Business-to-business commerce refers to business transactions between companies. Business-to-consumer models are those that sell products or services directly to personal-use customers. Often called B2C, business-to-consumer companies connect, communicate and conduct business transactions with consumers most often via the Internet. B2C is larger than just online retailing; it includes online banking, travel services, online auctions, and health and real estate sites.

Kentucky End-User Software License Agreement - Business to Consumer

Description

How to fill out End-User Software License Agreement - Business To Consumer?

Are you presently in a situation where you require documents for occasional business or personal purposes almost every working day.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast selection of form templates, like the Kentucky End-User Software License Agreement - Business to Consumer, which are crafted to comply with federal and state regulations.

Once you find the right form, click Get now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Following that, you may download the Kentucky End-User Software License Agreement - Business to Consumer template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

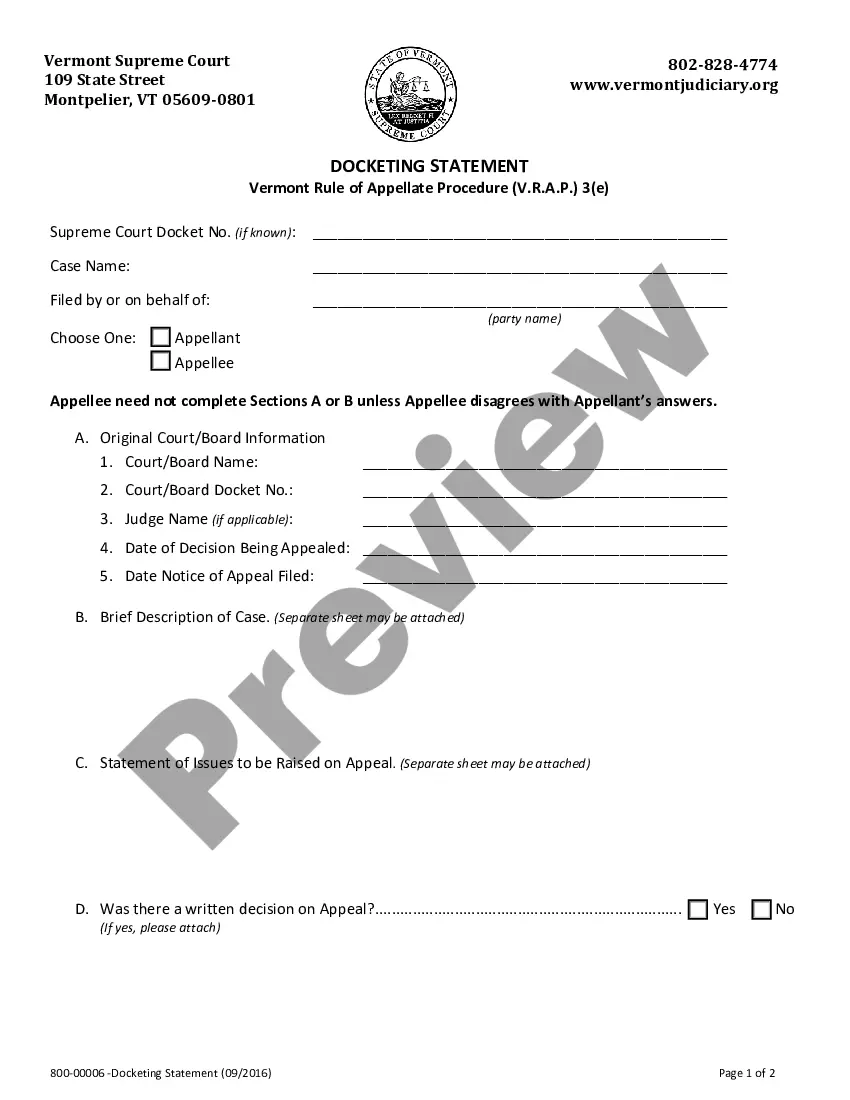

- Utilize the Preview button to view the form.

- Review the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that suits your requirements.

Form popularity

FAQ

SaaS became taxable in Kentucky as part of the state's broader efforts to define tax policies for digital products. If your business operates within the Kentucky End-User Software License Agreement - Business to Consumer framework, it's essential to stay updated on these changes. Knowing when the taxation began can help you navigate your financial obligations.

Software licenses are generally taxable under Kentucky law. If you are engaging in transactions involving the Kentucky End-User Software License Agreement - Business to Consumer, be aware of your tax responsibilities. Consult with a tax professional to ensure compliance with current regulations.

Yes, Kentuckians often face taxes on Software as a Service (SaaS). When using SaaS products, it's vital to consider these tax obligations as they fall under the Kentucky End-User Software License Agreement - Business to Consumer. Understanding how taxes apply to SaaS can inform your purchasing decisions.

Yes, in Kentucky, software is generally subject to sales tax. This includes both pre-written software and customized software when sold under the Kentucky End-User Software License Agreement - Business to Consumer. Understanding the tax obligations for software sales can help you stay compliant and manage your business finances effectively.

The Kentucky Local Option Sales and Use Tax (often abbreviated as KY llet) applies to various entities that conduct business within the state. If your business involves selling software licenses under the Kentucky End-User Software License Agreement - Business to Consumer, you may be subject to this tax. It is crucial to understand the implications for your specific business type.

Yes, Kentucky allows for the electronic filing of KY Form 725. This option streamlines the process for businesses and consumers alike. Filing your Kentucky End-User Software License Agreement - Business to Consumer electronically ensures quicker processing and can help you avoid potential delays.

In Kentucky, certain items are exempt from sales tax. For example, groceries, prescription drugs, and some farm equipment qualify for exemption. If you are dealing with software licenses under the Kentucky End-User Software License Agreement - Business to Consumer, it is important to review any applicable exemptions that may apply to your situation.

The two primary types of licensing agreements are exclusive and non-exclusive licenses. An exclusive license grants the licensee sole rights to use the software, while a non-exclusive license allows multiple parties to use it simultaneously. Knowing these differences can help you choose the right agreement, especially in the context of a Kentucky End-User Software License Agreement - Business to Consumer.

Creating an End-User License Agreement involves outlining the terms under which the software can be used, including rights and restrictions. You can draft this agreement yourself, but it's advisable to consult legal resources or platforms like US Legal Forms for templates tailored to a Kentucky End-User Software License Agreement - Business to Consumer. This ensures you cover all necessary legal aspects.

An End-User License Agreement (EULA) is a legal document that outlines the rights and restrictions granted to the user of a software product. Essentially, it defines what the user can do with the software, including installation and usage limits. Understanding this agreement is crucial for compliance, particularly within the framework of a Kentucky End-User Software License Agreement - Business to Consumer.