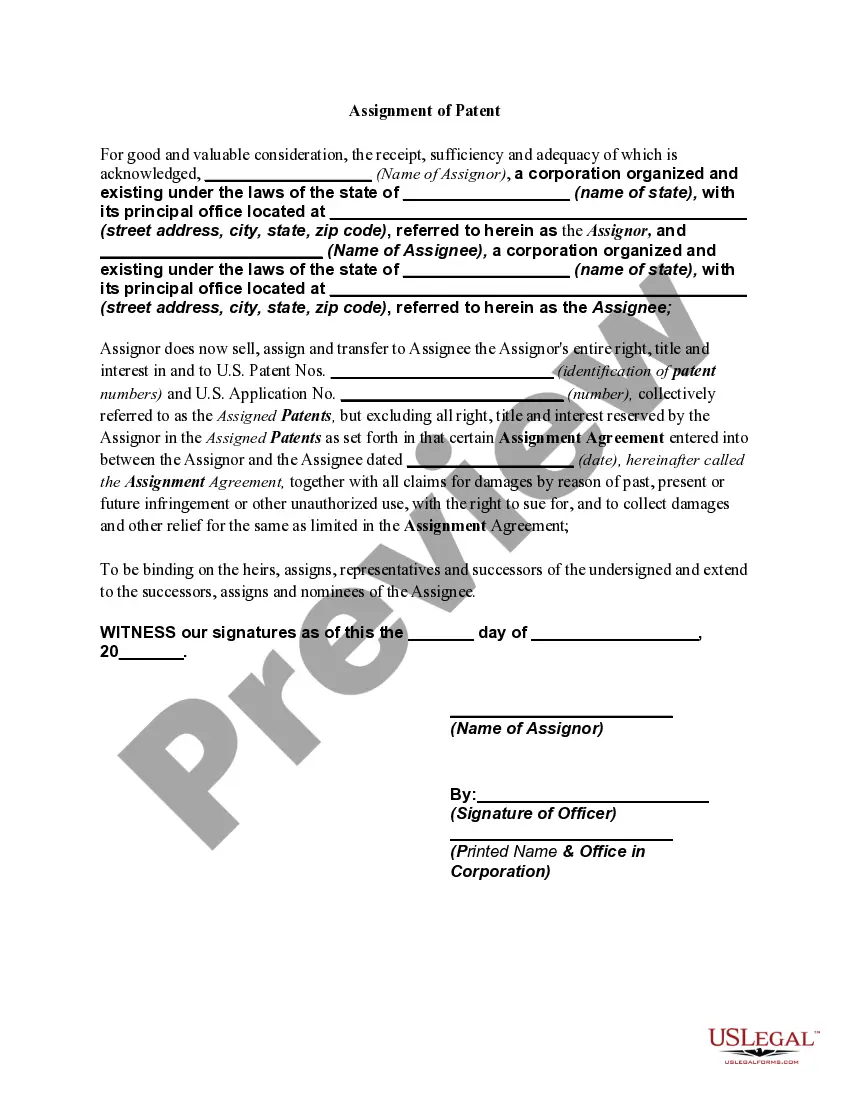

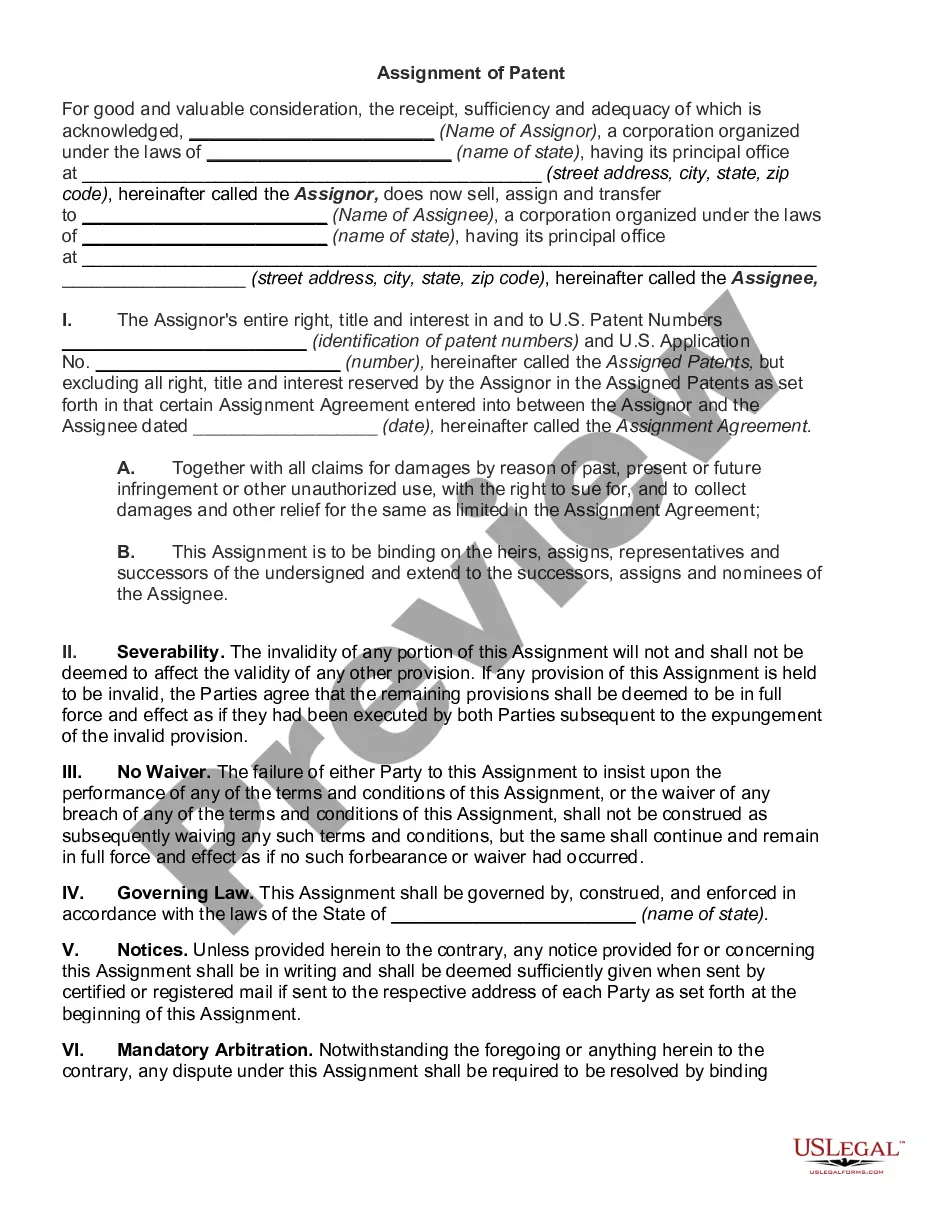

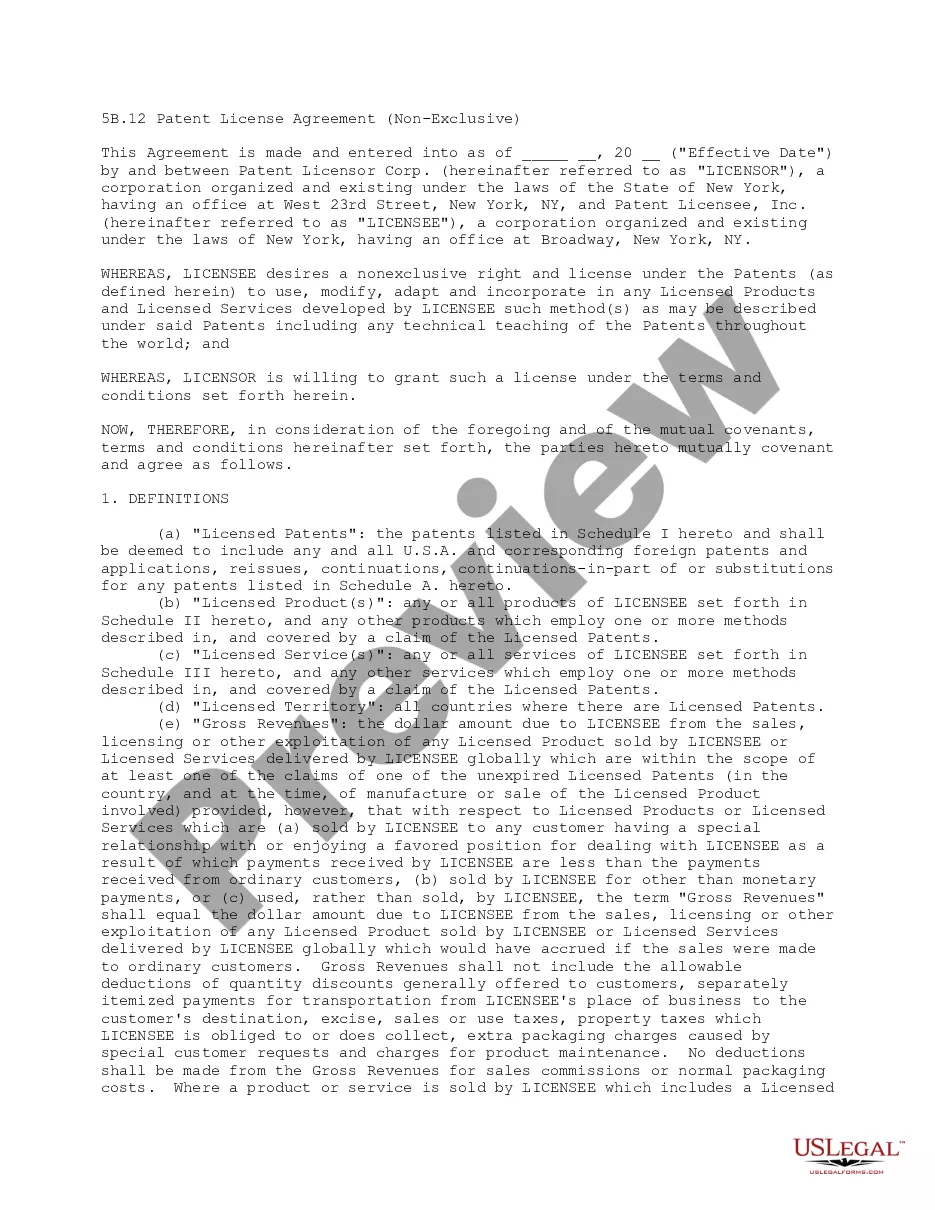

Kentucky Combined Declaration and Assignment

Description

How to fill out Combined Declaration And Assignment?

US Legal Forms - among the largest libraries of legal kinds in the United States - gives a wide range of legal record themes you can obtain or produce. Making use of the website, you will get a huge number of kinds for enterprise and specific reasons, categorized by types, suggests, or keywords and phrases.You can get the latest versions of kinds just like the Kentucky Combined Declaration and Assignment within minutes.

If you currently have a registration, log in and obtain Kentucky Combined Declaration and Assignment from the US Legal Forms local library. The Acquire button will show up on each and every type you view. You have accessibility to all in the past acquired kinds in the My Forms tab of your accounts.

If you wish to use US Legal Forms for the first time, allow me to share straightforward directions to obtain started out:

- Make sure you have picked the correct type for your personal area/area. Select the Review button to examine the form`s content. Browse the type explanation to ensure that you have selected the appropriate type.

- In the event the type doesn`t satisfy your needs, make use of the Lookup area near the top of the display screen to get the one who does.

- Should you be happy with the form, affirm your selection by simply clicking the Acquire now button. Then, select the pricing program you favor and offer your accreditations to sign up on an accounts.

- Procedure the deal. Use your Visa or Mastercard or PayPal accounts to finish the deal.

- Find the formatting and obtain the form in your system.

- Make changes. Complete, edit and produce and signal the acquired Kentucky Combined Declaration and Assignment.

Each format you included with your bank account lacks an expiry date which is yours permanently. So, if you would like obtain or produce one more duplicate, just proceed to the My Forms section and click around the type you want.

Obtain access to the Kentucky Combined Declaration and Assignment with US Legal Forms, by far the most considerable local library of legal record themes. Use a huge number of professional and state-particular themes that satisfy your business or specific needs and needs.

Form popularity

FAQ

No. Composite return language was stricken from KRS 141.206 for tax years beginning on or after January 1, 2022.

Today, 24 states (including Connecticut starting in tax year 2016) and the District of Columbia require combined reporting. These include Illinois (1982), Maine (1986), Massachusetts (2008), New Hampshire (1981), New York (2007), Rhode Island (2014), Vermont (2004), and Wisconsin (2009).

A Limited Liability Entity Tax (LLET) applies to both C corporations and Limited Liability Pass-Through Entities (LLPTEs) and is not an alternative to another tax. However, corporations paying the LLET are allowed to apply that amount as a credit towards its regular corporate income tax.

Note: For taxable periods beginning on or after January 1, 2019, every corporation doing business in Kentucky that is a member of a unitary business must file a combined report (Form 720U) per KRS 141.202(3), unless they elect to file a consolidated return as part of an affiliated group.

No. Composite return language was stricken from KRS 141.206 for tax years beginning on or after January 1, 2022.

Form 720EXT grants an automatic 6-month extension of time to file Form 720. Kentucky State General Business S Corporation tax extension Form 720EXT is due within 4 months and 15 days following the end of the corporation reporting period.

Yes, Kentucky requires an addback for: the increase in the limits under IRC Sec. 163(j) for the federal business interest expense deduction; and. expenses from exempt or nonapportionable income.

Note that you must provide reasonable cause for your Kentucky extension request on Form 40A102. If you have a valid Federal tax extension (IRS Form 4868), you will automatically receive a Kentucky tax extension.