Kentucky Sample Letter for Request for IRS not to Off Set against Tax Refund

Description

How to fill out Sample Letter For Request For IRS Not To Off Set Against Tax Refund?

Choosing the best legitimate papers design can be quite a have a problem. Needless to say, there are a variety of layouts accessible on the Internet, but how would you find the legitimate develop you will need? Use the US Legal Forms web site. The assistance provides 1000s of layouts, such as the Kentucky Sample Letter for Request for IRS not to Off Set against Tax Refund, which can be used for company and personal requires. Each of the kinds are examined by experts and satisfy federal and state demands.

Should you be presently registered, log in for your accounts and then click the Down load option to get the Kentucky Sample Letter for Request for IRS not to Off Set against Tax Refund. Make use of accounts to check through the legitimate kinds you have acquired earlier. Check out the My Forms tab of your accounts and get yet another backup of your papers you will need.

Should you be a new user of US Legal Forms, listed below are simple guidelines that you can comply with:

- Very first, be sure you have selected the appropriate develop for your town/county. You are able to check out the form utilizing the Review option and read the form explanation to make certain this is basically the right one for you.

- If the develop is not going to satisfy your requirements, utilize the Seach industry to get the appropriate develop.

- Once you are sure that the form is proper, select the Acquire now option to get the develop.

- Select the pricing program you would like and type in the necessary info. Make your accounts and pay money for your order using your PayPal accounts or Visa or Mastercard.

- Choose the submit format and acquire the legitimate papers design for your product.

- Full, edit and produce and signal the received Kentucky Sample Letter for Request for IRS not to Off Set against Tax Refund.

US Legal Forms is definitely the biggest catalogue of legitimate kinds for which you can find various papers layouts. Use the company to acquire professionally-produced papers that comply with state demands.

Form popularity

FAQ

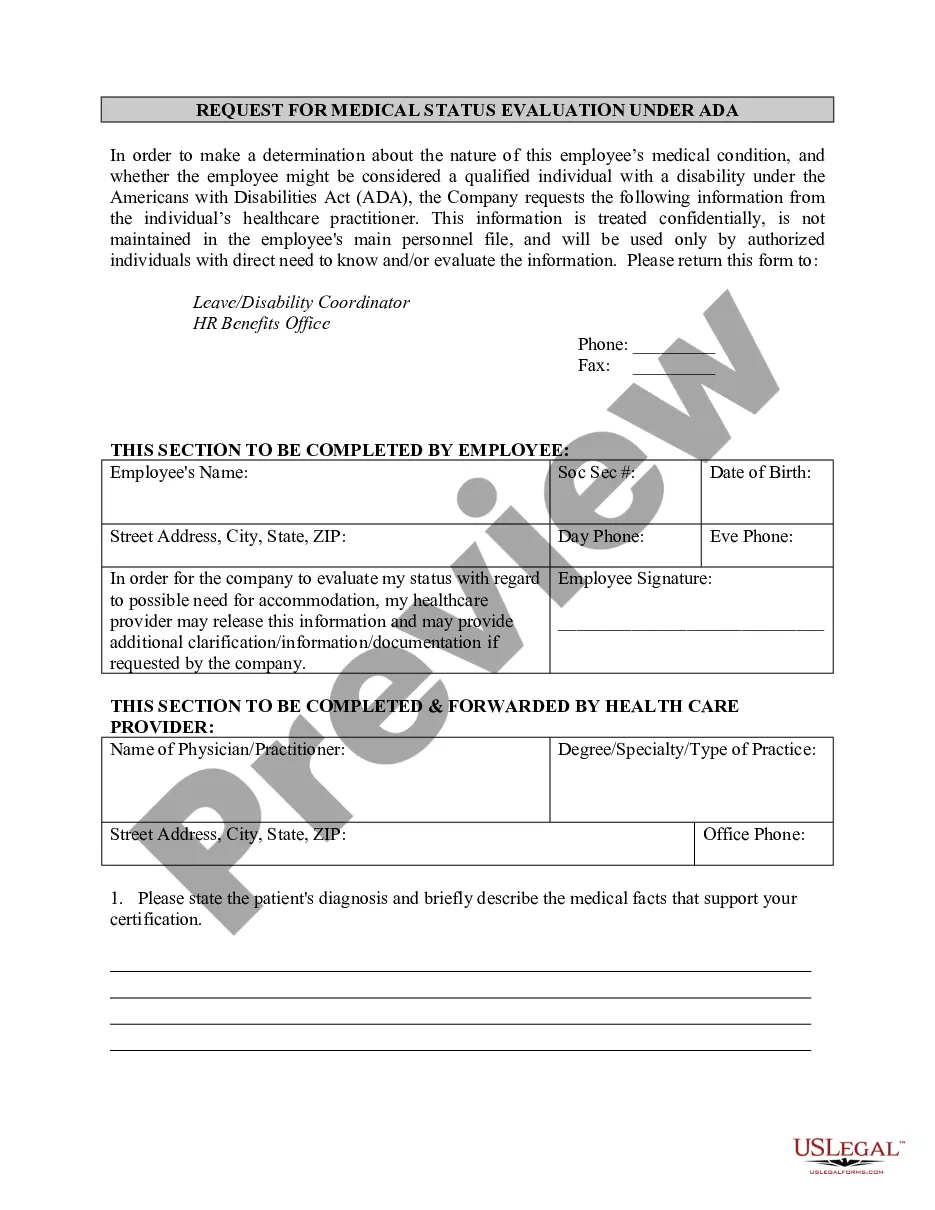

The Treasury Offset Program (TOP) collects past-due (delinquent) debts (for example, child support payments) that people owe to state and federal agencies. TOP matches people and businesses who owe delinquent debts with money that federal agencies are paying (for example, a tax refund).

What Elements are Required in the Written Protest? Your name and address; The date and symbols from the examination report listing the proposed adjustments; The tax periods or years involved; A statement of the adjustments being protested; A statement of facts stating the taxpayer's position on contested factual issues;

If you disagree you must first notify the IRS supervisor, within 30 days, by completing Form 12009, Request for an Informal Conference and Appeals Review. If you are unable to resolve the issue with the supervisor, you may request that your case be forwarded to the Appeals Office.

In your formal protest, include a statement that you want to appeal the changes proposed by the IRS and include all of the following: ? Your name, address, and a daytime telephone number. ? List of all disputed issues, tax periods or years involved, proposed changes, and reasons you disagree with each issue.

Offset letter The letter explains that we plan to notify BFS of the debt if you do not pay in full within 60 days. BFS will send you a letter explaining why your federal refund was reduced and that it may take several weeks before the federal refund reaches FTB.

Your audit reconsideration letter should: Say that it is an audit reconsideration request. Identify the taxpayer, the tax period(s), the type of tax (such as income tax), and, if available, the name and contact information for the IRS auditor who previously worked the case. Explain the circumstances for the audit,

Ing to the IRS, your letter should include the following: Taxpayer's name, address, and contact information. A statement expressing your desire to appeal IRS's findings to the Office of Appeals. The tax period in question. A list of the items you do not agree with and the corresponding reasons.

Your audit reconsideration letter should: Say that it is an audit reconsideration request. Identify the taxpayer, the tax period(s), the type of tax (such as income tax), and, if available, the name and contact information for the IRS auditor who previously worked the case. Explain the circumstances for the audit,