Louisiana Security Agreement - Short Form

Description

How to fill out Security Agreement - Short Form?

If you need to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Utilize the site's easy and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours permanently. You have access to every form you acquired with your account. Visit the My documents section and select a form to print or download again.

Compete and acquire, and print the Louisiana Security Agreement - Short Form with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Use US Legal Forms to find the Louisiana Security Agreement - Short Form in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to get the Louisiana Security Agreement - Short Form.

- You can also access forms you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Ensure you have selected the form for your correct city/state.

- Use the Review option to view the form's details. Don't forget to read the description.

- If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for the account.

- Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Select the format of your legal form and download it to your device.

- Complete, modify, and print or sign the Louisiana Security Agreement - Short Form.

Form popularity

FAQ

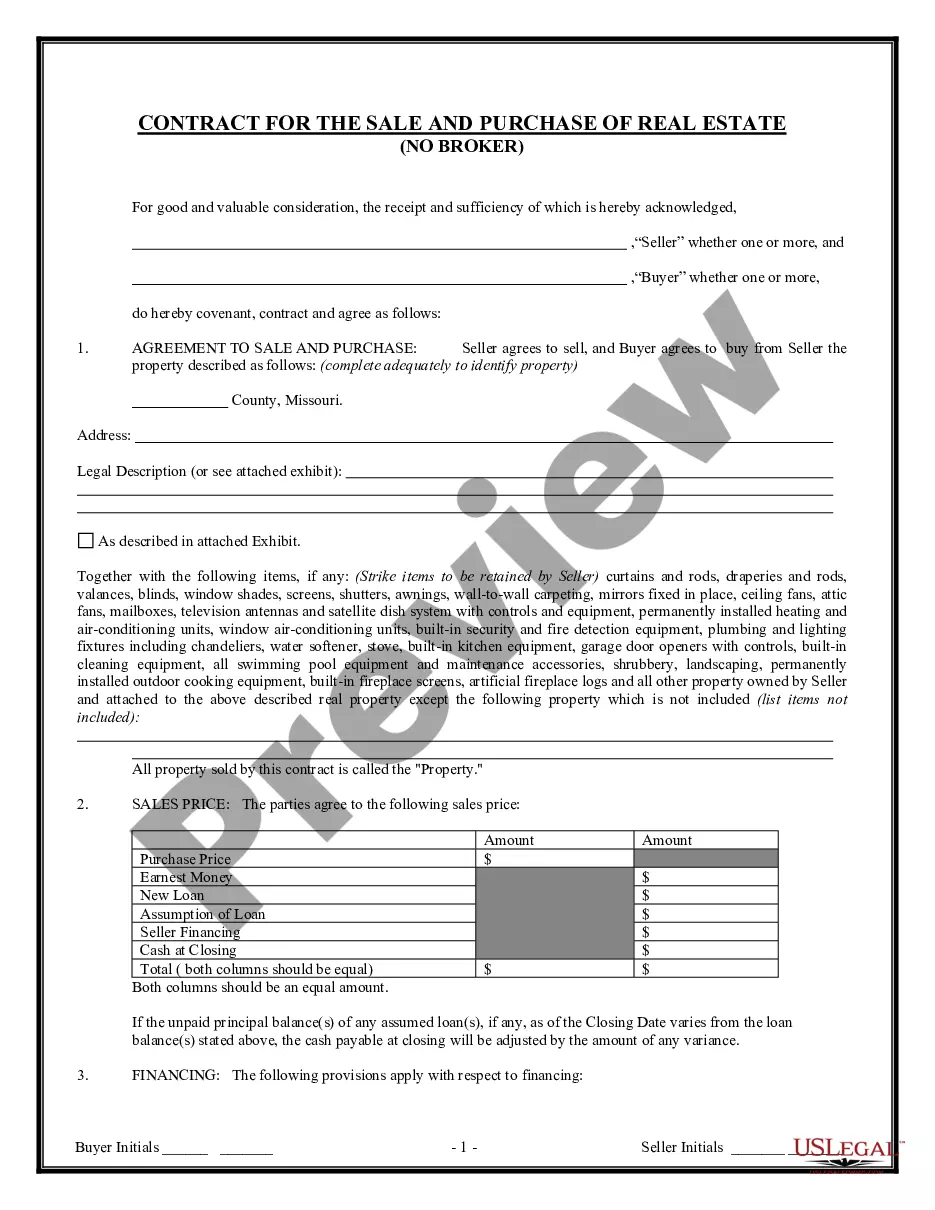

A Specific Security Agreement (formerly known as Chattel Mortgage) is an equipment financing option that allows businesses to own their equipment upon purchase. BOQ Equipment Finance Limited secures the loan by registering a charge over the goods.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Noun. : a statement that contains information about a security interest in collateral used to secure a debt and that is filed to provide notice to other creditors of the security interest see also perfect sense b, Uniform Commercial Code compare financial statement.

An unsecured note carries no collateral, backed only by the promise of the borrower to repay. An example would be an IOU between parties, stipulating a certain interest rate and maturity. Once that arrangement is sold to a third party, the note may become a security.

Sometimes confused with the security agreement itself, the financing statement provides notice of a party's security interest in a debtor. This document can alert third parties, but it cannot be used as substitute for the actual security agreement.

A security agreement normally will contain a clear statement that the debtor is granting the secured party a security interest in specified goods. The agreement also must provide a description of the collateral.

A security agreement creates the security interest, making it enforceable between the secured party and the debtor. A UCC-1 financing statement neither creates a security interest nor does it alter its scope; it only gives notice of the security interest to third parties.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.