Full text and guidelines for the Victims of Terrorism Relief Act of 2001, IRC 5891 (STRUCTURED SETTLEMENT FACTORING TRANSACTIONS.)

Kentucky Victims of Terrorism Relief Act of 2001

Description

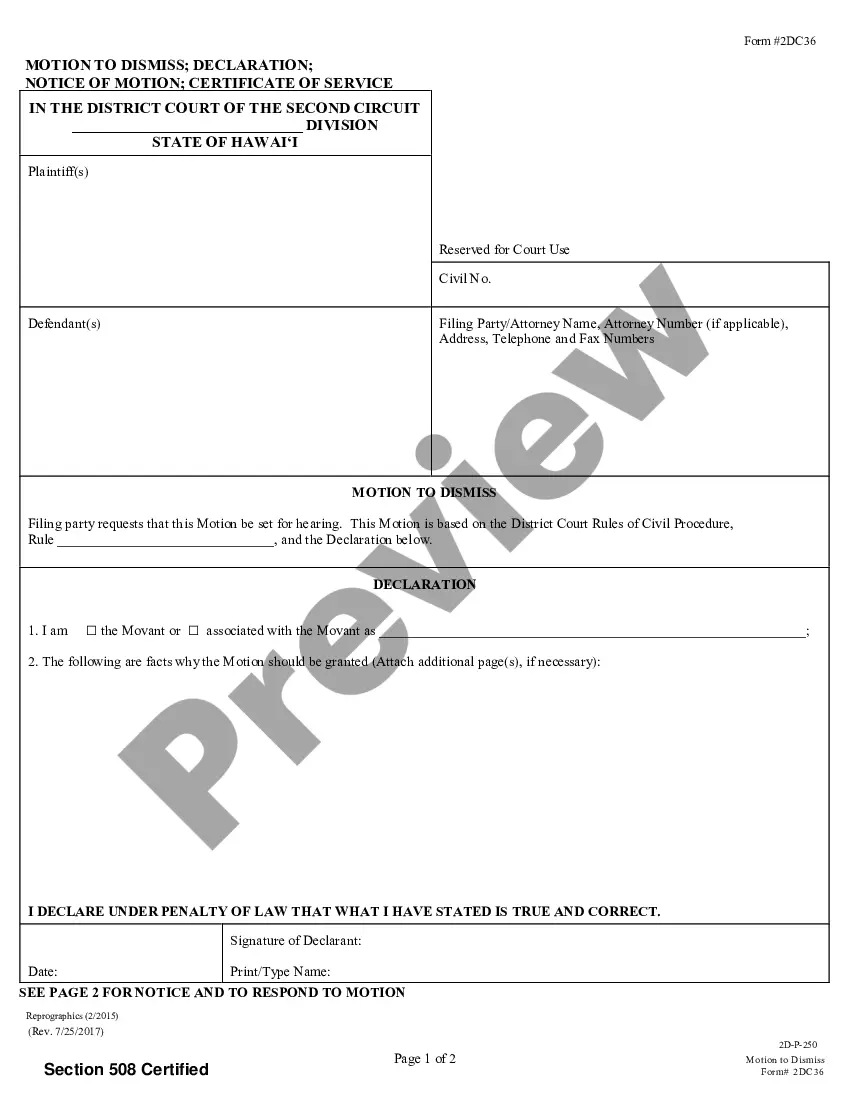

How to fill out Victims Of Terrorism Relief Act Of 2001?

You may invest time online trying to find the legal record format that suits the state and federal demands you require. US Legal Forms provides a large number of legal kinds which are reviewed by experts. It is possible to down load or print out the Kentucky Victims of Terrorism Relief Act of 2001 from the service.

If you currently have a US Legal Forms account, you can log in and click the Obtain option. Next, you can full, change, print out, or indication the Kentucky Victims of Terrorism Relief Act of 2001. Every single legal record format you purchase is the one you have for a long time. To acquire yet another duplicate of the obtained type, go to the My Forms tab and click the corresponding option.

Should you use the US Legal Forms web site the first time, follow the basic recommendations below:

- Initial, make certain you have selected the proper record format for your area/town of your liking. Read the type information to ensure you have chosen the appropriate type. If readily available, utilize the Preview option to check from the record format as well.

- If you would like discover yet another variation of your type, utilize the Lookup industry to obtain the format that suits you and demands.

- Once you have discovered the format you would like, simply click Acquire now to proceed.

- Pick the costs program you would like, enter your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can utilize your charge card or PayPal account to pay for the legal type.

- Pick the formatting of your record and down load it to the product.

- Make alterations to the record if possible. You may full, change and indication and print out Kentucky Victims of Terrorism Relief Act of 2001.

Obtain and print out a large number of record layouts utilizing the US Legal Forms web site, which offers the greatest selection of legal kinds. Use professional and condition-particular layouts to handle your organization or specific requirements.

Form popularity

FAQ

An act to amend the Internal Revenue Code of 1986 to provide tax relief for victims of the terrorist attacks against the United States, and for other purposes.

2 IRC § 692(a) applies to ?any individual who dies while in active service as a member of the Armed Forces of the United States, if such death occurred while serving in a combat zone (as determined under section 112) or as a result of wounds, disease, or injury incurred while so serving.? Under IRC § 112(c)(2), the ...

IRS Publication 3920 is clear that any amounts awarded and paid by the VCF are not income subject to taxes: ?Payments from the September 11th Victim Compensation Fund of 2001 are not included in income.?

PL 107-134 Victims of Terrorism Relief Act of 2001 (enacted 1/23/02) Provides tax relief for victims of terrorists attacks. Also under this law, victims owe no Federal income or payroll taxes for the year in which they died and the immediately preceding year.