Kentucky Statement of Work

Description

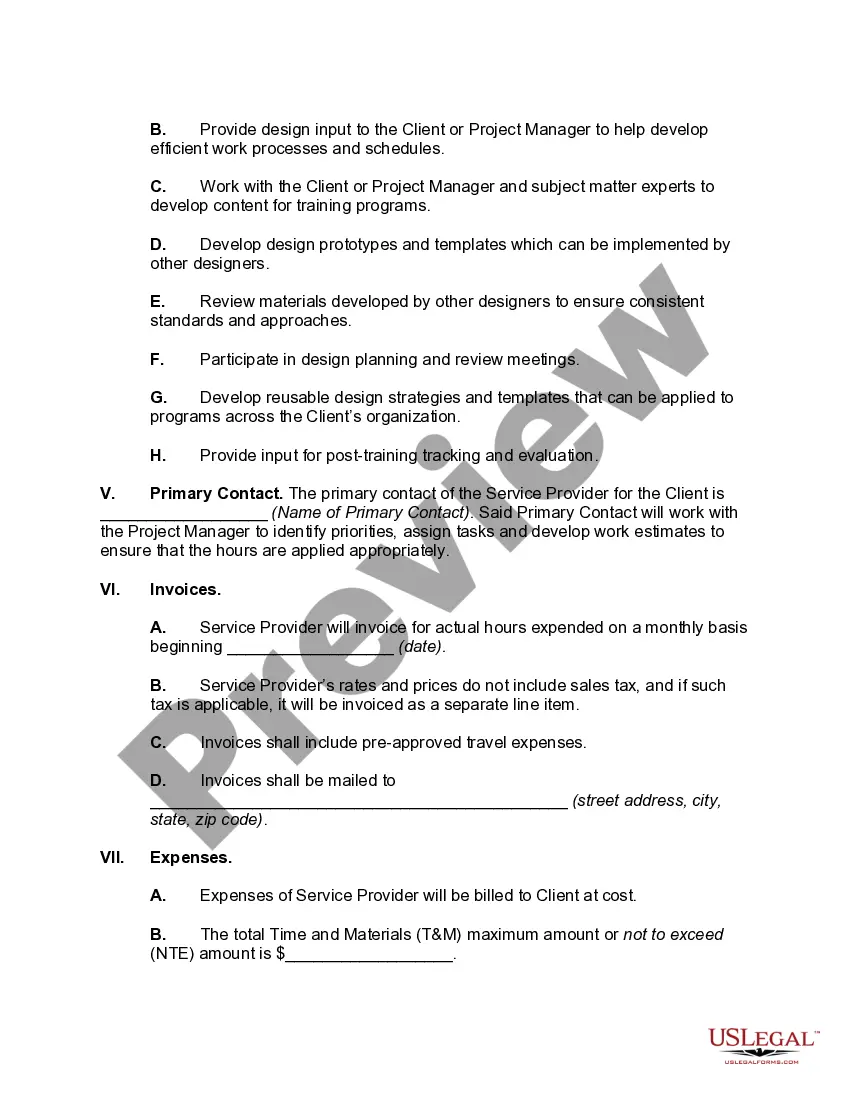

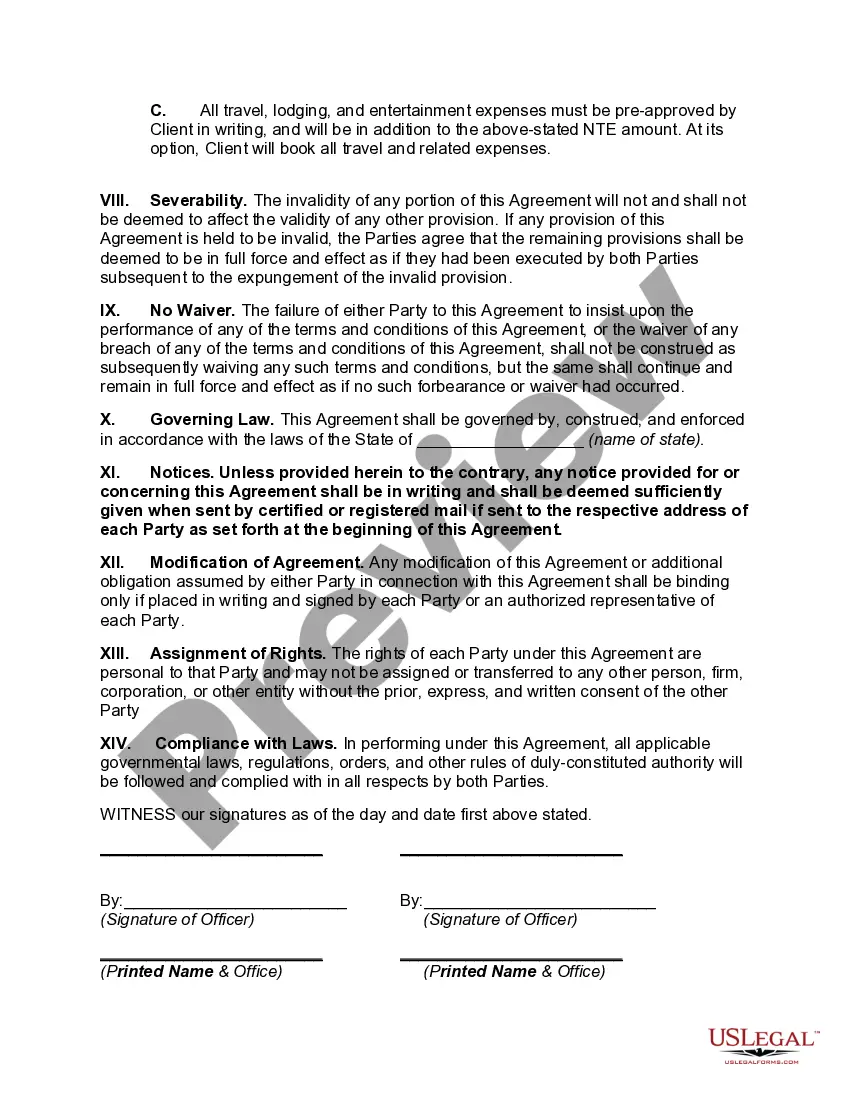

How to fill out Statement Of Work?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By using the site, you can find numerous forms for business and personal use, organized by types, states, or keywords.

You can access the latest versions of forms such as the Kentucky Statement of Work within minutes.

If the form does not meet your requirements, use the Lookup field at the top of the screen to find one that does.

When you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose your preferred payment plan and provide your details to register for an account.

- If you have a subscription, Log In and download the Kentucky Statement of Work from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms from the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have chosen the correct form for your city/region.

- Use the Preview button to review the form's content.

Form popularity

FAQ

To write a Kentucky Statement of Work, start with a clear outline of project objectives and scope. Include detailed descriptions of deliverables, timelines, and budgetary constraints. Using templates and resources from platforms like uslegalforms can facilitate a streamlined and effective writing process.

The W-4 form is a federal document that determines federal income tax withholding, while the K-4 is specifically for Kentucky state taxes. Understanding the distinction is important for employees as they complete their Kentucky Statement of Work. Both forms play a role in determining overall tax withholding responsibilities.

Claiming exemption from Kentucky withholding means that you believe you meet the criteria to have no state taxes withheld from your paycheck. Often, this status is reserved for those who had no tax liability in the previous year and expect none in the current year. It is critical to endorse this accurately in your Kentucky Statement of Work.

12 Payroll Forms Employers Need W-4 Form: Withholding Allowance Certificate. W-2 Form: Wage and Tax Statement. W-3 Form: Transmittal of Wage & Tax Statements. Form 940: Federal Unemployment Tax Reporting. Form 941: Quarterly Federal Tax Return. Form 944: Employer's Annual Federal Tax Return.More items...?

The withholding rate is at the maximum rate provided in KRS 141.020 or KRS 141.040. A partner, member, or shareholder may be exempt from withholding if an appropriate tax return was filed for the prior year.

You may be exempt from withholding for 2021 if both the following apply: 20, you had a right to a refund of all Kentucky income tax withheld because you had no Kentucky income tax. liability, and. 20, you expect a refund of all your Kentucky income tax withheld.

Take a few days to gather the following details and register for the appropriate accounts:Step 1: Get an EIN.Step 2: Get a local or state business ID (if necessary)Step 3: Nail down your team's info.Step 4: Classify your employees.Step 5: Choose a pay period.Step 6: Pick a payroll system.Step 7: It's go time.

A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee's paycheck. The Internal Revenue Service (IRS) Form W-4 is used to calculate and claim withholding allowances.

These instructions have been designed for pass- through entities: S-corporations, partnerships, and general partnerships , which are required by law to file a Kentucky income tax and LLET return. Form PTE is complementary to the federal forms 1120S and 1065.

Step-by-Step Guide to Running Payroll in KentuckyStep 1: Set up your business as an employer.Step 2: Register your business with the State of Kentucky.Step 3: Create your payroll process.Step 4: Have employees fill out relevant forms.Step 5: Review and approve time sheets.More items...?