Massachusetts Director's Fees - Resolution Form - Corporate Resolutions

Description

How to fill out Director's Fees - Resolution Form - Corporate Resolutions?

Are you in a situation where you need documents for both commercial or particular reasons almost every working day.

There are numerous legal document templates accessible online, but finding ones you can rely on isn’t straightforward.

US Legal Forms offers thousands of template options, including the Massachusetts Director's Fees - Resolution Form - Corporate Resolutions, which can be tailored to meet federal and state requirements.

Select the pricing plan you prefer, complete the necessary information to create your account, and process an order with your PayPal or Visa or Mastercard.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and possess your account, simply Log In.

- Afterward, you can download the Massachusetts Director's Fees - Resolution Form - Corporate Resolutions template.

- If you don’t have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it’s for the correct city/region.

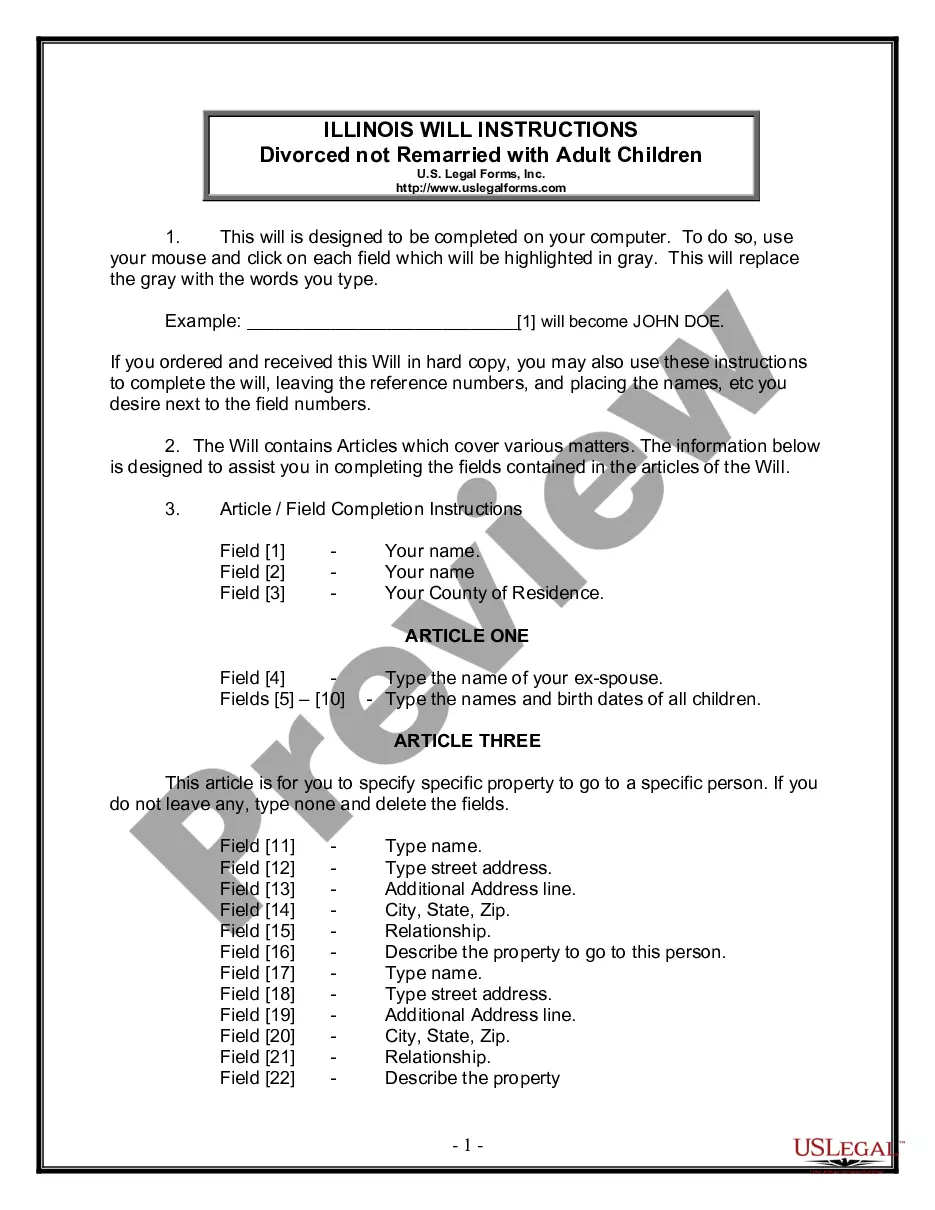

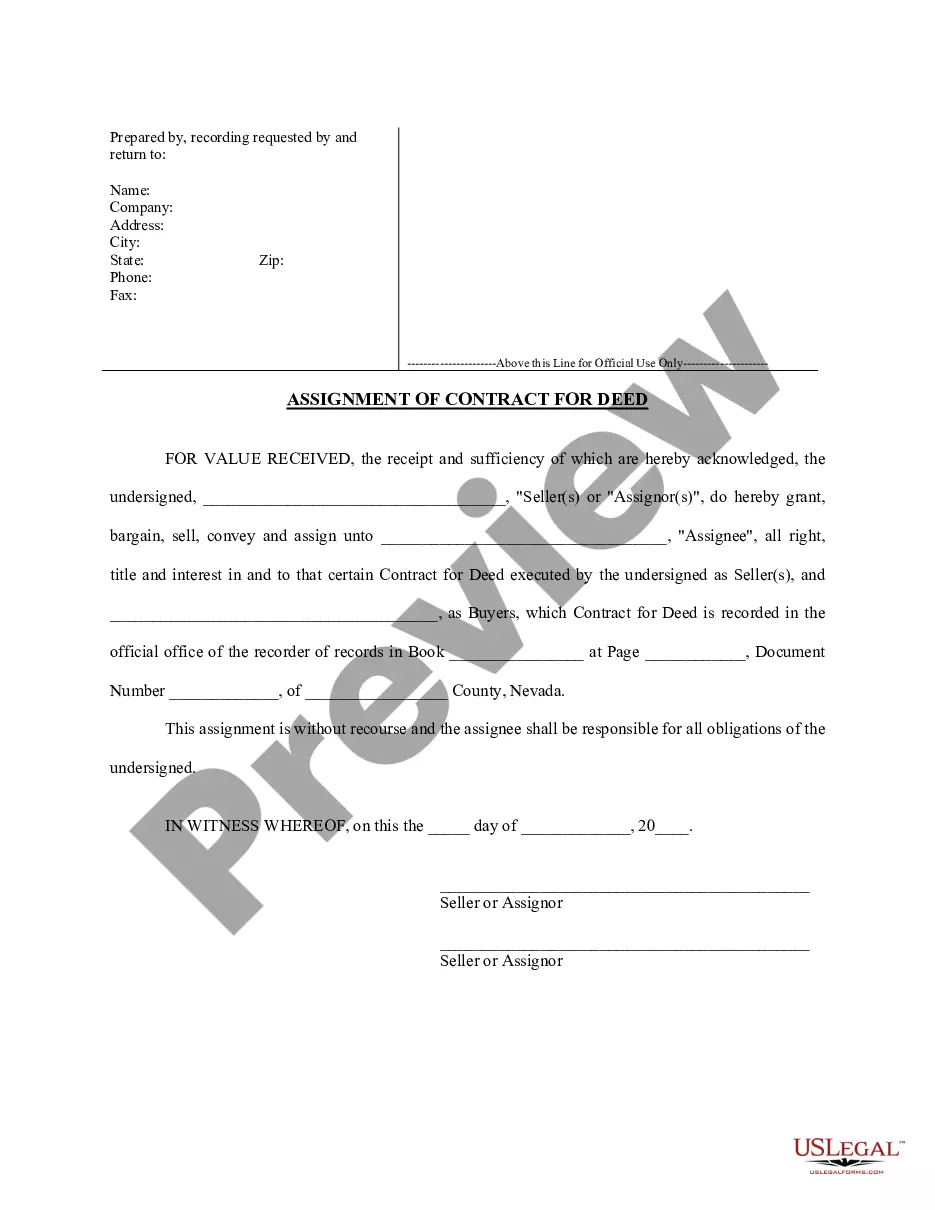

- Use the Preview button to inspect the form.

- Check the description to make certain you’ve selected the right form.

- If the form isn’t what you’re seeking, use the Search field to find the form that fits your needs and requirements.

- Once you find the appropriate form, click Purchase now.

Form popularity

FAQ

Resolution of directors documentation refers to the official record of the decisions made by the board concerning corporate governance. This type of documentation provides transparency and legal protection for both the directors and the corporation. By using the Massachusetts Director's Fees - Resolution Form - Corporate Resolutions, you can easily create comprehensive records that are essential for successful corporate management.

The purpose of a resolution is to provide a formal record of decisions made by a corporation’s leadership. These resolutions ensure clarity on the actions taken and signify the approval by the board. Utilizing the Massachusetts Director's Fees - Resolution Form - Corporate Resolutions helps companies maintain an accurate and organized account of their governance.

A resolution form is a formal document that outlines the decisions and actions approved by an organization's board of directors. This document serves as a record of significant choices made within the company. The Massachusetts Director's Fees - Resolution Form - Corporate Resolutions is an excellent resource to capture these important decisions in a structured manner.

The corporate resolution form is a template used to record decisions made by a corporation's board of directors. This form typically includes the decision, the names of those involved, and any specific instructions related to the decision. By leveraging the Massachusetts Director's Fees - Resolution Form - Corporate Resolutions, you gain access to a reliable format that can cater to various corporate actions.

A corporate resolution to sell stock is a written statement that authorizes the sale of shares by the corporation. This document includes details such as the amount of stock being sold and the identity of the buyer. When you utilize the Massachusetts Director's Fees - Resolution Form - Corporate Resolutions, it ensures that all necessary legalities are observed and recorded properly.

A director's resolution to appoint directors is a formal document that records the decision made by the current board members. This resolution specifies the names of the individuals who are appointed as directors, along with any relevant terms or conditions of their roles. Using the Massachusetts Director's Fees - Resolution Form - Corporate Resolutions simplifies this task and provides a clear framework for official appointments.

An example of a resolution for a company could be a document that authorizes a specific action, such as opening a new bank account. This resolution outlines the decision made by the board of directors, including details like who is authorized to manage the account. Utilizing the Massachusetts Director's Fees - Resolution Form - Corporate Resolutions can help streamline this process and ensure compliance.

Filling out a resolution form is straightforward. Start by clearly stating the resolution title and details, including the date and names of the directors involved. After drafting the content, the directors should sign the Massachusetts Director's Fees - Resolution Form - Corporate Resolutions to finalize it. This documentation will serve as an official record of the resolution, paving the way for legal compliance.

Yes, directors can pass a special resolution, but it typically requires a higher voting threshold, often two-thirds or even a unanimous vote. Special resolutions are used for more significant corporate actions, requiring careful consideration. Because of their importance, you should document these decisions using the Massachusetts Director's Fees - Resolution Form - Corporate Resolutions to ensure compliance with legal requirements and corporate records.

Directors pass resolutions through meetings or written consents, depending on the corporate bylaws. During a meeting, directors discuss the proposal and vote. After achieving the required majority, they document the decision using the Massachusetts Director's Fees - Resolution Form - Corporate Resolutions. This approach ensures clarity and accountability in corporate governance.