Kentucky Fuel Delivery And Storage Services - Self-Employed

Description

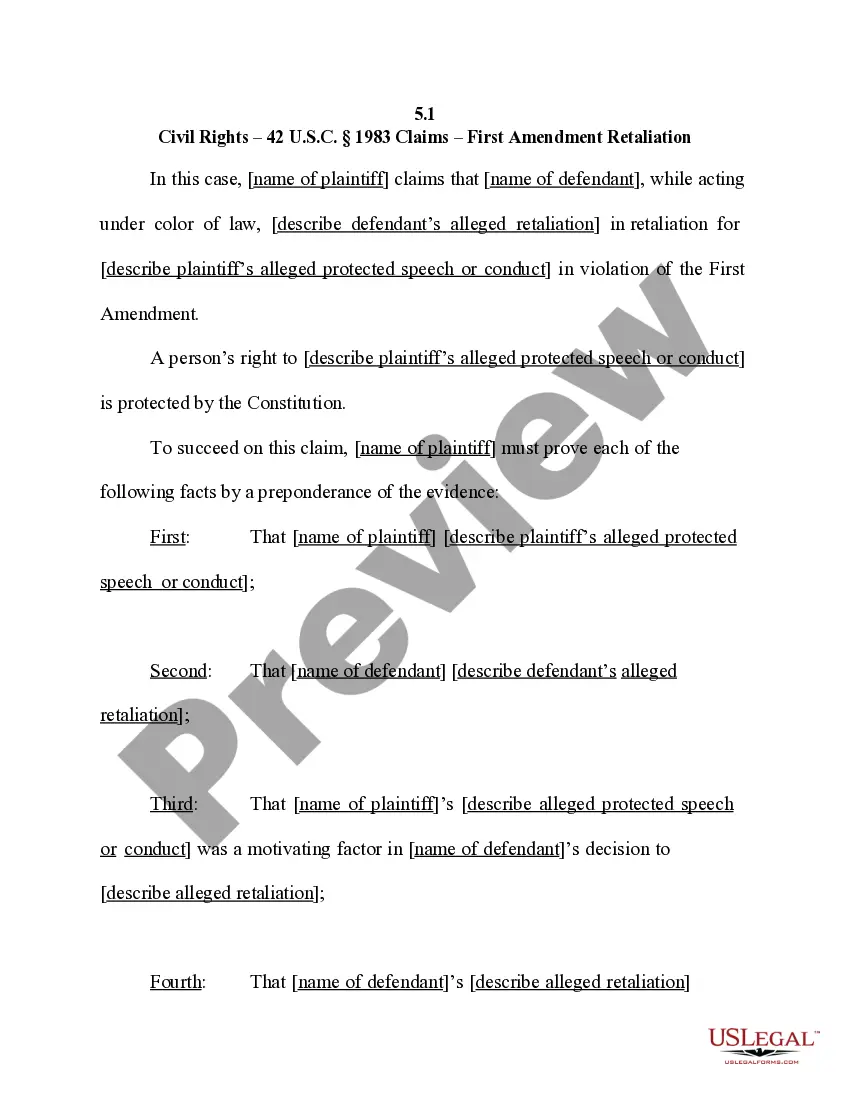

How to fill out Fuel Delivery And Storage Services - Self-Employed?

Selecting the optimal official document format can be challenging. Of course, there are numerous templates available online, but how do you locate the official version you require? Utilize the US Legal Forms website. This service offers a vast array of templates, including the Kentucky Fuel Delivery And Storage Services - Self-Employed, suitable for both business and personal needs. All documents are verified by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Obtain button to acquire the Kentucky Fuel Delivery And Storage Services - Self-Employed. Use your account to browse through the official documents you may have purchased before. Navigate to the My documents section of your account and retrieve an additional copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct document for your city/region. You can preview the form using the Review feature and examine the form description to confirm it is indeed suitable for you. If the document does not meet your requirements, utilize the Search box to find the correct form. Once you are confident the document is appropriate, click the Purchase now button to obtain the form. Select the payment plan you prefer and enter the necessary information. Create your account and finalize your order using your PayPal account or credit card. Choose the file format and download the official document template to your device. Complete, edit, print, and sign the acquired Kentucky Fuel Delivery And Storage Services - Self-Employed.

Make the most of US Legal Forms to ensure you have the proper legal documentation.

- US Legal Forms is the largest repository of official documents where you can find various document templates.

- Utilize the service to download professionally crafted files that adhere to state requirements.

- The platform offers easy navigation to locate the necessary legal forms.

- You can manage your account to access previously purchased documents effortlessly.

- The templates available cater to both business and personal use.

- All files are vetted for compliance with legal standards.

Form popularity

FAQ

While you cannot completely avoid self-employment tax, you can strategically minimize it. Deductions for business expenses related to your Kentucky Fuel Delivery and Storage Services can lower your taxable income. Additionally, consulting with a tax advisor might reveal legal options to optimize your tax situation.

An LLC in Kentucky may be taxed as a sole proprietorship, partnership, or corporation, depending on the number of members. If you operate your Kentucky Fuel Delivery and Storage Services as a single-member LLC, the income passes through to your personal tax return. It's vital to understand these options to make informed decisions for your business.

In Kentucky, the self-employment tax rate is typically 15.3%, which includes both Social Security and Medicare taxes. As a provider of Kentucky Fuel Delivery and Storage Services, your net earnings determine your tax amount. Always consult with a tax professional for personalized advice to optimize your tax situation.

As a self-employed individual providing Kentucky Fuel Delivery and Storage Services, you are responsible for paying self-employment tax, which is generally 15.3% on your net earnings. This tax covers Social Security and Medicare contributions. Always consider your individual deductions to reduce your taxable income, and remember to keep accurate records of all business expenses.

Starting a small fuel delivery business involves several key steps. First, conduct thorough market research to identify your target customers and define your service area. Next, secure the required licenses for Kentucky Fuel Delivery And Storage Services - Self-Employed to ensure legal compliance. Finally, consider using uslegalforms for streamlined access to necessary forms and compliance guidelines, enabling you to focus on building your customer base and delivering quality service.

To start a fuel delivery business, you will need specific equipment, appropriate licenses, and a solid business plan. Consider obtaining the necessary permits for Kentucky Fuel Delivery And Storage Services - Self-Employed, as regulatory compliance is crucial in this industry. Additionally, investing in reliable delivery vehicles and fuel storage solutions is essential for smooth operations. Utilizing platforms like uslegalforms can simplify the process of acquiring the right legal documents and permits.

Yes, the fuel delivery business can be quite profitable, especially in areas where demand for reliable fuel delivery is high. By offering Kentucky Fuel Delivery And Storage Services - Self-Employed, you tap into a growing market where businesses and individuals seek convenience. Additionally, building strong customer relationships and optimizing route efficiency can increase your profit margins. Ultimately, your success will hinge on careful planning and effective execution.

Yes, KY form 725 can be filed electronically, streamlining the process for self-employed individuals. Utilizing electronic filing is a convenient way to manage your tax responsibilities while operating within Kentucky Fuel Delivery And Storage Services - Self-Employed. Check official state resources to learn more about the electronic filing options available.

Self-employment tax in Kentucky includes Social Security and Medicare taxes that self-employed individuals are responsible for paying. This tax is often applicable to those providing services such as Kentucky Fuel Delivery And Storage Services - Self-Employed, ensuring that your contributions help fund these programs. Being aware of these obligations is essential for accurate tax planning.

Yes, in Kentucky, storage services may be subject to sales tax, depending on specific circumstances. Given your business in Kentucky Fuel Delivery And Storage Services - Self-Employed, understanding these tax implications is crucial for accurate revenue reporting. It is advisable to keep abreast of local tax regulations or consult an expert for specific guidance on your storage practices.