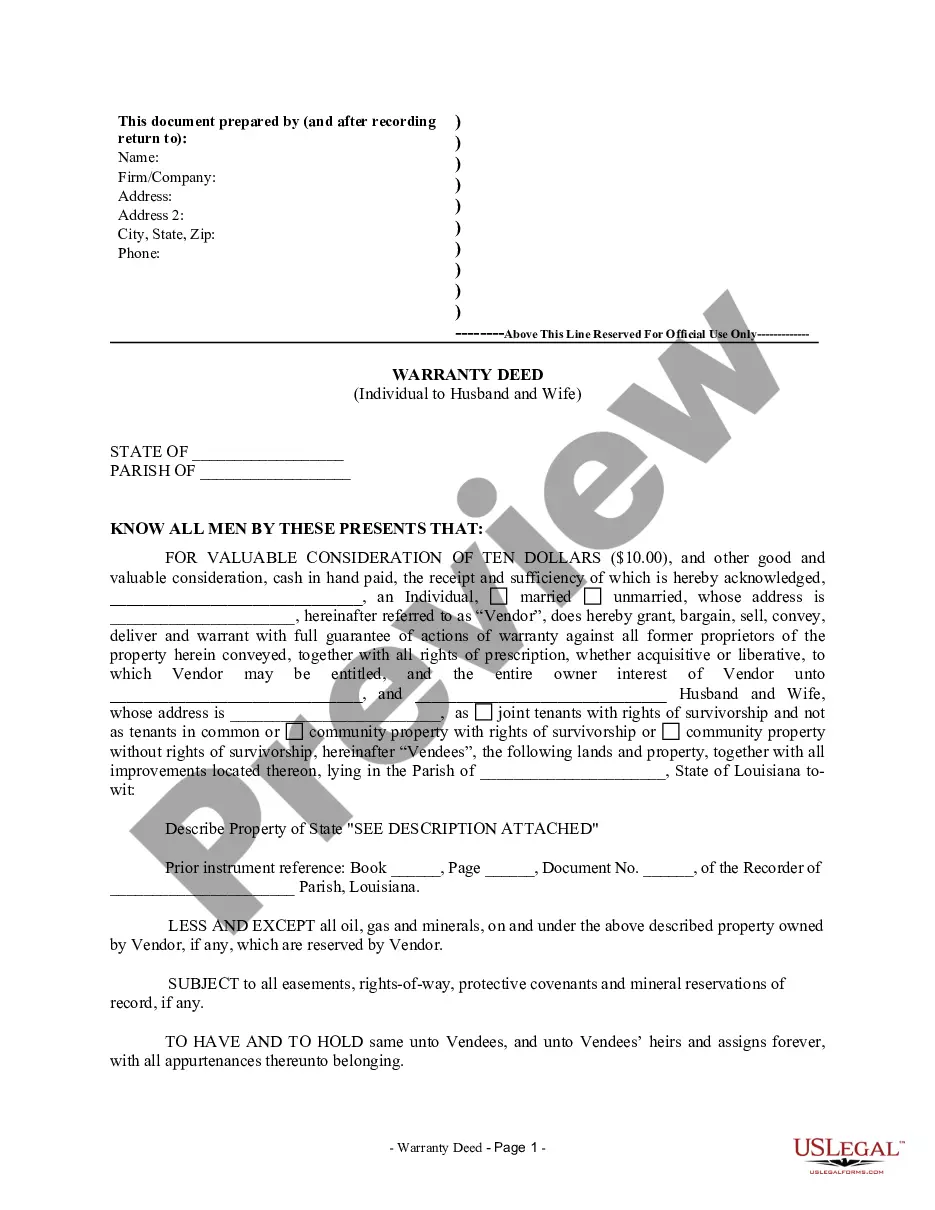

Louisiana Warranty Deed from Individual to Husband and Wife

Definition and meaning

A Louisiana Warranty Deed from Individual to Husband and Wife is a legal document used to transfer property ownership from one individual to a couple who are married. This deed ensures that the new owners receive the full rights to the property, including protection against claims from previous owners. Such deeds are often used in real estate transactions to formalize the change in ownership.

Who should use this form

This form is intended for individuals who wish to transfer ownership of real property to a married couple. It is suitable for various scenarios, including individuals who want to gift property to their partners, or for those involved in estate planning. If you are transferring property in Louisiana and want to ensure joint ownership rights for a husband and wife, this form is applicable.

Legal use and context

The Louisiana Warranty Deed is recognized under Louisiana law and provides a legally binding means for transferring property ownership. By using this form, the vendor (the individual transferring the property) guarantees that the property is free from liens and encumbrances, thus providing legal protection to the vendees (the married couple receiving the property). It is important for both parties to understand the legal implications of this deed before executing it.

Key components of the form

The Louisiana Warranty Deed includes several essential components:

- The identity of the vendor and vendees, including their marital status.

- A detailed description of the property being transferred.

- Consideration amount, typically stated as ten dollars plus other considerations.

- Warranties provided by the vendor regarding clear title and ownership.

- Signature lines for the vendor and notarization requirements.

What to expect during notarization or witnessing

Notarization is a critical step in executing a Louisiana Warranty Deed. The vendor must sign the document in the presence of a notary public, who will then verify the identity of the parties involved and ensure they are signing willingly. Expect to present identification and provide details about the property. Witnesses may also be required, depending on the specific stipulations of the deed.

Common mistakes to avoid when using this form

When completing the Louisiana Warranty Deed, be cautious of the following common mistakes:

- Failing to accurately describe the property

- Omitting required signatures or witnessing

- Not providing the correct marital status of vendees

- Using improper terminology regarding property rights

Benefits of using this form online

Using an online template for the Louisiana Warranty Deed offers several advantages, including:

- Convenience of completing the form from home

- Access to guidance and instructions throughout the process

- Reduction of potential errors due to structured templates

- The ability to quickly update and customize details as needed

Form popularity

FAQ

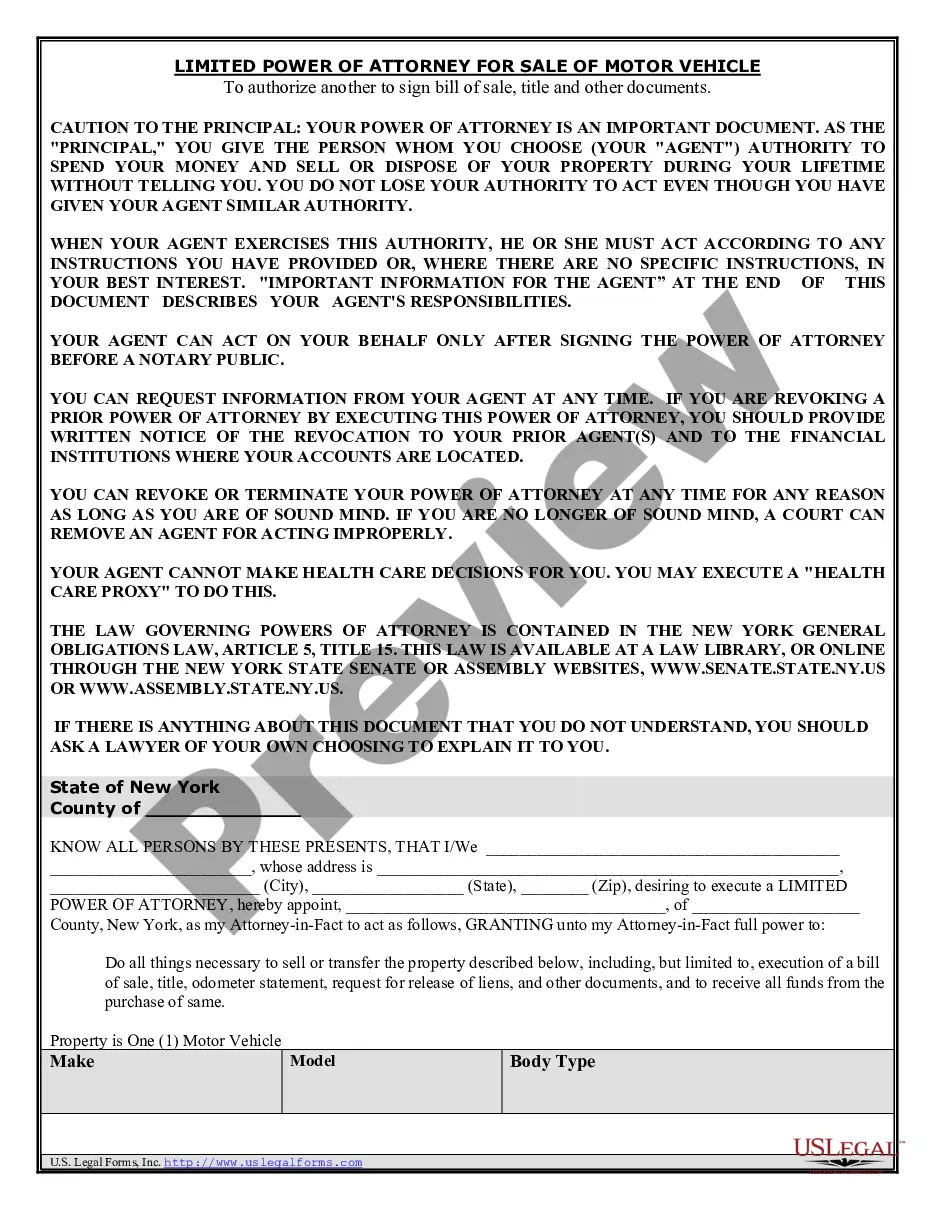

Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Property ownership in Louisiana is voluntarily transferred by a contract through the owner and the transferee. A transfer of real (immovable) property can be made by authentic act or by an act under private signature duly acknowledged (CC1839 Art. 1839).

You can gift property to spouse, child or any relative and register the same. Under section 122 of the Transfer of Property Act, 1882, you can transfer immovable property through a gift deed. The deed should contain your details as well as those of the recipient.

You may be able to transfer your interest in the property through a quitclaim deed, where you relinquish all ownership of the property to someone else. Your lender may also agree to add another name to the mortgage. In this case, someone else would be able to legally make payments on the mortgage.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner. The quitclaim deed must include the property's description, including its boundary lines.

When it comes to reasons why you shouldn't add your new spouse to the Deed, the answer is simple divorce and equitable distribution. If you choose not to put your spouse on the Deed and the two of you divorce, the entire value of the home is not subject to equitable distribution.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.