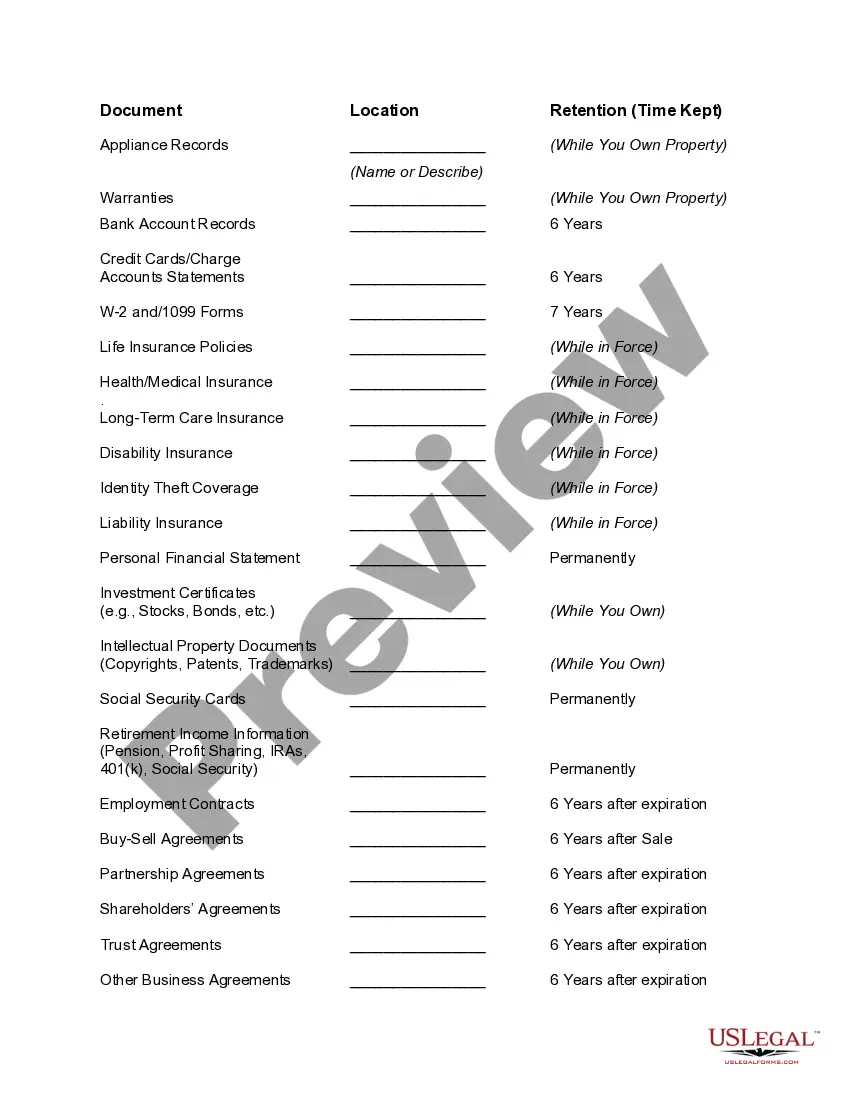

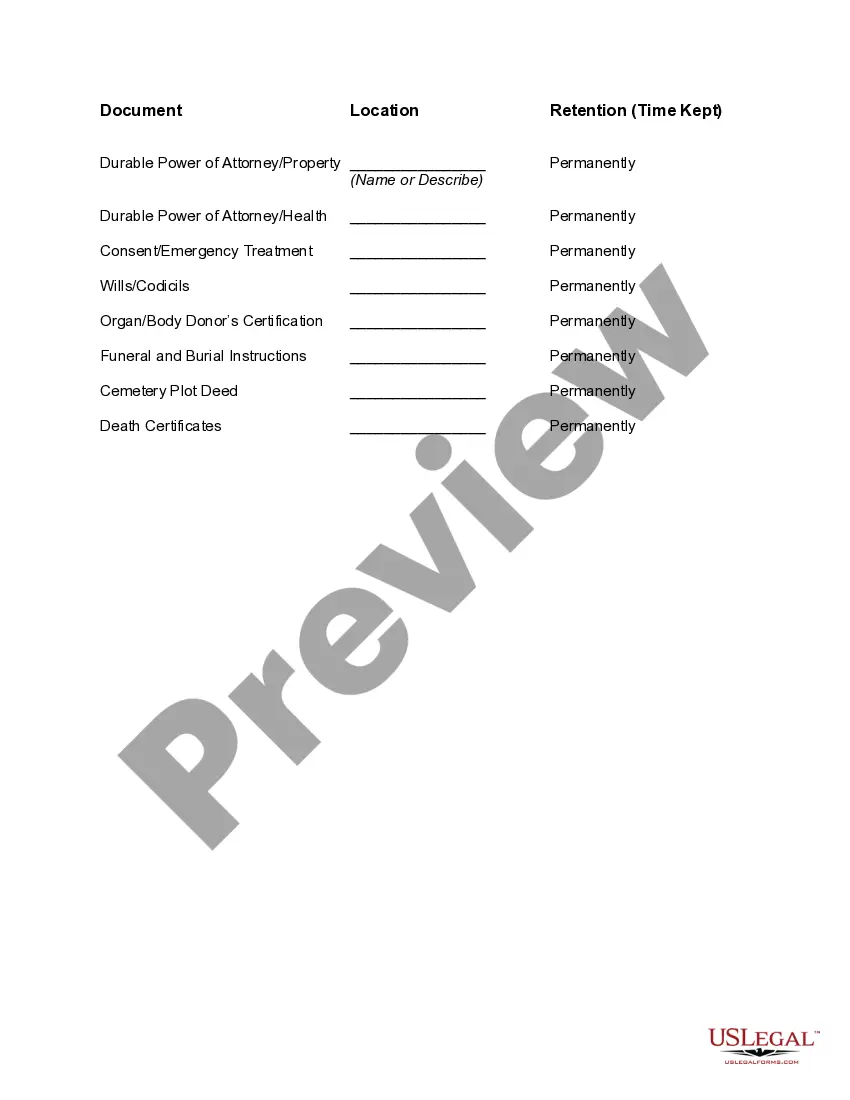

Louisiana Document Organizer and Retention

Description

How to fill out Document Organizer And Retention?

If you need to complete, obtain, or print authorized document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Take advantage of the site’s user-friendly and convenient search to find the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal form you purchase belongs to you indefinitely. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Be proactive and download, and print the Louisiana Document Organizer and Retention with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Employ US Legal Forms to obtain the Louisiana Document Organizer and Retention in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to retrieve the Louisiana Document Organizer and Retention.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you're using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to view the form’s details. Don’t forget to check the description.

- Step 3. If you are unhappy with the form, utilize the Search field at the top of the screen to find other versions of the legal form format.

- Step 4. After finding the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa, MasterCard, or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Louisiana Document Organizer and Retention.

Form popularity

FAQ

Federal regulations require research records to be retained for at least 3 years after the completion of the research (45 CFR 46) and UVA regulations require that data are kept for at least 5 years. Additional standards from your discipline may also be applicable to your data storage plan.

(also disposition standard), n. The length of time records should be kept in a certain location or form for administrative, legal, fiscal, historical, or other purposes.

There are different health and safety records retention periods to be aware of, but as a rule of thumb, most health and safety records should be kept for five years. Risk assessment records should be kept as long as the particular process or activity that the record refers to is still being performed.

The records must be maintained at the worksite for at least five years. Each February through April, employers must post a summary of the injuries and illnesses recorded the previous year. Also, if requested, copies of the records must be provided to current and former employees, or their representatives.

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

Howevber, the law states that employers must retain employee records in certain situations (for example working time and tax) and employers are advised to retain the records for themselves for six years in case they are sued for breach of contract.

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained," irrespective of format (paper, electronic, or other).

Destroy paper and electronic personnel records and confidential employee data after the retention deadlines have passed. Because employment records contain confidential and sensitive information, employers should establish specific policies and procedures for disposing of records safely.

Your employer or former employer is required to maintain any medical and exposure records created for you for specific periods of time. Paragraph (d) of 1910.1020 requires that employers keep exposure records for 30 years.

Payroll related records should be maintained for at least five calendar years. Agencies are encouraged to review exceptions in existing law or regulations, as well as any federal grant requirements to ensure that any applicable laws, regulations, or grants do not require longer retention periods.