Louisiana Authorization of Consumer Report

Description

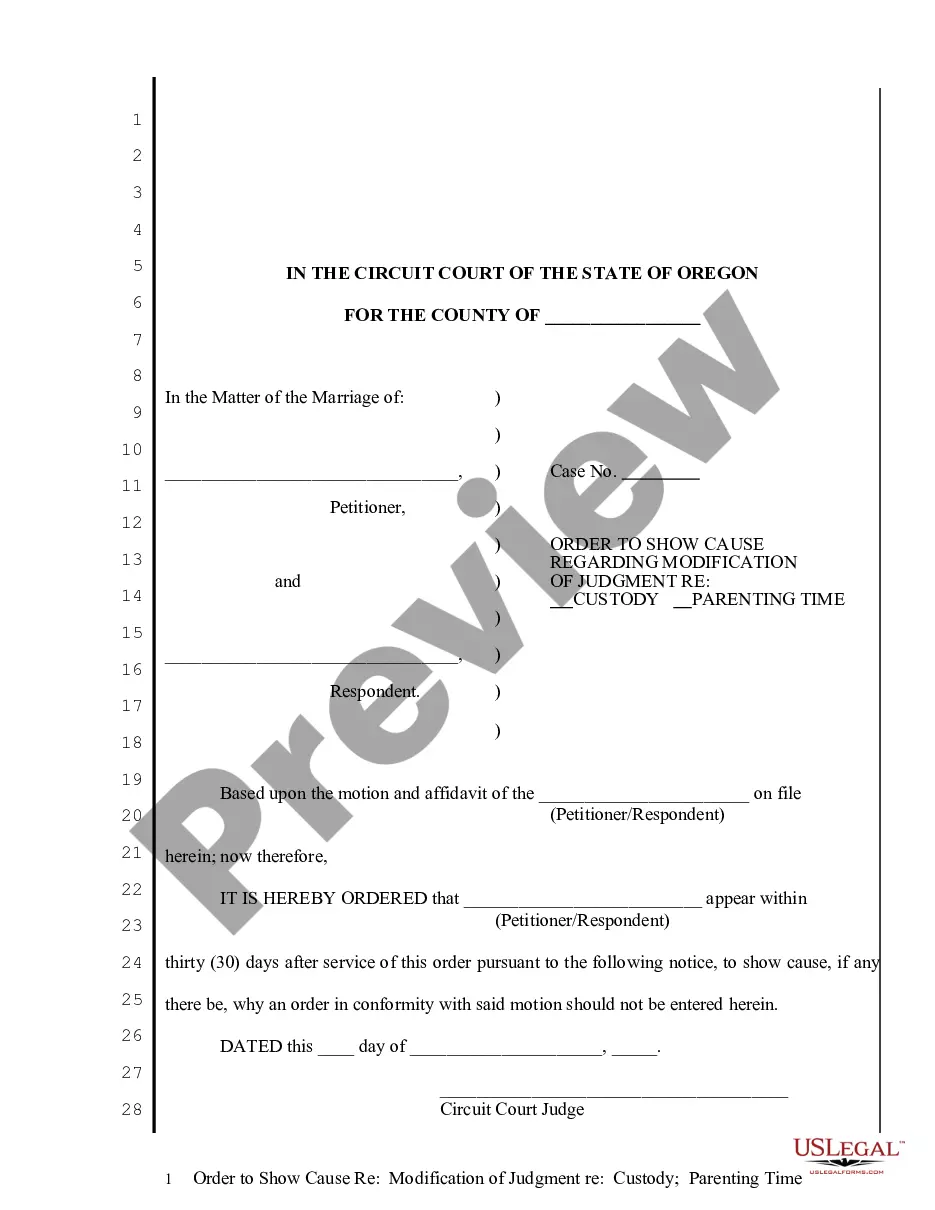

How to fill out Authorization Of Consumer Report?

If you wish to be thorough, acquire, or print authentic document templates, utilize US Legal Forms, the largest collection of authentic forms, available online.

Take advantage of the site`s straightforward and user-friendly search to find the documents you need.

A range of templates for business and personal objectives are sorted by categories and regions, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Select the pricing plan of your choice and enter your credentials to register for an account.

Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the Louisiana Authorization of Consumer Report in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to find the Louisiana Authorization of Consumer Report.

- You can also access forms you previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form`s contents. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Under the FCRA, Consumer Reporting Agencies are defined as persons who regularly engage in the practice of assembling or evaluating consumer credit information for the purpose of furnishing consumer reports to third parties. 15 U.S.C. § 1681a(f).

The FCRA requires any prospective user of a consumer report, for example, a lender, insurer, landlord, or employer, among others, to have a legally permissible purpose to obtain a report. Legally Permissible Purposes.

Consumer reports typically include an individual's credit history and payment patterns, demographic and identifying information, and public records information, such as arrests, judgments, and bankruptcies.

What is a Consumer Report? A consumer report contains information about your personal and credit characteristics, character, general reputation, and lifestyle. To be covered by the FCRA, a report must be prepared by a consumer reporting agency (CRA), a business that assembles such reports for other businesses.

The Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) are the two federal agencies charged with overseeing and enforcing the provisions of the act.

Under the FCRA, Consumer Reporting Agencies are defined as persons who regularly engage in the practice of assembling or evaluating consumer credit information for the purpose of furnishing consumer reports to third parties. 15 U.S.C. § 1681a(f).

A consumer report is any written, oral or other communication of any information by a Consumer Reporting Agency bearing on a consumer's credit worthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living.

The Fair Credit Reporting Act (FCRA) regulates the consumer credit reporting industry. In general, the FCRA requires that industry to report your consumer credit information in a fair, timely, and accurate manner. Banks and other lenders use this information to make lending decisions.

Examples of types of information that may qualify as CR include: arrest, convictions, judgements, and bankruptcies; criminal histories, education, and licenses held by consumers; drug tests (if provided by an intermediary to an employer but not when a drug lab provides the result directly to the employer)

The Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) are the two federal agencies charged with overseeing and enforcing the provisions of the act. Many states also have their own laws relating to credit reporting.