Kentucky Simple Agreement for Future Equity

Description

How to fill out Simple Agreement For Future Equity?

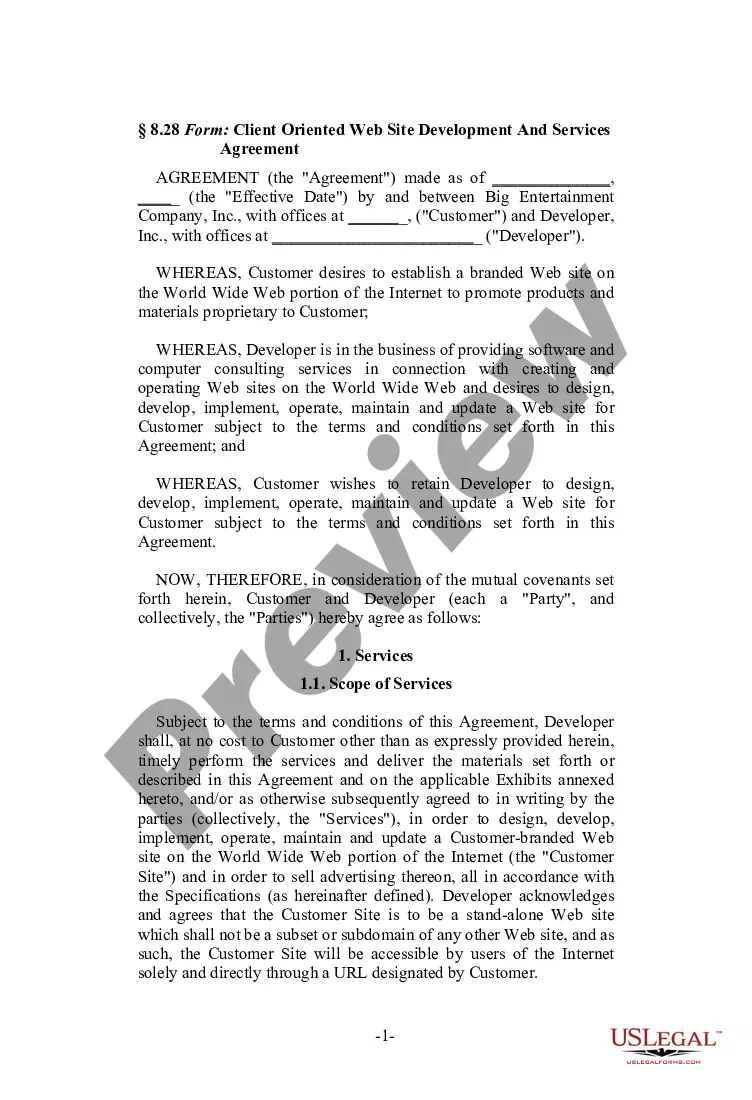

Have you been within a situation in which you need to have paperwork for sometimes organization or individual purposes virtually every working day? There are plenty of legitimate document web templates available online, but getting types you can rely isn`t effortless. US Legal Forms offers thousands of type web templates, such as the Kentucky Simple Agreement for Future Equity, which are written to fulfill federal and state needs.

Should you be currently familiar with US Legal Forms site and get a free account, simply log in. Afterward, you may down load the Kentucky Simple Agreement for Future Equity web template.

If you do not come with an accounts and would like to begin using US Legal Forms, follow these steps:

- Get the type you require and ensure it is for the proper area/state.

- Make use of the Preview switch to check the shape.

- Look at the description to actually have chosen the proper type.

- If the type isn`t what you are looking for, take advantage of the Search area to discover the type that meets your needs and needs.

- If you find the proper type, just click Purchase now.

- Choose the rates prepare you want, fill in the necessary details to produce your bank account, and buy your order utilizing your PayPal or credit card.

- Choose a handy paper format and down load your duplicate.

Discover all the document web templates you have bought in the My Forms menus. You can obtain a extra duplicate of Kentucky Simple Agreement for Future Equity anytime, if required. Just click the needed type to down load or print the document web template.

Use US Legal Forms, one of the most comprehensive collection of legitimate varieties, to conserve efforts and prevent blunders. The services offers expertly made legitimate document web templates that can be used for a range of purposes. Make a free account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

A SAFE is an investment contract between a startup and an investor that gives the investor the right to receive equity of the company on certain triggering events, such as a: Future equity financing (known as a Next Equity Financing or Qualified Financing), usually led by an institutional venture capital (VC) fund.

Calculation ing to the Discount Rate The total shares are calculated ing to the SAFE money invested divided by the share price in the next round, multiplied by the discount rate. If we take our example above, if during the next financing round, the company raises money ing to a share price of $10.

A simple agreement for future equity delays valuation of a company until it has more performance data on which to base a valuation. At the same time, it promises an investor the right to buy future equity when a valuation is made. A SAFE can be converted into preferred stock in the future.

money valuation is a company's estimated value after receiving outside investment or financing. So if a company was worth $10M, and then it raised another $5M, its postmoney valuation would now be $15M.

A Simple Agreement for Future Equity (we'll call it a SAFE from here on out) is an agreement that an early-stage startup makes with an investor?typically when raising money during a seed round. Because the startup doesn't yet have a formal valuation, it doesn't have shares to issue to the investor.

A SAFE note is simply a legally enforceable promise to allow an investor to buy a certain number of shares at a specific price at a later date. Valuation cap ? A valuation cap is a limit on how much a SAFE can be converted to equity ownership in the future.

Cons: SAFE investors assume most, if not all, of the risk, in that there is no guarantee of any equity ownership in the company. ... A SAFE holder is not entitled to any company assets in the event of a liquidation.

A simple agreement for future equity (SAFE) is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of the initial investment.