Louisiana Form of Convertible Promissory Note, Common Stock

Description

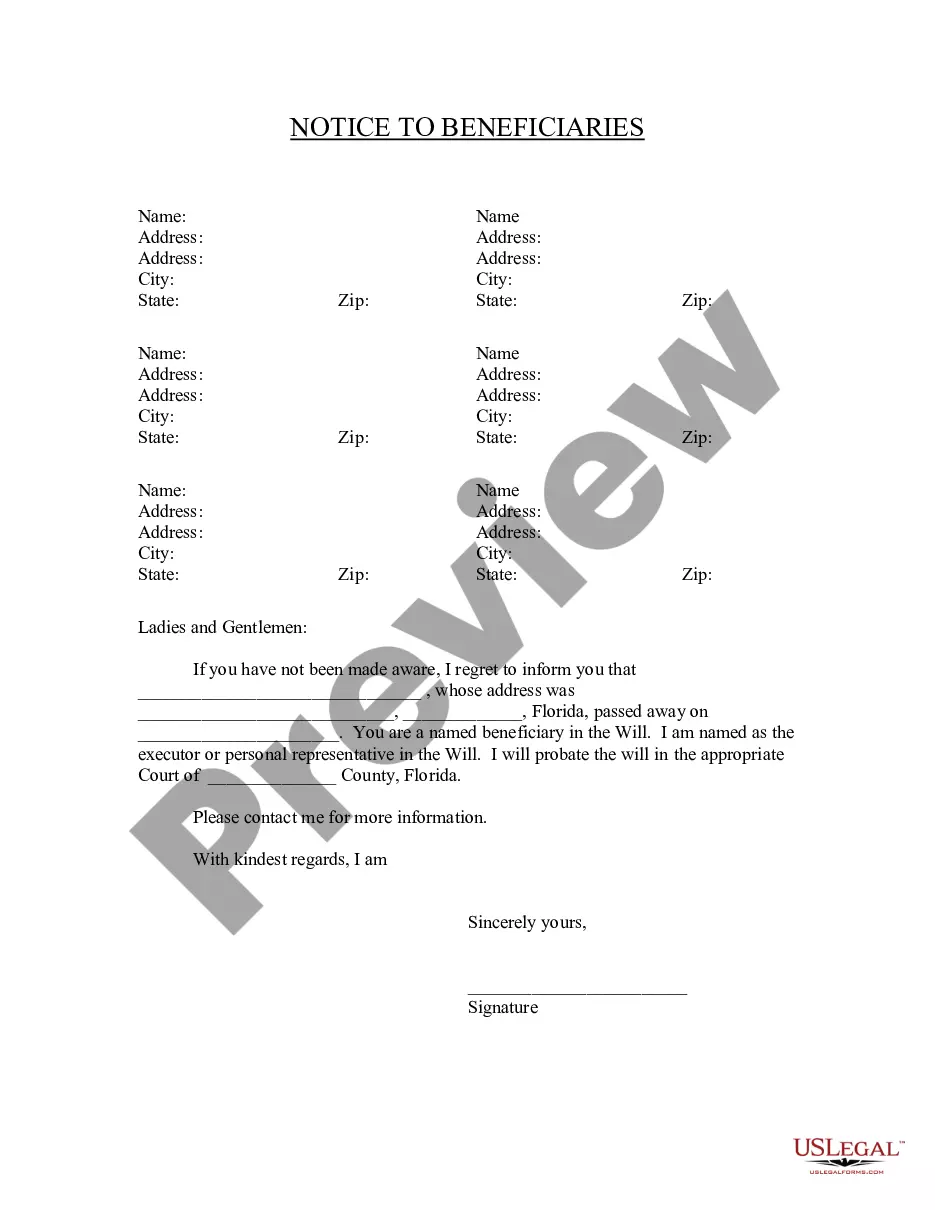

How to fill out Form Of Convertible Promissory Note, Common Stock?

US Legal Forms - one of several largest libraries of legitimate forms in the States - gives a wide array of legitimate papers layouts you are able to down load or printing. While using website, you can get thousands of forms for company and person functions, categorized by groups, says, or search phrases.You can get the most up-to-date models of forms much like the Louisiana Form of Convertible Promissory Note, Common Stock within minutes.

If you already have a monthly subscription, log in and down load Louisiana Form of Convertible Promissory Note, Common Stock from your US Legal Forms catalogue. The Down load option will show up on every single form you see. You have access to all in the past saved forms in the My Forms tab of your account.

In order to use US Legal Forms the first time, here are simple recommendations to obtain started:

- Be sure to have selected the right form to your metropolis/county. Go through the Review option to examine the form`s content material. Look at the form information to actually have chosen the correct form.

- In the event the form doesn`t fit your demands, utilize the Lookup area at the top of the display screen to discover the one that does.

- If you are pleased with the shape, verify your choice by visiting the Get now option. Then, pick the pricing plan you favor and offer your references to register for an account.

- Method the financial transaction. Use your Visa or Mastercard or PayPal account to perform the financial transaction.

- Select the formatting and down load the shape on the gadget.

- Make alterations. Fill up, edit and printing and sign the saved Louisiana Form of Convertible Promissory Note, Common Stock.

Each and every template you included with your money does not have an expiration time and it is the one you have permanently. So, in order to down load or printing one more duplicate, just go to the My Forms segment and then click about the form you need.

Get access to the Louisiana Form of Convertible Promissory Note, Common Stock with US Legal Forms, probably the most comprehensive catalogue of legitimate papers layouts. Use thousands of professional and status-distinct layouts that fulfill your organization or person requirements and demands.

Form popularity

FAQ

Typically, promissory notes are securities. They must be registered with the SEC, a state securities regulator, or be exempt from registration.

Also known as convertible promissory notes, bridge notes, or convertible debt. Since convertible notes are securities, they must be registered, or qualify for an exemption from registration, under the Securities Act.

General Definition Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

Secured: A secured promissory note is common in traditional mortgages. It means the borrower backs their loan with collateral. For a mortgage, the collateral is the property. If the borrower fails to pay back their loan, the lender has a legal claim over the asset and, in extreme cases, may foreclose on the property.

You can take a security interest in a promissory note owed to your debtor in the same way that you can take a security interest in account receivables. You can also take a security interest in any stocks or limited partnership interests owned by the debtor.

Convertible notes are promissory notes that serve an additional business purpose other than merely representing debt. Convertible notes include all of the terms of a vanilla promissory note, such as an interest rate and the pledge of underlying security (if applicable).

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.