Kentucky Reorganization of Partnership by Modification of Partnership Agreement

Description

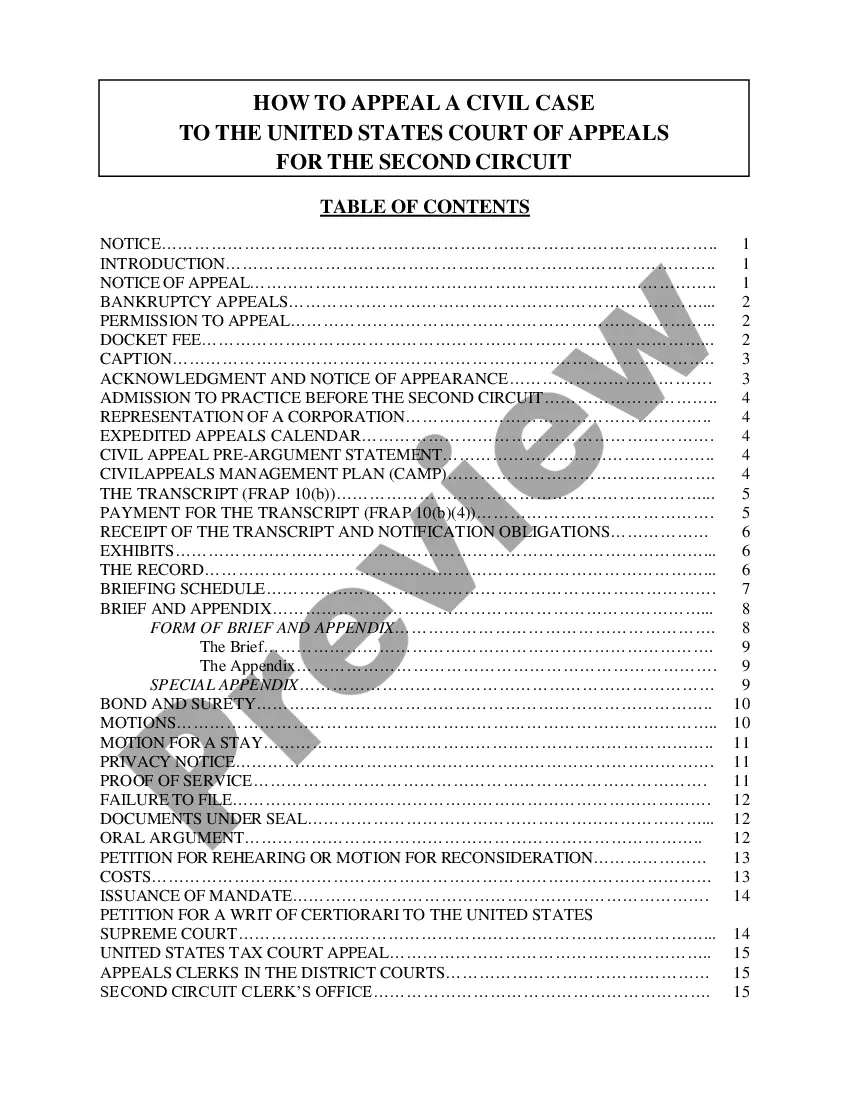

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a wide range of legal templates that you can download or print.

On the website, you can discover thousands of forms for both business and personal purposes, categorized by type, state, or keywords. You can obtain the latest versions of forms like the Kentucky Reorganization of Partnership by Modification of Partnership Agreement in just moments.

If you already maintain a monthly subscription, Log In and download the Kentucky Reorganization of Partnership by Modification of Partnership Agreement from your US Legal Forms library. The Acquire button will be present on every form you view. You can access all previously obtained forms from the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, and print or sign the downloaded Kentucky Reorganization of Partnership by Modification of Partnership Agreement. Each template saved in your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to 'My documents' section and click on the form you need. Access the Kentucky Reorganization of Partnership by Modification of Partnership Agreement with US Legal Forms, the largest collection of legal templates. Utilize a vast array of professional and state-specific templates that fulfill your business or personal requirements and needs.

- Ensure you have selected the correct form for your area/region.

- Click the Review button to verify the form’s details.

- Read the description of the form to confirm you have chosen the right document.

- If the form does not suit your needs, utilize the Search box at the top of the screen to find the one that fits.

- Once you are satisfied with the form, confirm your choice by selecting the Get now button.

- Next, pick your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

Certain entities and transactions are exempt from Kentucky sales tax, including non-profit organizations and specific goods. Understanding these exemptions can help in effective financial planning for partnerships. This knowledge is especially beneficial during the Kentucky Reorganization of Partnership by Modification of Partnership Agreement, fostering smoother operations.

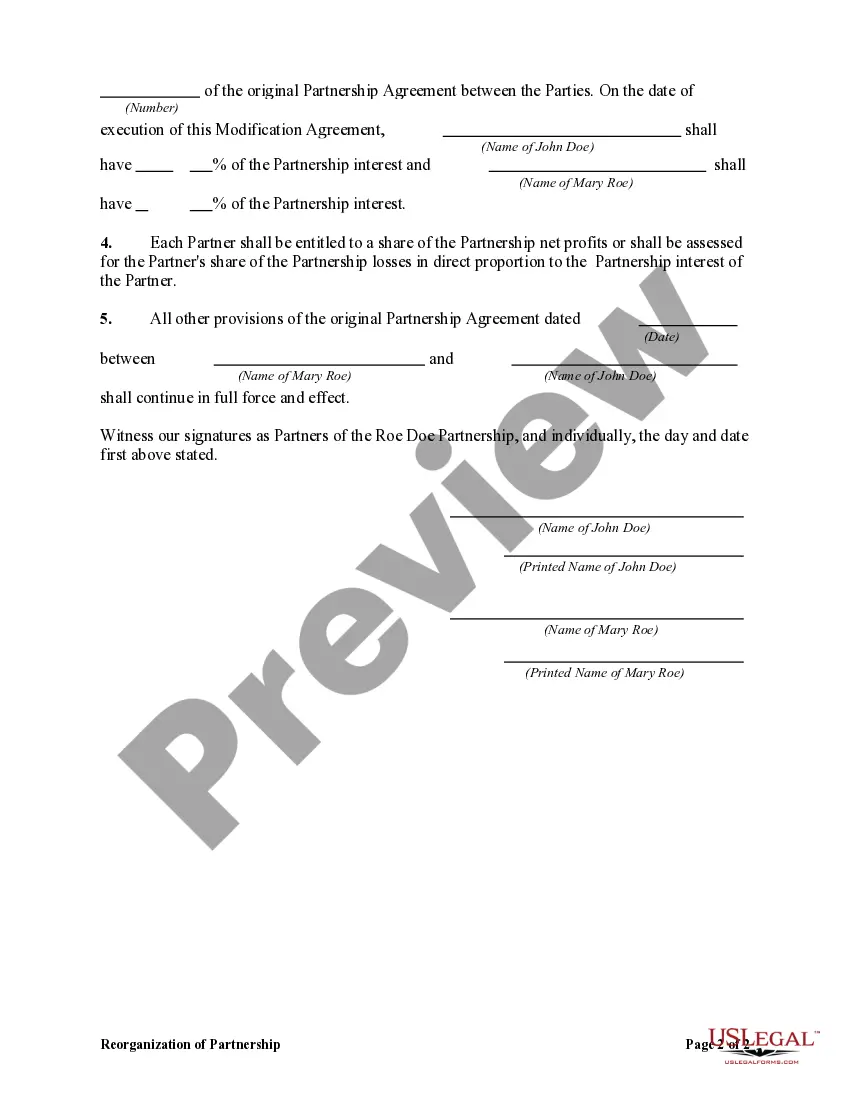

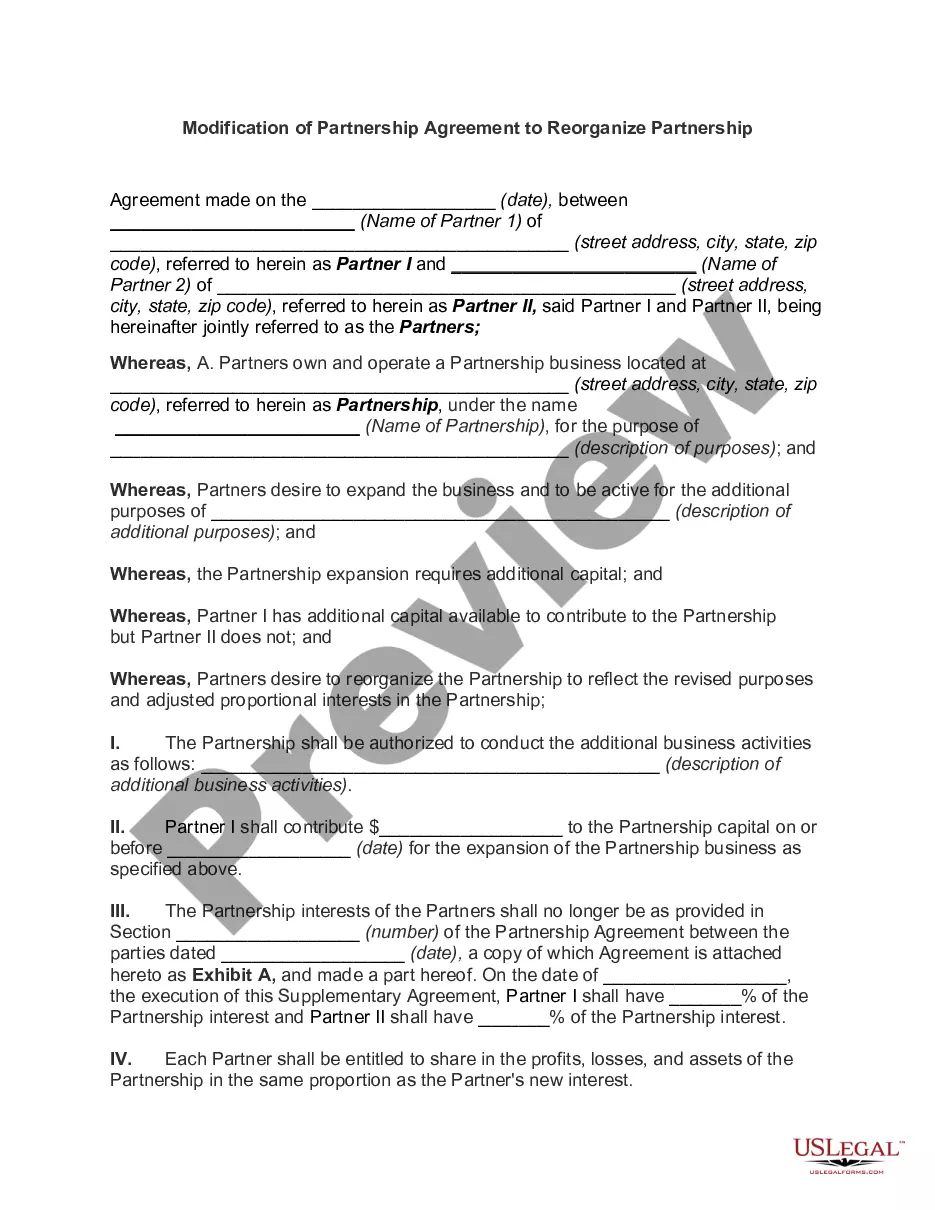

Filling out a partnership agreement involves several key steps, including defining the partnership terms, allocating profits and losses, and outlining responsibilities. It is advisable to involve legal counsel to ensure all important aspects are covered comprehensively. This process is crucial for the Kentucky Reorganization of Partnership by Modification of Partnership Agreement.

The Kentucky llet tax applies to businesses that have a physical presence in Kentucky or derive income from Kentucky sources. This includes partnerships and corporations, affecting how partnerships are organized and operated. Therefore, understanding this tax is essential for anyone involved in the Kentucky Reorganization of Partnership by Modification of Partnership Agreement.

To amend a partnership agreement, all partners must agree on the changes. It typically requires drafting an amendment document that outlines the modifications made to the original agreement. This is an important step in the Kentucky Reorganization of Partnership by Modification of Partnership Agreement to ensure that all partners are on the same page.

Yes, Kentucky does have a PTE election, allowing partnerships the option to be taxed at the entity level. This election can provide some tax advantages and simplifications for those reorganizing partnerships. Understanding this election is vital during the Kentucky Reorganization of Partnership by Modification of Partnership Agreement.

Kentucky form PTE is a tax form specifically designed for partnerships operating within the state. It facilitates the reporting of income, deductions, and credits for partnerships, making it crucial for proper tax assessment. Utilizing the form accurately supports the Kentucky Reorganization of Partnership by Modification of Partnership Agreement process.

Any partnership doing business in Kentucky must file the Kentucky form PTE. This includes both general partnerships and limited partnerships. The form is essential for reporting the entity’s income and ensuring compliance with state tax laws during the Kentucky Reorganization of Partnership by Modification of Partnership Agreement.

Kentucky Form 765 is the state tax return for partnerships operating in Kentucky. This form is essential for reporting income and calculating tax liabilities. Completing this form accurately is important for compliance and helps facilitate a successful Kentucky Reorganization of Partnership by Modification of Partnership Agreement.

Yes, articles of incorporation can be amended. This process involves filing the necessary amendments with the state, which may require approval from the partners or members. Amending articles is crucial for ensuring your documents accurately reflect your current structure, especially during a Kentucky Reorganization of Partnership by Modification of Partnership Agreement.

To remove a partner from an LLC in Kentucky, you must follow the procedures laid out in your operating agreement. Usually, this process involves a formal vote among remaining partners or members. Once the decision is made, you should document the change and file any necessary paperwork to reflect this within the partnership agreement, particularly during a Kentucky Reorganization of Partnership by Modification of Partnership Agreement.