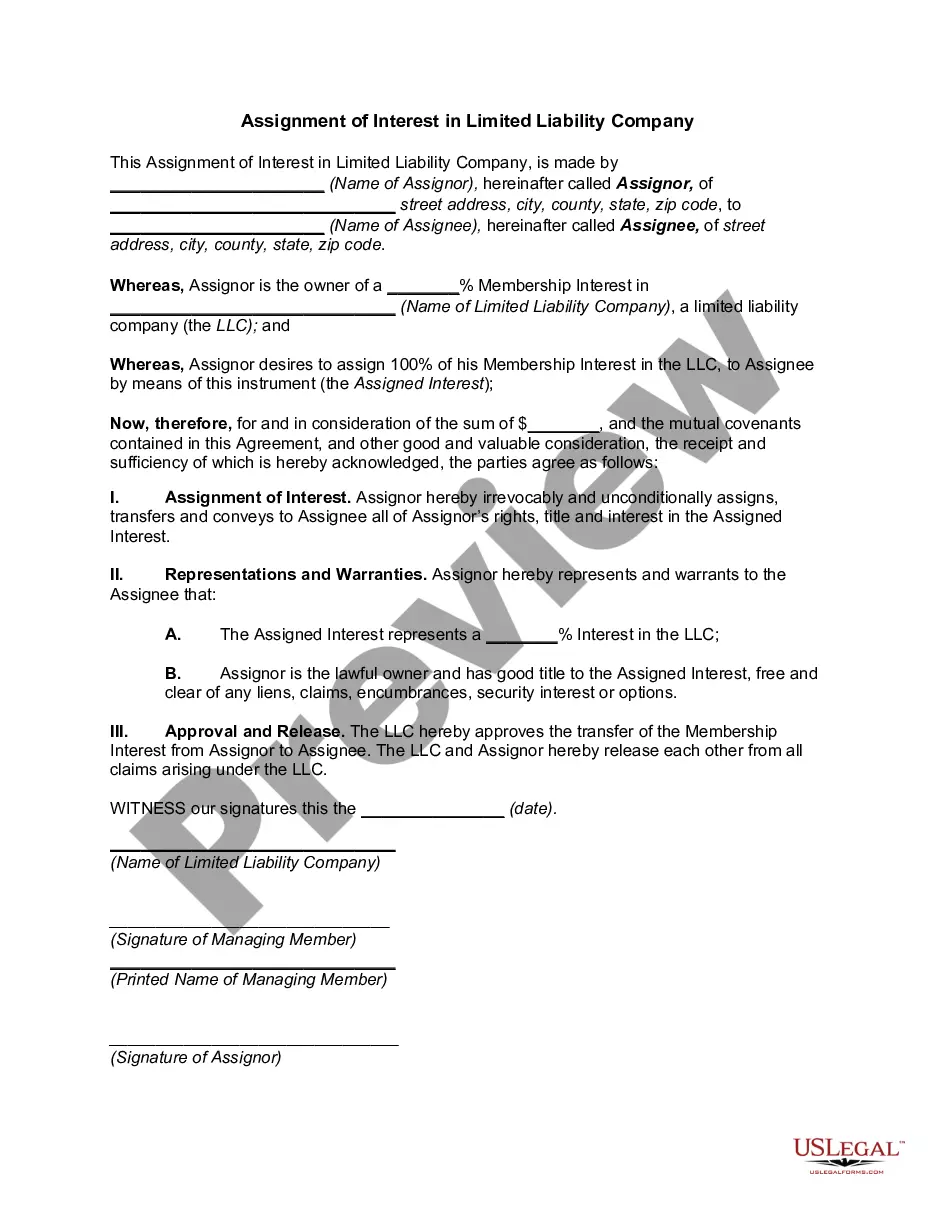

A membership interest may be used to refer to the ownership interest of a member in the LLC. The word unit is often used to reflect the membership interests of a member in the LLC. Some LLC's issue membership interest certificates. To become a new member of the LLC the consent of majority of the members is necessary. A transfer of units of an existing member does not automatically include membership into the LLC.