Kentucky Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector

Description

How to fill out Sample Letter For Tax Exemption - Review Of Sample Letter Received From Tax Collector?

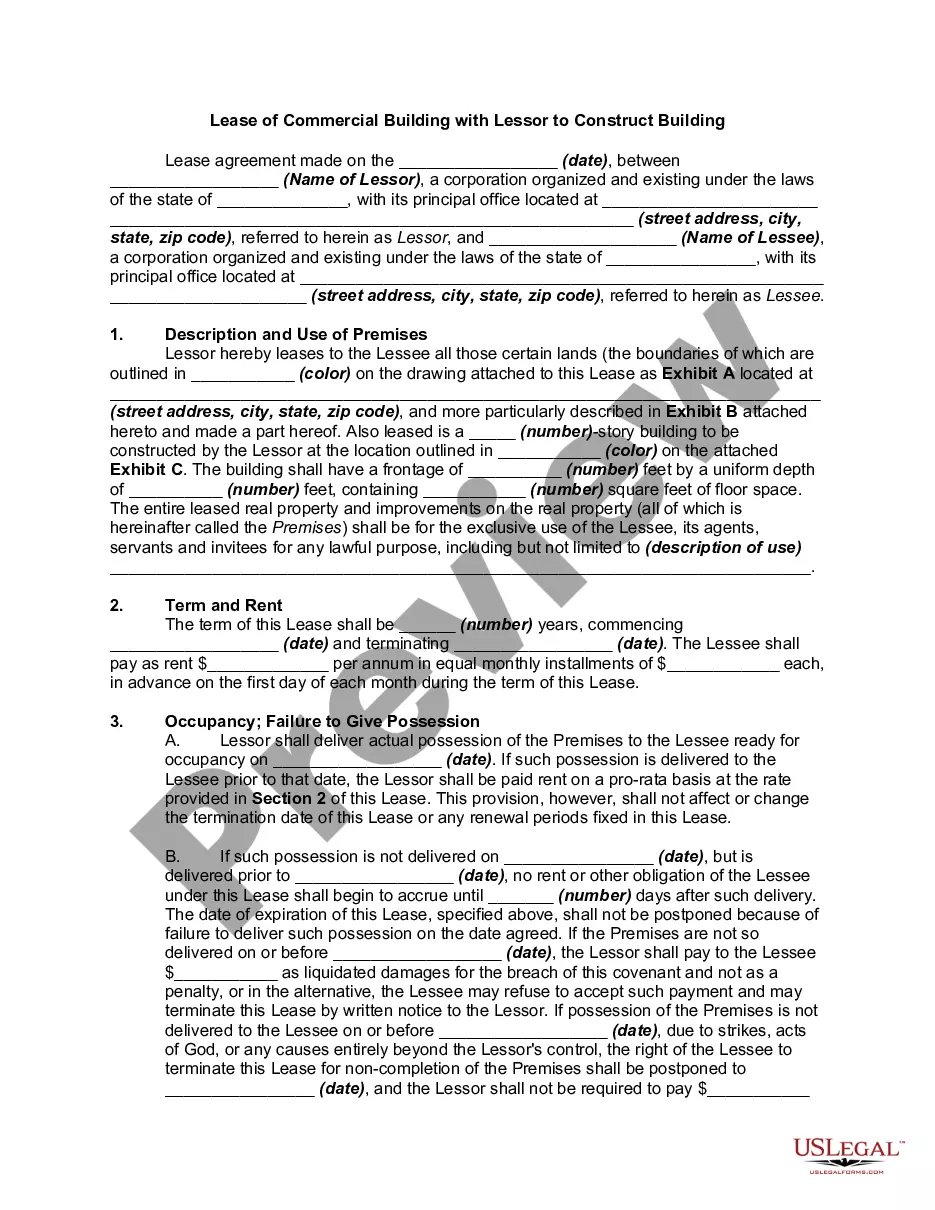

You may devote hrs on the web trying to find the legal document design that suits the state and federal needs you require. US Legal Forms provides 1000s of legal varieties that are examined by professionals. You can actually down load or produce the Kentucky Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector from our support.

If you already possess a US Legal Forms account, you may log in and click on the Acquire switch. Next, you may full, modify, produce, or indicator the Kentucky Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector. Every single legal document design you get is your own eternally. To have one more duplicate of the purchased type, visit the My Forms tab and click on the related switch.

If you work with the US Legal Forms site initially, adhere to the easy directions under:

- Very first, make sure that you have chosen the proper document design to the state/city that you pick. See the type explanation to make sure you have chosen the appropriate type. If readily available, make use of the Preview switch to search throughout the document design as well.

- If you wish to get one more edition from the type, make use of the Search field to obtain the design that suits you and needs.

- Once you have found the design you would like, simply click Purchase now to carry on.

- Find the costs program you would like, key in your accreditations, and register for your account on US Legal Forms.

- Comprehensive the deal. You may use your charge card or PayPal account to cover the legal type.

- Find the file format from the document and down load it for your gadget.

- Make alterations for your document if needed. You may full, modify and indicator and produce Kentucky Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector.

Acquire and produce 1000s of document layouts making use of the US Legal Forms web site, which offers the biggest selection of legal varieties. Use skilled and status-specific layouts to tackle your small business or specific requirements.

Form popularity

FAQ

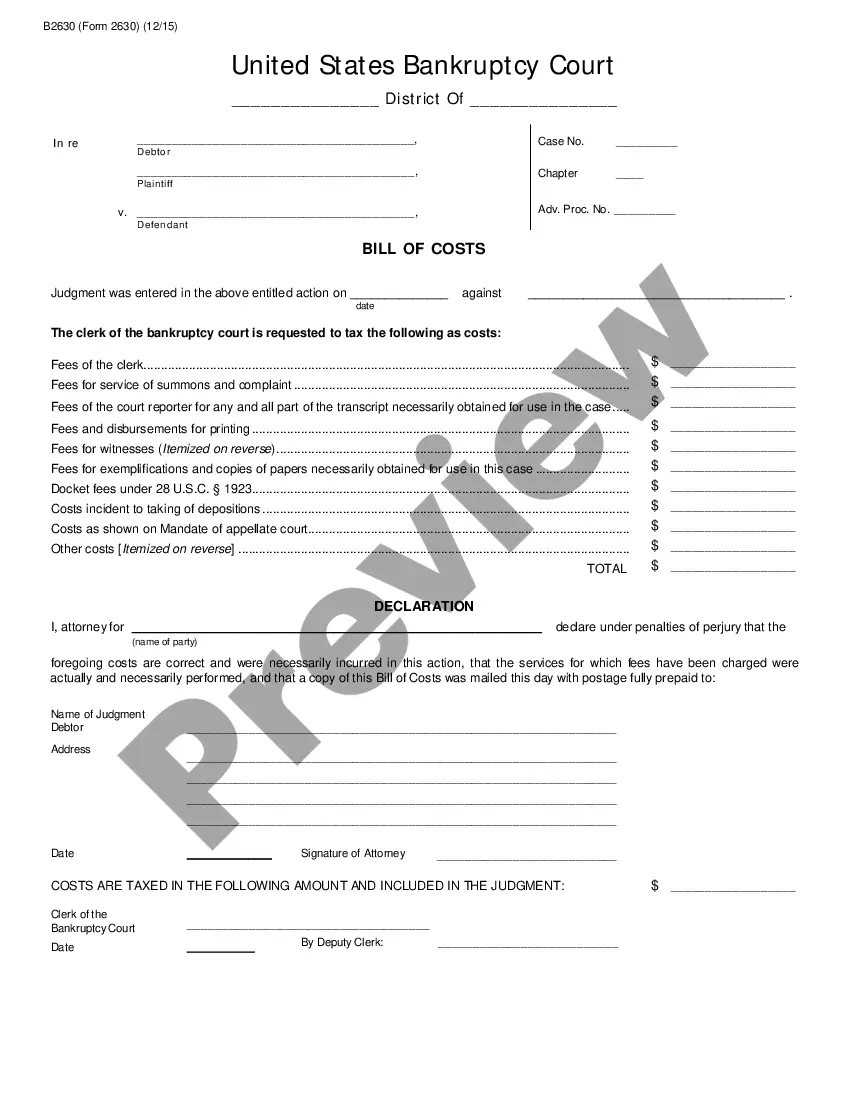

Paying A Tax Bill If no protest is submitted within the appropriate time, any unpaid debt will be referred to the Division of Collections. In addition, a 25% cost of collection fee will be added to each notice. Interest will continue to accrue. More penalties may be added if applicable.

Kentucky Department of Revenue (@RevenueKY) / X. KY Revenue is to administer tax laws, collect revenue, and provide services in a fair, courteous, and efficient manner for the benefit of the Commonwealth.

What is a Kentucky Tax Status Compliance Certificate? In Kentucky a Tax Status Compliance Certificate is called a Certificate of Good Standing and is issued by the Kentucky Department of Revenue for a Company (Corporation or LLC) or Sole Proprietor which has met all of its Kentucky tax obligations.

If you received a letter from us, your return has been selected for identity confirmation and verification is required in order to complete the processing of your tax return.

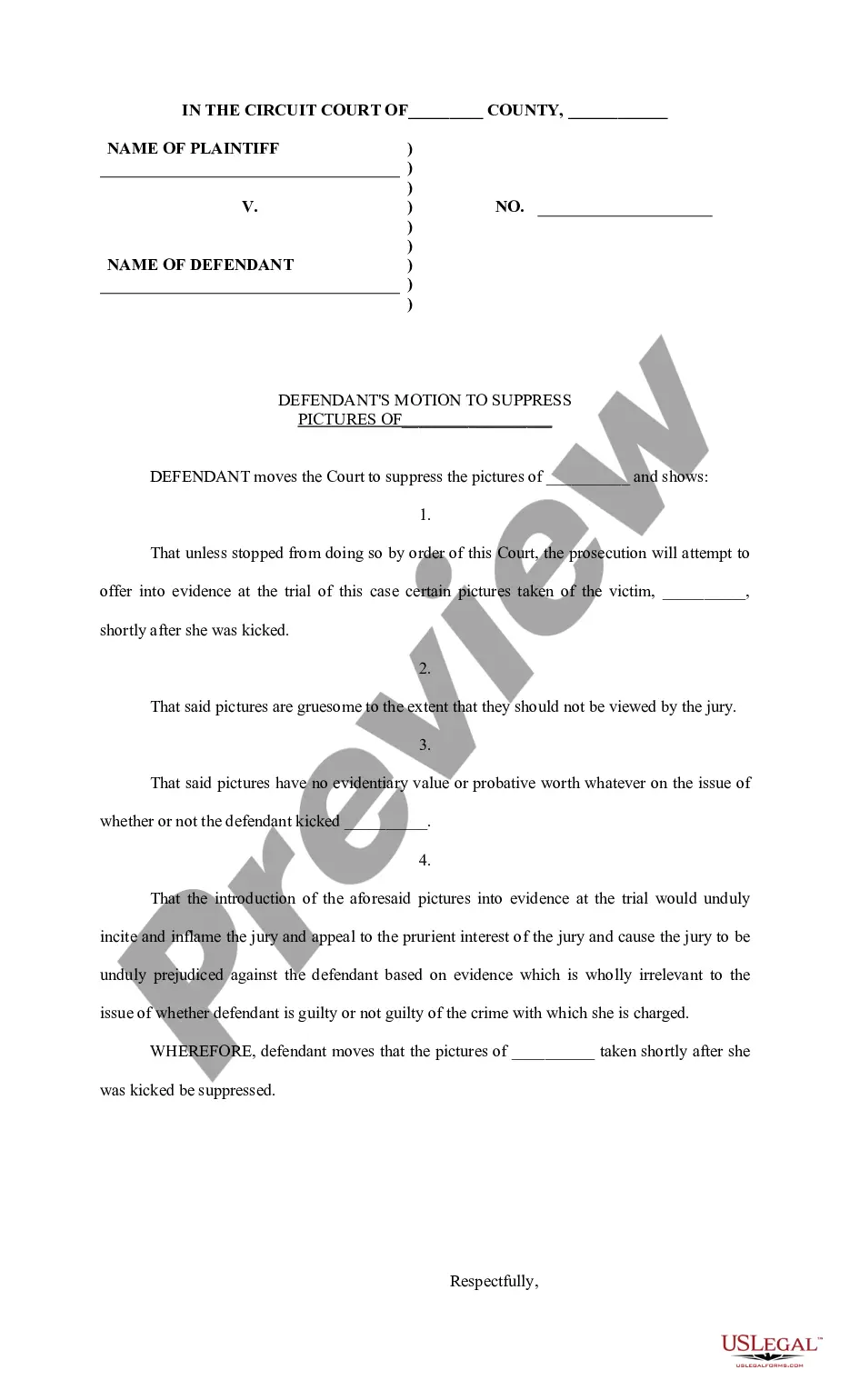

??In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead exemption.

A person or persons owning, living in and maintaining a residential unit must meet the 65 years of age requirement. If only one spouse is 65, the age requirement is met.

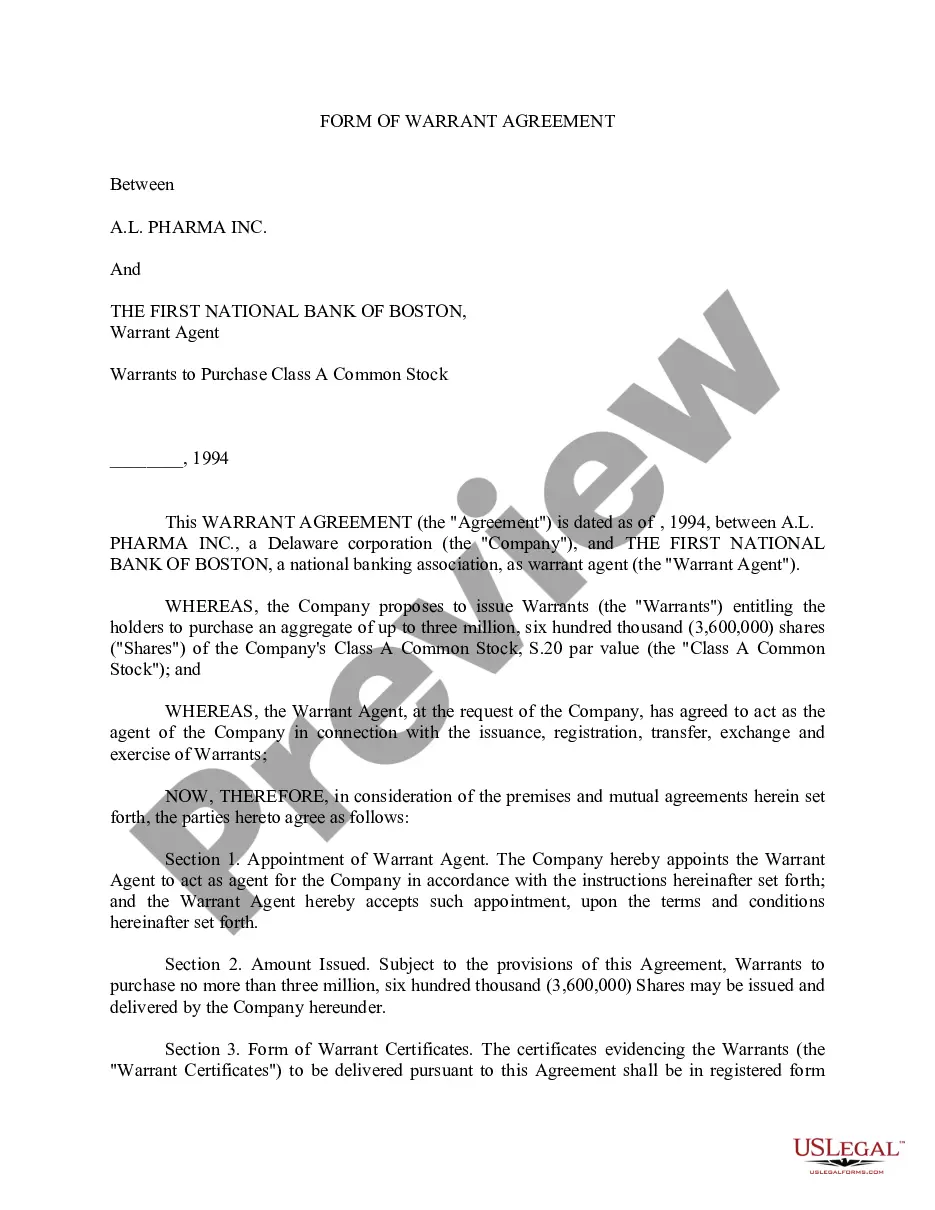

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

The Kentucky Department of Revenue has set the maximum homestead exemption at $46,350 for the 2023 and 2024 tax periods.