Louisiana Educator Agreement - Self-Employed Independent Contractor

Description

How to fill out Educator Agreement - Self-Employed Independent Contractor?

If you have to comprehensive, acquire, or print out authorized file web templates, use US Legal Forms, the largest selection of authorized forms, which can be found on-line. Take advantage of the site`s simple and handy look for to obtain the paperwork you require. Numerous web templates for organization and personal reasons are categorized by types and says, or keywords and phrases. Use US Legal Forms to obtain the Louisiana Educator Agreement - Self-Employed Independent Contractor with a few click throughs.

Should you be previously a US Legal Forms customer, log in in your accounts and then click the Download button to have the Louisiana Educator Agreement - Self-Employed Independent Contractor. Also you can gain access to forms you earlier delivered electronically inside the My Forms tab of your own accounts.

If you work with US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Ensure you have selected the shape for your correct area/region.

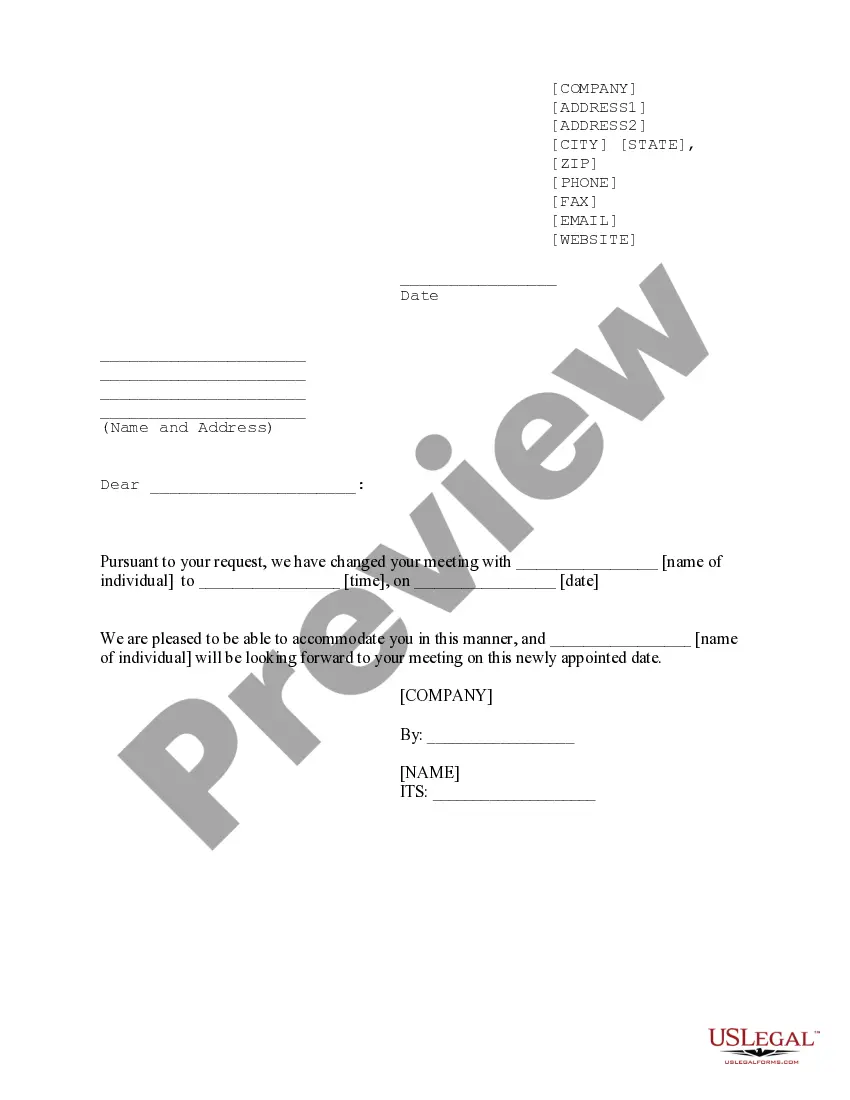

- Step 2. Make use of the Preview option to look through the form`s information. Don`t forget about to see the explanation.

- Step 3. Should you be not happy with all the form, use the Look for discipline at the top of the display screen to get other variations from the authorized form template.

- Step 4. Once you have discovered the shape you require, go through the Get now button. Choose the pricing program you like and add your credentials to register to have an accounts.

- Step 5. Procedure the purchase. You can use your Мisa or Ьastercard or PayPal accounts to complete the purchase.

- Step 6. Choose the format from the authorized form and acquire it on your own product.

- Step 7. Total, change and print out or sign the Louisiana Educator Agreement - Self-Employed Independent Contractor.

Every single authorized file template you buy is your own eternally. You may have acces to every single form you delivered electronically in your acccount. Click on the My Forms segment and choose a form to print out or acquire once again.

Contend and acquire, and print out the Louisiana Educator Agreement - Self-Employed Independent Contractor with US Legal Forms. There are many expert and state-specific forms you can use to your organization or personal requires.

Form popularity

FAQ

Are adjunct professors independent contractors (1099 workers) or W2 employees? Adjuncts are typically contracted to teach on a course-by-course basis but are considered W2 employees for tax purposes.

Employees with a 1099 status are self-employed independent contractors. They are paid according to the terms and conditions stated in the contract and receive a 1099 form on which to report their income on their tax return.

If you're actively running your own tutoring business, and not working for an agency or other employer, you're self-employed. That's true even if you have a full-time day job. In the eyes of the Internal Revenue Service, being self-employed classifies you as a 1099 independent contractor.

Yes, tutoring is normally an activity that is classified by the IRS as self-employment, because you don't receive a W-2 from an employer for doing it. If you wish to report business expenses as a reduction to business income, then you will need the TurboTax online Self-Employment program.

The glib answer is yes. Webster's defines tutor as a person employed to instruct another, esp. privately. California wage order 15 says a tutor may be considered a household employee, along with other staff such as maids.

In order to be legally classified as an independent contractor, a yoga instructor must: Be free from control and direction of the fitness studio as to how they perform their services. Perform their work outside of the fitness studio's usual business.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Because nearly all online English teachers are classified as Independent Contractors and therefor get no taxes taken out of our paychecks as employees would, we're in charge of making payments to the IRS ourselves, usually quarterly.

A worker, personal trainer, or fitness instructor can be classified as an independent contractor if: (a) the worker is free from control and direction in the performance of services; and. (b) the worker is performing work outside the usual course of the business of the hiring company; and.