Kentucky Agreement for Sales of Data Processing Equipment

Description

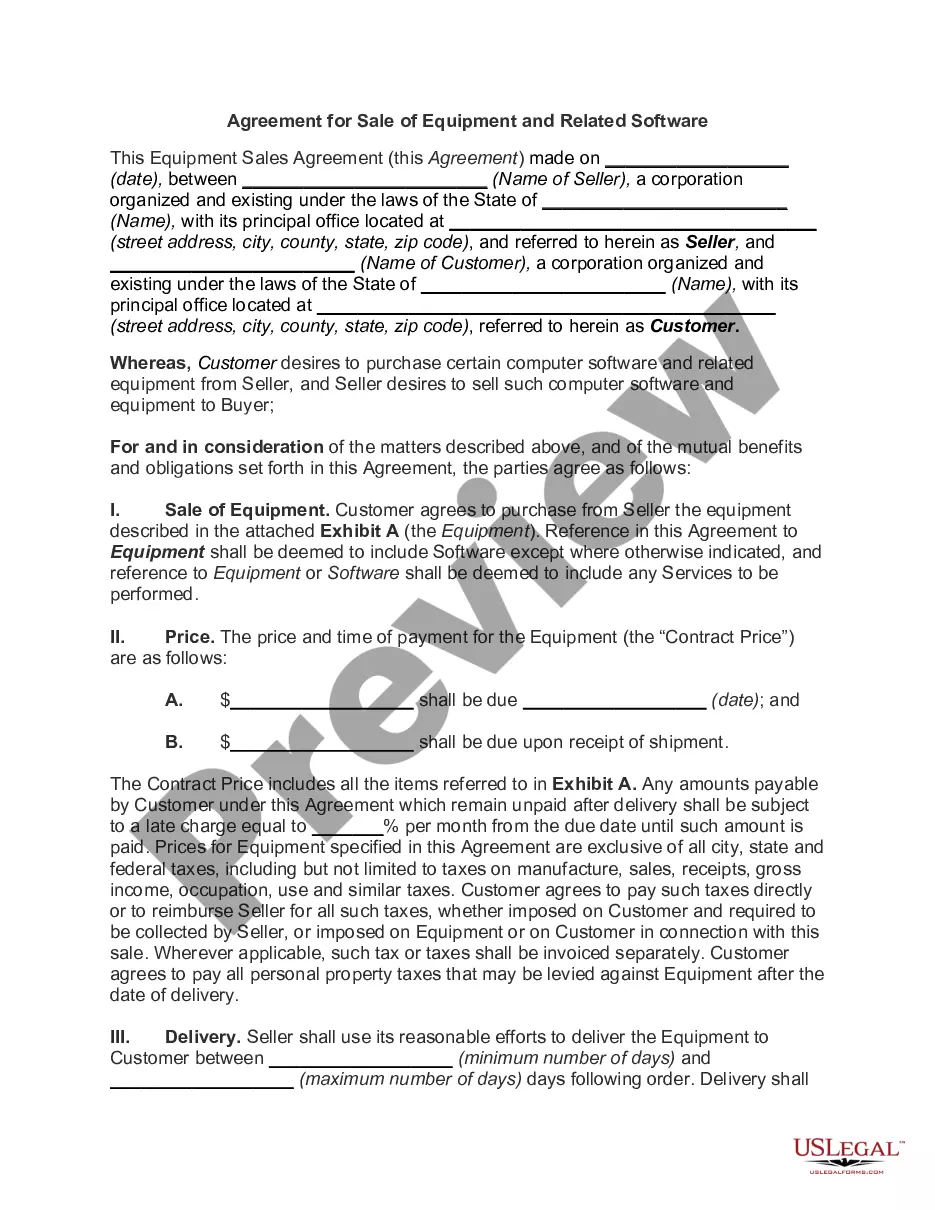

How to fill out Agreement For Sales Of Data Processing Equipment?

US Legal Forms - one of the most important collections of legal documents in the USA - offers a vast selection of legal paper templates that you can download or print.

By using the website, you can find countless forms for business and personal purposes, categorized by types, states, or keywords. You can discover the latest forms like the Kentucky Agreement for Sale of Data Processing Equipment in moments.

If you already have a monthly subscription, Log In and download the Kentucky Agreement for Sale of Data Processing Equipment from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Make changes. Fill out, modify, print, and sign the downloaded Kentucky Agreement for Sale of Data Processing Equipment.

Each template you add to your account does not expire and is yours permanently. So, if you want to download or print another copy, just visit the My documents section and click on the form you need. Access the Kentucky Agreement for Sale of Data Processing Equipment with US Legal Forms, the most extensive library of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

- If you're using US Legal Forms for the first time, here are simple steps to get started:

- Ensure you have selected the correct form for your location/state. Click the Preview button to review the form's details. Check the form description to ensure you have chosen the correct form.

- If the form doesn’t meet your needs, use the Search box at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose the payment plan you prefer and provide your details to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the payment.

- Select the format and download the form to your device.

Form popularity

FAQ

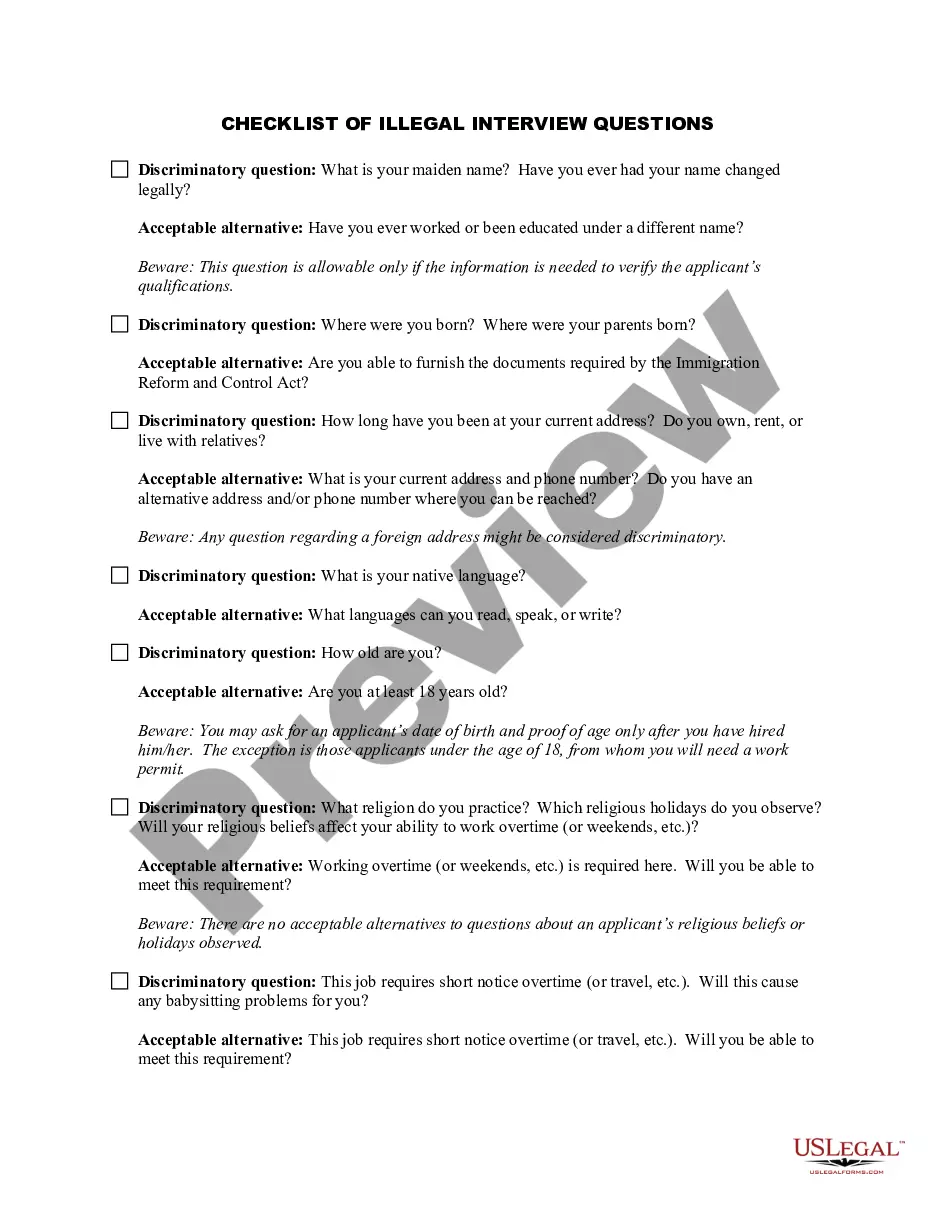

Yes, software licenses are generally subject to sales and use tax in Kentucky. This applies whether the software is purchased outright or through subscription models. When evaluating the Kentucky Agreement for Sales of Data Processing Equipment, it is important to consider how software licenses may impact your tax obligations.

A master agreement serves as a foundational contract that outlines the terms and conditions for future agreements between parties. Its purpose is to create clarity and efficiency, reducing the need for renegotiation each time a transaction occurs. This approach is often utilized in the Kentucky Agreement for Sales of Data Processing Equipment.

The Kentucky State Master Agreement refers to a standardized contract framework used by state agencies for procurement. This agreement outlines the provisions for various services and goods, ensuring compliance with state regulations. It can complement the Kentucky Agreement for Sales of Data Processing Equipment for public agencies.

In Kentucky, a land contract is an agreement where the buyer pays for land over time while the seller retains the title until payment is complete. This arrangement can benefit buyers who may not qualify for traditional financing. It is essential to document the terms clearly, similar to what you would do in a Kentucky Agreement for Sales of Data Processing Equipment.

A valid real estate contract in Kentucky must include clear terms and be signed by all parties. This contract should specify the property involved and the agreements made. When dealing with data processing equipment, ensure that your Kentucky Agreement for Sales of Data Processing Equipment aligns with these legal requirements.

In Kentucky, sales and use tax applies to various goods and services, including tangible personal property. Generally, items like machinery or equipment, including those relevant to the Kentucky Agreement for Sales of Data Processing Equipment, are taxable. It's crucial to understand these regulations to remain compliant in your transactions.

Yes, a Master Services Agreement (MSA) creates a legally binding arrangement between parties. This document outlines the terms of collaboration, protecting the interests of both parties involved. When properly executed, the MSA ensures that obligations are enforceable, including under the Kentucky Agreement for Sales of Data Processing Equipment.

Several items are exempt from Kentucky sales tax, like certain nonprofit organization purchases and agricultural products. Knowing these details can assist businesses in managing their expenditures effectively. When entering into a Kentucky Agreement for Sales of Data Processing Equipment, being informed about tax exemptions is key to enhancing your financial strategy. Platforms like USLegalForms can simplify the documentation process and keep you compliant.

Items exempt from sales tax in Kentucky include prescription drugs, unprepared food, and specific farm supplies. Understanding these exemptions ensures compliance and helps businesses make informed purchasing decisions. When drafting a Kentucky Agreement for Sales of Data Processing Equipment, it’s beneficial to be aware of these sales tax regulations. Check out USLegalForms for comprehensive documentation to guide your agreements.

In Kentucky, certain products are exempt from sales tax, such as food for human consumption, certain medical supplies, and specific educational materials. These exemptions help ease the financial burden on consumers and promote accessibility. When preparing a Kentucky Agreement for Sales of Data Processing Equipment, it's important to consider these exemptions to avoid unnecessary tax liabilities. For detailed insights, USLegalForms offers valuable resources.