Kentucky Daily Cash Report

Description

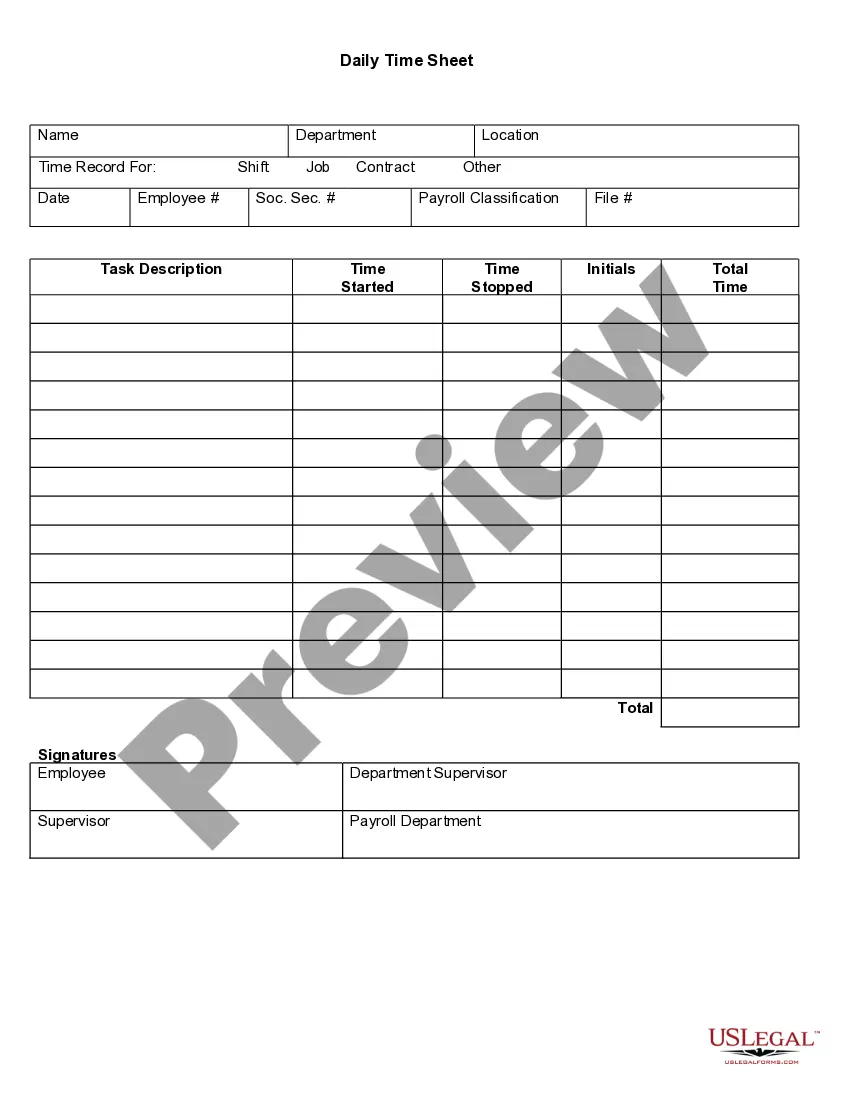

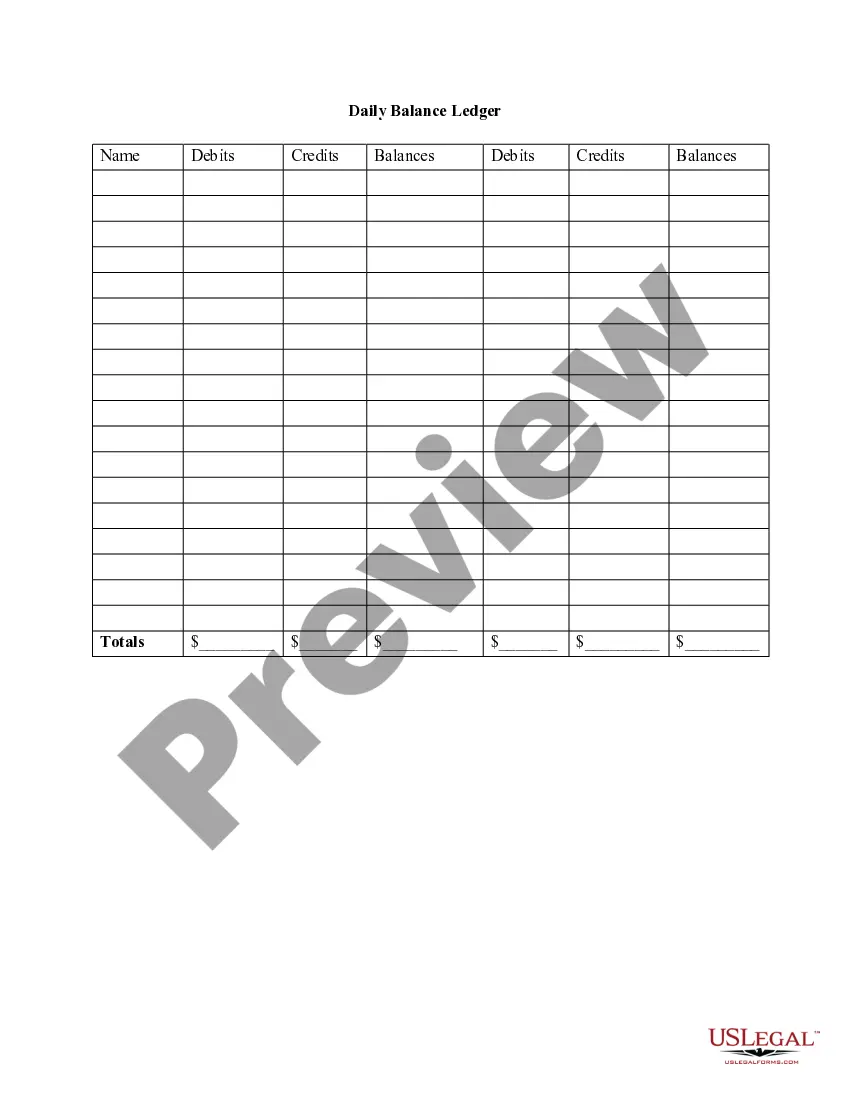

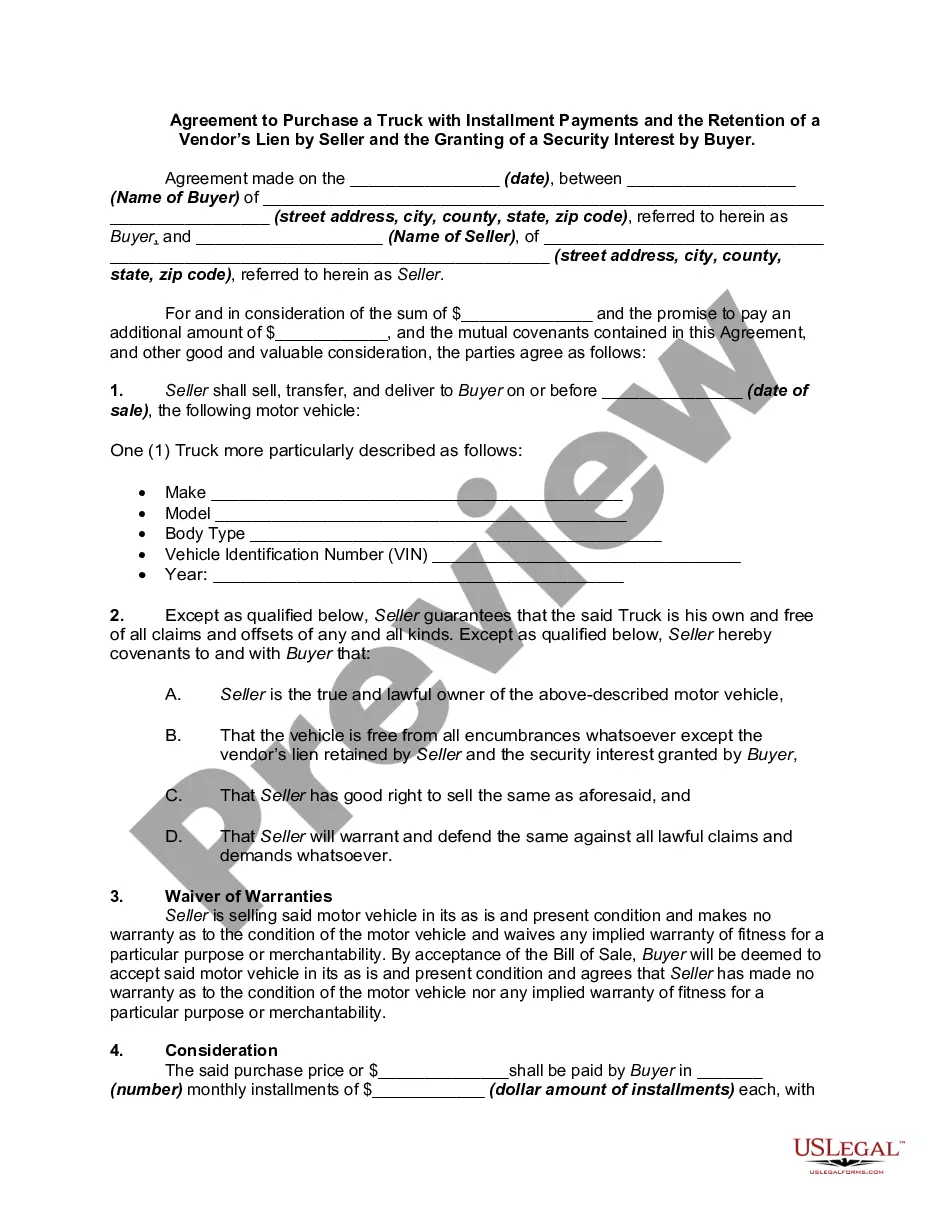

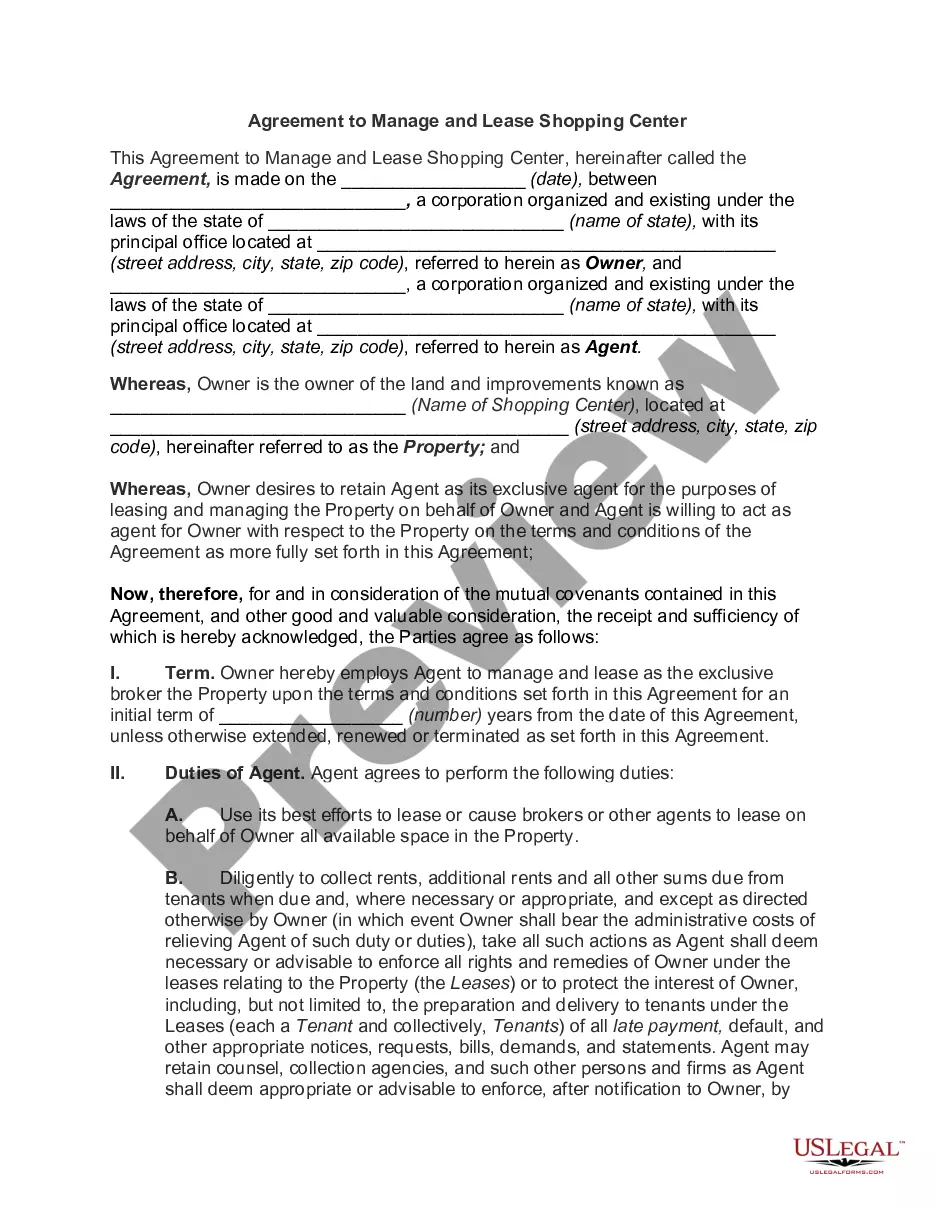

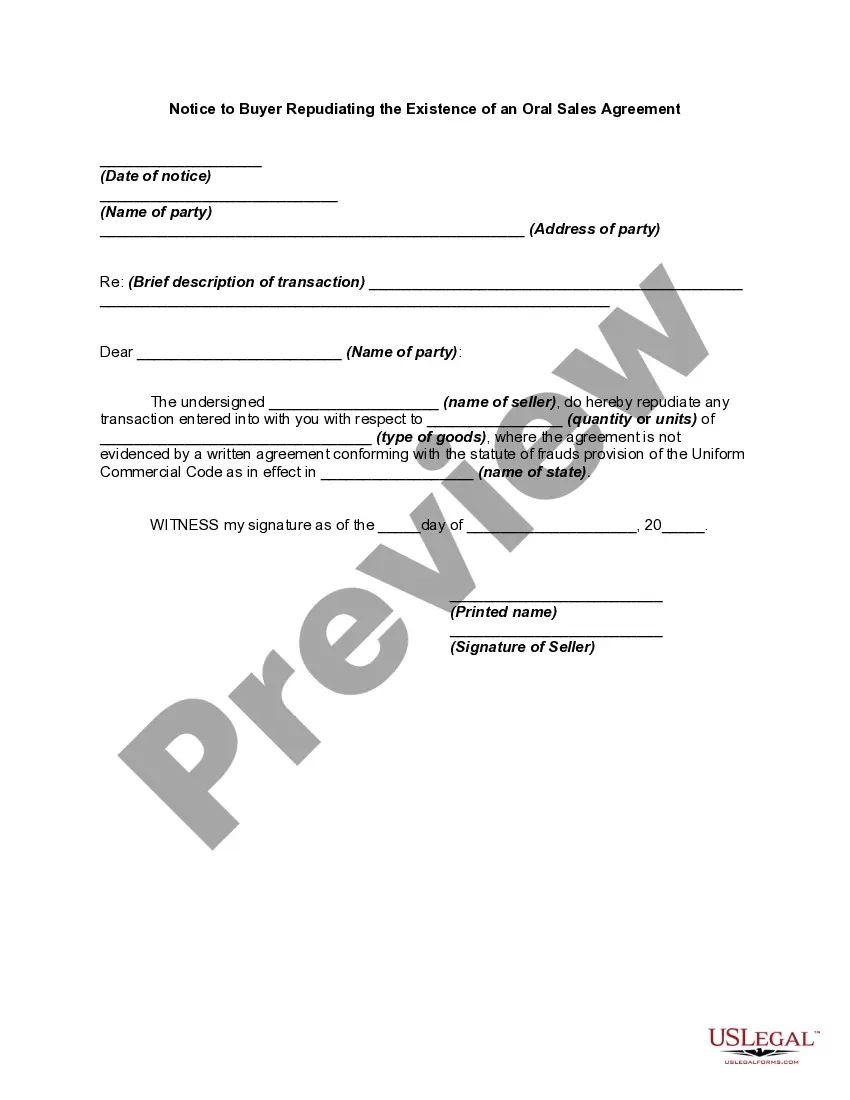

How to fill out Daily Cash Report?

Locating the appropriate legal document template can be a challenge. Clearly, there are many templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the Kentucky Daily Cash Report, which can be used for both business and personal purposes. Each form is reviewed by professionals and complies with state and federal regulations.

If you are already a registered user, Log In to your account and click the Download button to obtain the Kentucky Daily Cash Report. Use your account to browse the legal forms you have purchased previously. Navigate to the My documents section of your account to retrieve another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Kentucky Daily Cash Report. US Legal Forms is the largest repository of legal documents where you can find numerous document templates. Utilize the service to download professionally crafted documents that adhere to state requirements.

- First, ensure you have selected the correct form for your city/state.

- You can preview the form using the Preview feature and review the document details to verify it suits your needs.

- If the form does not meet your requirements, use the Search box to find the correct form.

- Once you are confident that the form is suitable, click the Purchase Now button to acquire the form.

- Choose the pricing plan you desire and fill in the required information.

- Create your account and complete the purchase using your PayPal account or credit card.

Form popularity

FAQ

The speed of receiving your Kentucky state tax refund can vary, but typically, online filings are processed faster, often within a few weeks. If you file a paper return, it may take longer. To streamline your tax process and enhance efficiency, consider using USLegalForms, which can help you file accurately and quickly, increasing the likelihood of a prompt refund.

To obtain a Kentucky withholding number, you must register with the Kentucky Department of Revenue. This registration can often be completed online, and it is crucial for businesses that hire employees and need to withhold state taxes. Services like USLegalForms can assist you in the registration process, ensuring you meet all legal requirements for operating your business in Kentucky.

You can check the status of your Kentucky state tax return by visiting the Kentucky Department of Revenue's website. They provide a dedicated section where you can enter your information to track your return. If you're looking for a more structured way to manage your tax reporting, USLegalForms offers services that can help keep your records organized, minimizing any confusion about your return status.

You can download your tax return form from the Kentucky Department of Revenue's website, where they offer various forms for both personal and business taxes. The forms are usually available in PDF format for easy printing. For further assistance, consider using USLegalForms, which can guide you through the downloading and filling out of the required forms correctly.

Yes, you can get a copy of your Kentucky tax return online through the Kentucky Department of Revenue's website. This method is often faster and more convenient. If you need assistance, platforms like USLegalForms offer guidance on the steps involved to access your tax return online smoothly. Make sure to have your identification details handy when accessing your records.

To obtain a copy of your Kentucky tax return, you can request it directly from the Kentucky Department of Revenue. They provide a process for individuals to access their tax records through their online portal or by submitting a request by mail. Additionally, using services like USLegalForms can help you navigate this process more efficiently. It's important to keep your information ready, such as your personal identification and the year of the tax return you need.

You may be exempt from withholding for 2021 if both the following apply: 20, you had a right to a refund of all Kentucky income tax withheld because you had no Kentucky income tax. liability, and. 20, you expect a refund of all your Kentucky income tax withheld.

The withholding rate is at the maximum rate provided in KRS 141.020 or KRS 141.040. A partner, member, or shareholder may be exempt from withholding if an appropriate tax return was filed for the prior year.

An employee who claims exemption from taxes for a particular tax is claiming they should not have withholding because they will not have to pay that tax at all. Their employer should not report their wages.

Employers withholding less than $400 Kentucky income tax a year will be required to file a return and remit the tax annually. The employer will be notified by DOR when the account is placed on an annual filing basis. The annual return (Form K-3) is filed with DOR by January 31, following the close of the calendar year.