Kentucky Stock Option Agreement of Ichargeit.Com, Inc.

Description

How to fill out Stock Option Agreement Of Ichargeit.Com, Inc.?

Are you presently within a place that you need papers for both business or individual purposes just about every working day? There are tons of authorized file templates available online, but finding versions you can depend on isn`t straightforward. US Legal Forms provides a huge number of develop templates, just like the Kentucky Stock Option Agreement of Ichargeit.Com, Inc., that are published to satisfy state and federal requirements.

In case you are currently acquainted with US Legal Forms internet site and have a free account, just log in. After that, you can download the Kentucky Stock Option Agreement of Ichargeit.Com, Inc. web template.

Should you not come with an profile and want to begin to use US Legal Forms, adopt these measures:

- Obtain the develop you require and ensure it is for that proper town/region.

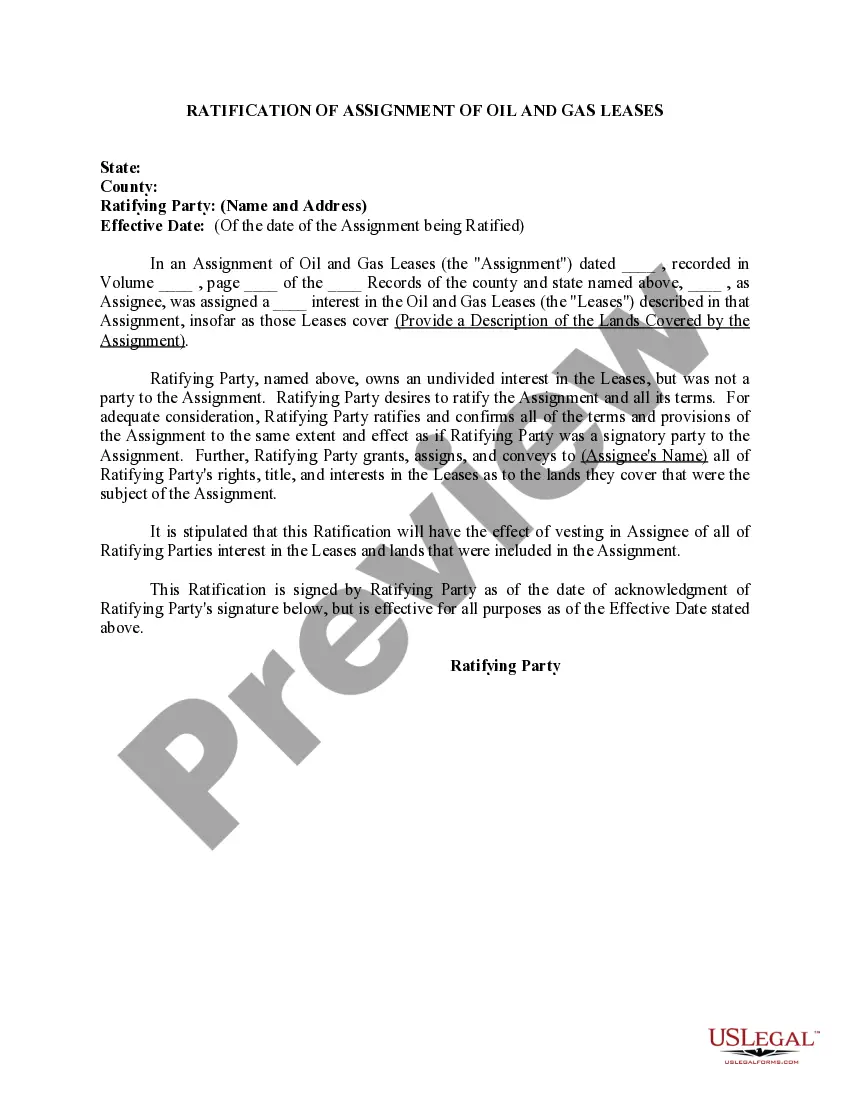

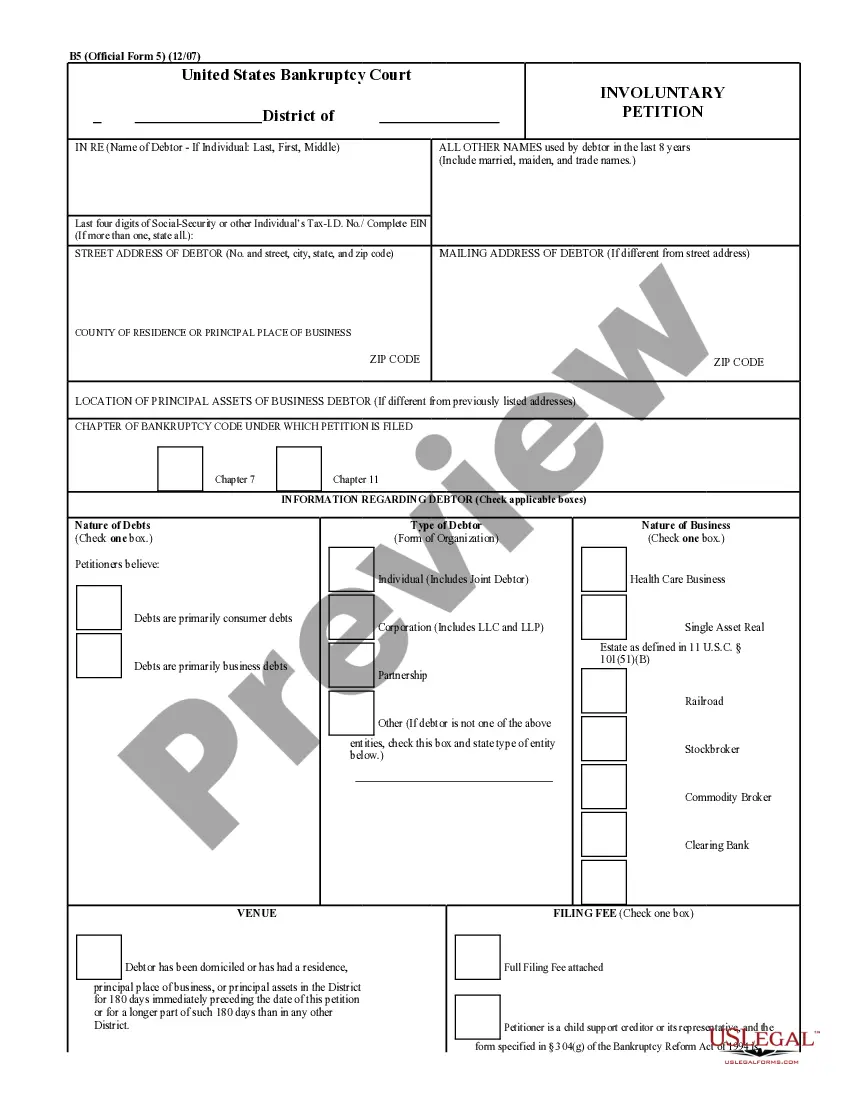

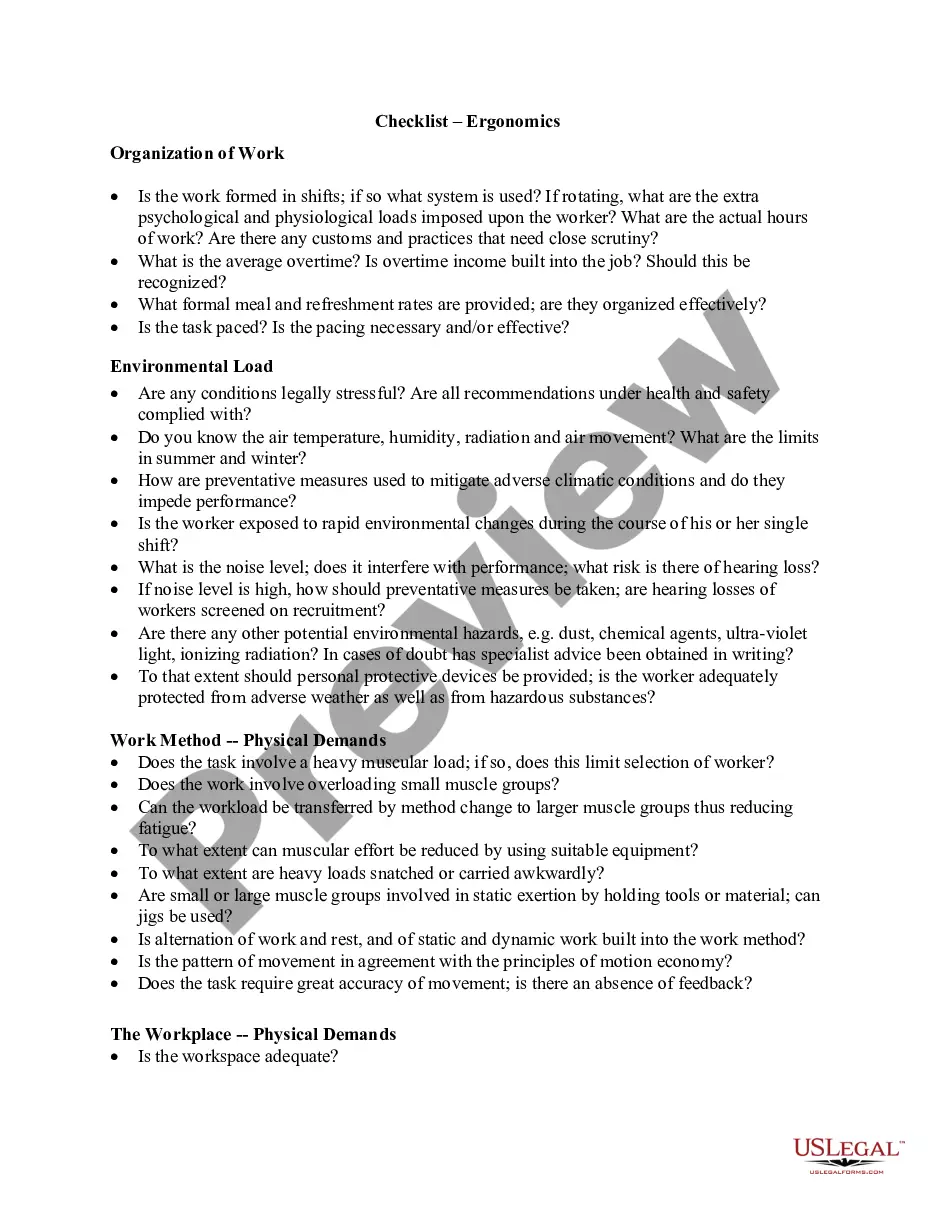

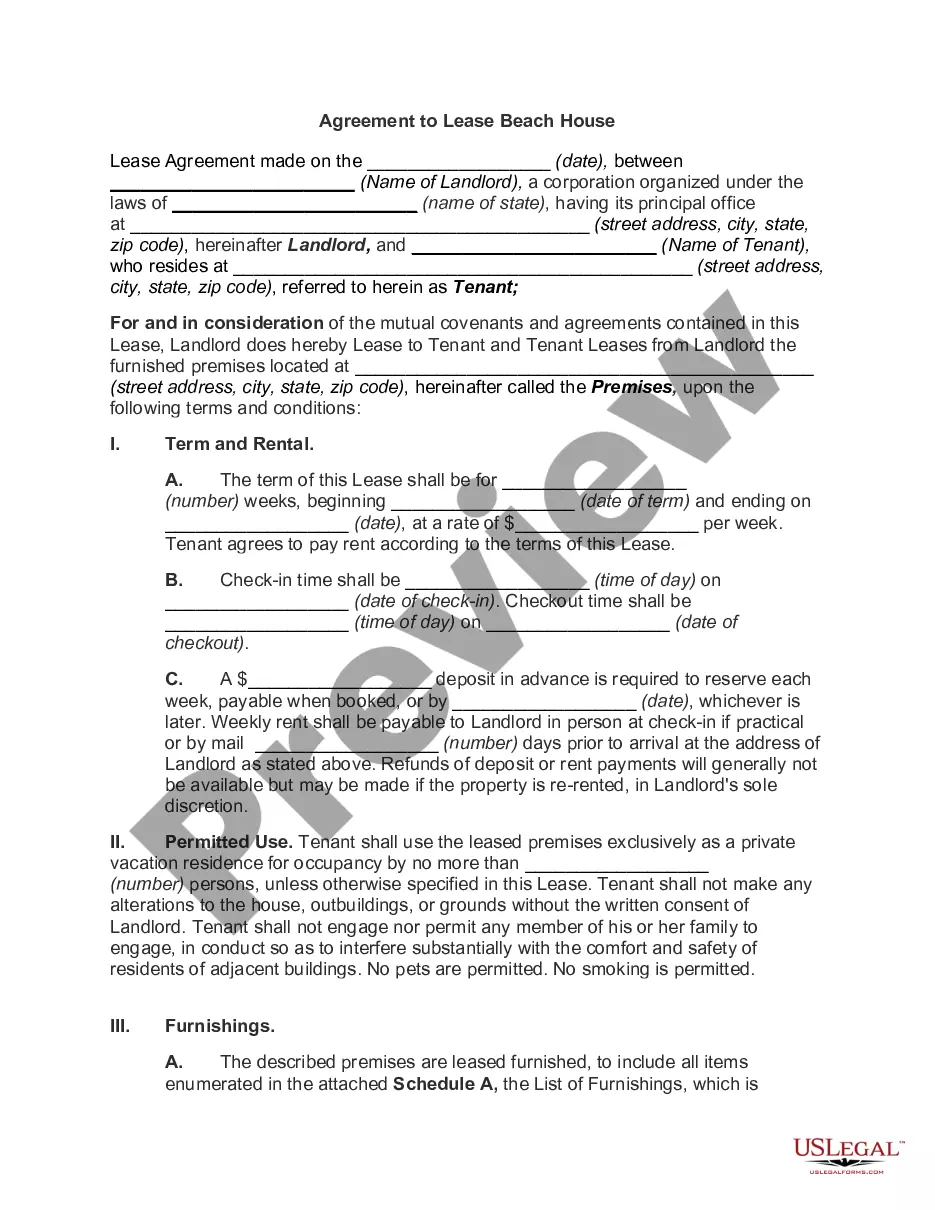

- Use the Preview button to check the shape.

- Read the information to actually have chosen the proper develop.

- If the develop isn`t what you are looking for, take advantage of the Search industry to get the develop that meets your needs and requirements.

- Whenever you get the proper develop, just click Buy now.

- Pick the pricing program you desire, submit the necessary information to produce your bank account, and buy your order utilizing your PayPal or Visa or Mastercard.

- Select a hassle-free data file format and download your duplicate.

Find each of the file templates you possess purchased in the My Forms food list. You can aquire a further duplicate of Kentucky Stock Option Agreement of Ichargeit.Com, Inc. at any time, if required. Just click on the required develop to download or print out the file web template.

Use US Legal Forms, probably the most substantial assortment of authorized forms, to conserve time as well as stay away from errors. The assistance provides appropriately manufactured authorized file templates that can be used for a range of purposes. Make a free account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

Example of an Option. Suppose that Microsoft (MFST) shares trade at $108 per share and you believe they will increase in value. You decide to buy a call option to benefit from an increase in the stock's price. You purchase one call option with a strike price of $115 for one month in the future for 37 cents per contract ...

When you're granted stock options, you're given the opportunity to purchase company shares in the future at the strike price. While you may be able to get the stock at a discounted price, you still have to pay for it. RSUs, on the other hand, are compensation in the form of stock.

An example of this would be a company granting a new employee 50 shares of shock that are vested over a period of two years. This entails that the employee is going to gain this stock only once these two years of working at the company are completed.

For example, you may be granted the right to buy 1,000 shares, with the options vesting 25% per year over four years with a term of 10 years. So 25% of the ESOs, conferring the right to buy 250 shares would vest in one year from the option grant date, another 25% would vest two years from the grant date, and so on.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price.

A stock option provides an employee with the opportunity to purchase a set number of shares of company stock at a certain price within a certain period of time. The price is called the ?grant price? or ?strike price.? This price is usually based on a discounted price of the stock at the time of hire.

Stock option grants are how your company awards stock options. This document usually includes details about: The type of stock options you'll receive (ISOs or NSOs) The number of shares you can purchase.