Kentucky Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

Have you ever been in a situation where you require documentation for both professional or personal purposes almost every day.

There is a plethora of valid document templates accessible online, yet finding ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, such as the Kentucky Resolution of Meeting of LLC Members to Define Amount of Annual Disbursements to Members of the Company, designed to comply with federal and state regulations.

If you find the appropriate form, click on Purchase now.

Choose the pricing plan you desire, fill in the required information to create your account, and complete the transaction using PayPal or credit card. Select a convenient file format and download your copy. You can view all the document templates you have purchased in the My documents menu. You may obtain another copy of the Kentucky Resolution of Meeting of LLC Members to Define Amount of Annual Disbursements to Members of the Company at any time if necessary. Just select the needed form to download or print the document template. Utilize US Legal Forms, the most extensive collection of official documents, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Kentucky Resolution of Meeting of LLC Members to Define Amount of Annual Disbursements to Members of the Company template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct city/region.

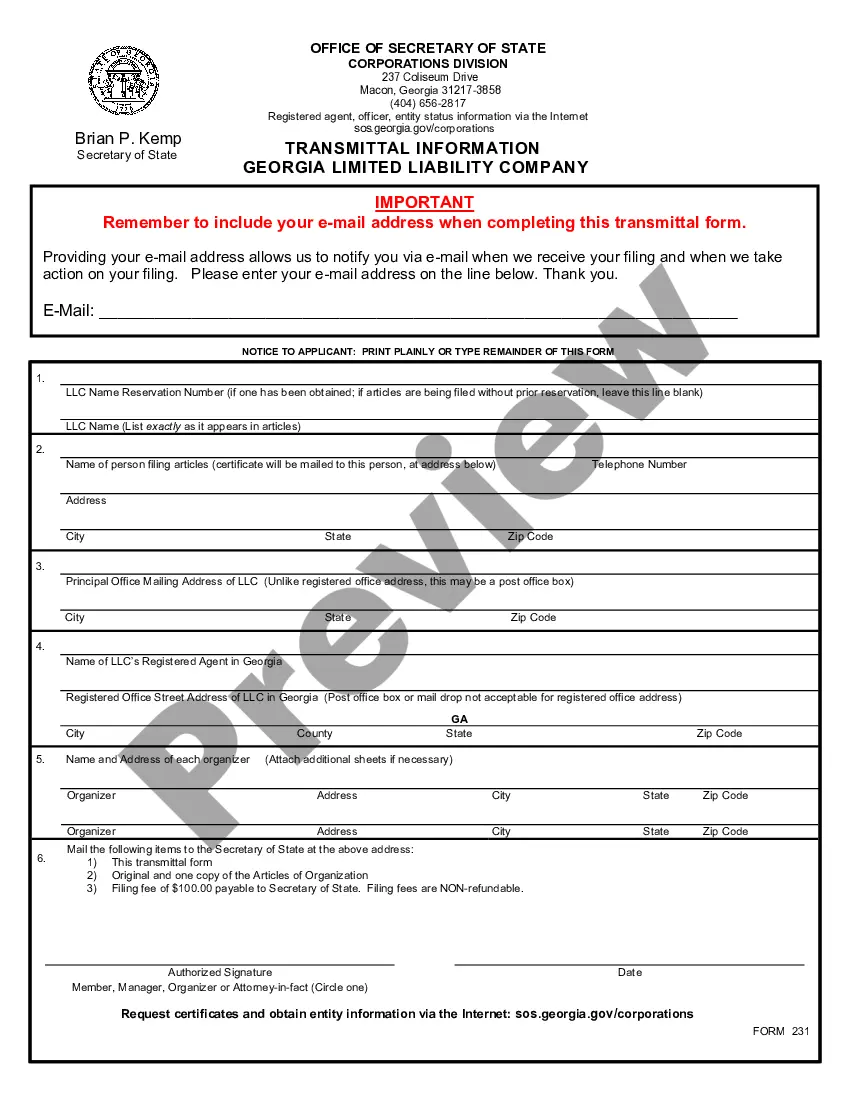

- Utilize the Review button to examine the form.

- Verify the details to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search field to locate the form that meets your needs.

Form popularity

FAQ

The non-resident tax form for Kentucky, typically referred to as Form 740-NP, is for individuals residing outside the state who earn income from Kentucky sources. When completing this form, consider any obligations related to the Kentucky Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company if your LLC has non-resident members. This ensures all financial activities are reported accurately, promoting compliance with state tax laws. Form 740-NP aids in determining your tax liability and ensures you meet your obligations appropriately.

Rather than taking a conventional salary, single-member LLC owners pay themselves through what's known as an owner's draw. The amount and frequency of these draws is up to you, but it's ideal to leave enough funds in the business account to operate and grow the LLC.

To get paid, LLC members take a draw from their capital account. Payment is usually made by a business check. They can also receive non-salary payments or guaranteed payments basically a payment that is made regardless of whether the LLC has generated any net income that month or quarter.

LLC distributions to members refer to shares of profits that a limited liability company (LLC) distributes to its owners. The way profits are distributed is specified in the LLC's operating agreement. The members of an LLC are required to pay taxes on the distributions they receive.

You pay yourself from your single member LLC by making an owner's draw. Your single-member LLC is a disregarded entity. In this case, that means your company's profits and your own income are one and the same. At the end of the year, you report them with Schedule C of your personal tax return (IRS Form 1040).

Summary answerYes: an LLC may account for regular payments to a member for services and paid ahead of payments to members as distributions of profits as guaranteed payments, essentially a salary substitute.

A member of the LLC should have an ethical responsibility to meet the obligations of the firm. They should have duty of care.

A single member LLC whose single member is an individual, estate, trust, or general partnership must file a Kentucky Single Member LLC Individually Owned Income and LLET Return (Form 725) or a Kentucky Single Member LLC Individually Owned LLET Return (Form 725-EZ) to report and pay any LLET that is due.

Each member reports tax distributions from the LLC on the member's IRS Form 1040 Schedule C as self-employment income. Even if the LLC does not actually pay a dividend to its member(s) in cash, but retains the funds for cash-flow reasons or reinvestment purposes, the income still appears on the member's income taxes.

If an LLC has at least two members, it is generally classified as a partnership. Therefore, members can pay themselves by taking a distribution of their portion of the profits. This amount is reported as part of the Schedule K-1. You'll need to pay taxes on this amount on your personal income tax returns.