Minutes are a permanent, formal, and detailed (although not verbatim) record of business transacted, and resolutions adopted, at a firm's official meetings such as board of directors of a corporation or members of a limited liability company. Once written up (or typed) in a minute book and approved at the next meeting, the minutes are accepted as a true representation of the proceedings they record and can be used as prima facie evidence in legal matters.

Louisiana Minutes and Resolutions of the Board of Trustees of a Non-Profit Corporation Authorizing to the Refinancing of a Loan

Category:

State:

Multi-State

Control #:

US-04520BG

Format:

Word;

Rich Text

Instant download

Description

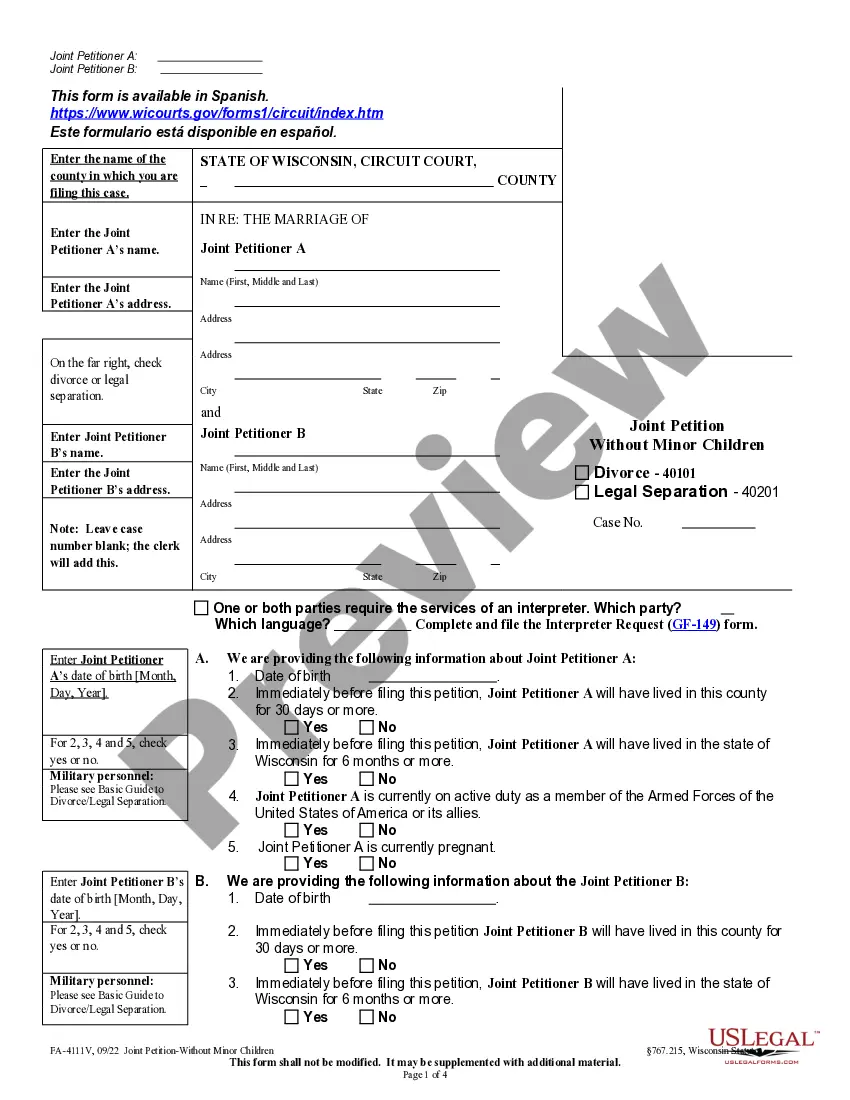

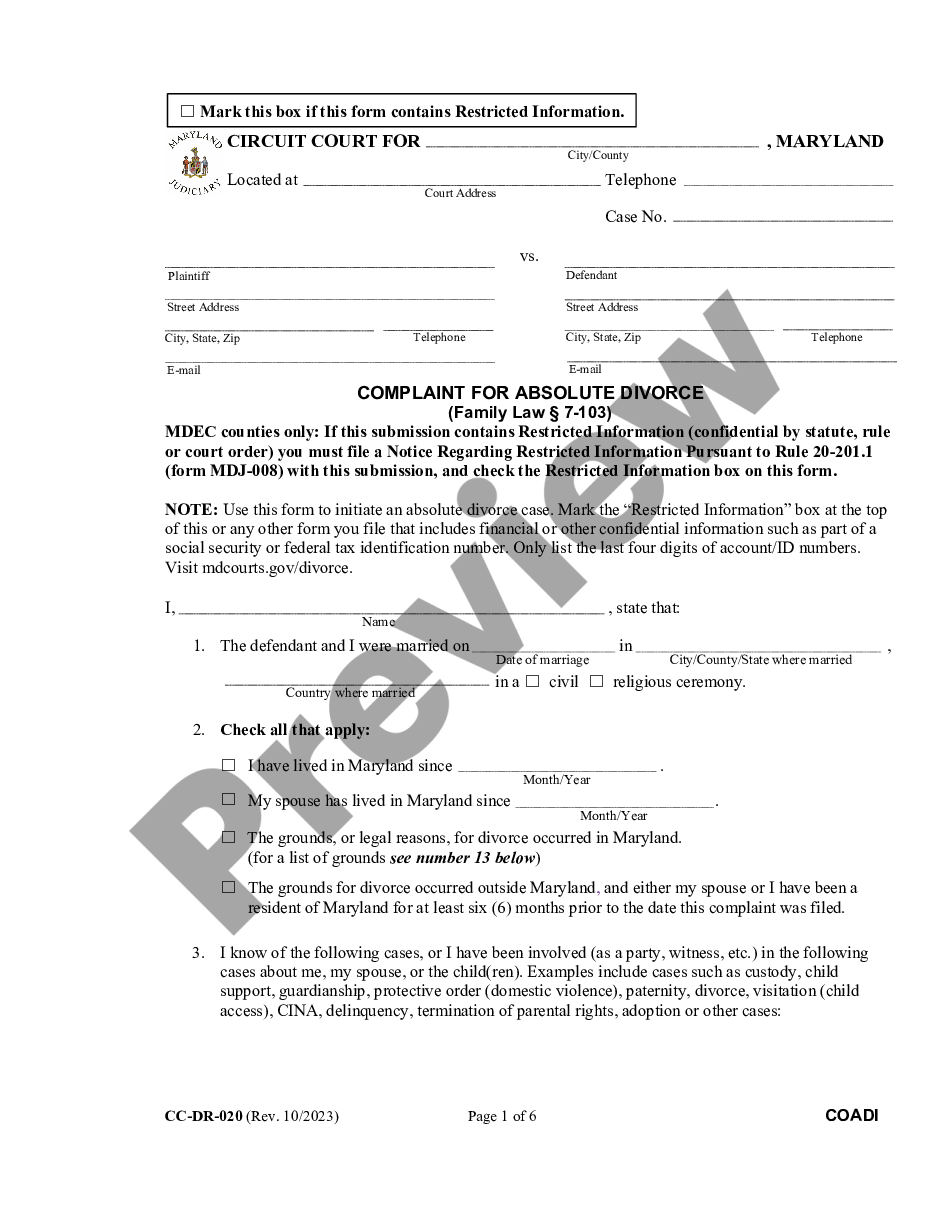

Free preview

How to fill out Minutes And Resolutions Of The Board Of Trustees Of A Non-Profit Corporation Authorizing To The Refinancing Of A Loan?

You can spend hours online searching for the legal document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that are examined by experts.

You can procure or print the Louisiana Minutes and Resolutions of the Board of Trustees of a Non-Profit Corporation Authorizing the Refinancing of a Loan from the service.

Check the form description to confirm you have selected the right template. If available, use the Review button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Louisiana Minutes and Resolutions of the Board of Trustees of a Non-Profit Corporation Authorizing the Refinancing of a Loan.

- Each legal document template you purchase is yours forever.

- To obtain another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city you choose.