Kentucky General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

How to fill out General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

If you need to finish, retrieve, or create legal document templates, utilize US Legal Forms, the most essential compilation of legal forms, available online.

Take advantage of the site’s user-friendly and effective search feature to find the documents you need.

Various templates for business and individual purposes are organized by categories and titles, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the payment. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Kentucky General Form of Factoring Agreement - Assignment of Accounts Receivable with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Obtain button to access the Kentucky General Form of Factoring Agreement - Assignment of Accounts Receivable.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/country.

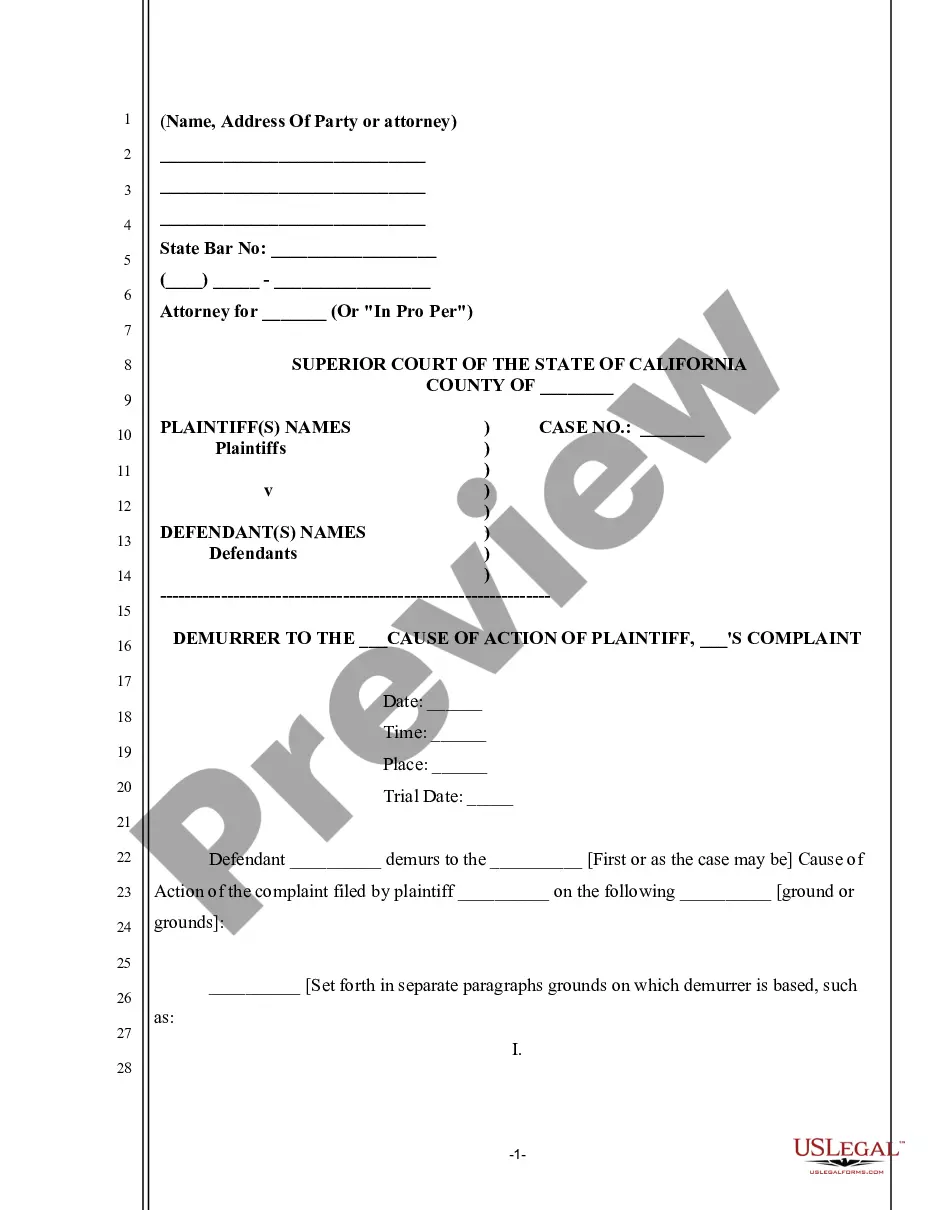

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to locate other models in the legal form template.

Form popularity

FAQ

A NoA, or Notice of Assignment, is a document that informs the debtor of the transfer of rights to collect the receivable. In a Kentucky General Form of Factoring Agreement - Assignment of Accounts Receivable, this notice plays a crucial role in ensuring that the debtor pays the correct party. It serves as formal communication and reinforces the validity of the assignment, thus securing the interests of the factor.

Consent to assignment of receivables refers to the approval required from debtors before a business can transfer its right to collect payments. In the context of a Kentucky General Form of Factoring Agreement - Assignment of Accounts Receivable, obtaining this consent ensures that the debtor is aware of and agrees to the change in who will receive payments. This step protects all parties involved and can eliminate potential disputes over payment obligations.

Accounts receivable factoring involves the sale of a company's unpaid invoices to a third-party factor. Initially, a business submits its invoices to the factor, which evaluates their legitimacy and customer credit. After approval, the factor advances a portion of the invoice amount. The Kentucky General Form of Factoring Agreement - Assignment of Accounts Receivable provides a solid foundation for establishing the terms and protecting the interests of both the seller and the factor.

To factor accounts receivable, you begin by selecting a factoring company and providing them with your outstanding invoices. Using a Kentucky General Form of Factoring Agreement - Assignment of Accounts Receivable, you will agree on the terms, including fees and advance rates. After the agreement, the factoring company pays you a percentage of the invoice amount upfront, while they handle the collections, allowing you to focus on your business.

In the assignment of receivables, you will find vital components like the terms of the agreement, the fees involved, and the rights and responsibilities of both parties. The Kentucky General Form of Factoring Agreement - Assignment of Accounts Receivable details how the factoring process works, ensuring clarity and security for all involved. This document protects your interests while maximizing the financial benefits of the assignment.

The assignment of accounts receivable refers to the legal process where a business formally transfers the rights to its receivables to another party. This is structured through a Kentucky General Form of Factoring Agreement - Assignment of Accounts Receivable, which outlines the terms of the transfer. This process can improve liquidity and reduce financial strain by providing immediate access to funds owed.

Factoring is the sale of receivables, whereas invoice discounting ("assignment of accounts receivable" in American accounting) is a borrowing that involves the use of the accounts receivable assets as collateral for the loan.

What is the Assignment of Accounts Receivable? Under an assignment of accounts receivable arrangement, a lender pays a borrower in exchange for the borrower assigning certain of its receivable accounts to the lender. If the borrower does not repay the loan, the lender has the right to collect the assigned receivables.

Pledging, or assigning, accounts receivable means that you essentially use your accounts receivable as collateral to obtain cash. The lender has the receivables as security, but you, as the business owner, are still responsible for the collection of the debts from your credit customers.

Under an assignment of accounts receivable arrangement, a lender pays a borrower in exchange for the borrower assigning certain of its receivable accounts to the lender. If the borrower does not repay the loan, the lender has the right to collect the assigned receivables.