Louisiana Sample of a Collection Letter to Small Business in Advance

Description

How to fill out Sample Of A Collection Letter To Small Business In Advance?

Are you within a location where you require documents for both business or personal purposes almost every time.

There are numerous legal document templates available online, but finding reliable ones is not simple.

US Legal Forms offers thousands of form templates, such as the Louisiana Sample of a Collection Letter to Small Business in Advance, which are designed to meet state and federal standards.

When you find the appropriate form, click Get now.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the order with your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Louisiana Sample of a Collection Letter to Small Business in Advance template.

- If you don’t have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

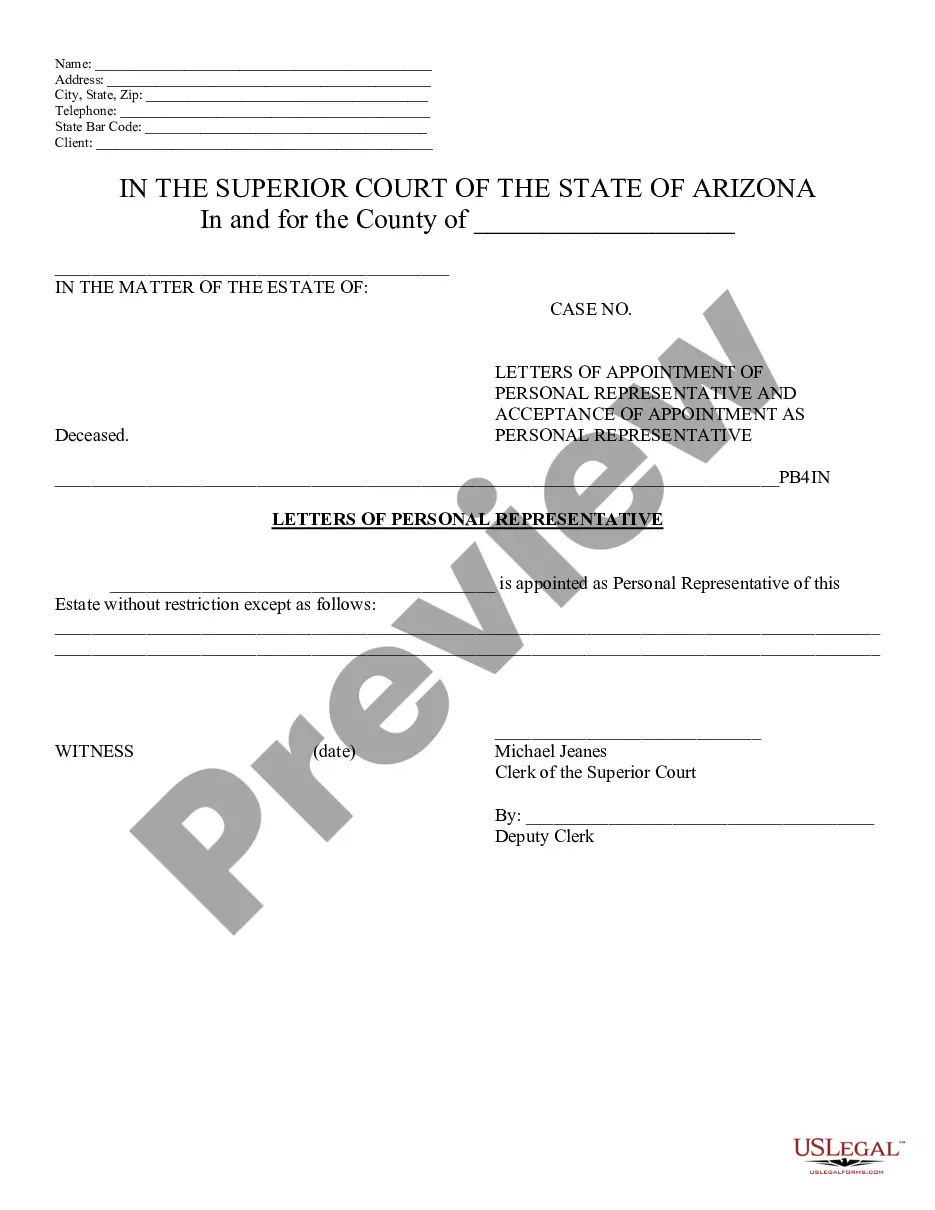

- Use the Preview button to review the form.

- Read the description to confirm you have selected the correct form.

- If the form is not what you are looking for, utilize the Search area to find the form that suits your needs and requirements.

Form popularity

FAQ

A good collection email should have a clear subject line that indicates the purpose of the message. Begin with a friendly greeting and address the recipient by name, followed by a concise summary of the payment due. Utilizing a Louisiana Sample of a Collection Letter to Small Business in Advance will help you format your request effectively, making it easier for the recipient to understand and respond promptly.

A collection letter is a written request for payment from a debtor. It should clearly state the outstanding amount and the purpose of the letter, keeping the message professional and respectful. When using a Louisiana Sample of a Collection Letter to Small Business in Advance, you can enhance your communication while ensuring that the recipient understands their obligations without feeling threatened.

To write a good collection letter, start by addressing the recipient clearly. Use a polite yet firm tone, mentioning the amount owed and the due date. Include relevant information about the Louisiana Sample of a Collection Letter to Small Business in Advance, which can help you structure your message effectively. Always provide instructions for payment and offer assistance for any questions.

Writing a collection letter in business communication requires professionalism and clarity. Start by addressing the recipient and stating the purpose of your letter upfront. Incorporating a Louisiana Sample of a Collection Letter to Small Business in Advance can help you craft a letter that effectively communicates your message while maintaining a respectful tone, increasing the likelihood of payment.

To send someone to collections, you need to provide proof of the debt, such as signed contracts or unpaid invoices. Document any communication attempts made to collect the debt prior to sending it to collections. A Louisiana Sample of a Collection Letter to Small Business in Advance can serve as a powerful tool, showcasing the evidence you have accumulated and emphasizing the need for resolution.

Writing a debt collection letter starts with a clear statement of the amount owed and a timeframe for payment. Include any previous payment arrangements and express your willingness to discuss the matter. Utilizing a Louisiana Sample of a Collection Letter to Small Business in Advance can give you a solid framework, ensuring your letter is professional and persuasive.

Yes, a small business can send a bill to collections if debts remain unpaid after follow-ups. This process allows businesses to recover funds while maintaining professional integrity. Using a Louisiana Sample of a Collection Letter to Small Business in Advance can help guide you in drafting a clear and impactful communication to collections, making the process smoother and more effective.

When sending a bill to a collection agency, gather all related documents, including the original invoice and any previous reminders. Ensure that the collection agency has all necessary information, like the business name and contact details. Utilizing a Louisiana Sample of a Collection Letter to Small Business in Advance can help structure your letter effectively, which is essential for ensuring the agency processes the collection efficiently.

To send a bill to a small business collection, first ensure your documentation is complete and accurate. You should provide a detailed invoice and a copy of previous correspondence. Additionally, consider using a Louisiana Sample of a Collection Letter to Small Business in Advance to format your communication. This method enhances clarity and professionalism, increasing the chances of successful collection.

To write a collection statement, incorporate key details such as the debtor's information, outstanding balance, and a deadline for payment. Ensure that you express the importance of settling the debt and encourage communication for any questions. For businesses navigating this process, the Louisiana Sample of a Collection Letter to Small Business in Advance can be an invaluable resource for crafting an effective statement.