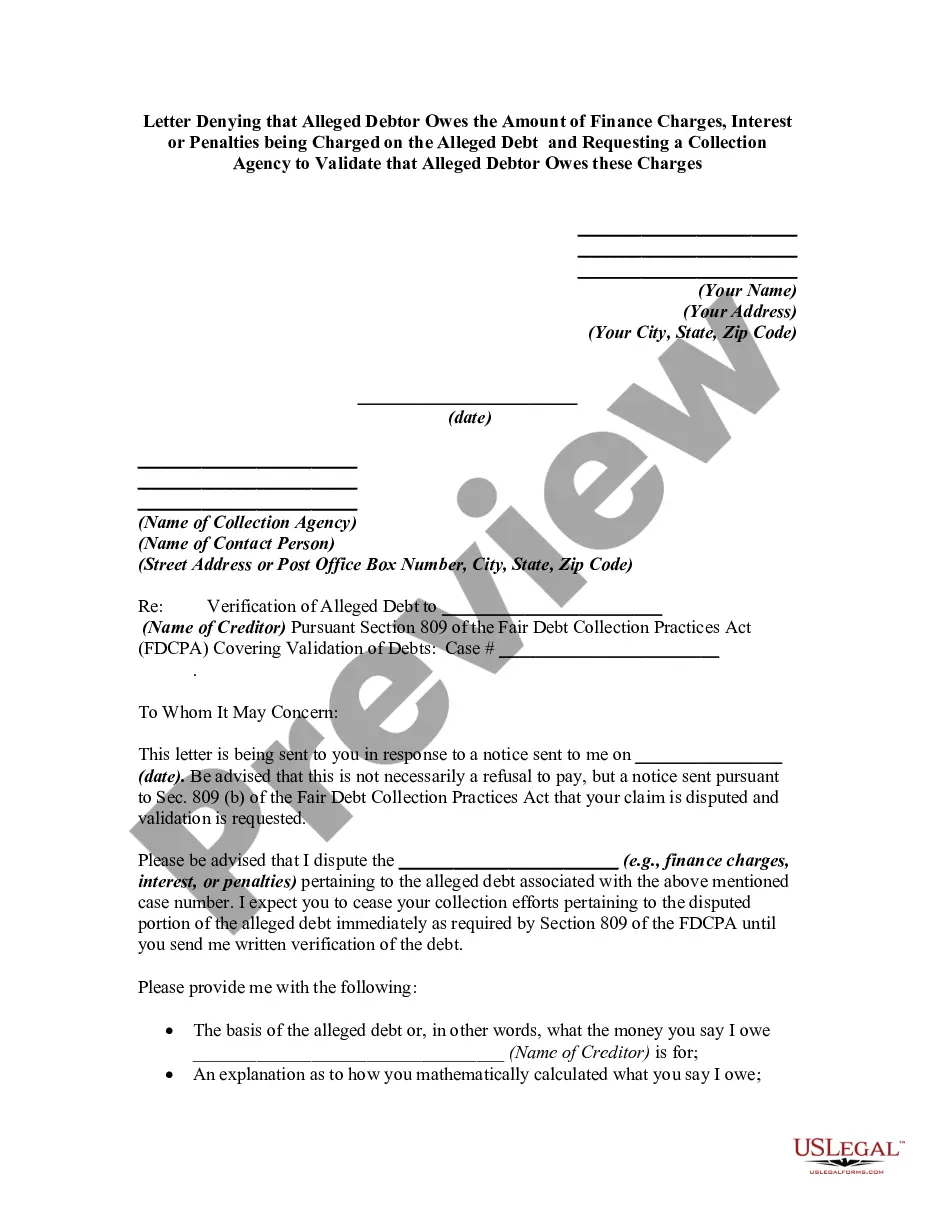

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Louisiana Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges

Description

How to fill out Letter Denying That Alleged Debtor Owes The Amount Of Finance Charges, Interest Or Penalties Being Charged On The Alleged Debt And Requesting A Collection Agency To Validate That Alleged Debtor Owes These Charges?

Are you within a place that you require paperwork for either company or individual purposes just about every day time? There are a lot of authorized papers web templates available on the net, but locating versions you can rely on isn`t straightforward. US Legal Forms delivers thousands of kind web templates, just like the Louisiana Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges, which are composed to meet state and federal demands.

In case you are presently acquainted with US Legal Forms site and also have your account, simply log in. Following that, you may down load the Louisiana Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges design.

If you do not offer an accounts and want to start using US Legal Forms, follow these steps:

- Get the kind you require and ensure it is to the correct town/county.

- Utilize the Review option to check the form.

- Read the description to ensure that you have chosen the appropriate kind.

- In the event the kind isn`t what you are trying to find, take advantage of the Search field to discover the kind that meets your needs and demands.

- When you get the correct kind, simply click Acquire now.

- Select the prices program you would like, complete the required info to produce your bank account, and purchase an order making use of your PayPal or Visa or Mastercard.

- Pick a hassle-free document formatting and down load your copy.

Find every one of the papers web templates you may have purchased in the My Forms menus. You may get a additional copy of Louisiana Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges any time, if required. Just click on the necessary kind to down load or printing the papers design.

Use US Legal Forms, the most substantial selection of authorized types, in order to save time and steer clear of errors. The assistance delivers professionally made authorized papers web templates that you can use for a selection of purposes. Produce your account on US Legal Forms and commence generating your lifestyle easier.

Form popularity

FAQ

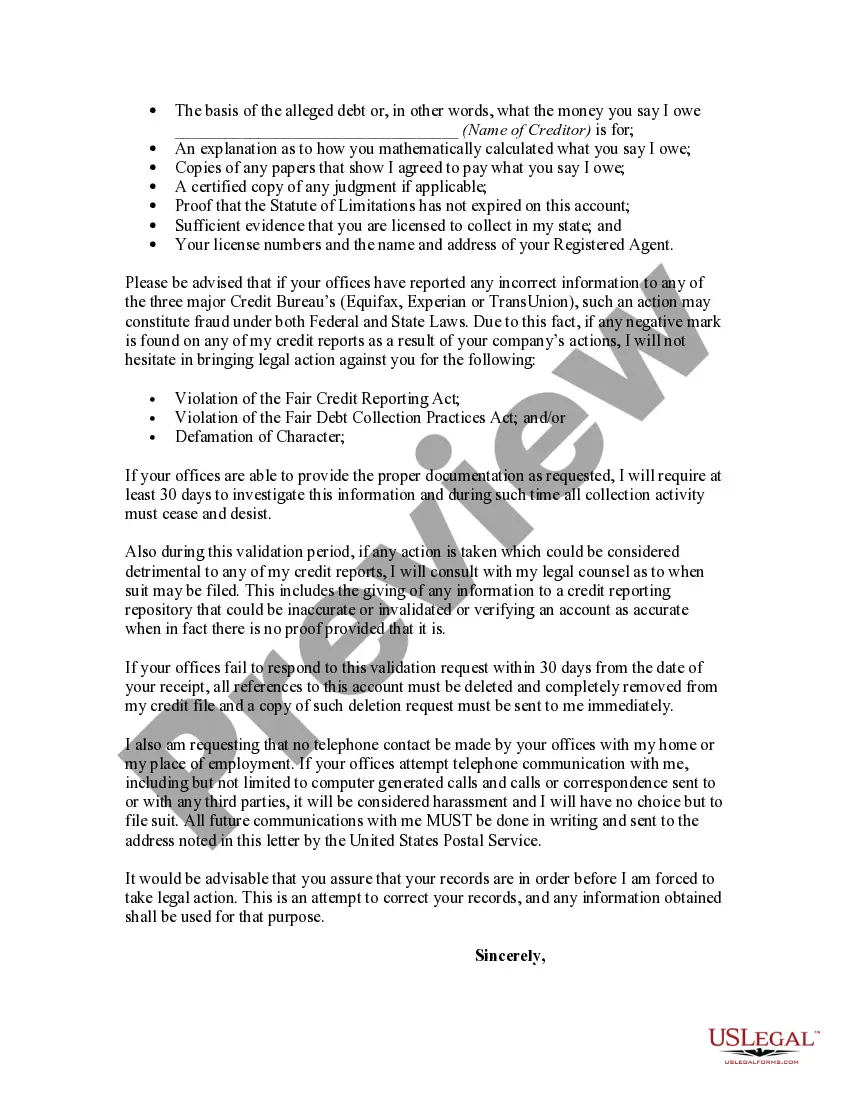

While a debt validation letter provides information about the debt the collection agency claims you owe, a verification letter must prove it. In other words, if the collection agency doesn't have enough evidence to prove you owe it, their hands may be tied.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

A debt validation letter is a letter a consumer sends to a debt collector requesting the debt collector validate a debt they are trying to collect. It is your first chance to assert your rights before debt collectors.

A debt verification letter doesn't have to say anything fancy. Just state that you're responding to a collection effort, you don't recognize the debt, you are demanding they prove you owe it and, if they can't, to stop contacting you. That's it.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay. Get help with your money questions.

How to Write a Debt Verification LetterDetermine the exact amounts you owe.Gather documents that verify your debt.Get information on who you owe.Determine how old the debt is.Place a pause on the collection proceedings.

§ 1006.34 Notice for validation of debts.Deceased consumers.Bankruptcy proofs of claim.In general.Subsequent debt collectors.Last statement date.Last payment date.Transaction date.Assumed receipt of validation information.More items...

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.