A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Massachusetts Receipt by Trustor for Trust Property Upon Revocation of Trust

Description

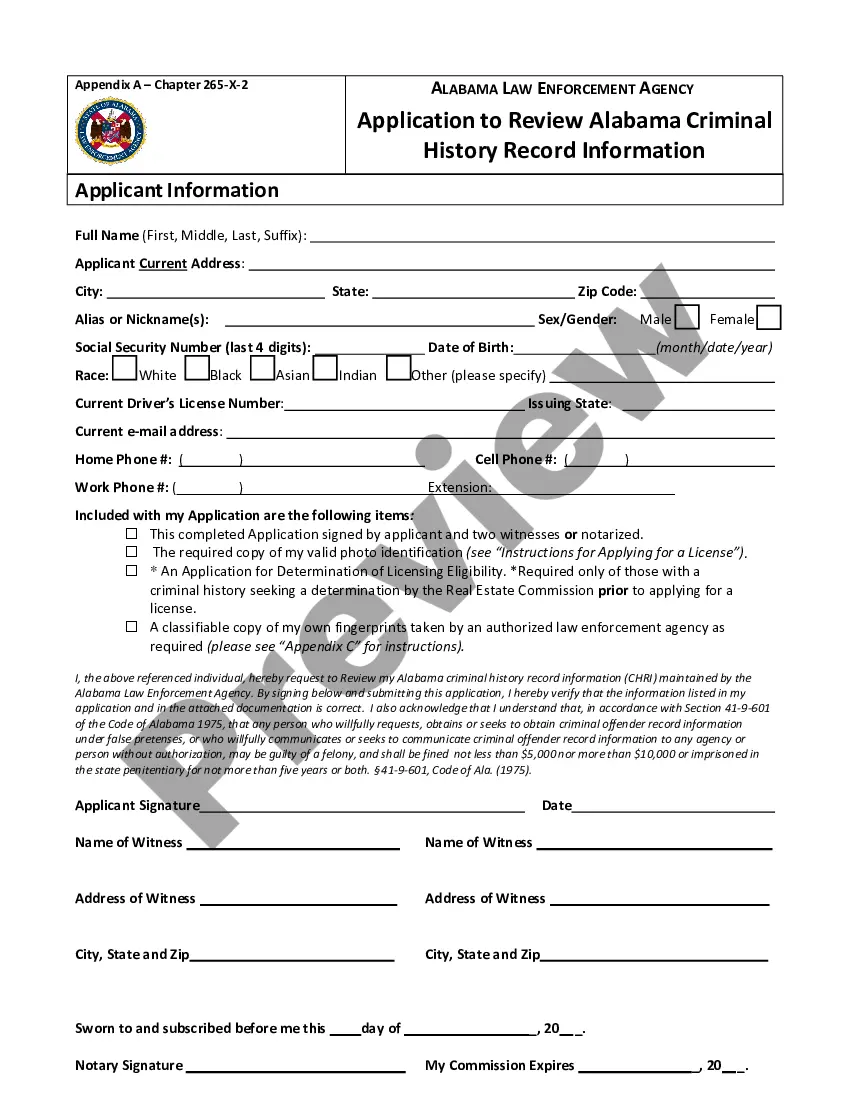

How to fill out Receipt By Trustor For Trust Property Upon Revocation Of Trust?

It is feasible to allocate time on the web searching for the legitimate document template that satisfies the federal and state requirements you require.

US Legal Forms offers thousands of legal forms that are evaluated by professionals.

You can easily download or print the Massachusetts Receipt by Trustor for Trust Property Upon Revocation of Trust from our service.

If available, use the Review button to verify the document template as well. If you wish to find another variant of the form, utilize the Search field to locate the template that meets your needs and requirements.

- If you possess a US Legal Forms account, you can sign in and click on the Acquire button.

- Subsequently, you can complete, edit, print, or sign the Massachusetts Receipt by Trustor for Trust Property Upon Revocation of Trust.

- Each legal document template you buy is yours permanently.

- To obtain another copy of any purchased form, visit the My documents section and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the basic instructions below.

- First, ensure you have selected the correct document template for your county/town of choice.

- Check the form outline to ensure you have chosen the correct form.

Form popularity

FAQ

To obtain a certificate of trust in Massachusetts, you typically need to request this document from the trustee of the trust. The certificate of trust serves as proof of existence and outlines the powers of the trustee. It's important to ensure that you also receive a 'Massachusetts Receipt by Trustor for Trust Property Upon Revocation of Trust' if applicable. For streamlined processes, consider using platforms like US Legal Forms, which offer templates and guidance to help navigate these requirements efficiently.

One significant mistake parents make when establishing a trust fund is failing to clearly define the terms of the trust, including how assets should be managed and distributed. Not providing a Massachusetts Receipt by Trustor for Trust Property Upon Revocation of Trust can lead to confusion and disputes among beneficiaries later on. Furthermore, neglecting to update the trust as family dynamics change can also create complications. Using platforms like uslegalforms helps ensure that all necessary documentation and updates are managed effectively.

Selling a house in an irrevocable trust can be complex and often requires approval from the trustee. While you can sell the property, you need to follow specific procedures laid out in the trust document. Consulting with a legal professional can help clarify options and ensure compliance with Massachusetts laws, ultimately safeguarding your interests.

When a trust is dissolved, its assets are distributed according to your wishes outlined in the trust document or state law. If you revoke the trust, you will receive the Massachusetts Receipt by Trustor for Trust Property Upon Revocation of Trust, allowing you to manage your assets directly. This process ensures that your beneficiaries understand their rights to the property.

The 5 year rule for trusts refers to the time frame concerning the treatment of assets for tax purposes. If you transfer assets to a trust, the IRS may consider those assets as part of your estate for five years. Understanding this rule can impact estate planning and your overall strategy, especially when you decide to revoke or modify a trust.

When you revoke a trust, the trust property is typically returned to you, known as the Massachusetts Receipt by Trustor for Trust Property Upon Revocation of Trust. This means you regain control over the assets. It's important to execute a proper revocation to ensure all terms are clear, which helps prevent any future disputes.

An example of revoking a trust can include a trustor deciding to change their estate plans, potentially due to changes in family circumstances or financial status. In this case, the trustor creates a written revocation stating their intention and follows legal guidelines. Ensuring you have a Massachusetts Receipt by Trustor for Trust Property Upon Revocation of Trust guarantees the process is well-documented.

When a trust is revoked, the assets held within it are typically transferred back to the trustor or distributed to the beneficiaries according to the trust's terms. It is essential to handle this process correctly to ensure compliance with legal requirements. Receiving a Massachusetts Receipt by Trustor for Trust Property Upon Revocation of Trust helps document this transfer effectively.

A trust becomes revoked when the trustor takes specific legal actions to formally nullify its terms. This usually involves creating a written document that declares the trust's revocation. Proper documentation, including the Massachusetts Receipt by Trustor for Trust Property Upon Revocation of Trust, is crucial to avoid potential disputes later.

A trust can be terminated in three primary ways: revocation by the trustor, fulfillment of the trust’s purpose, or due to an order from a court. Each method has specific processes that must be followed to ensure the trust is dissolved properly. For clarity and legality, particularly regarding the Massachusetts Receipt by Trustor for Trust Property Upon Revocation of Trust, consult with an attorney or a reliable platform like uslegalforms.