Louisiana Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus

Description

How to fill out Approval Of Amendment To Articles Of Incorporation To Permit Certain Uses Of Distributions From Capital Surplus?

If you have to total, download, or produce legitimate record themes, use US Legal Forms, the largest collection of legitimate types, that can be found online. Use the site`s basic and handy look for to discover the documents you need. Numerous themes for organization and specific purposes are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to discover the Louisiana Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus in a handful of clicks.

Should you be currently a US Legal Forms client, log in to the accounts and click the Down load button to get the Louisiana Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus. You may also entry types you previously acquired from the My Forms tab of your own accounts.

Should you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Make sure you have selected the form to the proper area/region.

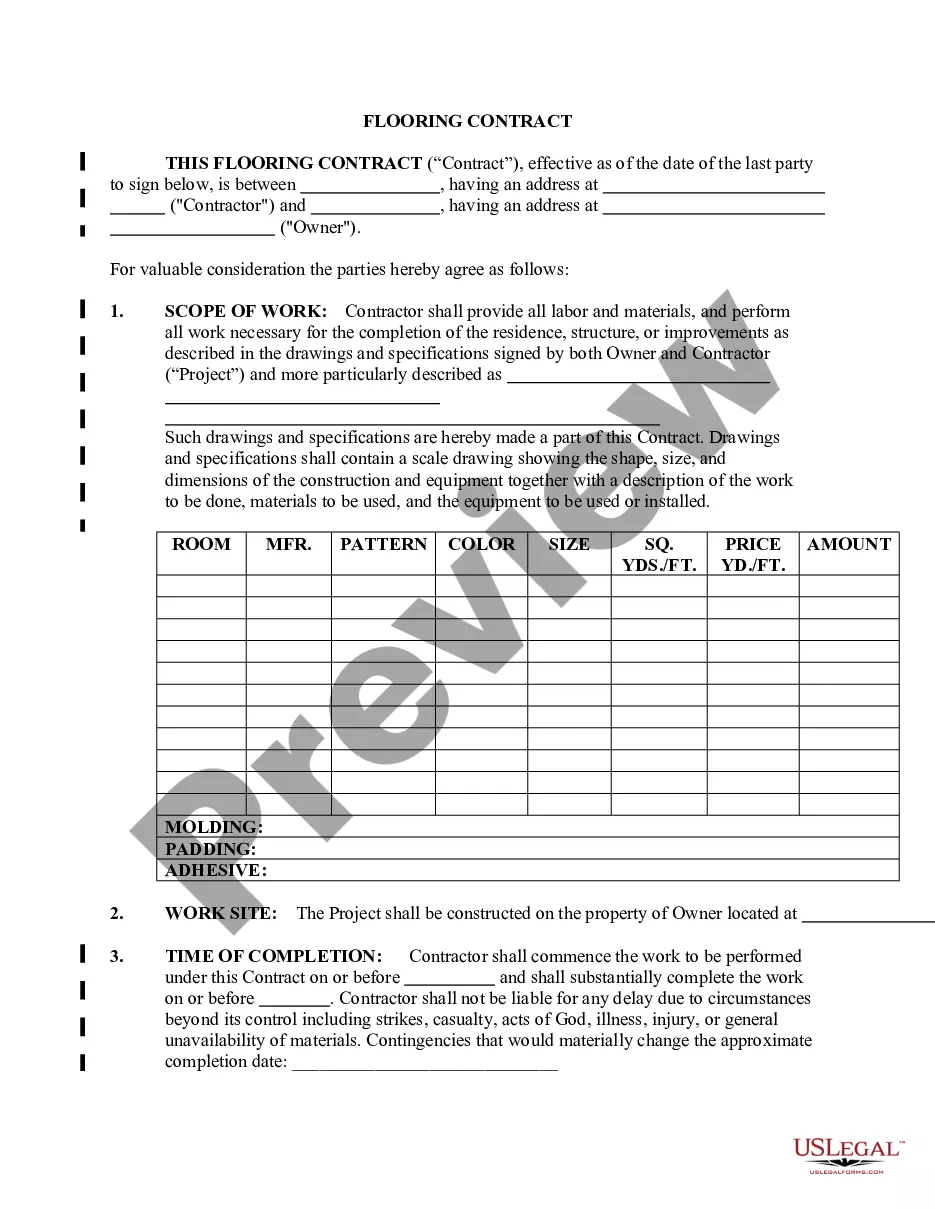

- Step 2. Utilize the Review choice to look over the form`s content material. Do not overlook to see the description.

- Step 3. Should you be unsatisfied with all the develop, take advantage of the Look for field on top of the display screen to locate other models of the legitimate develop template.

- Step 4. Upon having found the form you need, go through the Buy now button. Pick the pricing program you like and add your accreditations to register for an accounts.

- Step 5. Approach the financial transaction. You should use your credit card or PayPal accounts to complete the financial transaction.

- Step 6. Pick the structure of the legitimate develop and download it in your system.

- Step 7. Complete, modify and produce or indication the Louisiana Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus.

Each legitimate record template you buy is yours for a long time. You possess acces to every develop you acquired within your acccount. Click the My Forms segment and decide on a develop to produce or download once more.

Be competitive and download, and produce the Louisiana Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus with US Legal Forms. There are millions of expert and state-certain types you may use to your organization or specific requires.

Form popularity

FAQ

(1) A vehicle shall be driven as nearly as practicable entirely within a single lane and shall not be moved from such lane until the driver has first ascertained that such movement can be made with safety. LA Rev Stat § :: RS ? Driving on roadway laned for traffic ... justia.com ? codes ? louisiana ? title32 justia.com ? codes ? louisiana ? title32

Ing to Louisiana law, all lane changes should be signaled prior to moving lanes. Failure to use your blinker when changing lanes is a crime. Specifically, in Louisiana the law says that when one intends to change lanes, one must turn the appropriate signal on for a minimum of 100 feet prior to moving lanes. New Orleans Lane Change & Lane Usage Accidents - Bloom Legal LLC bloomlegal.com ? car-accidents ? lane-chan... bloomlegal.com ? car-accidents ? lane-chan...

(1) The driver of a vehicle upon a highway meeting or overtaking from any direction any school bus that has stopped for the purpose of receiving or discharging any school children shall stop the vehicle not less than thirty feet from the school bus before reaching such school bus when there are in operation on said ... Louisiana Revised Statutes Tit. 32, § 80 - Codes - FindLaw findlaw.com ? la-rev-stat-tit-32-sect-80 findlaw.com ? la-rev-stat-tit-32-sect-80

Following vehicles; exceptions. A. The driver of a motor vehicle shall not follow another vehicle more closely than is reasonable and prudent, having due regard for the speed of such vehicle and the traffic upon and the condition of the highway. Louisiana Revised Statutes Tit. 32, § 81 - Codes - FindLaw findlaw.com ? la-rev-stat-tit-32-sect-81 findlaw.com ? la-rev-stat-tit-32-sect-81