Louisiana Interest Verification

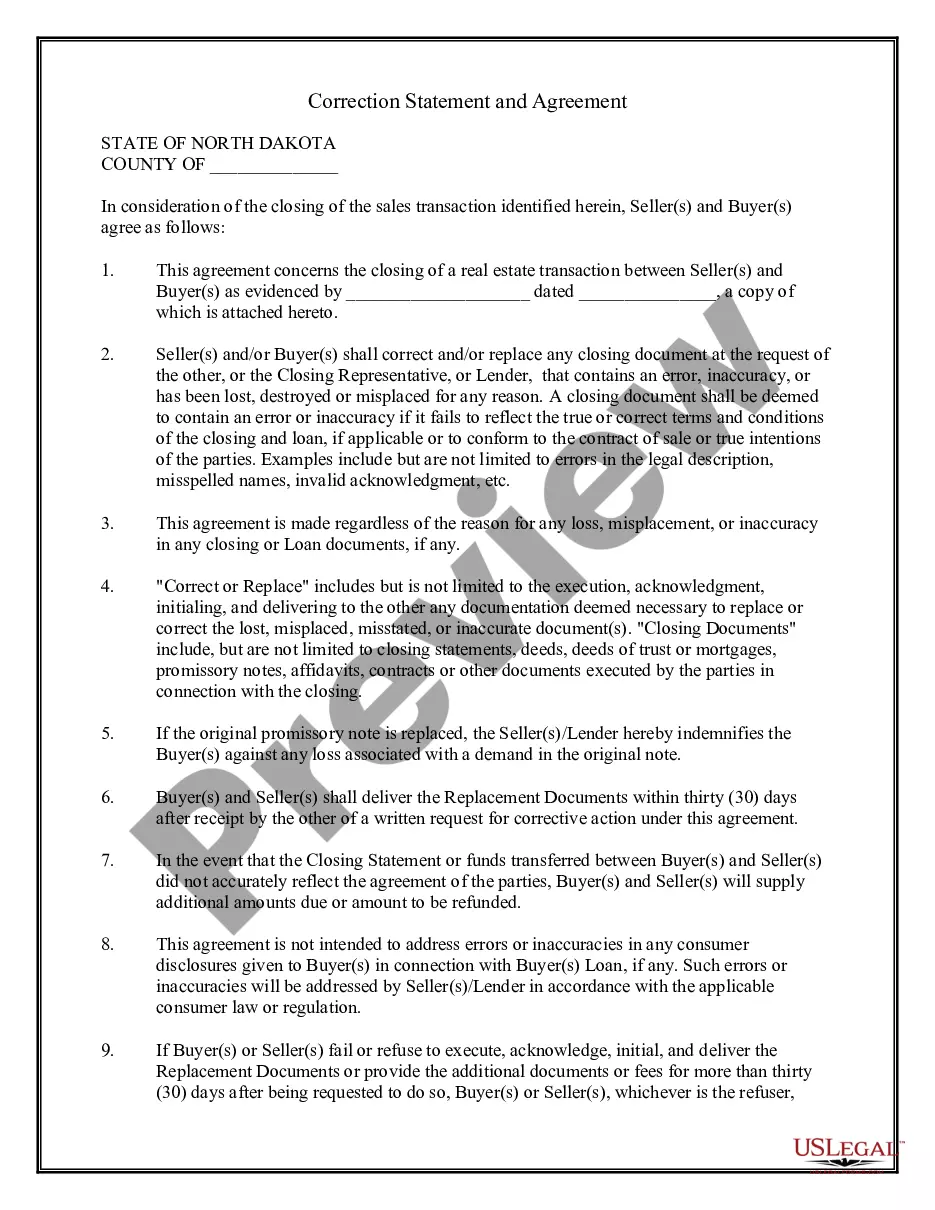

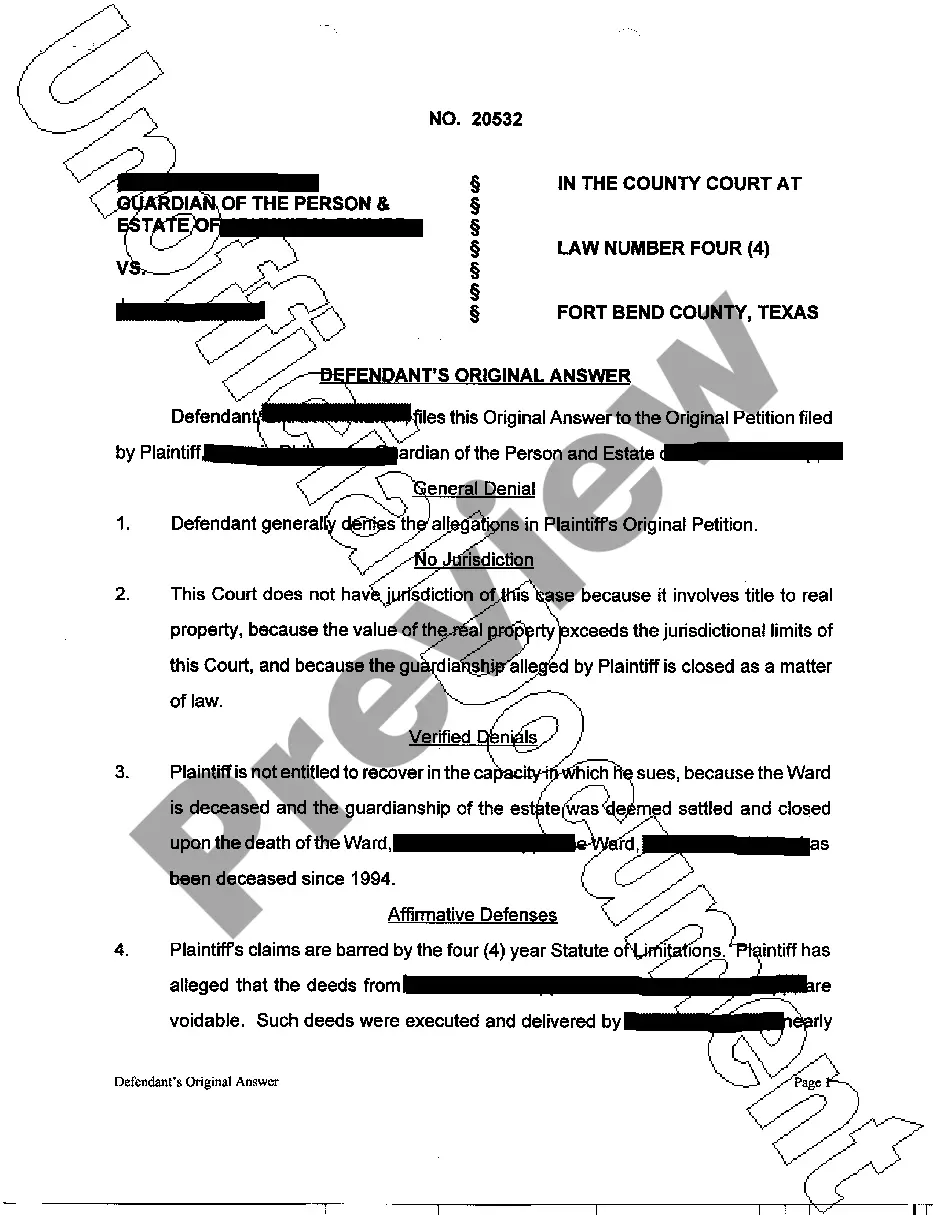

Description

How to fill out Interest Verification?

US Legal Forms - one of several biggest libraries of legitimate kinds in the States - offers a wide range of legitimate file web templates you can down load or printing. Using the site, you can find thousands of kinds for company and person uses, sorted by classes, suggests, or search phrases.You will discover the most recent variations of kinds like the Louisiana Interest Verification within minutes.

If you have a monthly subscription, log in and down load Louisiana Interest Verification from your US Legal Forms collection. The Download key will appear on every single form you see. You have accessibility to all earlier downloaded kinds inside the My Forms tab of your own account.

If you would like use US Legal Forms the first time, listed below are simple instructions to help you started:

- Be sure to have picked the correct form for your personal metropolis/region. Go through the Review key to review the form`s content. Look at the form information to actually have selected the proper form.

- In the event the form doesn`t fit your requirements, use the Research field near the top of the display screen to obtain the one which does.

- If you are pleased with the form, confirm your choice by simply clicking the Purchase now key. Then, choose the rates plan you like and provide your qualifications to sign up for the account.

- Method the deal. Use your charge card or PayPal account to perform the deal.

- Select the structure and down load the form in your gadget.

- Make modifications. Fill up, change and printing and indication the downloaded Louisiana Interest Verification.

Each template you put into your bank account lacks an expiration particular date and it is yours forever. So, if you want to down load or printing one more duplicate, just check out the My Forms area and click in the form you need.

Obtain access to the Louisiana Interest Verification with US Legal Forms, the most substantial collection of legitimate file web templates. Use thousands of specialist and express-distinct web templates that meet your small business or person demands and requirements.

Form popularity

FAQ

What You Need To Know About Louisiana State Taxes. Louisiana requires you to pay taxes if you're a resident or nonresident who receives income from a Louisiana source. The state income tax rates for the 2021 tax year range from 2.0% to 6.0%, and the sales tax rate is 4.45%.

What is the Phone Number to Find Out the Taxes You Owe? Individual taxpayers may call 1-800-829-1040, Monday through Friday, 7 a.m. to 7 p.m. local time. Taxpayers representing a business may call 1-800-829-4933, Monday through Friday, 7 a.m. to 7 p.m. local time.

Income Tax Department Go to 'e-file'>Income Tax Returns> ' Click 'View e-Filed Returns' to view the respective ITRs. ?

After you verify your identity and tax return information using this service, it may take up to nine weeks to complete the processing of the return. Visit Where's My Refund? or use the IRS2Go mobile app 2-3 weeks after using this service to check your refund status.

If you are single, you should file Form IT-540, Louisiana Resident Individual Income Tax Return, reporting all of your income to Louisiana. If you are married and both you and your spouse are residents of Louisiana, you should file Form IT-540 reporting all of your income to Louisiana.

Individual income tax liabilities may be paid electronically by an electronic bank account debit using the Louisiana File Online application or by credit card using Official Payments. Credit card payments may also be initiated by telephone at 1-888-272-9829.

To verify your tax liability for individual income tax, call LDR at (225) 219-0102. To verify your tax liability for business taxes, you can review your liabilities online using the Louisiana Taxpayer Access Point (LaTAP) system.

Louisiana has a 4.45 percent state sales tax rate, a max local sales tax rate of 7.00 percent, and an average combined state and local sales tax rate of 9.55 percent. Louisiana's tax system ranks 39th overall on our 2023 State Business Tax Climate Index.

Determination of Tax Effective January 1, 2009Effective January 1, 2022First $12,5002 percent1.85 percentNext $37,5004 percent3.50 percentOver $50,0006 percent4.25 percent6 more rows

Your Louisiana Income Tax ? Line 10 - Act 395 of the 2021 Regular Legislative Session reduced the income tax rates to 1.85%, 3.5%, and 4.25%. The lower rates are reflected in the tax tables.