This License applies to any original work of authorship whose owner has placed the

following notice immediately following the copyright notice for the Original Work:

Licensed under the Open Software License version 2.0.

Kentucky Open Software License

Description

How to fill out Open Software License?

Are you currently in a situation where you need documents for either business or personal reasons on a daily basis.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Kentucky Open Source License, designed to comply with federal and state requirements.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

This service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kentucky Open Source License template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

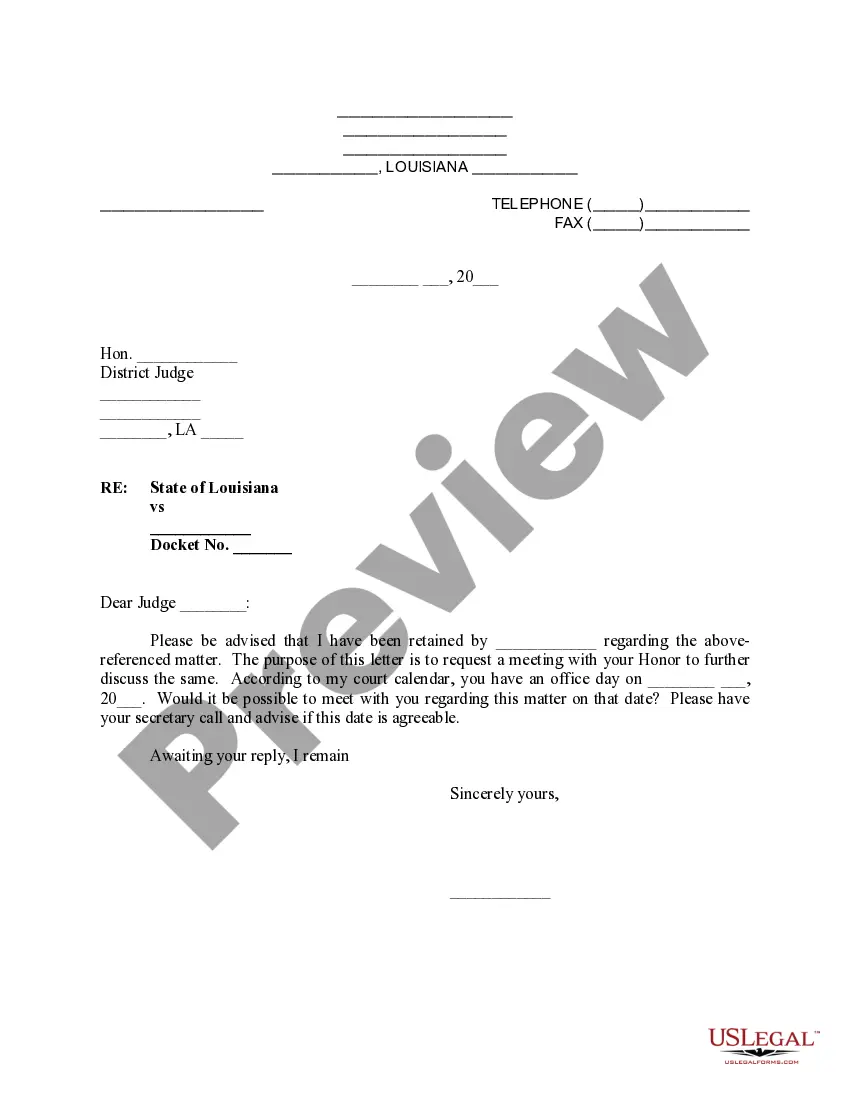

- Use the Review button to check the form.

- Read the description to make sure you have selected the right document.

- If the form is not what you are looking for, use the Search field to locate the form that meets your requirements.

- Once you find the correct form, click on Purchase now.

- Choose the pricing plan you want, provide the required information to create your account, and complete the transaction using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can download another copy of Kentucky Open Source License anytime if needed. Click on the desired form to download or print the document template.

Form popularity

FAQ

An open source software license allows users to freely use, modify, and distribute software. This means you can access the source code, make changes, and share your improvements with others. The Kentucky Open Software License is a specific type of open source license that promotes collaboration and innovation within software development. Understanding licenses like this can empower developers and organizations to enhance their projects effectively.

The KY ID in box 15 where it states State employer ID is 6 digits for KY. But, there are KY companies that only print out five digits on the W-2. Check to see if your entry is 5 digits instead of 6. If on the W-2 you only see five digits, then add a zero in front of the number in TurboTax.

Can I get a Kentucky account number for a client? 200bThe best way to access company account numbers is via Kentucky One Stop Business Portal. Another way would be if the interested party is listed on form 20A100 (Power of Attorney/Declaration of Representative) on file with the Department of Revenue.

Kentucky's limited liability entity tax applies to traditional corporations, S corporations, LLCs, limited partnerships (LPs), and limited liability partnerships (LLPs). The tax is based on a business's annual gross receipts. For businesses with gross receipts less than $3 million, there is a minimum LLET of $175.

To obtain an EIN number immediately, apply online (available for most businesses) or call the IRS at (800) 829-4933.

Commonwealth Business Identifier (CBI): A unique, ten-digit, number assigned to all Kentucky businesses. The CBI allows the business to be easily identified by all state agencies that utilize the Kentucky OneStop Portal.

The LLET is a tax on the Kentucky gross receipts or gross profits (i.e., gross receipts less cost of goods sold, as that term is statutorily defined) from the sale of tangible property of each non-exempt corporation and limited liability tax pass-through entity (LLPTE), such as a limited liability company (LLC),

200bThe best way to access company account numbers is via Kentucky One Stop Business Portal. Another way would be if the interested party is listed on form 20A100 (Power of Attorney/Declaration of Representative) on file with the Department of Revenue.

Register online with the Kentucky Office of Employment and Training to get your KEIN account number. The Kentucky account number ("KEIN") should include nine digits (Example: 12 123456 1), but some accounts include an alpha character or letter between the eighth and the ninth digit (Example: 12 123456A 1).

Electronic Filing Mandate - Kentucky follows the Federal mandate that a preparer must e-file KY individual returns unless they file 10 or fewer returns in a calendar year.