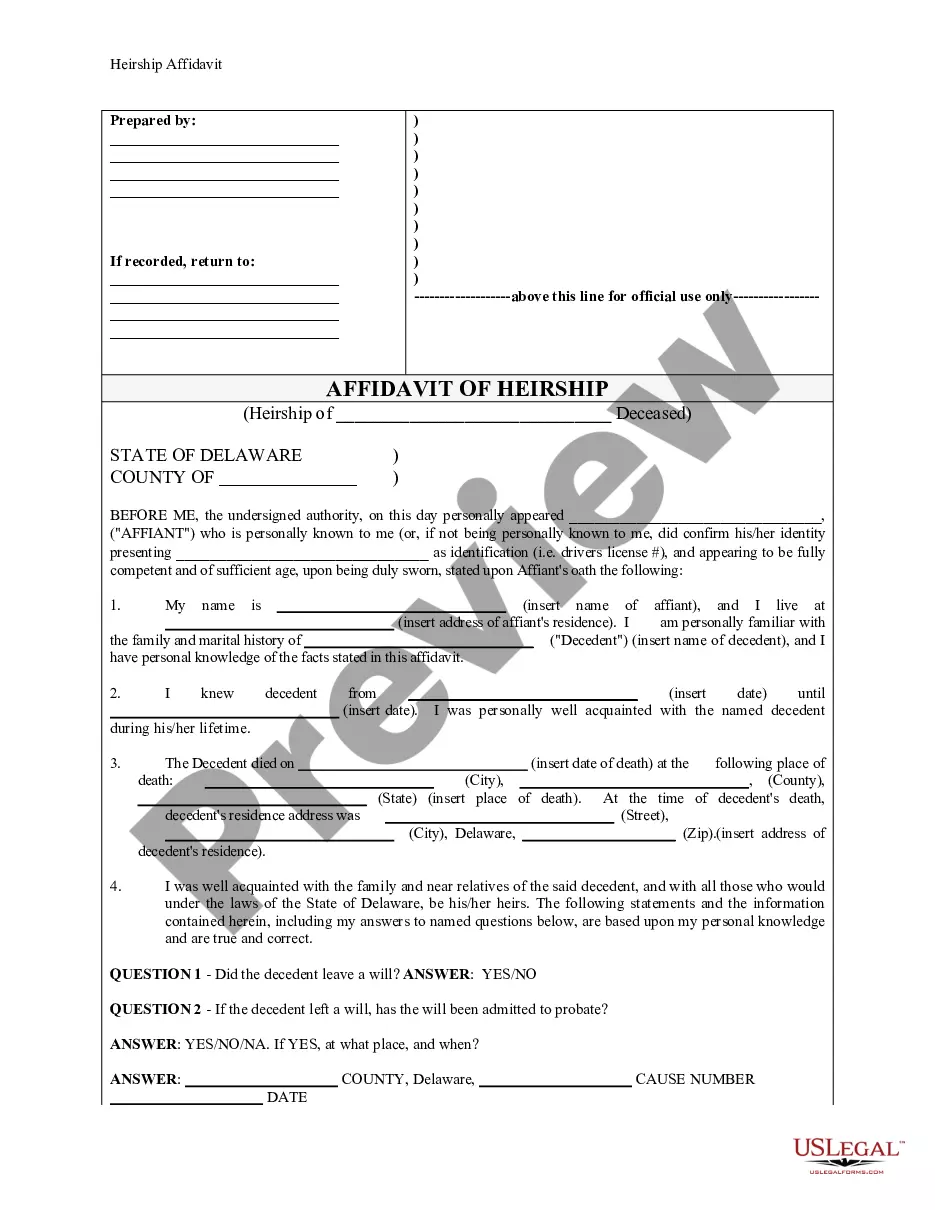

The Massachusetts Category Form is an official form used by the Massachusetts Department of Revenue (FOR) to collect information on taxpayers’ income sources. This form is used to determine whether taxpayers owe income taxes and to calculate the amount they owe. The form includes information about wages, salaries, and other income, such as capital gains, dividends, interest, and business income. There are several types of Massachusetts Category Form, including the Resident Form 1, Nonresident/Part-Year Resident Form 1-NR/BY, Schedule HC, and Schedule Y. The Resident Form 1 is used by Massachusetts residents to report their income and calculate their taxes. The Nonresident/Part-Year Resident Form 1-NR/BY is used by taxpayers who are nonresidents or part-year residents of Massachusetts. Schedule HC is used to report health care expenses, and Schedule Y is used to report the Massachusetts earned income tax credit.

Massachusetts Category Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Massachusetts Category Form?

Generating official documents can be quite a challenge if you lack accessible fillable templates. With the US Legal Forms online database of formal documents, you can trust the contents you discover, as they all align with federal and state laws and are verified by our specialists.

Acquiring your Massachusetts Category Form from our service is as straightforward as 1-2-3. Previously authorized users with a legitimate subscription simply need to Log In and click the Download button once they locate the appropriate template. Subsequently, if desired, users can access the same document from the My documents section of their account. Nevertheless, even if you are not acquainted with our service, registering with a valid subscription takes only a few moments. Here’s a brief guide for you.

Have you yet to try US Legal Forms? Subscribe to our service today to obtain any official document swiftly and effortlessly whenever necessary, and maintain your paperwork in an organized manner!

- Document compliance confirmation. You should carefully review the content of the form you require and ensure that it meets your needs and adheres to your state law requirements. Examining your document and reviewing its general description will assist you in achieving this.

- Alternative search (optional). If there are any discrepancies, explore the library using the Search tab at the top of the page until you identify an appropriate blank, and click Buy Now once you find the one you desire.

- Account registration and form acquisition. Create an account with US Legal Forms. After account validation, Log In and select your most fitting subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and subsequent use. Select the file format for your Massachusetts Category Form and click Download to save it on your device. Print it to manually complete your documents, or utilize a multi-featured online editor to prepare an electronic version more rapidly and effectively.

Form popularity

FAQ

An affidavit of non-prosecution in Massachusetts is a formal declaration by a victim indicating they do not wish to pursue criminal charges. This affidavit can significantly affect the prosecutor's case strategy, potentially leading to the dismissal of charges. However, it’s crucial to note that the prosecutor retains the authority to continue the case if they deem it necessary. To create this affidavit accurately, consider using the Massachusetts Category Form available on USLegalForms.

How do I serve the summons if the defendant does not live in Massachusetts? When the defendant lives out of state, serve them the same way you do as if they live in Massachusetts. Find a sheriff, constable, or other person who is not involved in your case and who works where the defendant can be found.

Acceptance of service is defined as an agreement by the defendant (or the defendant's attorney) to accept papers or a complaint without having the papers served by a process server or a sheriff.

To sue someone in Massachusetts, you have to file a complaint with the clerk of the court. A complaint is not a specific form. It is a document that contains a short statement of the facts showing your claim and why you are entitled to relief and a demand for judgment granting that relief.

About the Superior Court The court's 82 justices sit in 20 courthouses in all 14 state counties.

?Service of Process? is the way you deliver court papers to the person required to respond to them. This person is called the ?defendant.? You must tell the defendant, in writing: there is a case, what the case is about, what the defendant must do, if there is a court hearing, and when and where to come to court.

Under Rule 5(b), service may be made by mailing the paper to the party or attorney at his last known address; if no address is known, the paper may be left with the clerk of court. Prior Massachusetts practice made no provision in cases where the address was unknown. Notice must be written.

A party who waives service of the summons retains all defenses and objections (except any relating to the summons or to the service of the summons), and may later object to the jurisdiction of the court or to the place where the action has been brought.