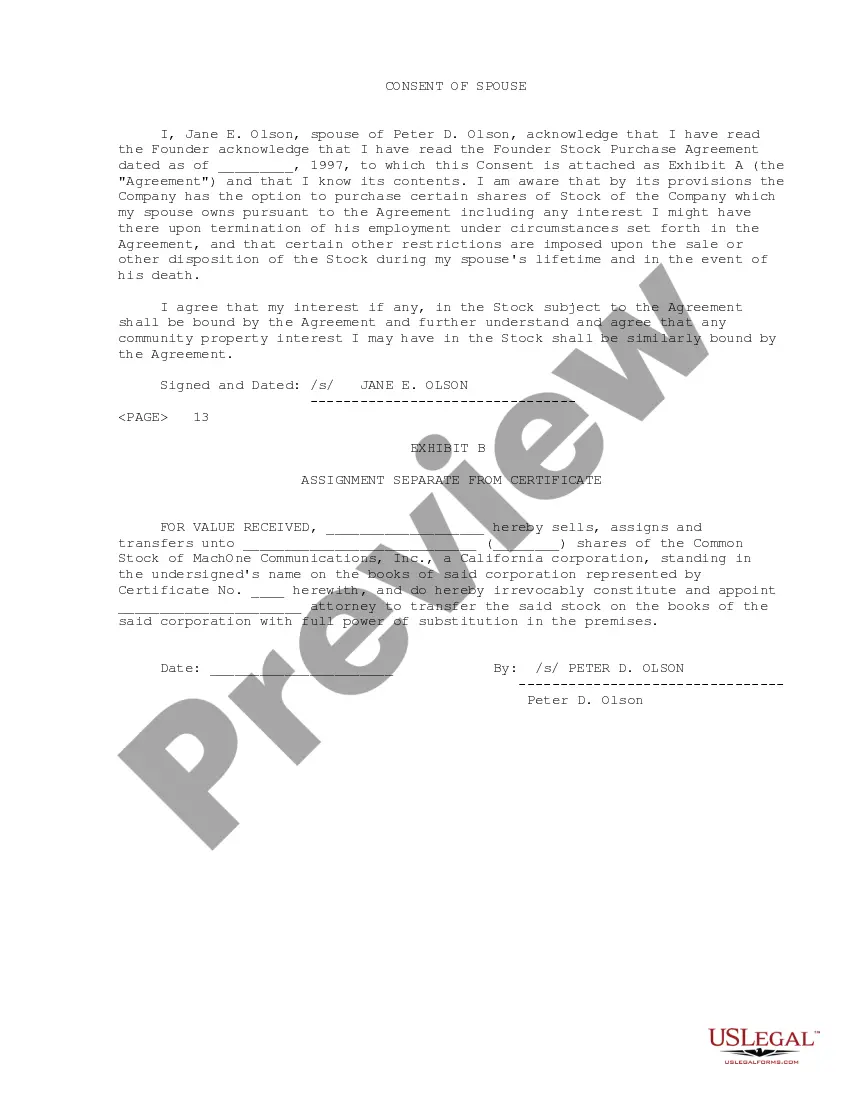

Kentucky Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson

Description

How to fill out Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

Are you in a position that you require paperwork for sometimes company or person functions just about every time? There are a lot of legitimate file web templates accessible on the Internet, but finding ones you can depend on is not effortless. US Legal Forms provides a huge number of form web templates, such as the Kentucky Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson, that are written in order to meet federal and state demands.

When you are already informed about US Legal Forms web site and possess a merchant account, basically log in. Next, you may obtain the Kentucky Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson template.

Should you not come with an profile and would like to start using US Legal Forms, abide by these steps:

- Obtain the form you will need and ensure it is for the right town/state.

- Utilize the Review key to examine the form.

- Read the information to ensure that you have selected the proper form.

- When the form is not what you are trying to find, use the Search discipline to get the form that fits your needs and demands.

- If you get the right form, simply click Acquire now.

- Opt for the pricing strategy you would like, complete the desired info to create your bank account, and pay for your order using your PayPal or bank card.

- Pick a convenient data file file format and obtain your backup.

Get all the file web templates you might have bought in the My Forms menu. You can aquire a additional backup of Kentucky Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson any time, if required. Just go through the necessary form to obtain or print out the file template.

Use US Legal Forms, one of the most extensive variety of legitimate kinds, to save some time and stay away from mistakes. The services provides skillfully manufactured legitimate file web templates which you can use for a range of functions. Produce a merchant account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

A: The most common provisions included in restricted stock purchase agreements are restrictions on when and how stock can be sold or transferred; non-compete agreements; rights of first refusal; and termination clauses which allow either party to terminate the agreement under specified conditions. Step-by-Step Guide to Drafting a Restricted Stock Purchase Agreement genieai.co ? blog ? step-by-step-guide-to-dr... genieai.co ? blog ? step-by-step-guide-to-dr...

RSUs are a type of restricted stock (which may also be known as ?letter stock? or ?restricted securities?). Restricted stock is company stock that cannot be fully transferable until certain restrictions have been met. These can be performance or timing restrictions, similar to restrictions for options. RSU vs. stock options: What's the difference? - Empower empower.com ? the-currency ? money ? sto... empower.com ? the-currency ? money ? sto...

An RSPA will typically allow the Company to buyback shares from the founder through a repurchase option. The repurchase option can be triggered by a number of events, including the founder being fired or force to quit. Single / Double Trigger Acceleration.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

A Restricted Stock Purchase Agreement (RSPA) is an agreement issuing restricted stock. RSPAs are typically granted to founders to prevent the founder from leaving the company prematurely and taking a lot of the ownership with her. The RSPA establishes when the shares will fully vest and belong to the founder.

This agreement allows the founders to document their initial ownership in the Company, including standard transfer restrictions and any vesting provisions with respect to their shares.

A Restricted Stock Purchase Agreement (RSPA) is an agreement issuing restricted stock. RSPAs are typically granted to founders to prevent the founder from leaving the company prematurely and taking a lot of the ownership with her. The RSPA establishes when the shares will fully vest and belong to the founder. Restricted Stock Purchase Agreement (RSPA) - Vela Wood Vela Wood ? glossary-term ? restricted-stoc... Vela Wood ? glossary-term ? restricted-stoc...

RSUs. Restricted stock awards (RSAs) and restricted stock units (RSUs) are two alternatives to stock options (such as ISOs and NSOs) that companies can use to compensate their employees. While stock options offer employees the ?option? to buy shares at a fixed price, RSAs and RSUs are grants of stock. RSA vs RSU: Key Differences & Tax Treatments - Carta Carta ? blog ? breaking-down-rsas-and-rsus Carta ? blog ? breaking-down-rsas-and-rsus