Louisiana Subrogation Agreement between Insurer and Insured

Description

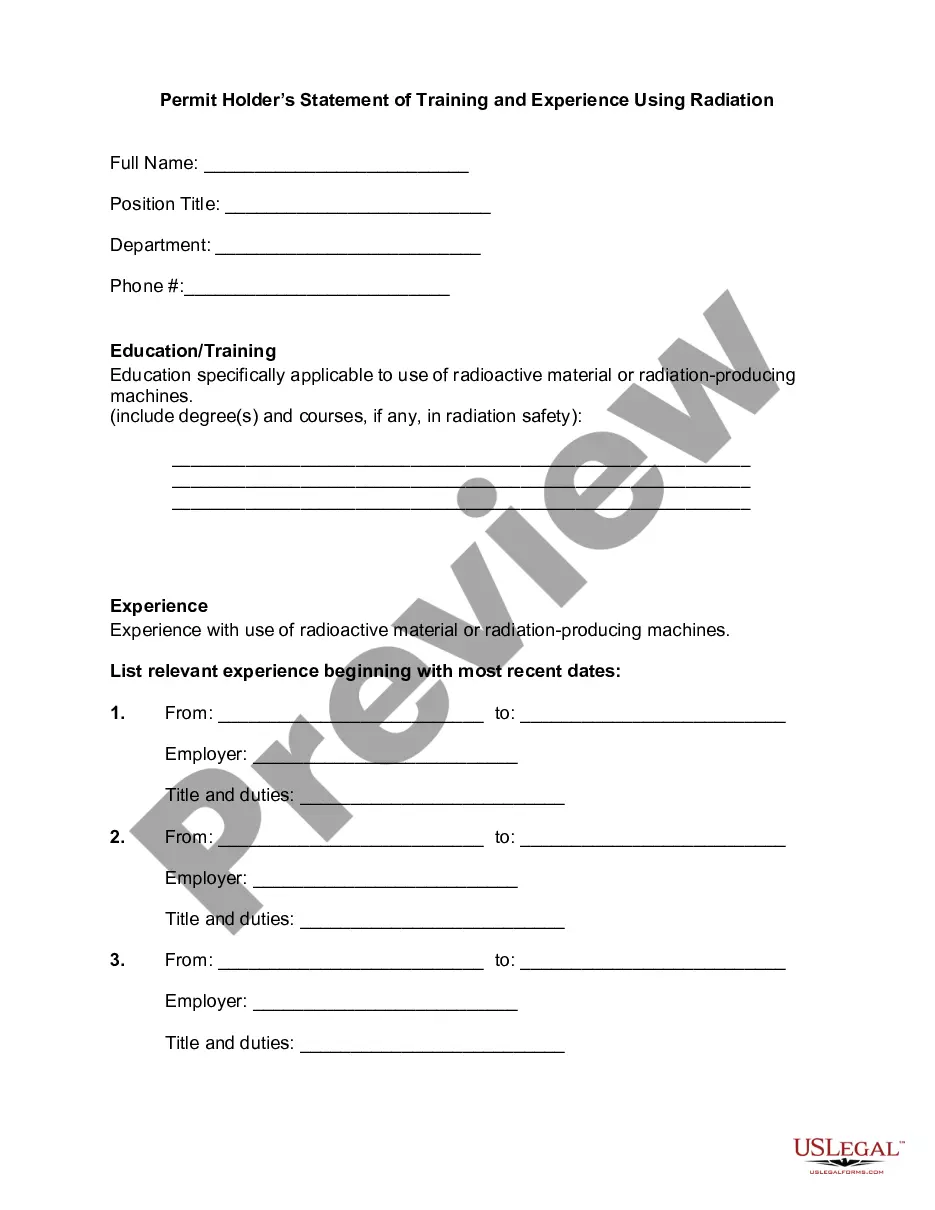

How to fill out Subrogation Agreement Between Insurer And Insured?

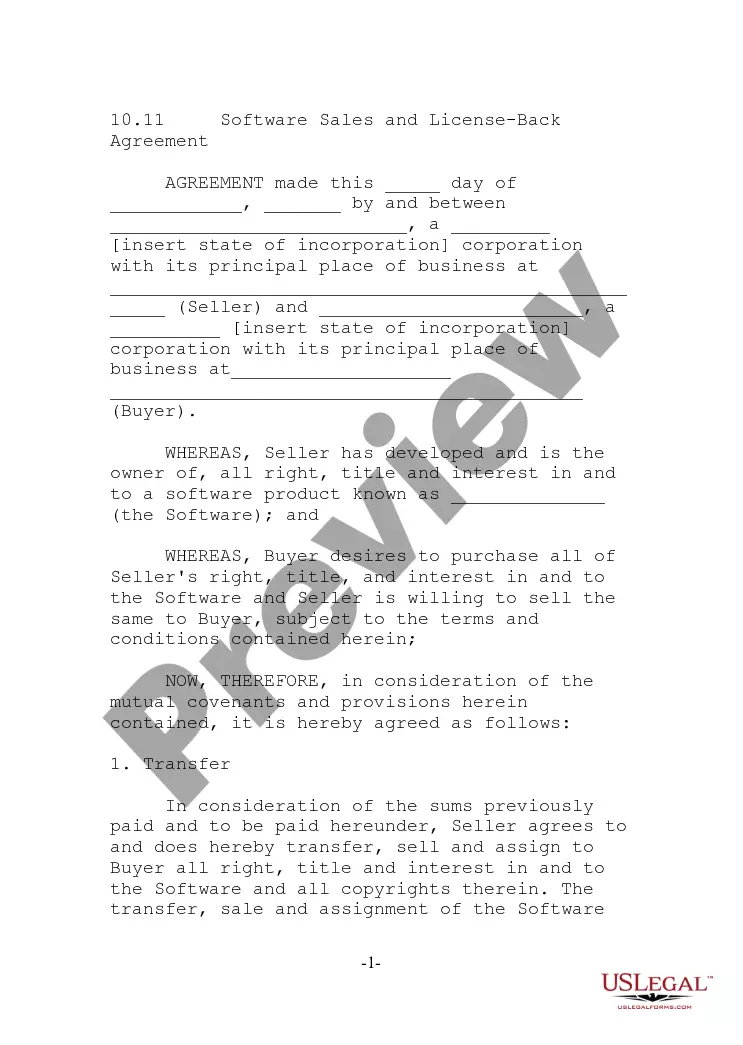

You may commit hours on-line trying to find the authorized record web template that fits the state and federal requirements you want. US Legal Forms supplies a large number of authorized varieties that are analyzed by specialists. You can easily download or printing the Louisiana Subrogation Agreement between Insurer and Insured from the service.

If you currently have a US Legal Forms profile, you may log in and then click the Obtain switch. Next, you may total, revise, printing, or sign the Louisiana Subrogation Agreement between Insurer and Insured. Every single authorized record web template you acquire is your own forever. To get an additional copy for any obtained form, check out the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms web site the very first time, keep to the simple guidelines listed below:

- Initial, be sure that you have chosen the correct record web template for the state/city of your choice. Browse the form information to ensure you have picked out the appropriate form. If readily available, utilize the Review switch to search throughout the record web template too.

- If you want to get an additional edition of your form, utilize the Research field to find the web template that fits your needs and requirements.

- After you have identified the web template you need, just click Acquire now to carry on.

- Pick the prices strategy you need, key in your credentials, and register for a free account on US Legal Forms.

- Complete the deal. You may use your bank card or PayPal profile to pay for the authorized form.

- Pick the format of your record and download it in your gadget.

- Make modifications in your record if required. You may total, revise and sign and printing Louisiana Subrogation Agreement between Insurer and Insured.

Obtain and printing a large number of record themes while using US Legal Forms Internet site, that provides the biggest assortment of authorized varieties. Use skilled and express-distinct themes to tackle your business or person needs.

Form popularity

FAQ

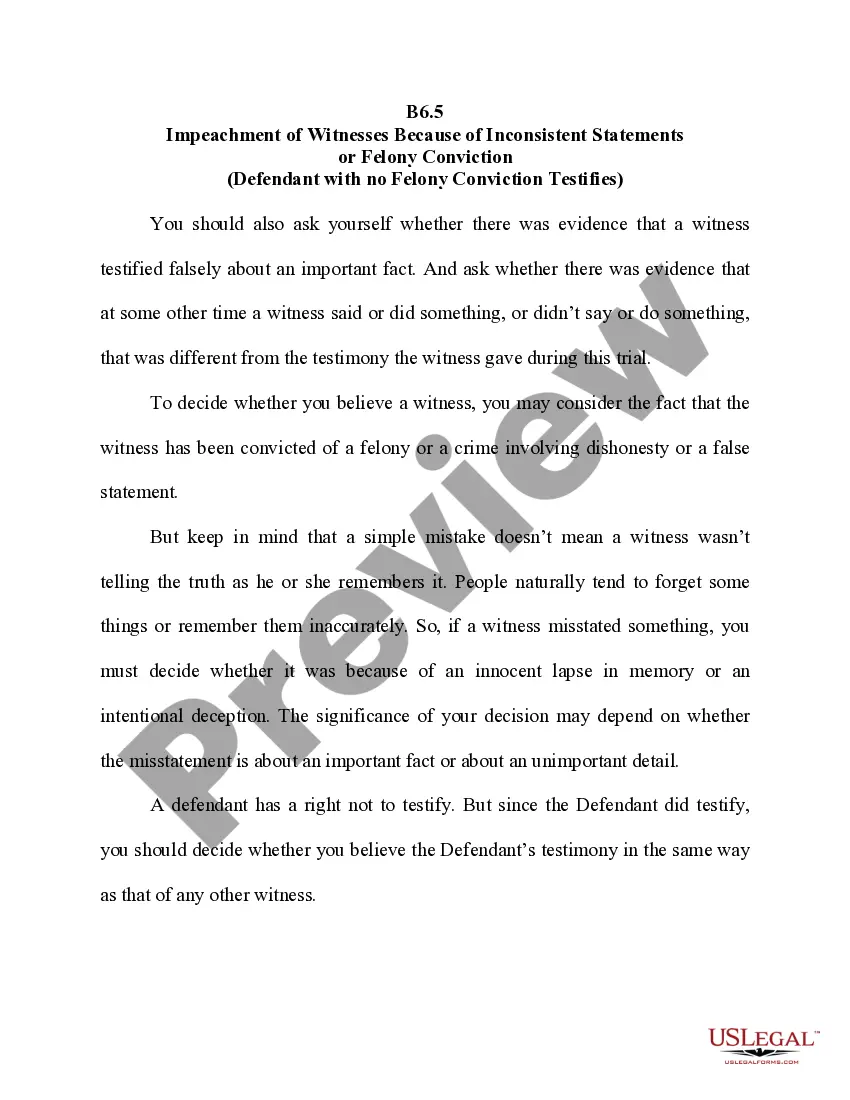

Understanding Louisiana Subrogation Claims If somebody pays money on your behalf (ex. your insurance company) for which somebody else is responsible (ex. the driver of the other car), they can ?stand in your shoes? and bring a claim (called a subrogation claim) against the other party.

Disadvantages of Subrogation On the downside, subrogation claims can sometimes result in delays. Recovering costs from the at-fault party can take time, especially if the case goes to court.

When factoring comparative negligence and improper referrals, the recovery rate should be somewhere in the range of 85-90%. This requires adjusters properly identifying subrogation, assessing comparative negligence and pursuing only what they are entitled to.

One example of subrogation is when an insured driver's car is totaled through the fault of another driver. The insurance carrier reimburses the covered driver under the terms of the policy and then pursues legal action against the driver at fault.

An insurance company may not subrogate against its own insured or a co-insured. However, when a party claiming to be a co-insured is merely a loss payee to which no liability coverage is afforded, subrogation is permissible.

"Subrogation," or "subro" for short, refers to the right your insurance company holds under your policy ? after they've paid a covered claim ? to request reimbursement from the at-fault party. This reimbursement often comes from the at-fault party's insurance company.

It says that the insurer (which is the insurance company) pays for a loss to the insured (an individual or company) due to the wrongdoing of a third party, then the insurer has the authority to subrogate the rights of insured and therefore is able to prosecute a suit against the wrongdoer for the recovery of the amount ...

An insurer may attempt to subrogate against an additional insured for completed operations injuries caused by the insured if the additional insured endorsement provides coverage only for ongoing operations injuries.