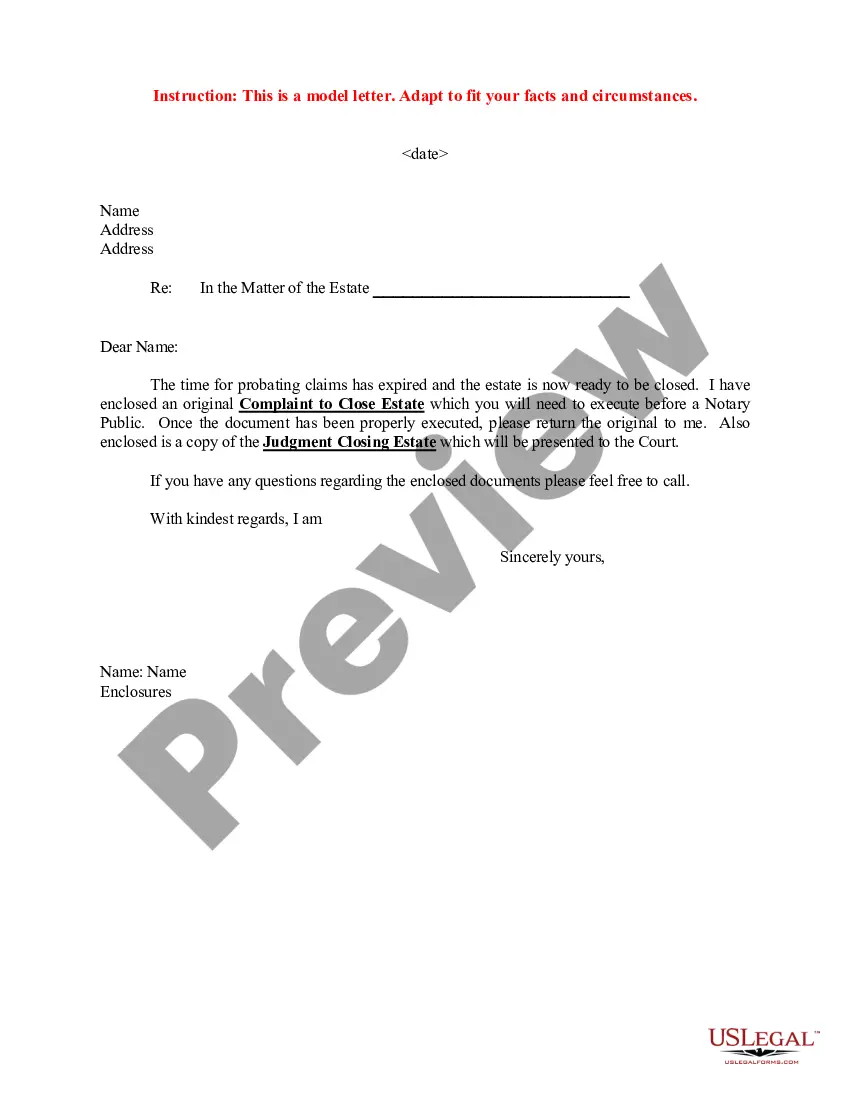

Kentucky Sample Letter regarding Judgment Closing Estate

Description

How to fill out Sample Letter Regarding Judgment Closing Estate?

Are you currently in a placement in which you will need paperwork for possibly business or specific purposes nearly every day time? There are a lot of lawful document web templates accessible on the Internet, but getting types you can rely isn`t straightforward. US Legal Forms gives a large number of develop web templates, much like the Kentucky Sample Letter regarding Judgment Closing Estate, that happen to be published to satisfy state and federal needs.

Should you be previously acquainted with US Legal Forms web site and get a free account, merely log in. Afterward, you may acquire the Kentucky Sample Letter regarding Judgment Closing Estate web template.

Unless you have an account and wish to begin using US Legal Forms, adopt these measures:

- Discover the develop you need and make sure it is to the proper area/state.

- Utilize the Preview button to check the shape.

- See the information to actually have selected the correct develop.

- When the develop isn`t what you are searching for, use the Research industry to get the develop that meets your needs and needs.

- If you find the proper develop, click Acquire now.

- Choose the prices plan you want, fill in the necessary information and facts to make your account, and buy the transaction utilizing your PayPal or credit card.

- Select a convenient file formatting and acquire your backup.

Find all of the document web templates you may have bought in the My Forms food selection. You can aquire a further backup of Kentucky Sample Letter regarding Judgment Closing Estate whenever, if required. Just click on the essential develop to acquire or print the document web template.

Use US Legal Forms, one of the most considerable assortment of lawful kinds, in order to save some time and stay away from errors. The support gives appropriately produced lawful document web templates that you can use for a variety of purposes. Create a free account on US Legal Forms and commence creating your lifestyle easier.

Form popularity

FAQ

In Kentucky, creditors have up to 6 months from the date of executor appointment to file claims, or 2 years if no executor has been appointed.

Settling the Estate After paying the debts and any income and death taxes owed by the estate, and after distributing any remaining assets of the estate to the heirs, the personal representative must prepare and file a final settlement with the District Court using form AOC-846. KRS §§395.190, 395.510.

Although there is no statute that requires an estate to stay open for any particular length of time, estates generally do have to stay open for a minimum of six months. This is because KRS Chapter 396 states that creditors of estates have six months to file claims.

Even a spouse might not be responsible under certain circumstances, but always check with a lawyer to see if you have any obligation. The estate of the deceased is responsible for paying any outstanding debts. You should refer debt collectors to the individual responsible for settling the estate of the deceased.

All creditors that wish to be paid from the estate are required to file a claims against the estate within 180 days (6 months) from the date the personal representative is appointed. Valid debts can be paid after the six months are up.

The Creditors' Claim Period The decedent's creditors have six months from the date of the Fiduciary's appointment to present their claims either to the court or to the Fiduciary (or the Fiduciary's lawyer). This means all probate estates must be open for at least this six-month notice period.

Statute of Limitations by State Statute of Limitations by State (in years)Kentucky55Louisiana103Maine66Maryland3350 more rows ?

Depending on the number of claims and the state of the deceased's financial affairs, this process can take anywhere from a few months to over a year. Distributing the Remaining Assets: The final step in the estate settlement process is distributing the remaining assets to the beneficiaries as outlined in the will.