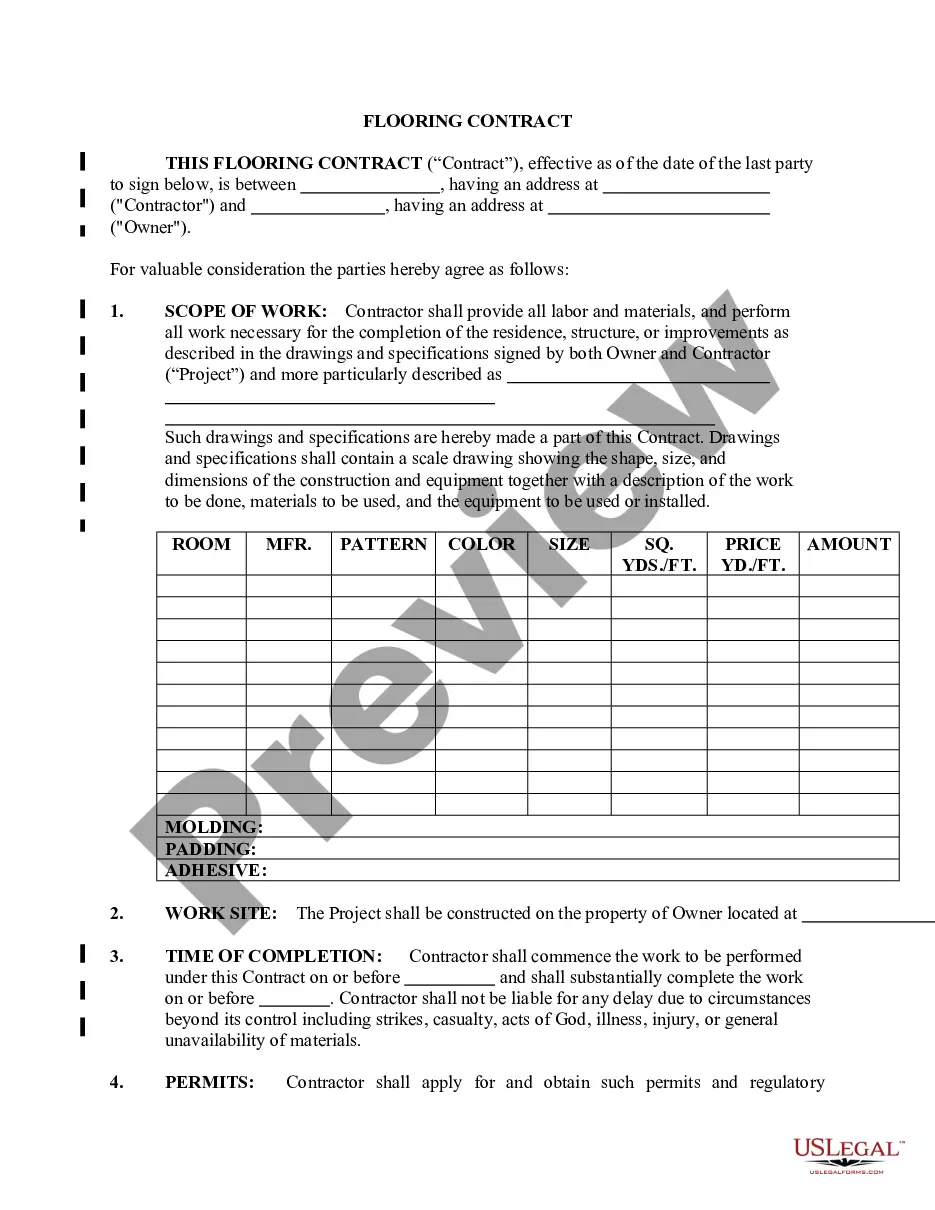

This Depreciation Worksheet is a template used by companies for creating a worksheet to evaluate depreciation expenses. The Depreciation Worksheet organizes and outlines a company's depreciation expenses and can be customized for a company's specific usage.

Louisiana Depreciation Worksheet

Description

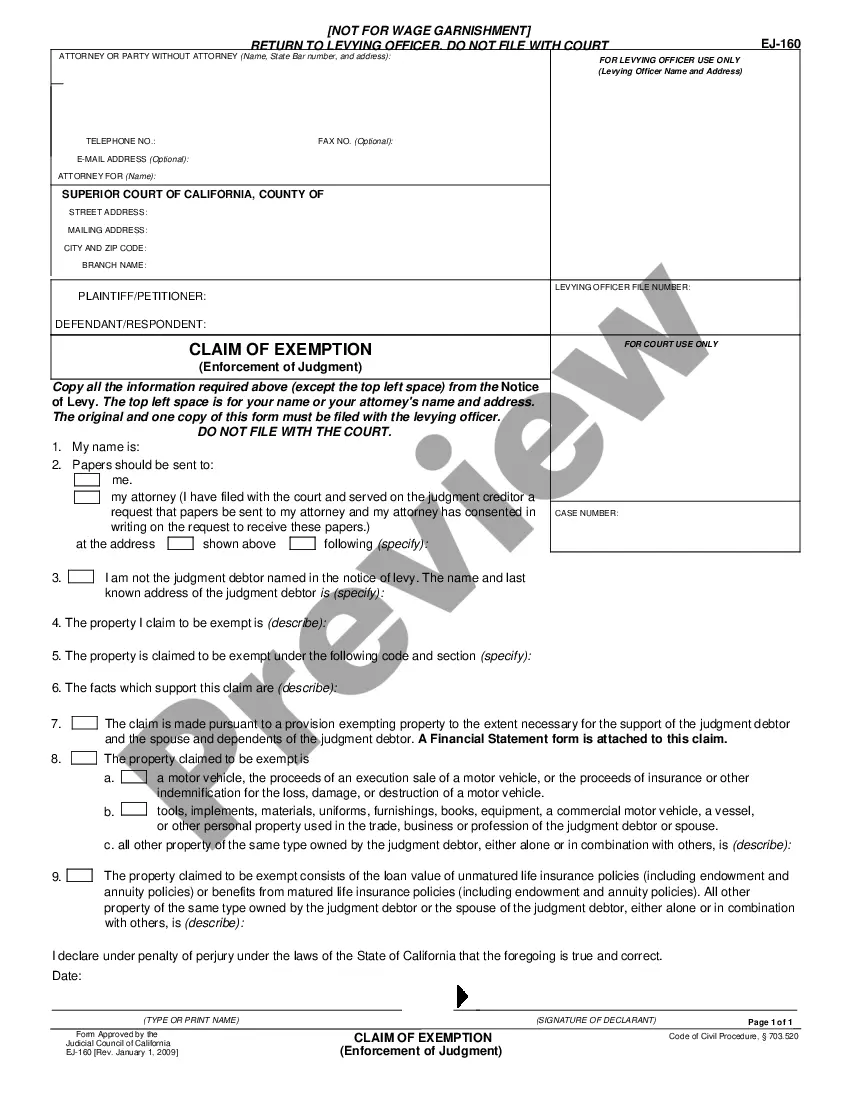

How to fill out Depreciation Worksheet?

You can spend several hours online searching for the legal document template that meets the federal and state obligations you require.

US Legal Forms offers a wide range of legal forms that have been reviewed by professionals.

It is easy to download or print the Louisiana Depreciation Worksheet from their services.

Once you’ve found the template you want, click Buy now to proceed. Select the pricing plan you want, enter your details, and create your account on US Legal Forms. Complete the payment using your credit card or PayPal account to purchase the legal form. Choose the format of the document and download it to your device. Make any necessary modifications to your document. You can complete, edit, sign, and print the Louisiana Depreciation Worksheet. Access and print thousands of document templates via the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to fulfill your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and then click the Acquire button.

- Afterwards, you can complete, edit, print, or sign the Louisiana Depreciation Worksheet.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you’re using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your preferred state/city.

- Check the form details to confirm you have chosen the right one.

- If available, use the Review button to view the document template as well.

- To find another version of the form, use the Search field to locate the template that fits your needs and requirements.

Form popularity

FAQ

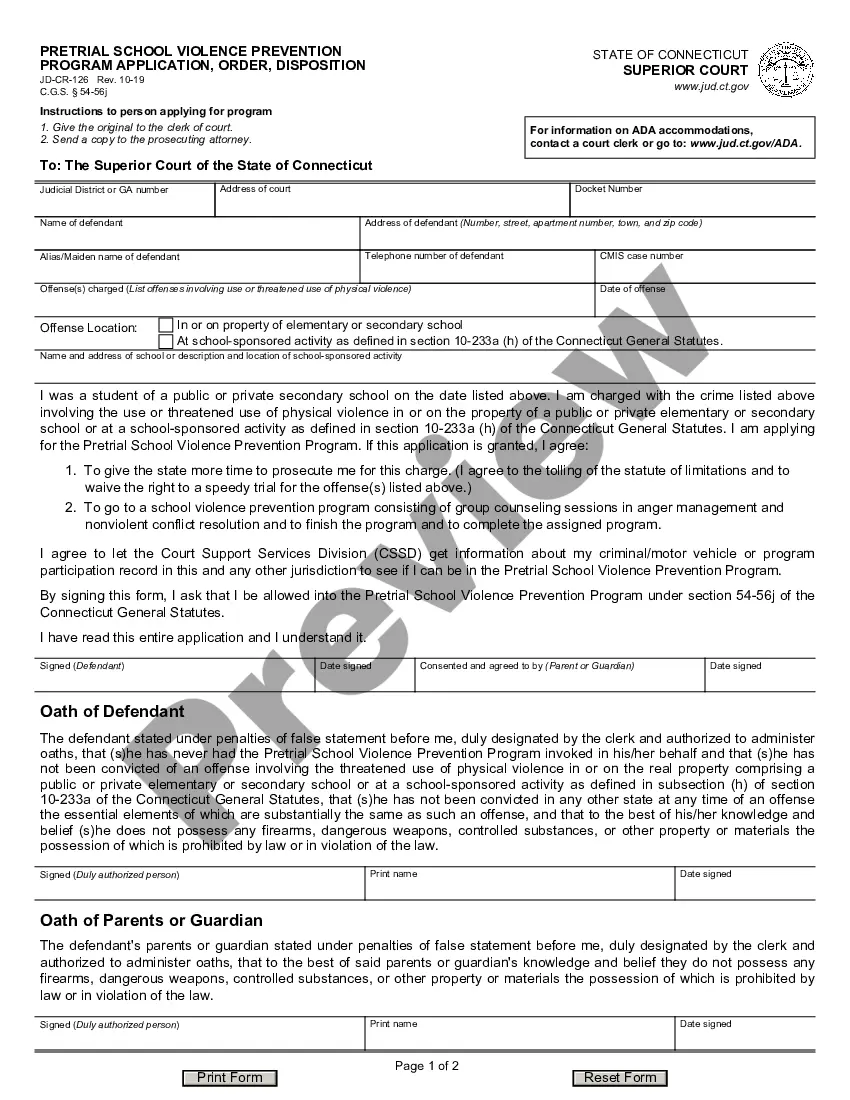

To enter depreciation on your tax return, you typically need to complete Form 4562, which details your assets and the depreciation you've taken. Ensure that you keep your Louisiana Depreciation Worksheet updated, as it provides essential figures and helps you fill out the form correctly. By accurately recording your depreciation, you can reduce your taxable income and benefit financially.

The personal property tax in Louisiana is levied on items owned by individuals and businesses, such as vehicles, equipment, and inventory. This tax contributes to local government funding. By utilizing the Louisiana Depreciation Worksheet, you can better manage your personal property records and ensure that you are accurately reporting the value of your assets for tax purposes.

Yes, Louisiana does impose a personal property tax on movable property. This can include items like machinery, equipment, and other assets. Understanding your liabilities is crucial, which is where the Louisiana Depreciation Worksheet comes in handy to ensure precise calculations of your personal property values and depreciation.

To calculate property tax in Louisiana, first determine the assessed value of your property, which is usually a percentage of the market value. Next, apply the local tax rate to this assessed value. For accurate calculations, you may want to utilize tools such as the Louisiana Depreciation Worksheet. This tool can help you keep track of property values and depreciation, offering a clearer picture of your financial obligations.

In Louisiana, property taxes are typically required for all property owners, but certain exemptions apply for individuals aged 65 and older. These exemptions can significantly reduce the amount you owe. Always check the local guidelines to understand how these exemptions relate to your specific situation and ensure that you're maximizing benefits like the Louisiana Depreciation Worksheet.

Your depreciation can usually be found in the 'Depreciation and Amortization' section on your tax return. For detailed tracking, refer to your Louisiana Depreciation Worksheet, which will outline the depreciation deductions you've claimed. This ensures clarity and accuracy in your overall tax filing.

You can obtain your depreciation schedule from your accounting software, such as TurboTax or QuickBooks. If you have used a Louisiana Depreciation Worksheet, it will consolidate pertinent information regarding your assets. If you need tailored assistance, platforms like US Legal Forms provide templates and guidance to streamline this process.

A depreciation schedule on a tax return outlines the value of your depreciable assets over a specific period. This document, which resembles a Louisiana Depreciation Worksheet, helps you track and report the depreciation deductions you can claim. It's an essential tool for managing your finances and tax obligations effectively.

You can obtain Louisiana tax forms from the Louisiana Department of Revenue's official website. They provide downloadable forms, including those necessary for your Louisiana Depreciation Worksheet. Alternatively, consider using platforms like US Legal Forms to easily access and fill out the required tax forms.

You can find your depreciation schedule on your tax return usually in the 'Schedule C' for business income or the 'Form 4562' if you are claiming depreciation for rental property. When you utilize a Louisiana Depreciation Worksheet, it should be attached to your tax return. Ensure all necessary forms are included for accurate filing.