Massachusetts Agreement for Web Design Maintenance Services

Description

How to fill out Agreement For Web Design Maintenance Services?

Locating the appropriate valid document format can be challenging.

Clearly, there are numerous templates accessible online, but how can you find the correct version you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Massachusetts Agreement for Web Design Maintenance Services, which can be utilized for both business and personal purposes.

You can view the form using the Preview button and read the form description to confirm it's suitable for you.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to get the Massachusetts Agreement for Web Design Maintenance Services.

- Use your account to browse the legal forms you have previously purchased.

- Navigate to the My documents section of your account to retrieve another copy of the form you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

In addition, sales of prewritten software, computer hardware, and hardware and software maintenance contracts involving software updates, upgrades and fixes are generally subject to the Massachusetts sales and use tax under the rules provided in the regulation.

Sales of digital products are exempt from the sales tax in Massachusetts.

Sales of custom software, personal and professional services, and reports of individual information are generally exempt from Massachusetts sales and use taxes.

Are service contract or warranty sales to the end customer subject to sales tax at the time of sale? Yes. Retail sales tax applies to a service contract or warranty sold to a consumer (WAC 458-20-257).

Unlike Connecticut and New York, business and professional services in Massachusetts are presumed taxable unless specifically exempt by state statute. In general, most business and professional services are exempt from the state's sales tax (MASS.

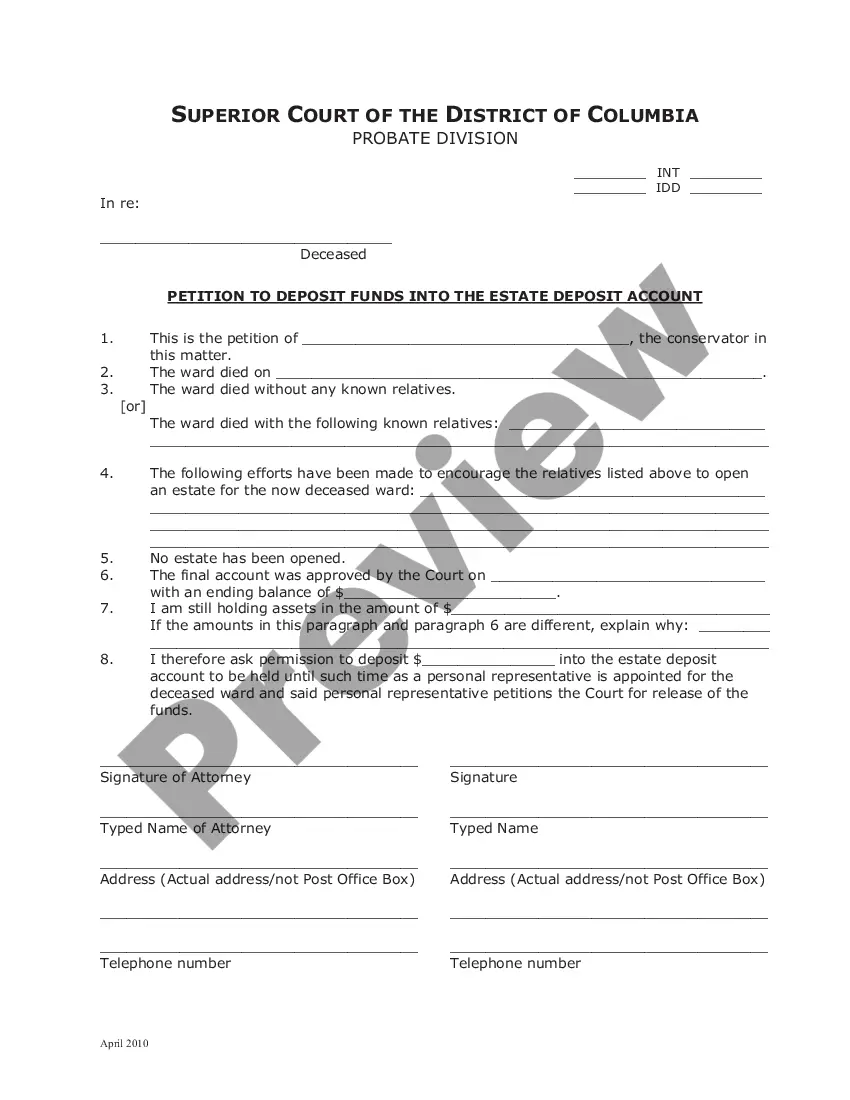

A Website Maintenance Agreement is an agreement formed between the company and the website maintenance services provider wherein the client is asked to maintain the company's website and is paid for his services.

Sales of prewritten computer software, regardless of the method of delivery, are subject to the Massachusetts sales tax. SaaS, cloud computing and electronically downloaded software are all taxable in the state because the object of the transaction is acquiring the right to use the software.

Web design services and sales taxIf you also deliver the work in any form of personal tangible property, that portion of the sale is taxable and must be stated separately on the invoice.

Purchase's design transactions are not taxable.