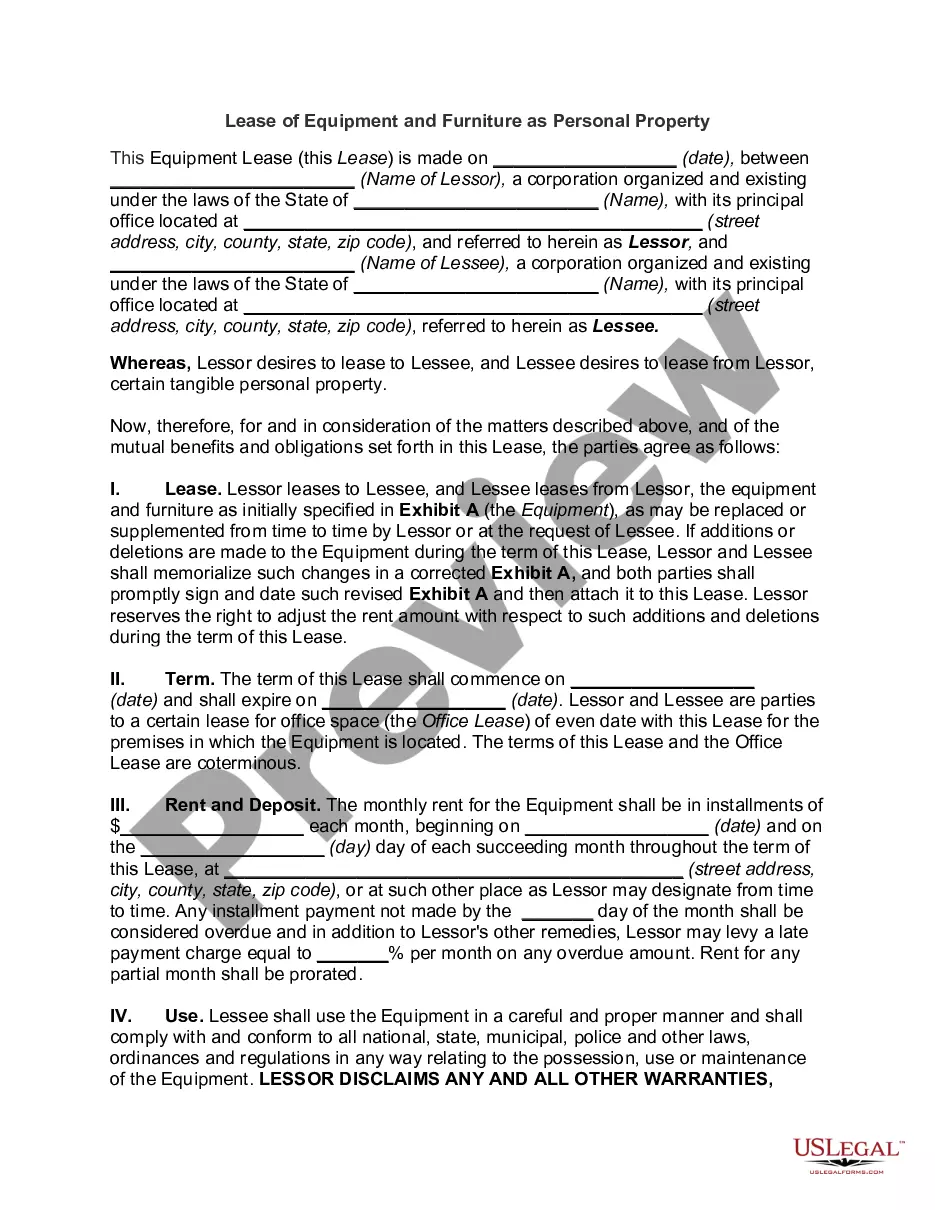

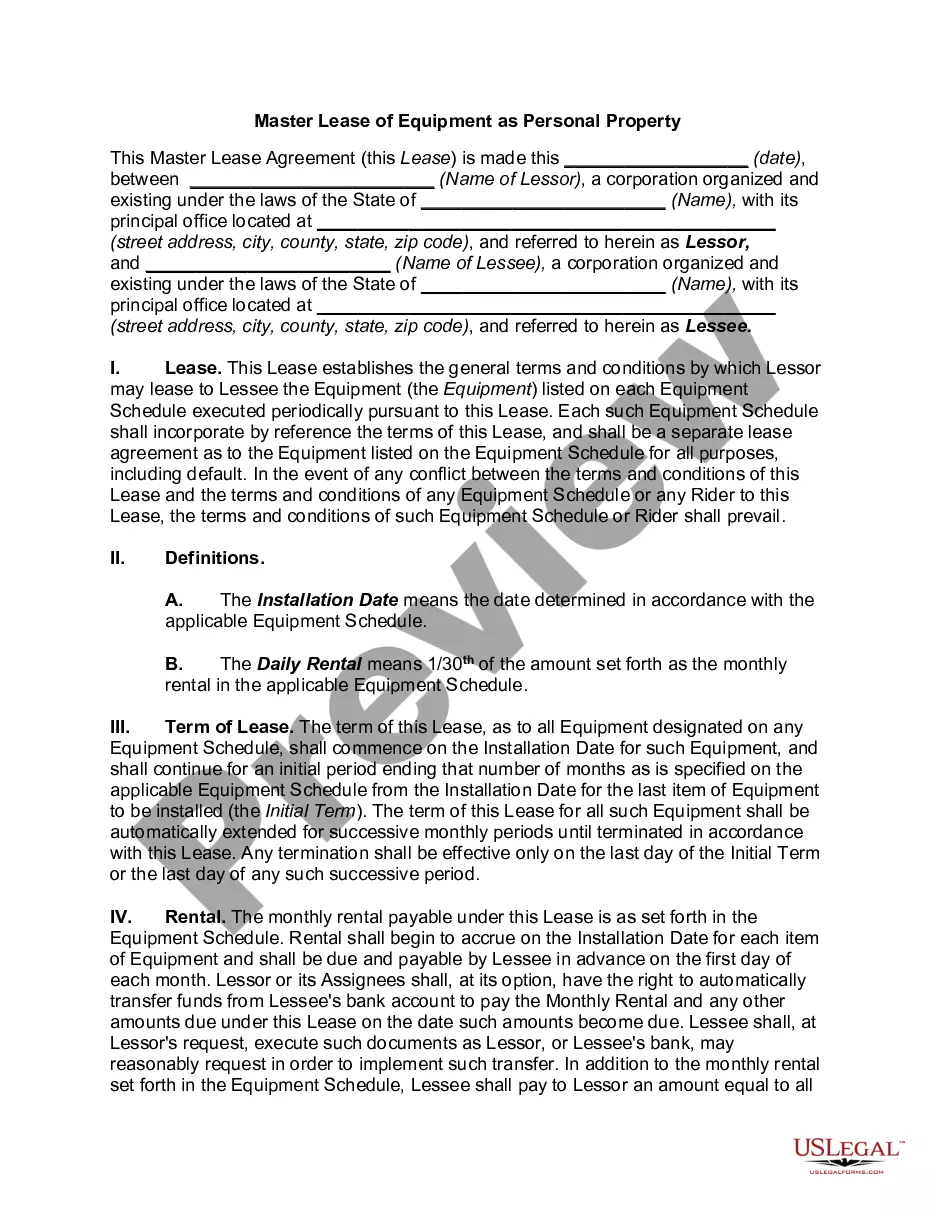

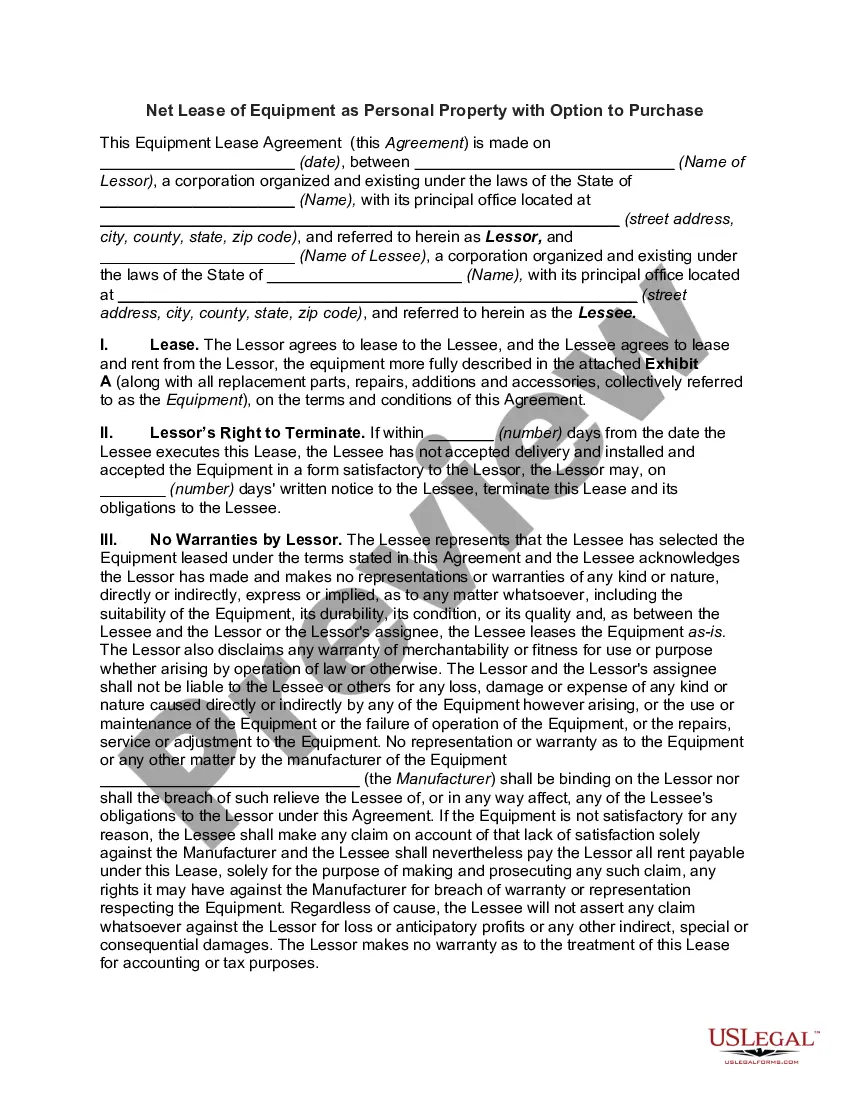

Kentucky Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase

Description

How to fill out Net Lease Of Equipment (personal Propety Net Lease) With No Warranties By Lessor And Option To Purchase?

You might spend several hours online trying to locate the valid document template that meets the state and federal criteria you require.

US Legal Forms offers thousands of valid forms that are reviewed by experts.

You can easily download or print the Kentucky Net Lease of Equipment (Personal Property Net Lease) without Warranties by Lessor and Option to Purchase from the platform.

To seek another version of the form, use the Search field to find the template that suits your needs.

- If you possess a US Legal Forms account, you can Log In and click on the Acquire button.

- Then, you can complete, edit, print, or sign the Kentucky Net Lease of Equipment (Personal Property Net Lease) without Warranties by Lessor and Option to Purchase.

- Every valid document template you obtain is yours to keep permanently.

- To get another copy of any downloaded form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for the area/region of your choice.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

In Kentucky, personal property tax does exist and applies to various types of property, including equipment. If you enter into a Kentucky Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, it's crucial to understand how this tax impacts your financials. Typically, the lessee is responsible for the personal property tax unless otherwise stated in your lease agreement. It's advisable to consult with a tax expert or utilize resources like USLegalForms to ensure compliance and optimize your lease structure.

Yes, rental income is considered taxable in Kentucky. If you are receiving income from a Kentucky Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, you must report this income on your tax returns. It is advisable to maintain thorough records of your rental agreements and consult a tax advisor to optimize your tax situation.

Yes, equipment rental is generally taxable in Kentucky. When you engage in a Kentucky Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, it's crucial to consider the tax implications of your rental agreements. Always consult with a tax professional to ensure you understand your obligations regarding sales tax.

Filing a DC personal property tax return online is straightforward through the Office of Tax and Revenue website. While this process may differ from Kentucky, ensuring compliance is essential, especially if you enter into a Kentucky Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase. Always follow the guidelines outlined on your local government site for a smooth filing experience.

The personal property tax form in Kentucky is primarily the PVA (Property Valuation Administrator) form. It is necessary for reporting the value of personal property, including equipment under a Kentucky Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase. It is advisable to check with your local PVA office for specific filing instructions and deadlines.

Tangible personal property in Kentucky includes physical items that can be touched and moved. This categorization plays a significant role in the context of Kentucky Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase. Examples include machinery, vehicles, and equipment, which are often subject to personal property taxes.

In Kentucky, certain items are exempt from sales tax, such as most food items, prescription drugs, and some agricultural products. These exemptions can be important considerations when entering a Kentucky Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase. Understanding these exemptions can help you make informed decisions about your leasing agreements and potential tax liabilities.