Louisiana Sample Letter for History of Deed of Trust

Description

How to fill out Sample Letter For History Of Deed Of Trust?

Are you currently within a placement in which you need to have files for both business or specific functions almost every day? There are tons of legal papers themes available on the net, but finding kinds you can rely isn`t easy. US Legal Forms provides a large number of kind themes, like the Louisiana Sample Letter for History of Deed of Trust, that are published in order to meet federal and state requirements.

In case you are presently familiar with US Legal Forms internet site and also have your account, simply log in. Next, you are able to obtain the Louisiana Sample Letter for History of Deed of Trust template.

Unless you have an account and need to start using US Legal Forms, adopt these measures:

- Find the kind you require and make sure it is for that correct area/state.

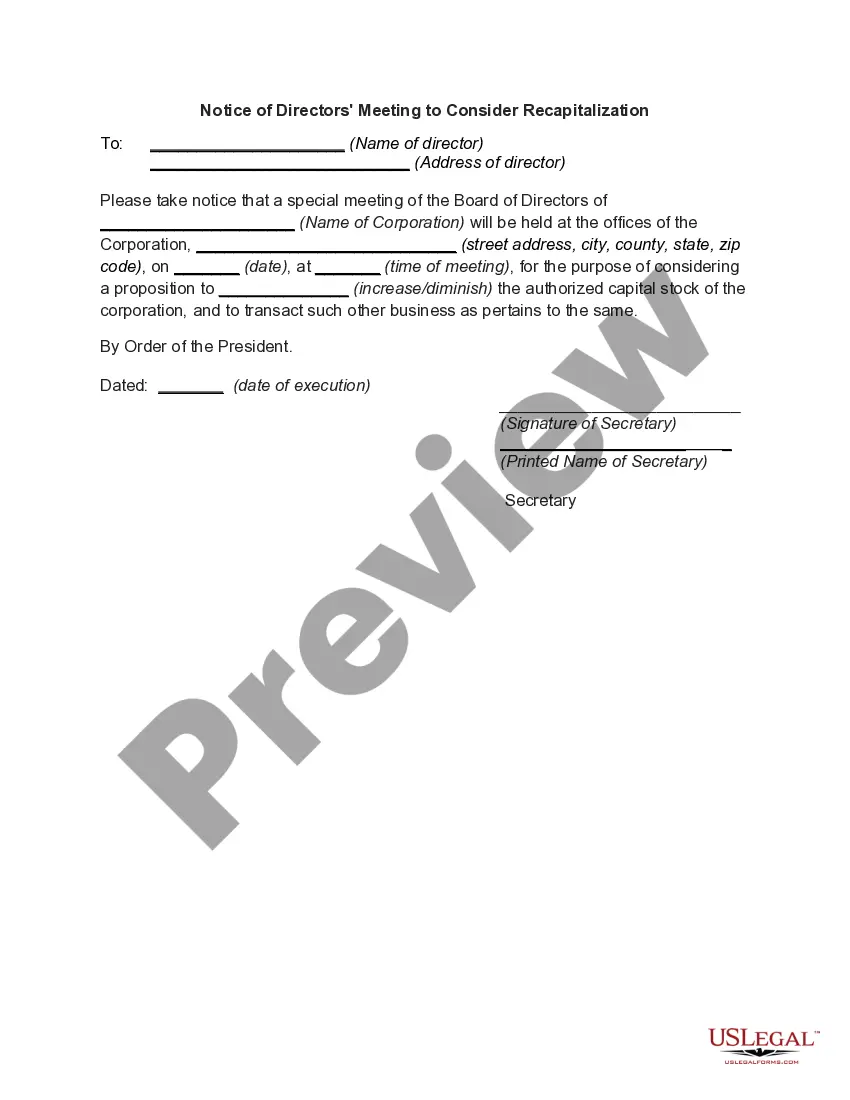

- Use the Review option to examine the shape.

- Browse the outline to ensure that you have selected the proper kind.

- When the kind isn`t what you`re searching for, take advantage of the Research area to find the kind that fits your needs and requirements.

- Whenever you discover the correct kind, click Acquire now.

- Pick the rates plan you desire, fill in the desired info to make your money, and purchase your order using your PayPal or Visa or Mastercard.

- Decide on a practical paper formatting and obtain your copy.

Find all of the papers themes you might have purchased in the My Forms menu. You can get a additional copy of Louisiana Sample Letter for History of Deed of Trust whenever, if required. Just click the necessary kind to obtain or printing the papers template.

Use US Legal Forms, by far the most substantial assortment of legal types, to save lots of time and prevent mistakes. The support provides skillfully produced legal papers themes that can be used for a range of functions. Make your account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.

A deed of trust can benefit the lender because it typically allows a faster foreclosure on a home. Most deeds of trust have a ?non-judicial foreclosure? clause, which means that the lender won't have to wait for the court system to review and approve the foreclosure process.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

A Trust deed is a legal document that comprises and sets out the terms and conditions of creating and managing a trust. It involves the objective of the trust established , the names of the beneficiaries and the amount of lump sum income they will receive and even the method by which they will receive the payment.

Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan. If the loan is not repaid on time, the lender can foreclose on and sell the property and use the proceeds to pay off the loan. Note: A trust deed is not used to transfer property to a living trust (use a Grant Deed for that).