Kentucky Adjustments in the event of reorganization or changes in the capital structure

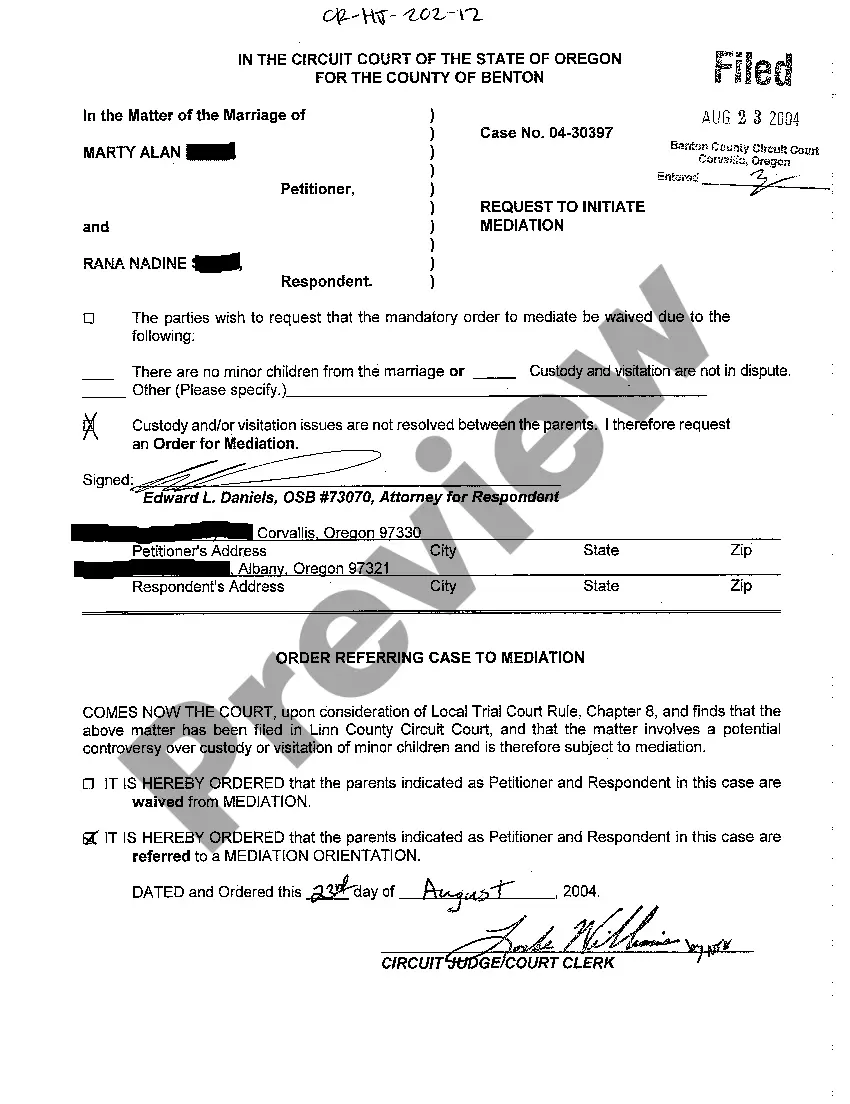

Description

How to fill out Adjustments In The Event Of Reorganization Or Changes In The Capital Structure?

Choosing the right lawful papers template can be quite a struggle. Naturally, there are tons of layouts available online, but how can you get the lawful form you require? Use the US Legal Forms internet site. The services offers a huge number of layouts, like the Kentucky Adjustments in the event of reorganization or changes in the capital structure, that you can use for organization and personal needs. Every one of the forms are checked by specialists and satisfy state and federal demands.

If you are previously listed, log in in your profile and click on the Acquire key to have the Kentucky Adjustments in the event of reorganization or changes in the capital structure. Make use of your profile to look with the lawful forms you may have bought in the past. Visit the My Forms tab of the profile and obtain yet another backup of your papers you require.

If you are a new customer of US Legal Forms, here are basic recommendations that you can stick to:

- Initially, make certain you have chosen the right form for your area/state. You are able to examine the form utilizing the Review key and study the form information to make sure it is the right one for you.

- If the form fails to satisfy your expectations, utilize the Seach industry to find the correct form.

- Once you are positive that the form is suitable, go through the Get now key to have the form.

- Opt for the pricing strategy you need and enter the needed details. Create your profile and pay money for the transaction using your PayPal profile or credit card.

- Pick the data file formatting and acquire the lawful papers template in your product.

- Full, change and produce and indication the attained Kentucky Adjustments in the event of reorganization or changes in the capital structure.

US Legal Forms will be the biggest collection of lawful forms in which you can discover a variety of papers layouts. Use the company to acquire appropriately-created files that stick to express demands.

Form popularity

FAQ

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment purchased or financed during the tax year. That means that if you buy a piece of qualifying Kentucky Gauge equipment, you can deduct the FULL PURCHASE PRICE from your gross income.

In Kentucky, business entities are required by law to formally dissolve. In order to properly close, a domestic entity must file articles of dissolution, and a foreign entity must file a certificate of withdrawal. These forms are available for download on this website.

You can make changes to your business' name by filing Articles of Amendment with the Secretary of State.

Eliminated?For property placed into service on or after January 1, 2020, the Kentucky Section 179 deduction will no longer be reduced or eliminated for exceeding the threshold. Kentucky allows a deduction under §179 of the IRC of up to $100,000 for property placed into service on or after January 1, 2020.

There are specific steps you need to take to transfer ownership of an LLC in Kentucky. Learn what forms to file, steps to take, and more. A limited liability company (LLC) is a unique business structure that offers many advantages for business owners.

Section 179 of the IRC allows businesses to take an immediate deduction for business expenses related to depreciable assets such as equipment, vehicles, and software. This allows businesses to lower their current-year tax liability rather than capitalizing an asset and depreciating it over time in future tax years.

California law does not conform to federal law for the following: The expanded definition of IRC Section 179 property for certain depreciable tangible personal property related to furnishing lodging and for qualified real property for improvements to nonresidential real property.

Eligible section 179 property must meet the following criteria: The property is tangible property depreciable under the Modified Accelerated Cost Recovery System (MACRS) or is off-the-shelf computer software. The property is section 1245 property or qualified real property.