Section 4(2) of the Securities Act of 1933 exempts from the registration requirements of that Act "transactions by an issuer not involving any public offering.” This is the so-called "private offering" provision in the Securities Act. The securities involved in transactions effected pursuant to this exemption are referred to as restricted securities because they cannot be resold to the public without prior registration. They are also sometimes referred to as "investment letter securities" because of the practice frequently followed by the seller in such a transaction, in order to substantiate the claim that the transaction does not involve a public offering, of requiring that the buyer furnish an investment letter representing that the purchase is for investment and not for resale to the general public. The private offering exemption of Section 4(2) of the Securities Act is available only where the offerees do not need the protections afforded by the registration procedure.

Louisiana Investment Letter for a Private Sale of Securities

Description

How to fill out Investment Letter For A Private Sale Of Securities?

Are you in a situation where you often require documents for business or personal purposes.

There are numerous legal document templates accessible online, but locating reliable ones is not easy.

US Legal Forms offers a wide array of form templates, such as the Louisiana Investment Letter for a Private Sale of Securities, designed to meet federal and state requirements.

Once you find the right form, click Buy now.

Choose your preferred pricing plan, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Louisiana Investment Letter for a Private Sale of Securities template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and confirm it’s for the correct area/state.

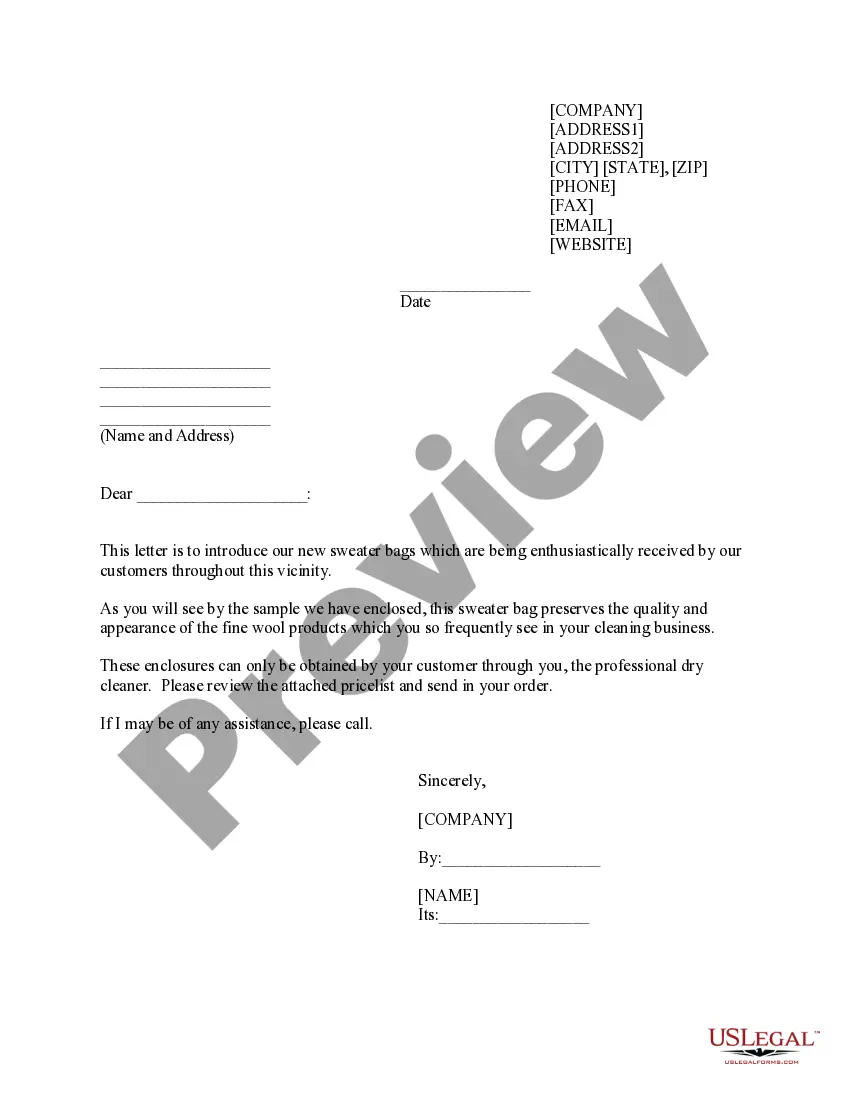

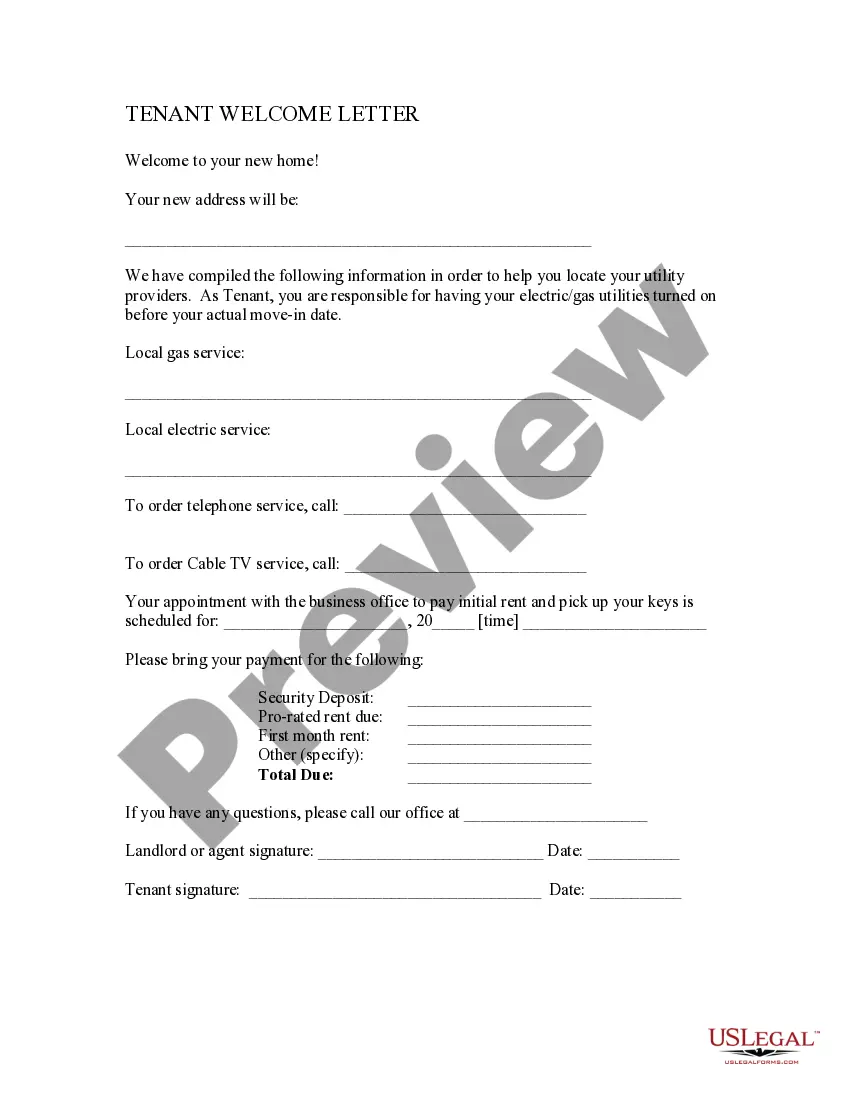

- Use the Preview button to view the form.

- Check the description to ensure you have selected the right form.

- If the form isn’t what you’re looking for, use the Search box to find a form that meets your requirements.

Form popularity

FAQ

A legal document for selling securities or mutual fund shares is often known as a prospectus. This document discloses essential information about the investment, such as its objectives, risks, and performance metrics. When crafting your Louisiana Investment Letter for a Private Sale of Securities, including this information is crucial to meet legal requirements and build investor trust.

A legal document that offers securities for sale is typically a prospectus or an offering memorandum. This document outlines the details of the investment, including risks, financial information, and terms of the securities being offered. Creating a comprehensive Louisiana Investment Letter for a Private Sale of Securities ensures that potential investors have all the legal information they need before making a decision.

An offer to sell securities is a formal proposal from an issuer to potential buyers, indicating their willingness to sell securities. This offer must comply with relevant laws, including Louisiana's blue sky laws. When drafting a Louisiana Investment Letter for a Private Sale of Securities, you will outline the terms of the sale, ensuring clarity and legal compliance, which protects both parties.

The blue sky law in Louisiana refers to state regulations that govern the sale of securities to protect investors. These laws require issuers to register their securities and provide necessary disclosures. By complying with these laws, you can ensure a safer investment environment, especially when preparing a Louisiana Investment Letter for a Private Sale of Securities. Understanding these regulations helps you make informed decisions.

The primary purpose of an investment letter is to confirm the investor’s commitment and understanding of the investment opportunity. In the case of a Louisiana Investment Letter for a Private Sale of Securities, it helps protect both the investor and the issuer by clarifying the investor's qualifications and expectations. It establishes a clear framework for the investment process and enhances the transparency of the transaction.

To write an investment letter, start by clearly stating your name and contact information. Next, specify the investment opportunity you wish to engage with, such as the Louisiana Investment Letter for a Private Sale of Securities, and outline your financial status and willingness to invest. Make sure to include a statement about your understanding of the investment's risks and your accreditation status, if applicable.

An invest letter represents a written statement from an investor expressing their intent to invest in a particular offering. In the context of a Louisiana Investment Letter for a Private Sale of Securities, it assures the issuer that the investor meets the necessary criteria and understands their rights and obligations. Such letters are key to ensuring compliance and protecting all parties involved.

An investment letter is a formal document provided by an investor to affirm their understanding of the investment and its risks. Specifically for a Louisiana Investment Letter for a Private Sale of Securities, this document indicates that the investor has the financial capability to invest and acknowledges the potential risks involved. This letter serves as a vital component in private securities transactions.