Kentucky Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners

Description

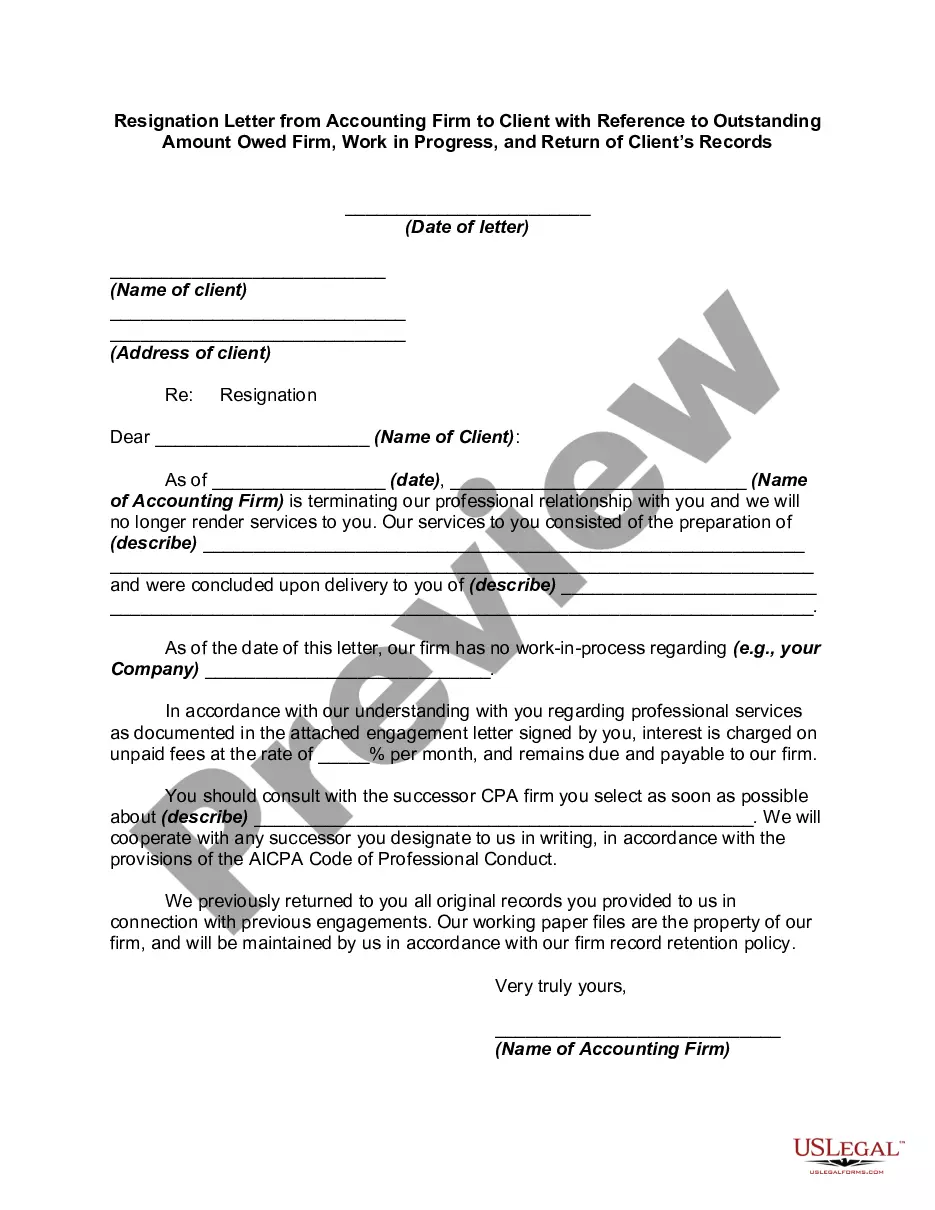

How to fill out Agreement To Dissolve And Wind Up Partnership With Division Of Assets Between Partners?

Are you in a scenario where you require documents for either business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but locating ones you can trust is not easy.

US Legal Forms offers thousands of form templates, such as the Kentucky Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners, that are designed to meet federal and state regulations.

If you locate the right form, click Buy now.

Choose the pricing plan you want, complete the necessary information to create your account, and purchase your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the Kentucky Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/region.

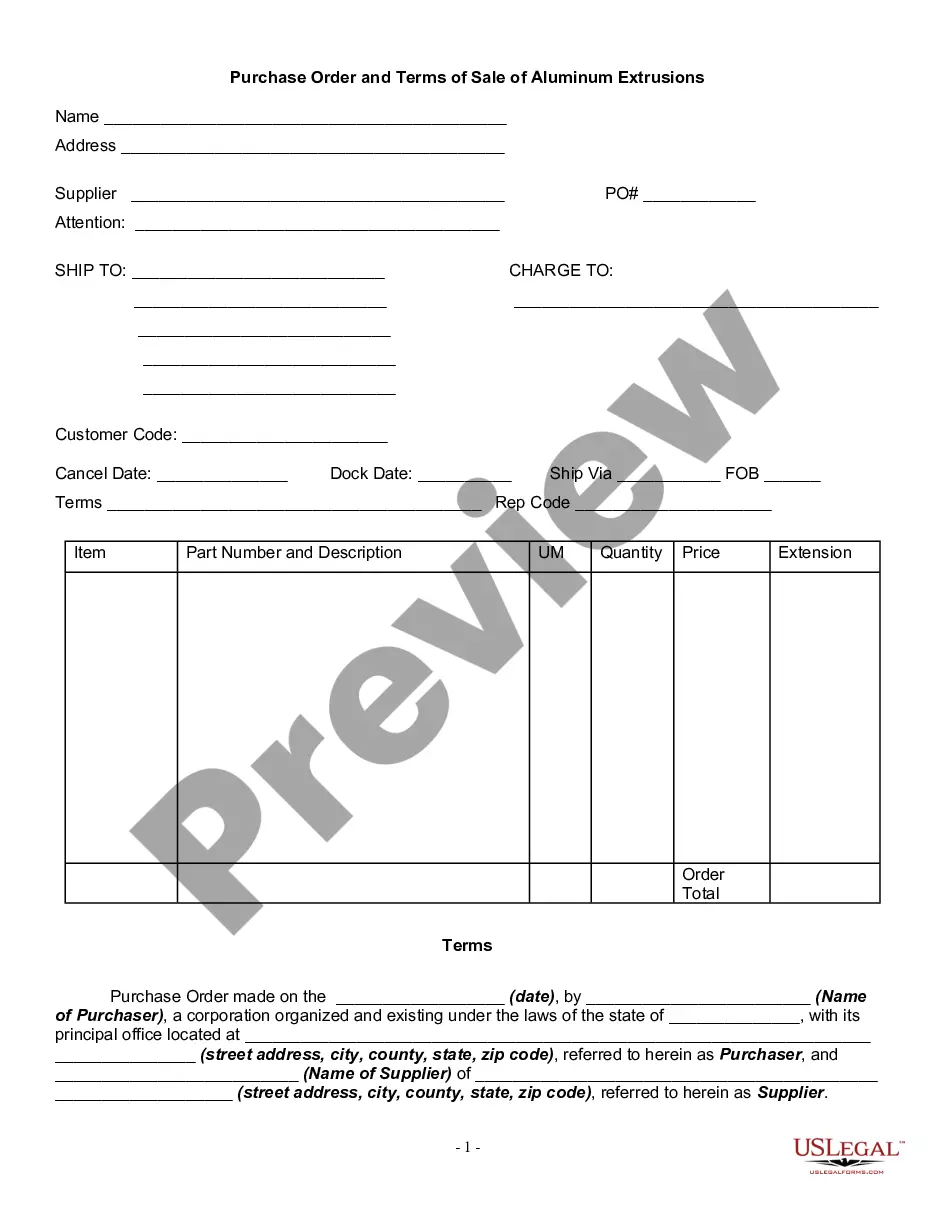

- Utilize the Preview button to review the form.

- Read the details to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that suits your needs and requirements.

Form popularity

FAQ

Partnerships may be dissolved under several circumstances, including mutual agreement, expiration of the partnership term, or a partner's inability to fulfill their obligations. Additionally, if the partnership achieves its purpose or if conditions make the partnership impractical to continue, dissolution may be warranted. A Kentucky Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners can help navigate this process effectively. Using a platform like uslegalforms can streamline the necessary paperwork and ensure that all legal requirements are met.

After the dissolution of the partnership, the partner is liable to pay his debt and to wind up the affairs regarding the partnership. After the dissolution, partners are liable to share the profit which they have decided in agreement or accordingly.

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

After the dissolution of the partnership, the partner is liable to pay his debt and to wind up the affairs regarding the partnership. After the dissolution, partners are liable to share the profit which they have decided in agreement or accordingly.

Settlement of accounts on dissolution Losses including deficiencies of capital shall be first paid out from the profits, next from the capital, and if necessary, by the personal contribution of partners in their profit-sharing ratio. 2.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

Section 37 of the UPA provides that unless otherwise agreed, the partners who have not wrongfully dissolved the partnership or the legal representative of the last surviving solvent partner have the right to wind up the partnership affairs, provided, however, that any partner, his legal representative, or his assignee

The partners who have not wrongfully dissociated may participate in winding up the partnership business. On application of any partner, a court may for good cause judicially supervise the winding up. UPA, Section 37; RUPA, Section 803(a).

Each partner has a right to share in the profits of the partnership. Unless the partnership agreement states otherwise, partners share profits equally. Moreover, partners must contribute equally to partnership losses unless a partnership agreement provides for another arrangement.

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).