Kentucky Sample Letter for Execution of Petition to Close Estate and For Other Relief

Description

How to fill out Sample Letter For Execution Of Petition To Close Estate And For Other Relief?

US Legal Forms - one of several greatest libraries of lawful types in the United States - provides a wide array of lawful papers themes you are able to download or produce. Utilizing the web site, you can get a huge number of types for enterprise and person uses, categorized by categories, says, or key phrases.You can get the most recent variations of types much like the Kentucky Sample Letter for Execution of Petition to Close Estate and For Other Relief within minutes.

If you currently have a subscription, log in and download Kentucky Sample Letter for Execution of Petition to Close Estate and For Other Relief from the US Legal Forms catalogue. The Obtain button will appear on every single type you see. You get access to all in the past saved types from the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, listed below are straightforward instructions to help you started:

- Be sure you have selected the best type to your metropolis/area. Go through the Preview button to examine the form`s information. See the type information to ensure that you have chosen the correct type.

- In case the type doesn`t fit your specifications, take advantage of the Look for field at the top of the monitor to obtain the the one that does.

- If you are happy with the form, confirm your decision by visiting the Purchase now button. Then, choose the costs strategy you like and give your accreditations to sign up to have an bank account.

- Procedure the transaction. Use your charge card or PayPal bank account to perform the transaction.

- Pick the format and download the form on your own product.

- Make alterations. Fill out, change and produce and indicator the saved Kentucky Sample Letter for Execution of Petition to Close Estate and For Other Relief.

Each design you added to your money lacks an expiration day and is also your own property forever. So, if you wish to download or produce one more copy, just proceed to the My Forms portion and click on the type you want.

Get access to the Kentucky Sample Letter for Execution of Petition to Close Estate and For Other Relief with US Legal Forms, one of the most comprehensive catalogue of lawful papers themes. Use a huge number of specialist and condition-certain themes that meet your company or person demands and specifications.

Form popularity

FAQ

If the estate is $30,000 or less, and there is no real estate, then either the surviving spouse, surviving child or a preferred creditor may file a petition to dispense with administration of probate.

(1) Administration of the estate of a person dying intestate may be dispensed with by agreement if there are no debts owing by the estate; all persons beneficially entitled to the personal estate have agreed in writing that there shall be no administration; and either there are no claims or demands due the estate, or ...

Kentucky has a lenient time requirement for probate. ing to the Kentucky Revised Statutes 395.010, it must be completed within 10 years after the person's death. However, it is better to file soon after the person's death and to complete the probate process as quickly as possible.

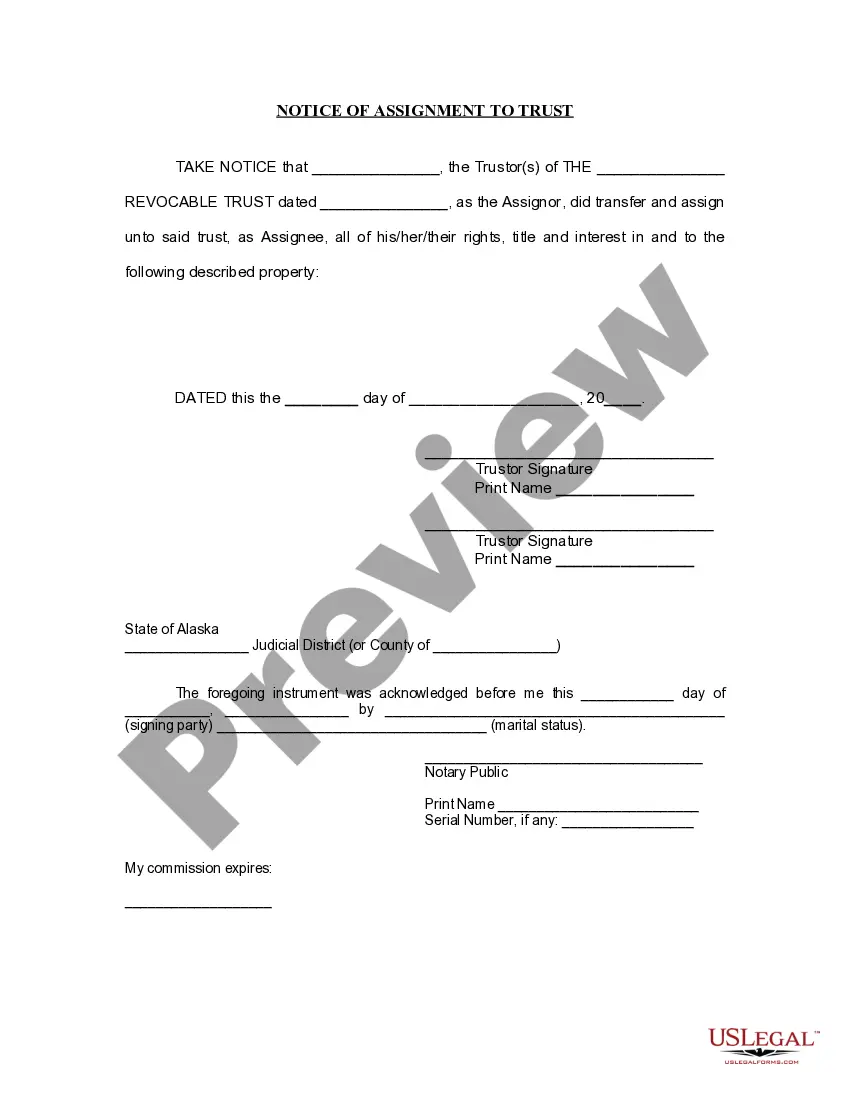

The Living Trust If you have a larger estate, you can avoid a long and expensive probate process by using a technique of asset transfer called a Living Trust. A document called a ?trust document?, which is similar to a Will, is created which names a person who will control the trust.

Settling the Estate After paying the debts and any income and death taxes owed by the estate, and after distributing any remaining assets of the estate to the heirs, the personal representative must prepare and file a final settlement with the District Court using form AOC-846. KRS §§395.190, 395.510.

Establish a living trust: This is a common way for people with high-value estates to avoid probate. With a living trust, the person writing the trust decides which assets to put into the trust and who will act as trustee. When the trust owner dies, the trustee will divide the assets outside of probate.

In Kentucky, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on.

Filing Independently Download Kentucky's Form AOC-830. Locate the decedent's will and collect information regarding the estate's debts and assets. Fill out Form AOC-830. Get the form notarized ? if there are multiple surviving children who are filing, they must all swear and sign the petition before a notary.