Kentucky Chef Services Contract - Self-Employed

Description

How to fill out Chef Services Contract - Self-Employed?

US Legal Forms - one of the most important collections of legal templates in the USA - provides a variety of legal document formats you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the most recent versions of forms such as the Kentucky Chef Services Contract - Self-Employed in moments.

If you have a membership, Log In and download the Kentucky Chef Services Contract - Self-Employed from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Select the format and download the form to your device.

Edit. Complete, modify, and print and sign the downloaded Kentucky Chef Services Contract - Self-Employed. Each template added to your account has no expiration date, meaning you have it forever. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Kentucky Chef Services Contract - Self-Employed with US Legal Forms, the most comprehensive library of legal document formats. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/county. Click the Preview button to review the form's content.

- Read the form description to confirm you have selected the appropriate form.

- If the form doesn't meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose your preferred pricing plan and provide your details to create an account.

- Process the transaction. Use your credit card or PayPal account to complete the purchase.

Form popularity

FAQ

While you can refer to yourself as a chef, it is important to comprehend the skills and knowledge associated with this title. Many chefs have undergone formal training or have significant experience in the culinary field. To strengthen your credibility, consider operating under a Kentucky Chef Services Contract - Self-Employed, which outlines your qualifications and services.

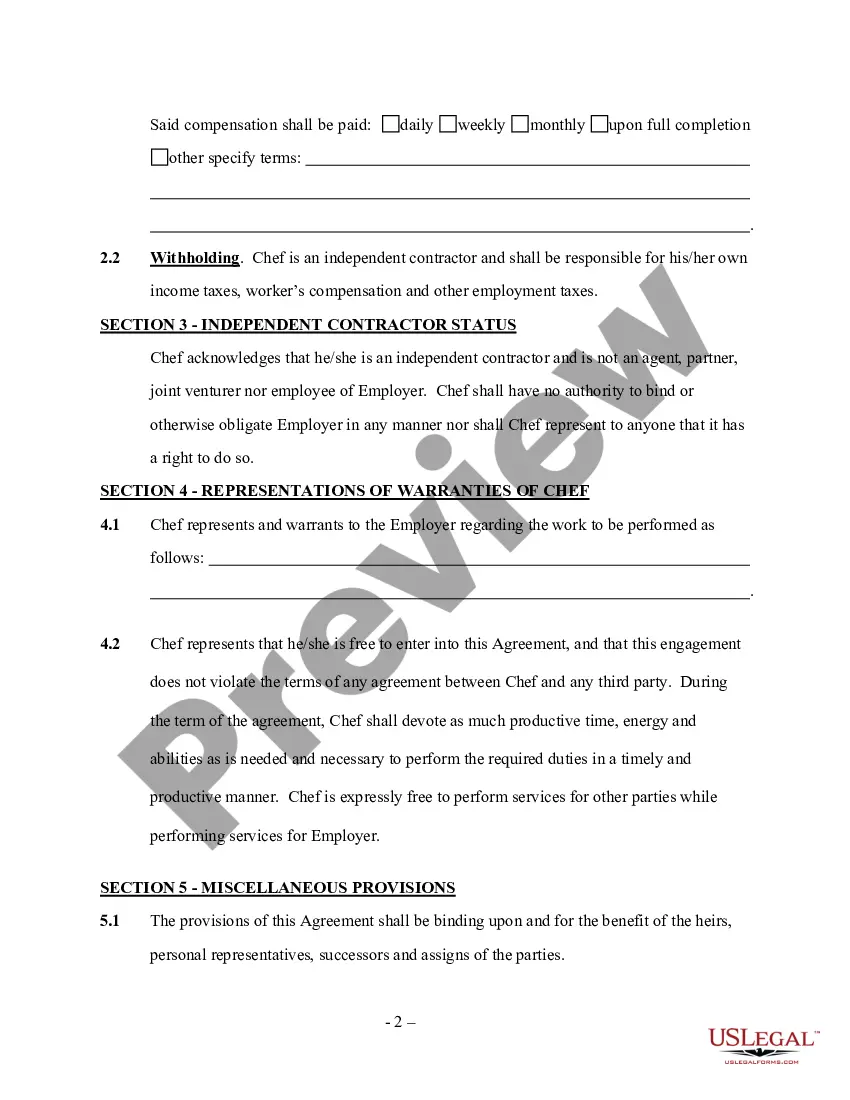

An independent contractor agreement in Kentucky outlines the relationship between a business owner and a contractor. This document details the scope of work, payment terms, and other essential conditions. For chefs, using a Kentucky Chef Services Contract - Self-Employed can help formalize this arrangement, ensuring both parties understand their obligations.

Definitely, being a self-employed chef is a viable career option. This path allows chefs to showcase their culinary skills independently, catering to diverse client needs. Utilizing tools like a Kentucky Chef Services Contract - Self-Employed can streamline your business operations, ensuring clear agreements and responsibilities.

Indeed, personal chefs typically work as self-employed professionals. They cater to individual clients, creating customized meal plans and providing in-home cooking services. A well-crafted Kentucky Chef Services Contract - Self-Employed can help outline the services provided, protecting both the chef and the client.

Yes, you can prepare meals from home to sell, but you must follow local health regulations. It is crucial to understand the specific laws governing food preparation and sales in Kentucky. A Kentucky Chef Services Contract - Self-Employed can help establish your business framework, ensuring compliance and clarity with clients.

Yes, private chefs often operate as self-employed individuals. This allows them to provide personalized culinary services directly to clients. By entering into a Kentucky Chef Services Contract - Self-Employed, private chefs can define their working terms, ensuring clarity and legal protection in their business operations.

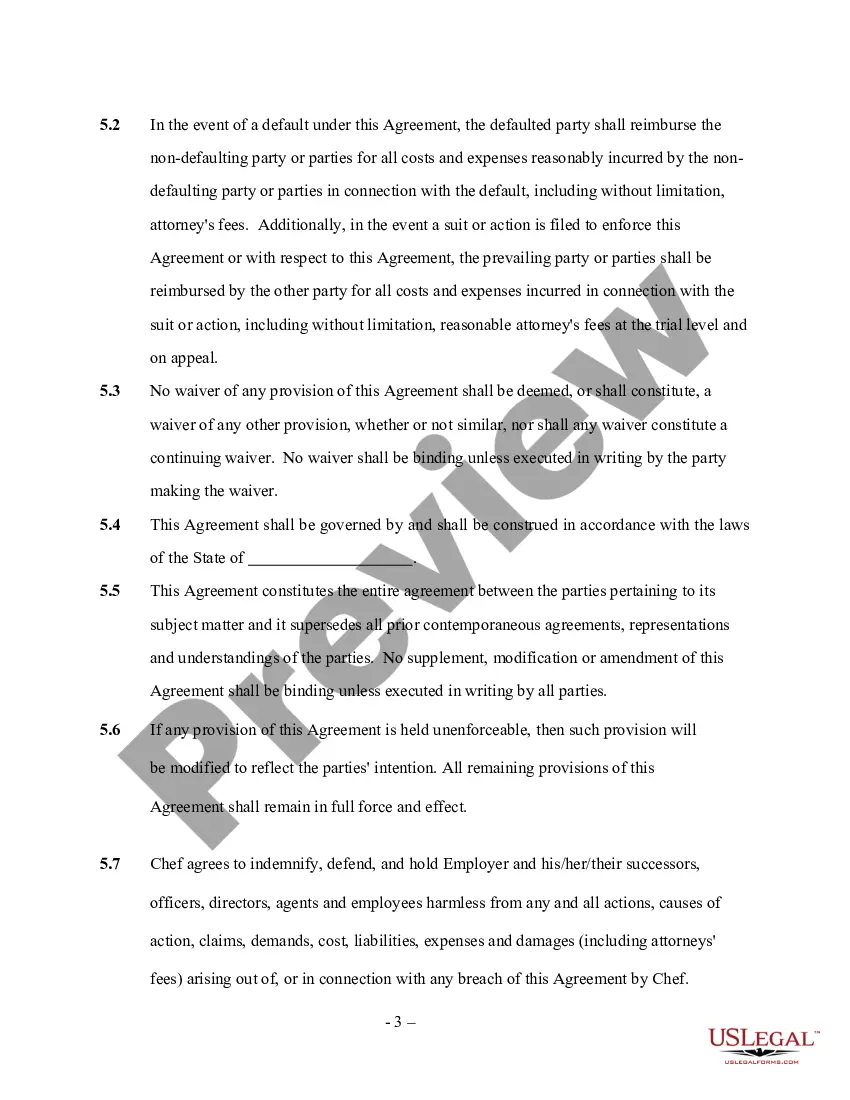

Not having a contract can lead to significant challenges, such as misunderstandings regarding payment and responsibilities. If a dispute arises, the lack of documented terms can make it difficult to seek recourse. With a Kentucky Chef Services Contract - Self-Employed, you mitigate these risks and create a clear framework for your work. This can save both time and stress in the future.

Freelancing without a contract is not recommended, even though it may be possible. A Kentucky Chef Services Contract - Self-Employed strengthens your position by outlining expectations, responsibilities, and payment terms. This contract can protect you from misunderstandings and disputes. Moreover, having a contract can enhance your professionalism, making clients more likely to trust your services.

While it is possible to be classified as a 1099 worker without a written contract, it is not advisable. A Kentucky Chef Services Contract - Self-Employed provides necessary documentation of your working relationship, enhancing your legal protections. Having this contract helps clarify roles and payment terms, benefiting both the chef and the client. Additionally, it helps avoid potential conflicts down the line.

In many cases, yes, a chef can be classified as an independent contractor. This classification allows chefs to offer their services independently, setting their own rates and working hours. To formalize this relationship, having a Kentucky Chef Services Contract - Self-Employed can clearly define the terms of engagement. This clarity can lead to a successful working relationship.