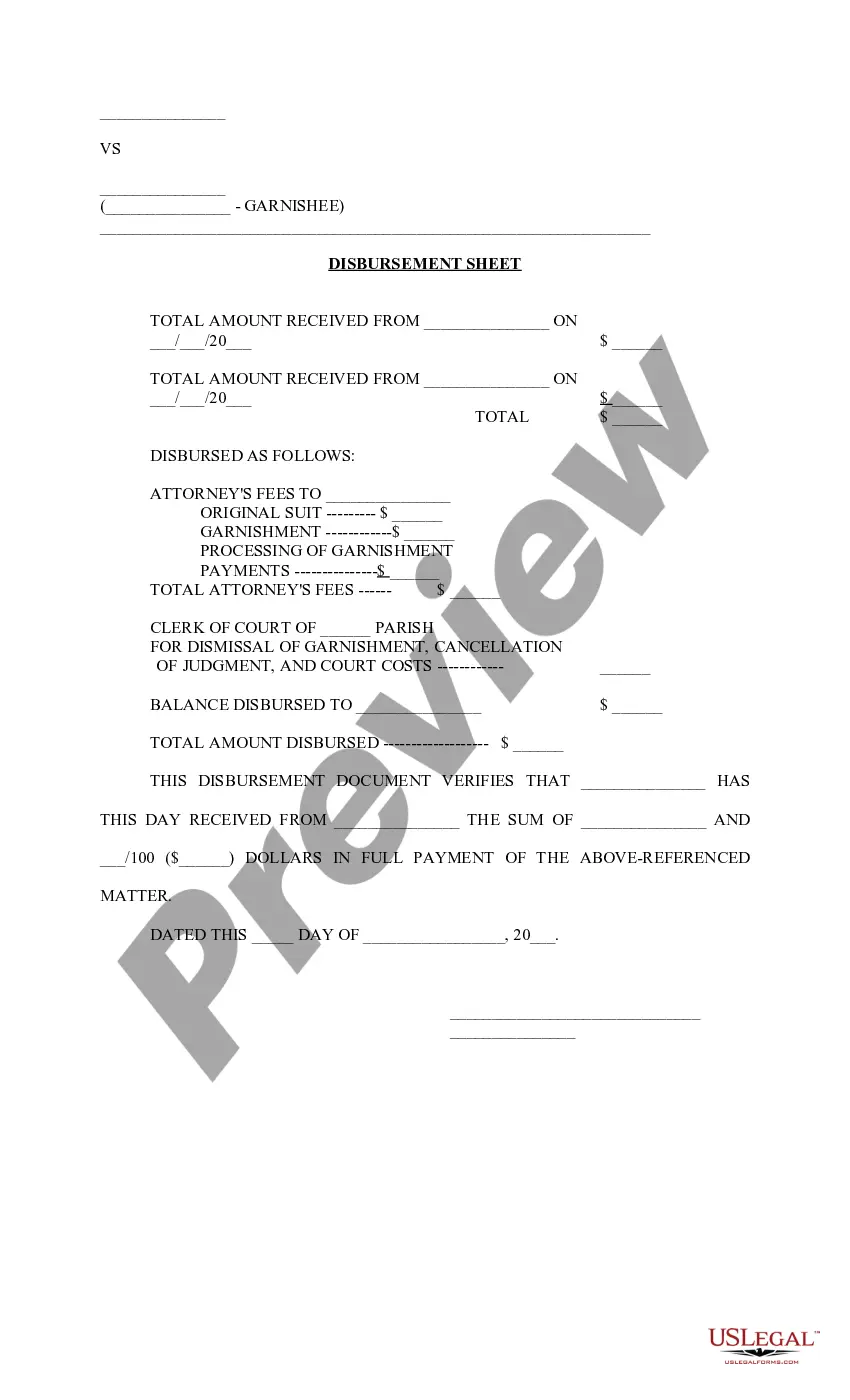

Louisiana Disbursement Sheet on Garnishment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Disbursement Sheet On Garnishment?

Searching for Louisiana Disbursement Sheet regarding Garnishment templates and filling them out can be challenging.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the appropriate sample specifically for your state with just a few clicks.

Our legal experts prepare all documents, so you only need to complete them. It's truly that simple.

Select your plan on the pricing page and create your account. Decide whether you would like to pay with a credit card or via PayPal. Save the sample in your preferred format. Now you can print the Louisiana Disbursement Sheet concerning Garnishment form or fill it out using any online editor. Don't worry about making errors because your form can be used, submitted, and printed as many times as you desire. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to download the document.

- Your saved templates are retained in My documents and are available anytime for future use.

- If you haven't subscribed yet, you ought to register.

- Review our detailed guidance on how to obtain the Louisiana Disbursement Sheet concerning Garnishment template in a matter of minutes.

- To acquire a suitable form, verify its relevance for your state.

- Examine the form using the Preview feature (if it's available).

- If there's an explanation, read it to grasp the specifics.

- Click on Buy Now button if you discovered what you're looking for.

Form popularity

FAQ

In Louisiana, several types of personal property may be subject to seizure under a judgment. This includes vehicles, real estate, and certain valuable items such as jewelry or electronics. Using a Louisiana Disbursement Sheet on Garnishment can help you assess which personal assets are impacted and make informed decisions moving forward. Protecting your rights requires understanding both the laws and your options.

There is no wage garnishment tax deduction that can automatically reduce your income tax if you have wages garnished. However, if your wages are being garnished to pay a tax-deductible expense, like medical debt, you may be able to deduct those payments.

Determine disposable earnings by subtracting legally required deductions from the employee's gross wages. Legally required deductions are those that the government requires, such as federal income tax, Social Security tax and Medicare tax. The result is the disposable earnings, which are subject to wage garnishment.

The journal entry will be Debit Gross Wages, and Credit "Child Support Liability account." When you write the check to pay the garnishment, on the Expenses tab, you list the Child Support Liability account.

This current liability account reports the amount a company must remit to a court or other agencies for amounts withheld from its employees' salaries and wages.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

(When it comes to wage garnishment, disposable income means anything left after the necessary deductions such as taxes and Social Security.) Either 25% or the amount by which your weekly income exceeds 30 times the federal minimum wage (currently $7.25 an hour), whichever is less.

Go to Employees, then choose the Employee's name. In the Deductions and Contributions section, select Edit. Select Add a Garnishment. Select a garnishment type, then enter the required information. Field. Select Save, then OK.

Wage Garnishments Only Apply to the Employment Relationship In most situations, the creditor must first file a lawsuit, overcome any defenses the debtor may assert (many debtors simply default), and then obtain a Monetary Judgment in the exact amount of the debt due plus interest (both past and ongoing).