Kentucky Credit Information Request

Description

How to fill out Credit Information Request?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a range of legal form templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms like the Kentucky Credit Information Request in just minutes.

If you already have an account, Log In and download the Kentucky Credit Information Request from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finish the purchase.

Select the format and download the form to your device. Make adjustments. Fill in, modify, and print, then sign the downloaded Kentucky Credit Information Request.

Each template you saved in your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply return to the My documents section and click on the form you need.

Access the Kentucky Credit Information Request with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you wish to use US Legal Forms for the first time, here are simple instructions to help you get started.

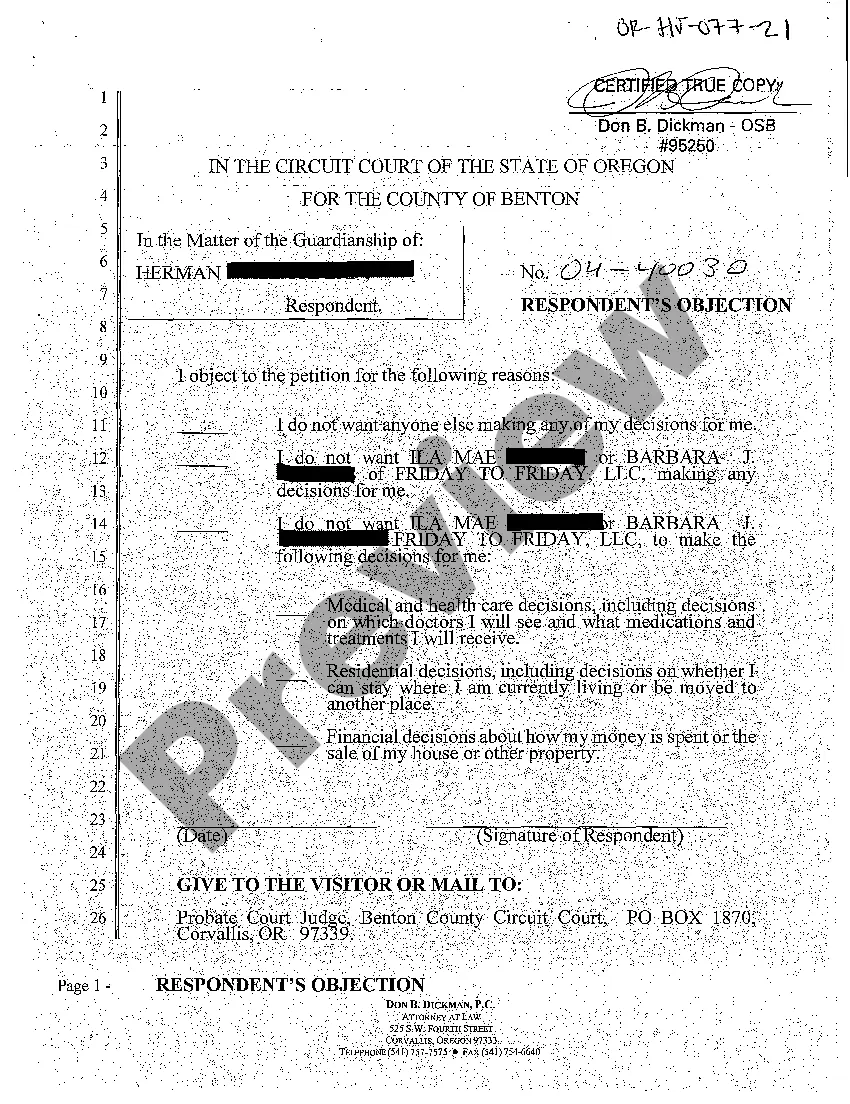

- Make sure you have selected the correct form for your city/state. Click the Preview button to review the form's content.

- Read the form description to confirm that you have chosen the correct form.

- If the form doesn’t meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose your preferred payment option and provide your information to create an account.

Form popularity

FAQ

The Letter tells our member his or her tax return has been reviewed and adjusted. Our team of expert audit representatives, which includes attorneys, CPAs, and Enrolled Agents, provides tax audit help for thousands of cases each month.

California law requires tax preparers to e-file if they prepare: More than 100 individual income tax returns. 1 or more returns using tax preparation software.

Form 740 is the Kentucky income tax return for use by all taxpayers. This PDF packet includes Form 740, supplemental schedules, and tax instructions combined in one document, updated for the 2011 tax year.

The final regulations are effective upon their publication in the Federal Register. The mandatory e-filing requirement applies to any income tax return for an individual, estate or trust. However, certain returns that the IRS cannot accept electronically are currently exempt from the requirement.

Do I need to file a Kentucky tax return? A. No, you do not have a filing requirement with Kentucky because your modified gross income is not greater than $12,880; however, you will need to file a return to claim a refund of any Kentucky income tax withheld.

The IRS does this as part of its compliance program. There is nothing you need to do. You will be notified via a letter when the IRS is finished and what, if any, changes it claims need to be made to your return. Of course, many audits result in a no change audit.

Electronic Filing Mandate - Kentucky follows the Federal mandate that a preparer must e-file KY individual returns unless they file 10 or fewer returns in a calendar year.

In Kentucky, state tax identification numbers for companies are called commonwealth business identifier numbers, or CBIs. If you need a company's CBI for tax purposes, you can get it directly from the business. You may also be able to find a CBI in various business filings of publicly held companies.

To File a ReturnRefund or No Payment 740 or 740-NP. Kentucky Department of Revenue. Frankfort, KY 40618-0006.740-NPR. Kentucky Department of Revenue. Frankfort, KY 40620-0012.Overnight Address. Kentucky Department of Revenue.If paying by check or money order, make it payable to "KY State Treasurer" and mail to.

In India, e-filing of income tax was introduced in September, 2004, initially on a voluntary usage basis Page 2 380 Mukesh Kumar and Mohammad Anees for all categories of income tax assessee. But from July, 2006, it was made mandatory for all corporate firms to e-file their income tax returns.