Louisiana Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

How to fill out Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

Are you inside a place in which you need to have paperwork for sometimes organization or specific purposes virtually every day time? There are tons of authorized record layouts available on the Internet, but getting types you can rely is not simple. US Legal Forms delivers a large number of type layouts, like the Louisiana Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will), which are created to satisfy federal and state requirements.

If you are already informed about US Legal Forms site and get your account, merely log in. Following that, you may obtain the Louisiana Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) design.

If you do not have an bank account and wish to start using US Legal Forms, abide by these steps:

- Obtain the type you want and ensure it is for your right city/area.

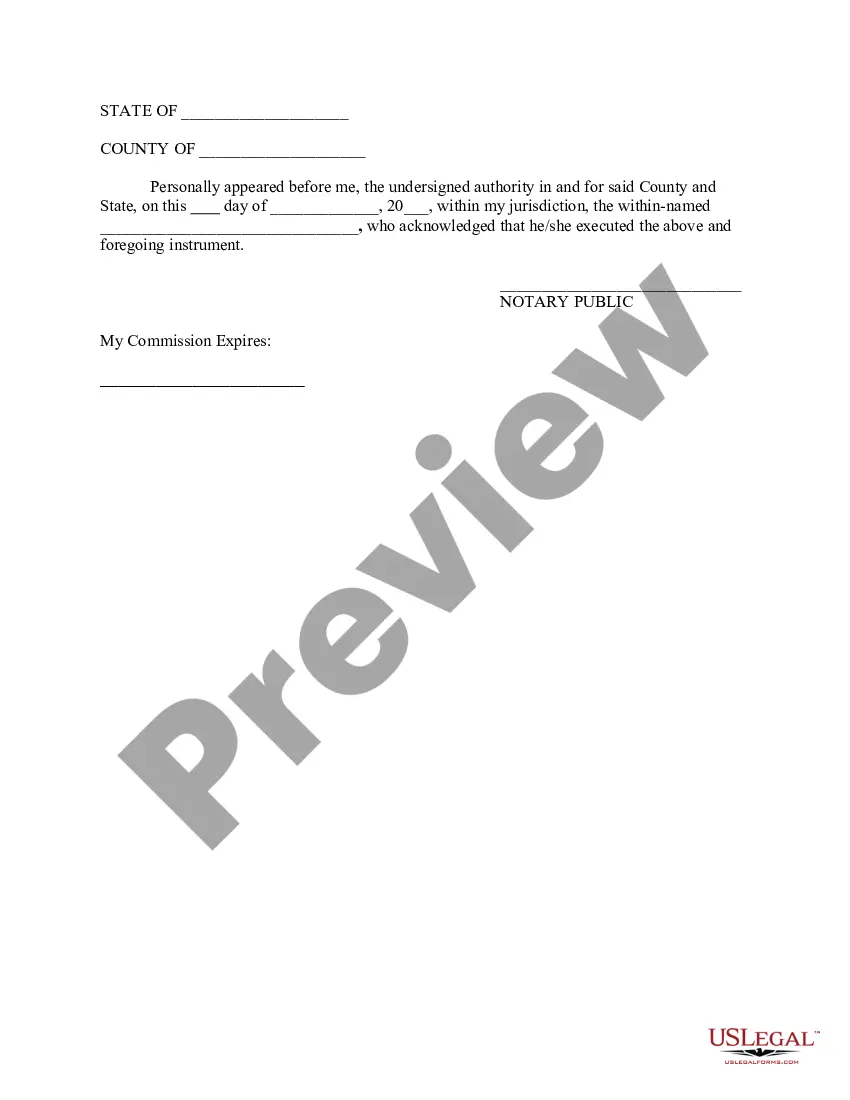

- Take advantage of the Preview button to check the form.

- Read the information to ensure that you have selected the proper type.

- If the type is not what you`re seeking, take advantage of the Search discipline to obtain the type that meets your requirements and requirements.

- Whenever you find the right type, click on Purchase now.

- Pick the costs strategy you desire, fill out the required information to generate your account, and buy the order utilizing your PayPal or bank card.

- Choose a practical file format and obtain your copy.

Discover all the record layouts you possess purchased in the My Forms food list. You can obtain a more copy of Louisiana Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) any time, if necessary. Just go through the needed type to obtain or printing the record design.

Use US Legal Forms, by far the most extensive variety of authorized forms, to save lots of some time and prevent mistakes. The service delivers expertly made authorized record layouts that can be used for a variety of purposes. Create your account on US Legal Forms and initiate generating your way of life a little easier.

Form popularity

FAQ

Requirements for Transferring a Vehicle Title by Affidavit Appropriate signatures as required by law. A copy of the decedent's will or notarized statement about the will's contents regarding motor vehicles, if a will exists. The vehicle's Louisiana title and registration certificate, if it is available.

In the field where it asks for the sales price, you may simply fill in ?gift.? In Louisiana, you will also need to: Get a lien release (if necessary) Get the gifter's signature on the title notarized. Complete a Vehicle Application form. Complete and notarize an Act of Donation of a Movable form.

What You'll Need to Do to Transfer your Vehicle Title in Louisiana. The Buyer & Seller Sign the Title & Have It Notarized. To finalize the transfer of the car's ownership, you must pay a transfer fee to the OMV. In Louisiana, it's typically $18.50 with possible sales tax and handling fees.

Transferring ownership of your car when you donate it in Louisiana is as simple as 1. remove your license plates from the vehicle before it is picked up and either destroy them or return them to your local motor vehicle office 2. complete a notice of vehicle transfer online, and 3.

Gifting a Car 101: Make Sure You Can Afford the Gift Tax Depending on where you live and who you're giving the car to, you may be responsible for paying a gift tax. If you do have to pay taxes on your gifted vehicle, the state uses the vehicle's fair market value to calculate the amount you have to pay.

If one of the heirs is a surviving spouse and he/she wishes to transfer the vehicle to a new owner, this affidavit of heirship must be completed by him/her as well as all other heirs, but only the surviving spouse is required to execute a notarized bill of sale or act of donation.

When you gift or donate your vehicle to a friend or family member, we can assist you with this type of transfer. An act of donation is an authentic act executed before a notary, and both buyer and seller need to be present in front of two witnesses (all parties must have valid identification).