Kentucky Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005

Description

How to fill out Declaration Under Penalty Of Perjury On Behalf Of A Corporation Or Partnership - Form 2 - Pre And Post 2005?

If you have to comprehensive, down load, or print lawful papers themes, use US Legal Forms, the largest assortment of lawful types, that can be found on the web. Make use of the site`s easy and practical lookup to obtain the paperwork you require. Different themes for business and specific uses are sorted by groups and says, or keywords and phrases. Use US Legal Forms to obtain the Kentucky Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005 in a number of mouse clicks.

Should you be previously a US Legal Forms consumer, log in for your account and then click the Download option to get the Kentucky Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005. Also you can accessibility types you earlier acquired within the My Forms tab of your account.

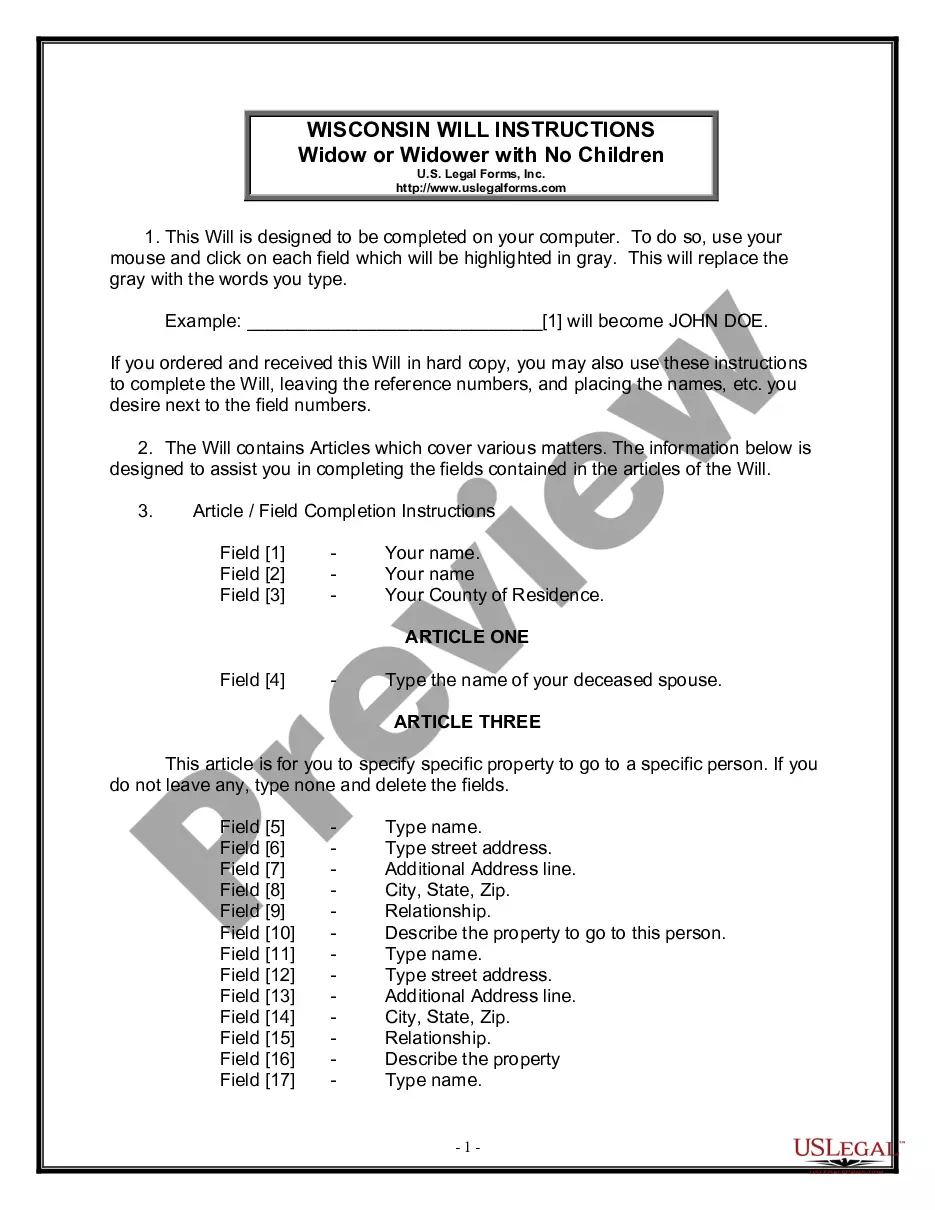

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for your correct metropolis/country.

- Step 2. Make use of the Preview option to look over the form`s articles. Do not overlook to see the description.

- Step 3. Should you be unsatisfied together with the form, take advantage of the Research discipline at the top of the screen to discover other versions of your lawful form web template.

- Step 4. Upon having found the form you require, click the Buy now option. Pick the costs strategy you favor and include your references to register on an account.

- Step 5. Method the transaction. You may use your credit card or PayPal account to finish the transaction.

- Step 6. Pick the format of your lawful form and down load it on your system.

- Step 7. Full, edit and print or indication the Kentucky Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005.

Every single lawful papers web template you acquire is yours eternally. You may have acces to each and every form you acquired within your acccount. Click the My Forms area and choose a form to print or down load yet again.

Be competitive and down load, and print the Kentucky Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005 with US Legal Forms. There are millions of expert and state-certain types you may use for your personal business or specific needs.

Form popularity

FAQ

The elements of perjury are (1) that the declarant took an oath to testify truthfully, (2) that he willfully made a false statement contrary to that oath (3) that the declarant believed the statement to be untrue, and (4) that the statement related to a material fact. It is easy to prove that a declarant took an oath.

Examples of perjury could be: The purposeful telling of a lie while under oath to tell the truth in a matter a person is called to testify for. The purposeful telling of a lie on a written document that is submitted to the court as a testimony of evidence.

If executed within the United States, its territories, possessions, or commonwealths: "I declare (or certify, verify, or state) under penalty of perjury that the foregoing is true and correct. Executed on (date). (Signature)".

Primary tabs. Declaration under penalty of perjury is a statement of facts or testimony accompanied by the declaration that the person making the statement will be found guilty of perjury if the facts declared in the statement are shown to be untrue.

Such a statement should include the following language: ?I declare (or certify, verify, or state) under penalty of perjury under the laws of the United States of America that the foregoing is true and correct.

And for perjury, the statement must be literally false and made with intent to deceive or mislead. In contrast, making false statements applies when people lie to the government regardless of whether it's under oath or not.

When you sign a document "under penalty of perjury" you swear that the contents of the document are truthful and acknowledge that you can get in trouble for lying. It's also called signing "under oath and penalty of perjury." The bankruptcy forms are all signed under penalty of perjury.

Under 28 U.S. Code § 1746, any affidavit requirement can be met by signing with the following declaration: ?I declare (or certify, verify, or state) under penalty of perjury under the laws of the United States of America that the foregoing is true and correct.? Per the statute, the words ?under the laws of the United ...