Massachusetts Minimum Checking Account Balance - Corporate Resolutions Form

Description

How to fill out Minimum Checking Account Balance - Corporate Resolutions Form?

If you need to finish, obtain, or print authorized document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Utilize the site's straightforward and user-friendly search feature to locate the documents you need.

A variety of templates for business and personal purposes are organized by categories, states, or keywords.

Step 4. Once you have identified the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for the account.

Step 5. Complete the payment. You may use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Massachusetts Minimum Checking Account Balance - Corporate Resolutions Form in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and hit the Obtain button to search for the Massachusetts Minimum Checking Account Balance - Corporate Resolutions Form.

- You can also access forms you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

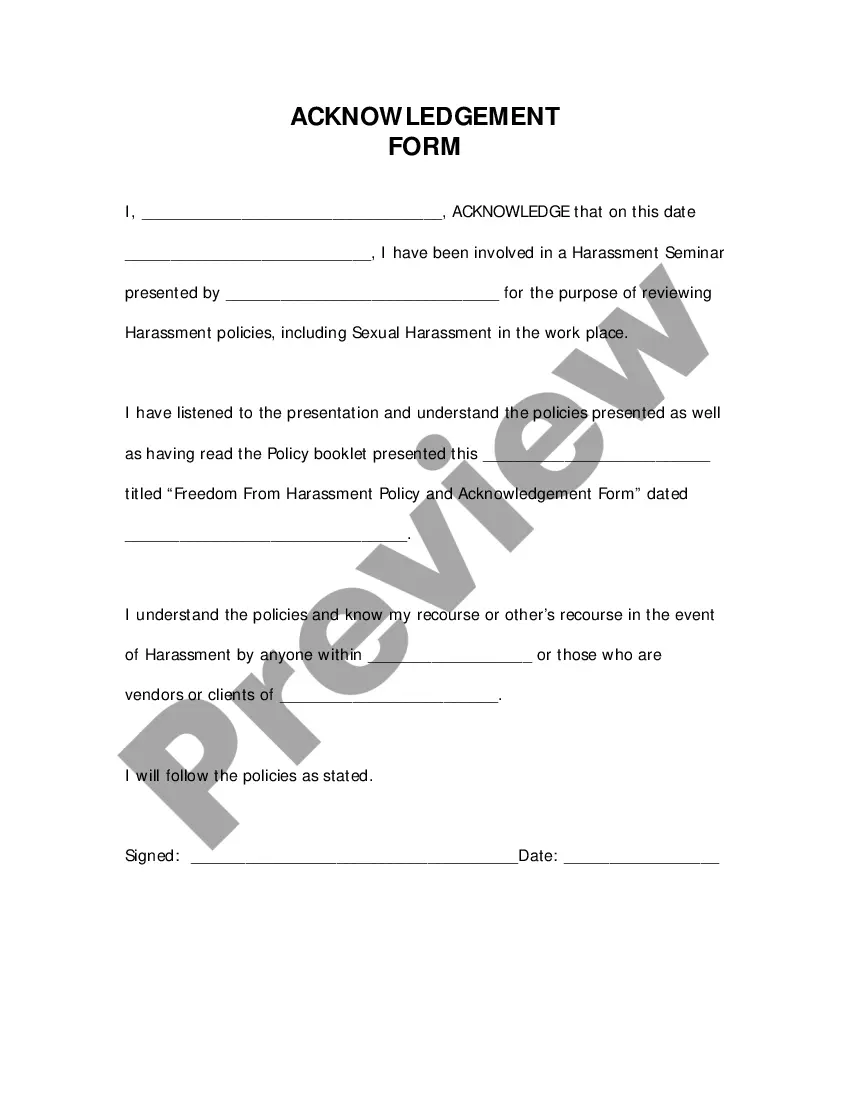

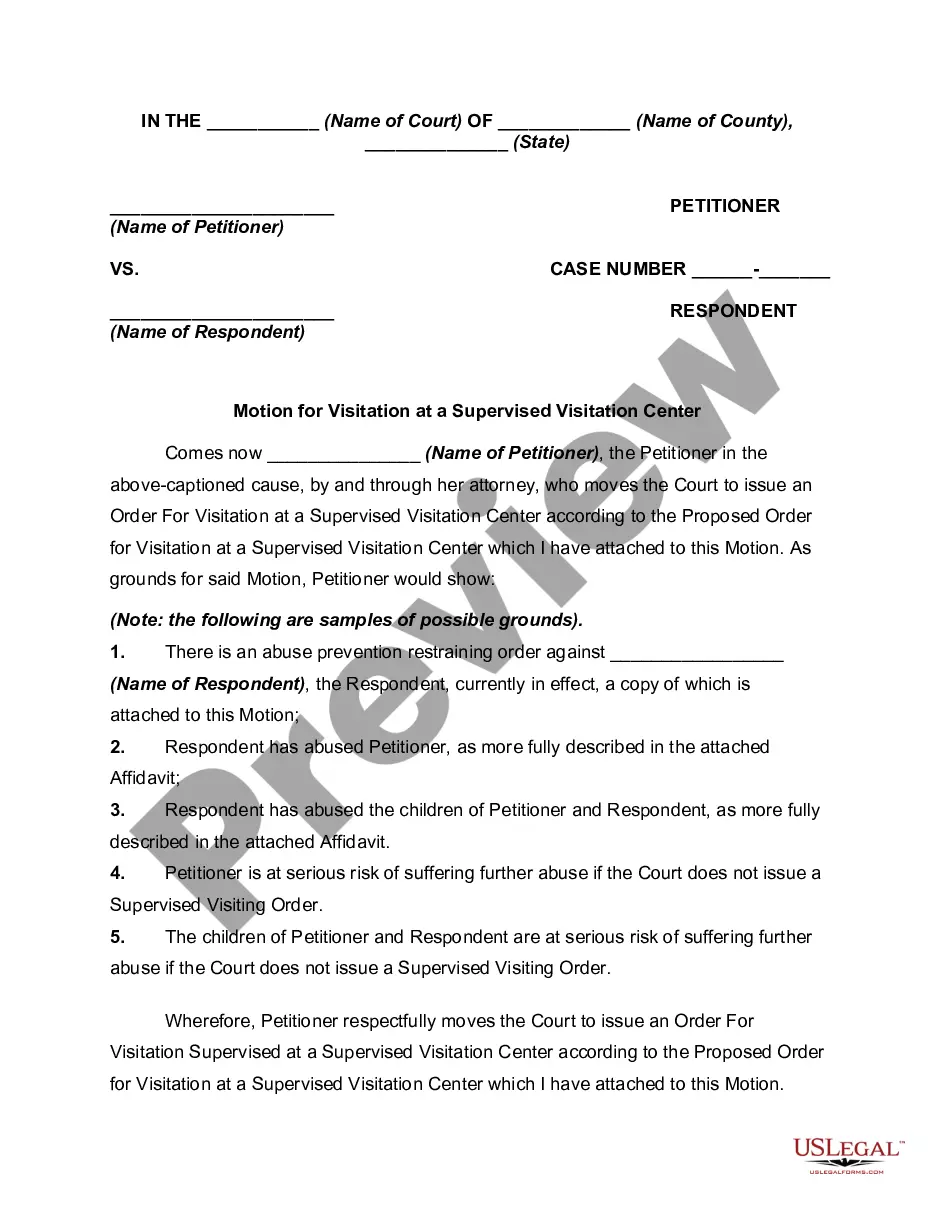

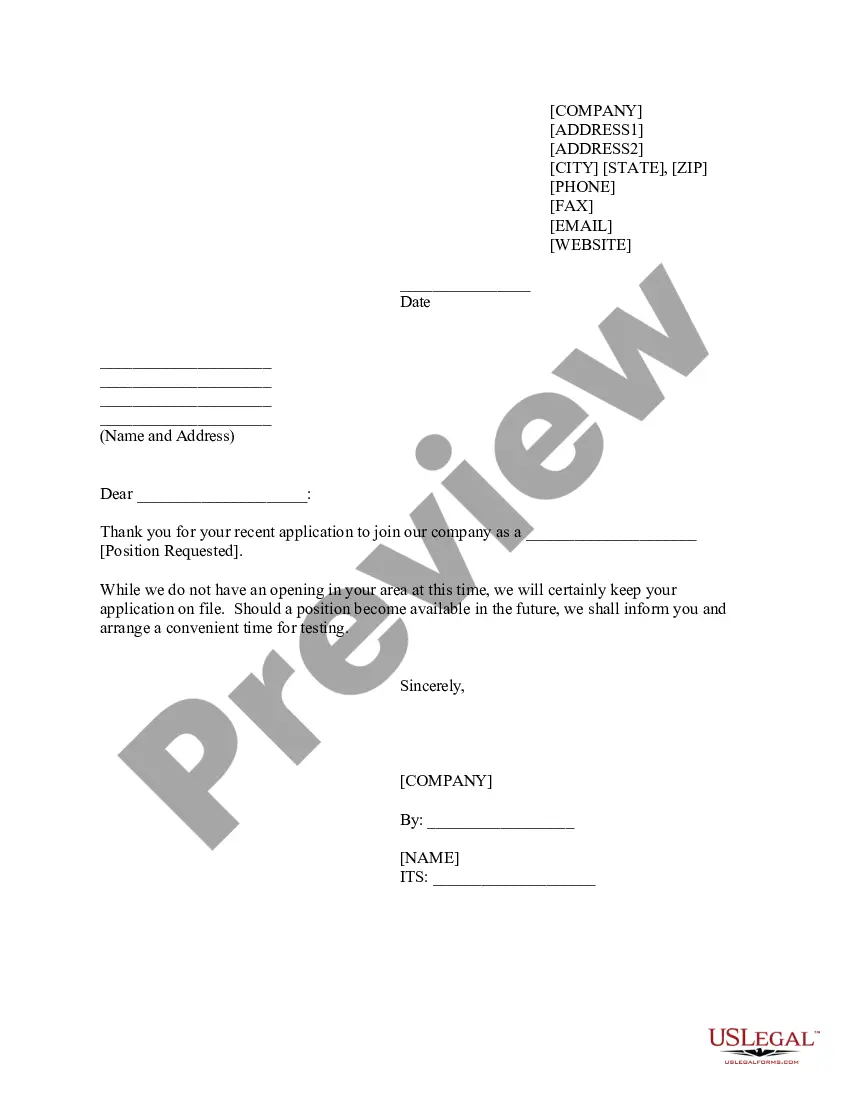

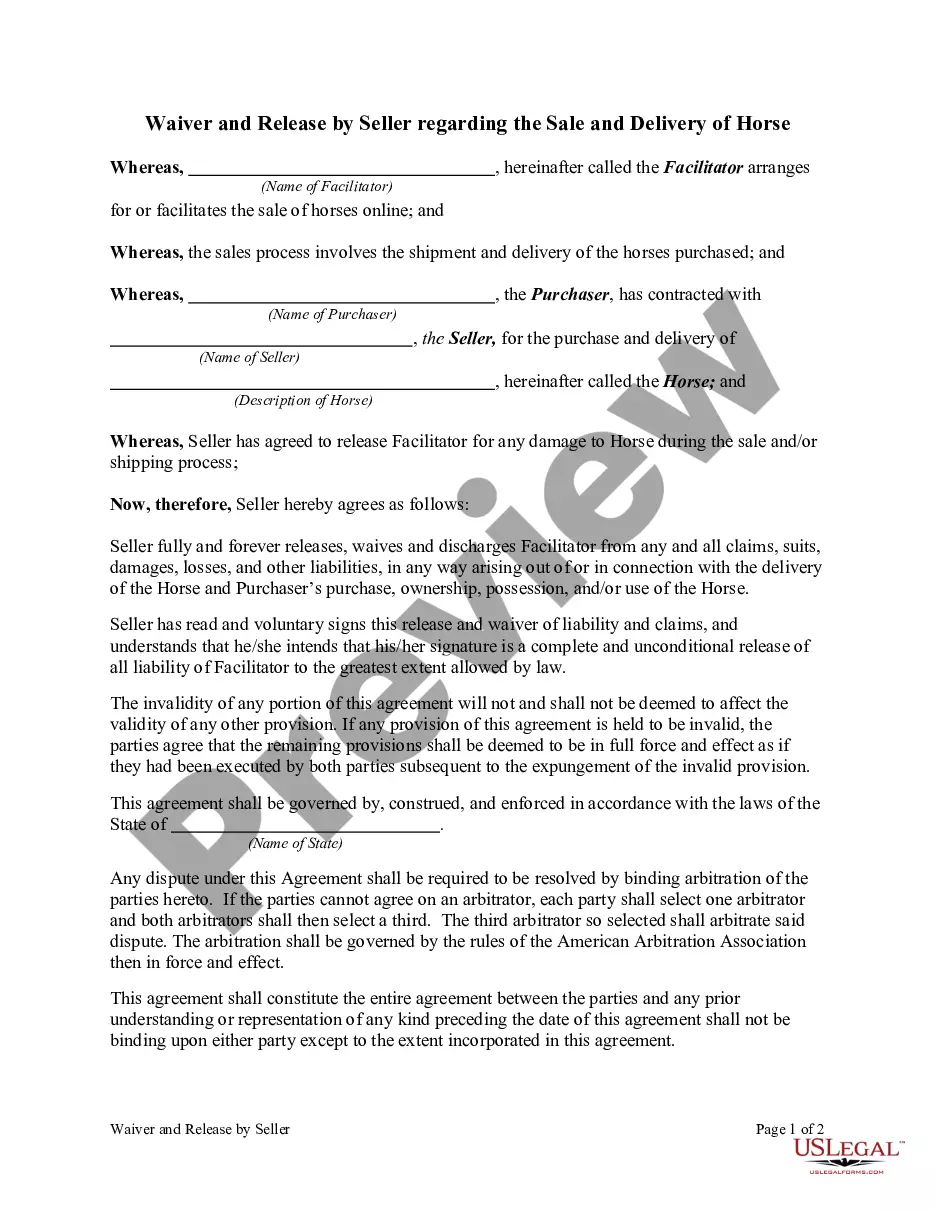

- Step 2. Use the Preview option to review the content of the form. Make sure to read the details.

- Step 3. If you are unhappy with the form, utilize the Lookup field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

MA form 355 must be filed by corporations doing business in Massachusetts, particularly those that are subject to corporate excise tax. This form is essential for compliance and accurate reporting of your financial position. Assistance is available through US Legal Forms to ensure you meet all filing requirements, including those related to the Massachusetts Minimum Checking Account Balance - Corporate Resolutions Form.

To mail your federal tax return in Massachusetts, refer to the IRS guidelines for the correct filing address based on your specific situation. Different addresses apply based on whether you are including a payment or not. If you have additional obligations, such as filing the Massachusetts Minimum Checking Account Balance - Corporate Resolutions Form, US Legal Forms can help you manage all necessary submissions.

Yes, if your business is a corporation operating in Massachusetts, you typically need to file a corporate tax return. Filing ensures compliance with state regulations and helps maintain accurate records. For detailed guidance on necessary forms and requirements, including the Massachusetts Minimum Checking Account Balance - Corporate Resolutions Form, rely on resources like US Legal Forms.

MA form 355S is a tax form specifically designed for S corporations conducting business in Massachusetts. It allows these entities to report their income, deductions, and other important financial information. If you are an S corporation, understanding your obligations related to forms such as the Massachusetts Minimum Checking Account Balance - Corporate Resolutions Form is crucial, and US Legal Forms can provide the necessary assistance.

Send your Massachusetts estimated tax payments to the address provided by the Massachusetts Department of Revenue. It's critical to follow the guidelines to ensure your payment is successfully processed. Platforms like US Legal Forms can guide you through these requirements to avoid any issues.

You need to file your Massachusetts state tax return with the Massachusetts Department of Revenue. You can file online or via mail, depending on your preference. If you're collecting documents related to business operations, such as the Massachusetts Minimum Checking Account Balance - Corporate Resolutions Form, US Legal Forms can help streamline the process.

You should file Massachusetts form 2 with the Massachusetts Department of Revenue, usually via mail. Ensure you check the submission guidelines carefully to avoid any mistakes. If you need any help, consider using US Legal Forms to simplify the process and ensure compliance.

To file Massachusetts form 355, you will need to send it to the Massachusetts Department of Revenue. Make sure to include all the required documentation along with your form for smooth processing. Utilizing the right resources is important, and US Legal Forms can assist you in navigating the requirements effectively.

Filling out a corporate resolution form involves entering your corporation's name, the date, and the resolutions passed by the board. Provide details about the individuals authorized to take action on behalf of the corporation. Ensure to include specific resolutions concerning the Massachusetts Minimum Checking Account Balance - Corporate Resolutions Form, as this provides necessary context for the banking institution.

An example of a company resolution could be one authorizing an officer to open a specific bank account. The resolution will include the company name, the officer’s name, and the actions permitted, like maintaining the Massachusetts Minimum Checking Account Balance - Corporate Resolutions Form. This clarity assures the bank that all necessary approvals have been granted.