Louisiana Letter to Debt Collector - Only call me on the following days and times

Description

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

Locating the appropriate legal document template can be quite challenging.

Of course, there are many designs accessible on the web, but how can you pinpoint the legal form you require.

Utilize the US Legal Forms website. The platform offers a vast selection of templates, including the Louisiana Letter to Debt Collector - Only contact me on these specific days and times, which you can use for both business and personal purposes.

If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are certain the form is correct, click on the Purchase now button to obtain the document. Select the pricing plan you prefer and provide the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Fill out, modify, print, and sign the acquired Louisiana Letter to Debt Collector - Only contact me on these specific days and times. US Legal Forms is the largest collection of legal forms where you can discover various document templates. Use the service to download professionally prepared documents that align with state requirements.

- All of the forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Louisiana Letter to Debt Collector - Only contact me on these specific days and times.

- Use your account to review the legal forms you may have acquired previously.

- Visit the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions to follow.

- First, ensure you have selected the correct form for your area/county. You can examine the form using the Preview feature and read the form description to confirm it is the right one for you.

Form popularity

FAQ

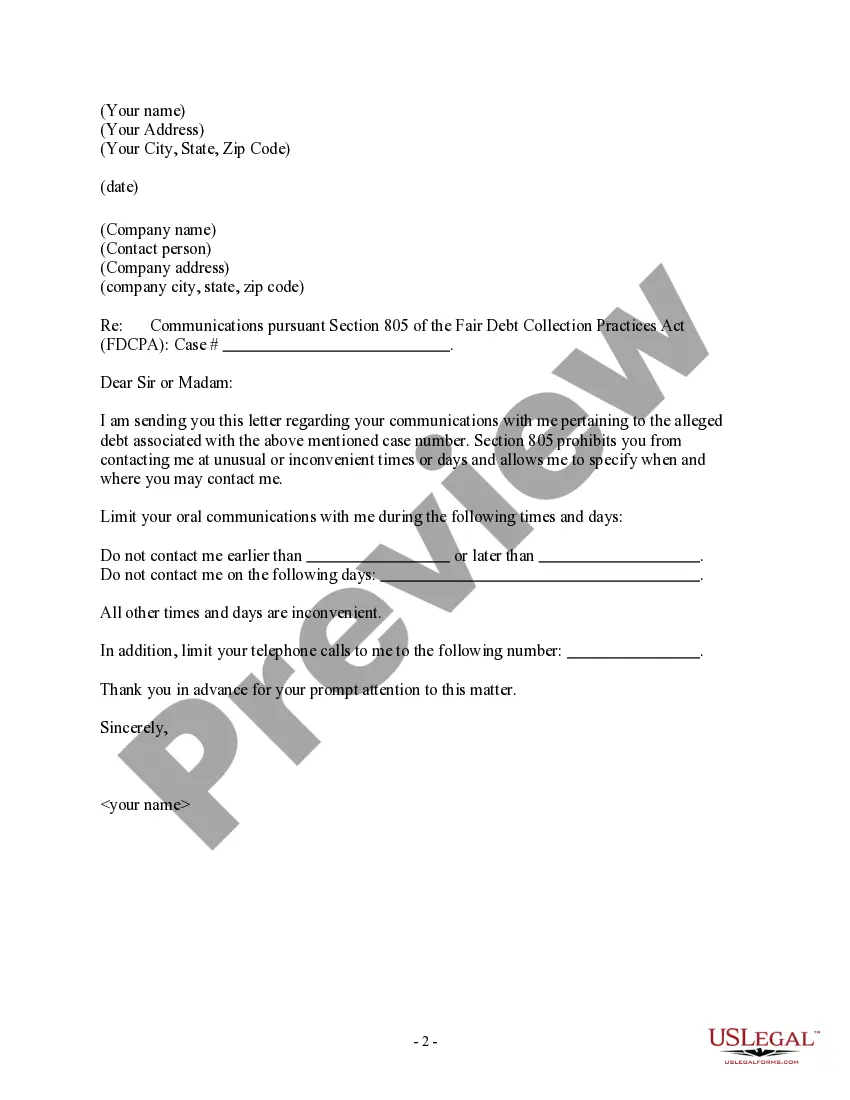

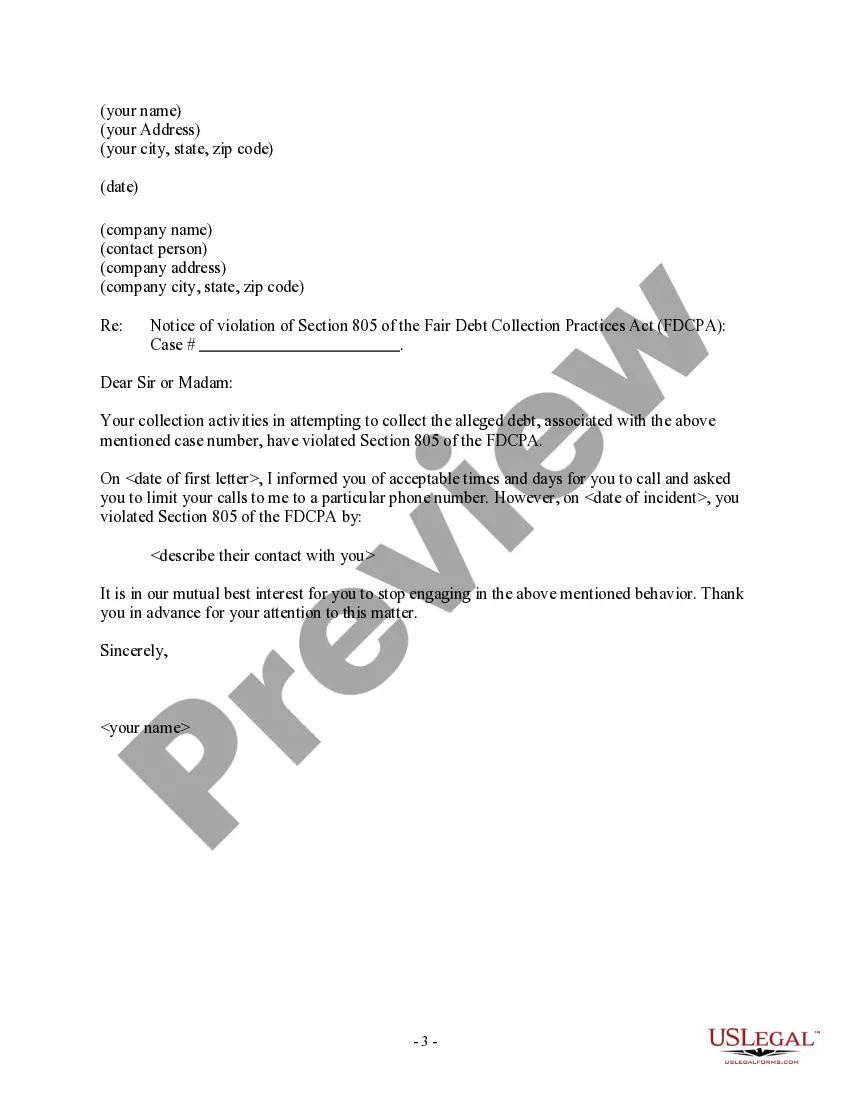

You may ask a debt collector to contact you only by mail, or through your attorney, or set other limitations. Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt.

Dear Debt collector name, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

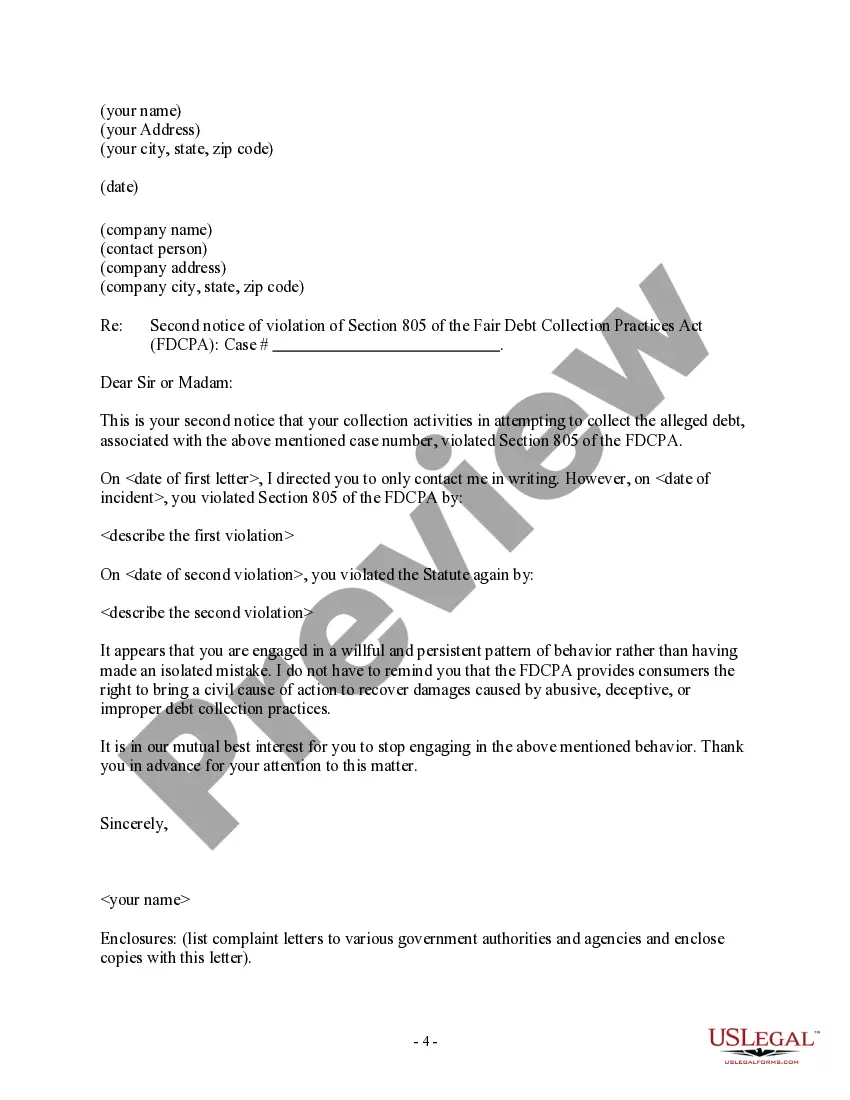

Although debt collectors can leave a message on your machine, they cannot necessarily do it legally. The FDCPA exists in order to protect your privacy and prohibits debt collectors from disclosing your information to third parties. Third parties include your family, friends, boss, or anyone other than your spouse.

Nowadays, most debt collectors record all phone calls so they retain that authorization through recordings, but it is also not uncommon for the debt collector to request the consumer send that initial email anyway so they know for certain who they are replying to.

You can report a debt collector's failure to respond to your state's attorney general, the Consumer Financial Protection Bureau (CFPB), or the FTC. You may also file a counterclaim against the debt collector for up to $1,000 for each violation.

The FDCPA Prohibits Sunday Calls if They're Inconvenient in Your Situation. While Sunday calls don't automatically violate the FDCPA, they are prohibited if the collector knows that Sunday is not a good day for you to receive collection calls.

A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L.